It’s worse than I feared.

The recession is still coming. And stocks are continuing to go up.

With every passing week, they ignore reality and cling to false hope.

And just like a roller coaster, their upward climb is only going to increase the future stock market drop.

A month ago, our Wide Moat Research economic model reported a 20% market decline was on its way.

Two weeks ago, that decline data reading was 25%.

And now, if economists are right about the recession’s timing, a 35% market crash is most likely.

So today let me show you why stock market despair is coming, and how to protect yourself from the soon-to-be hopeless market.

Investor Despair Is Coming

The bond market, the “smart money” on Wall Street, is predicting a recession by July 31, 2024 with 100% probability.

How often is the bond market wrong? The bond market indicator we follow at Wide Moat Research has been right for 73 years.

It’s as close to having God email or text you a recession warning.

And this indicator is now flashing “recession” with some dramatic peak decline percentages from record highs.

So do you want to know how bad the market carnage is likely to get?

Here is what the financial media isn’t telling you…

No matter how optimistic you want to be, the market is cruising for a bruising.

No matter how optimistic you want to be, the market is cruising for a bruising.

Based on Goldman Sach’s (GS) estimates, we are likely to fall into the 32% –34% peak decline range this year with an estimated earnings decline of 11%.

And that’s being optimistic… Close to a best-case scenario.

If the recession happens sooner, the market pain will worsen.

Why? Because where the earnings (and thus stocks) bottom in a recession depends on where earnings start.

The later the recession starts, the higher earnings will be before they fall.

And the higher the market’s ultimate bottom will be.

And if economists are right? Then the stock market is likely to fall 35%. That’s 41% below the January 4, 2022 record high.

That would be a historically average recessionary bear market.

But it won’t feel average. It will feel like the end of the world.

Millions of investors will panic sell and lose fortunes. Thousands of retirement dreams will be permanently shattered, and countless lives will be ruined.

How to Protect Yourself

So if you’re thinking – “A 27% to 35% market crash! I must sell everything now!”

Don’t.

If you listen to dangerous doomsday prophets like Robert Kiyosaki, you will never buy stocks again.

And you will never retire rich.

Selling now, before investors stampede for the exits of the stock market, sounds smart.

And granted, it is a very normal gut reaction.

But it’s the worst possible thing you can do.

The secret to being a stock market genius is not being an idiot.

In the coming months, you might feel like owning stocks is the craziest idea on earth. But let me show you why it’s not.

No one can predict when a bear market will hit bottom.

But what is guaranteed, is a face-ripping rally you will want to take advantage of.

But what is guaranteed, is a face-ripping rally you will want to take advantage of.

And one you can’t afford to miss.

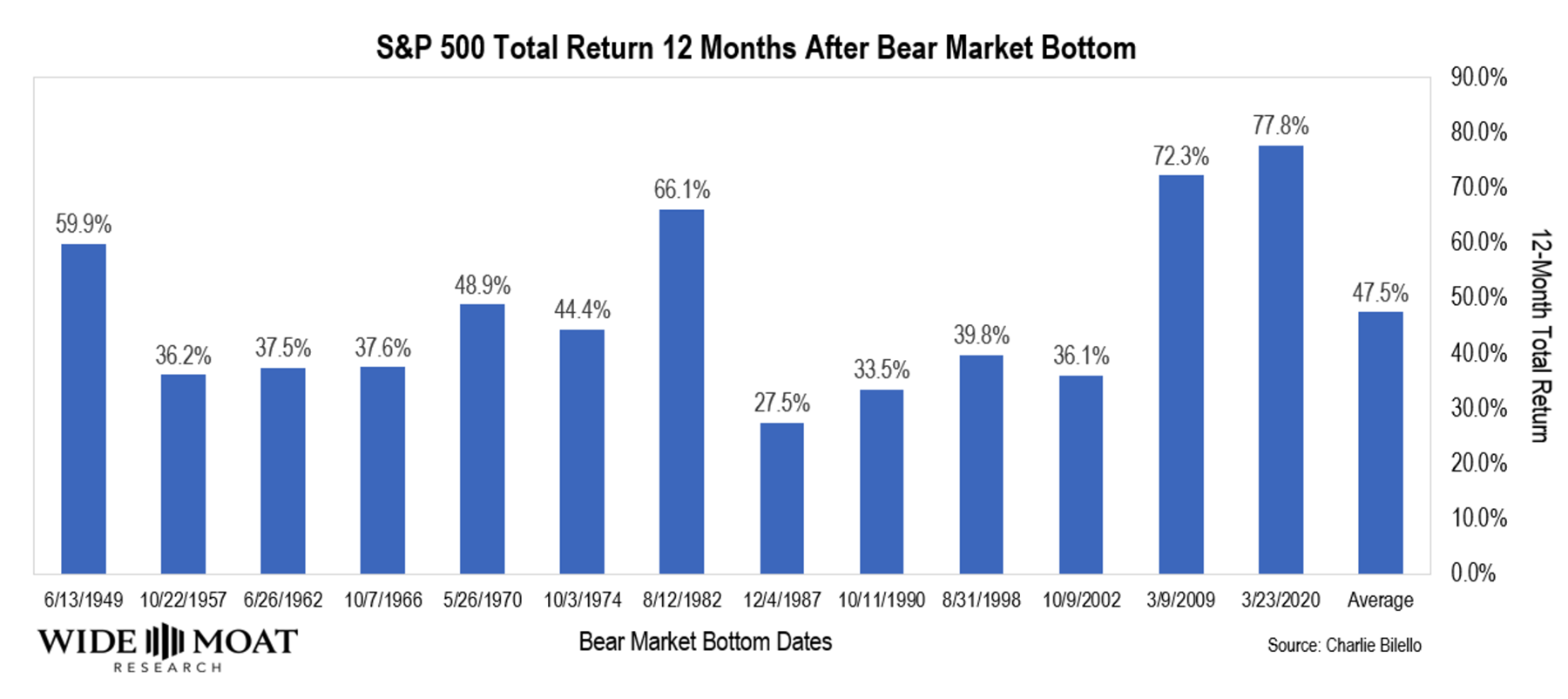

A study from Bank of America (BAC), confirmed by Wide Moat’s own research, found that 99.8% of the stock market’s returns since 1930 were generated in such powerful post-bear market rallies.

If you try to avoid bear markets entirely, you are almost sure to fail and kill your financial dreams.

I’m not kidding.

Since 1930 missing post-bear market rallies would have resulted in -94% inflation-adjusted returns.

If you were not in the market when the market bottomed, you would have lost all your money.

Market timing is the single-greatest killer of rich retirement dreams in history.

So to protect your wealth, stay in the game and don’t buy overvalued stocks in this market.

As I said earlier, we are on the upward swing of a roller coaster ride that is about to make its way down.

The closer you buy stocks towards the top, the bigger their drop and the more money you will lose.

So right now, hang tight. Because it’s about to be a wild ride.

And trust the high-quality companies that you have in your portfolio to lock in your profits… Because there will be an upward swing you and your portfolio will not want to miss.

Safe Investing,

Adam Galas

Analyst, Intelligent Income Daily

Source: Wide Moat Research