NRG Energy (NRG) , a Zacks Rank #1 (Strong Buy), operates as an integrated power company in the United States. Renewed strength in interest rate sensitive utilities provides a durable backing for this industry leader.

NRG stock is displaying relative strength, recently surging to 52-week highs even as the general market has encountered volatility early in 2024. Increasing volume has attracted investor attention as buying pressure accumulates in this top-ranked stock.

NRG is part of the Zacks Utility – Electric Power industry group, which currently ranks in the top 27% out of more than 250 Zacks Ranked Industries. Because it is ranked in the top half of all Zacks Ranked Industries, we expect this group to outperform the market over the next 3 to 6 months.

Quantitative research studies suggest that approximately half of a stock’s price appreciation is due to its industry grouping. In fact, the top 50% of Zacks Ranked Industries outperforms the bottom 50% by a factor of more than 2 to 1. It’s no secret that investing in stocks that are part of leading industry groups can give us a leg up relative to the market. By focusing on leading stocks within the top 50% of Zacks Ranked Industries, we can dramatically improve our stock-picking success.

Company Description

NRG Energy is involved in producing and selling electricity and related services to residential, commercial, industrial, and wholesale customers. The company generates electricity using natural gas, coal, oil, solar, nuclear, and battery storage. NRG also provides system power, distributed generation, renewable products, and energy efficiency and advisory services.

In addition, NRG Energy trades in electric power, natural gas, and related commodities; environmental and weather products; and financial products including forwards, futures, options, and swaps. The company sells energy, services, and products under the NRG, Reliant, Direct Energy, Green Mountain, Stream, and XOOM Energy brands.

Earnings Trends and Future Estimates

The utility provider has put together an impressive earnings history, surpassing earnings estimates in three of the last four quarters. Back in November, the company reported third-quarter earnings of $1.62/share, a 5.88% surprise over the $1.53/share consensus estimate. NRG Energy has delivered a trailing four-quarter average earnings surprise of 4.73%.

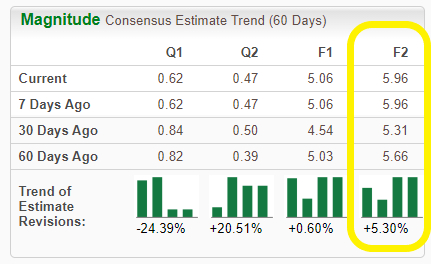

NRG shares received a boost as analysts covering the company have been increasing their 2024 earnings estimates lately. For the full year, earnings estimates have risen 5.3% in the past 60 days. The 2024 Zacks Consensus EPS Estimate now stands at $5.96/share, reflecting a potential growth rate of 17.9% relative to the prior year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Let’s Get Technical

NRG shares have advanced more than 67% in the past year. Only stocks that are in extremely powerful uptrends are able to experience this type of outperformance. This is the kind of stock we want to include in our portfolio – one that is trending well and receiving positive earnings estimate revisions.

Image Source: StockCharts

Image Source: StockCharts

Notice how both the 50-day (blue line) and 200-day (red line) moving averages are sloping up. The stock has been making a series of 52-week highs, widely outperforming the major indices. With positive fundamental and technical indicators, NRG stock is poised to continue its outperformance.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. As we know, NRG Energy has recently witnessed positive revisions. As long as this trend remains intact (and NRG continues to deliver earnings beats), the stock will likely continue its bullish run this year.

Bottom Line

NRG Energy’s management continues to approve share repurchases with a $950 million accelerated program currently authorized. A 7-9% long-term target dividend growth rate will also further enhance shareholder value. A positive string of acquisitions over the past several years has resulted in realized synergies that bode well moving forward.

Backed by a top industry group and impressive history of earnings beats, it’s not difficult to see why this company is a compelling investment. Robust fundamentals combined with an appealing technical trend certainly justify adding shares to the mix. The future looks bright for this highly-ranked, leading stock.

— Bryan Hayes

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks