In a market like this, you never know when opportunity’s going to come knocking… although having a proprietary algorithm like S.C.A.N. to help follow the money sure helps.

S.C.A.N. looks at all kinds of stocks from one end of the market to the other. Aerospace, defense, semiconductors, entertainment, consumables – no stone unturned.

One of April’s hottest and maybe most unusual stocks – an outdoor equipment maker with a huge cult following – rocketed 33% over three weeks or so. Then it suddenly ran out of gas.

In fact, it fell nearly 7% this week, before climbing again during heavy volatility.

But one of the most reliable indicators I know of is showing how we can get a second crack at owning this popular company for as much as 10% off the current “sticker price.”

Opportunities to profit twice in the same week don’t come around all that often – here’s the ticker…

Hot Summer, Big Profits

You might not have heard of Yeti, but chances are if you have at least one, you’re a true believer.

Austin, Texas-based Yeti Holdings Inc. (NASDAQ: YETI) makes all kinds of outdoor leisure products, but it’s best known for its high-quality coolers and “Rambler” beverage containers.

When I say “best known,” I mean its containers have almost a cult following out there among consumers who are familiar. And if a customer has one kind of Yeti, it’s likely they have at least two more.

Inc. magazine called them “obsessively designed.”

I won’t say whether I have one or not, but people who have them swear by them. They’re sharp-looking aluminum cups, mugs, tumblers, and bottles with “Magslider” locking lids, mostly in subdued, trendy colors.

They’re expensive, that’s for sure; a gallon jug will set you back $130 in most places, while a 20-ounce tumbler could go for as much as $35. Yeti containers have a kind of “vacuum insulation” that’s eerily good at keeping cold beverages cold and hot ones hot – like, for hours and hours on end, easily a full baseball double-header. And if you were wondering: Yes, you can get custom labeling… for a small fee, and there’s a corporate gifts program.

So Yeti has the right ingredients there for a solid business. Yeti revenue went from an impressive-for-its-size $29 million in 2011 to nearly $780 million by 2018, but when the COVID-19 pandemic sent tens of millions of people outdoors to do just about anything, business exploded.

They haven’t reported their first-quarter earnings yet, but during the third quarter of 2020, they grew operating margins by 900 basis points, amassed $235 million in cash, and retired more than $50 million in debt. The company pulled in almost $295 million in net sales that quarter; it’s not a huge stretch to estimate $1 billion, maybe $1.2 billion in net sales last year. In 2020, Yeti saw high single- to mid-double-digit increases in nearly every key business metric…

… which is why the stock has quadrupled since October 2018. More than 316% of that growth happened between the March 2020 crash lows and the end of December.

But, what goes up must come down; all bull runs have to come to an end sometime.

Here’s a Chance to Own Yeti at a Possible 10% Discount

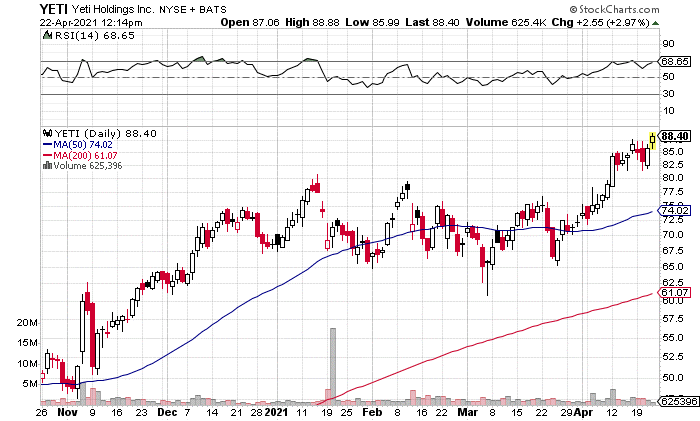

The relative strength index (RSI) reading on YETI shares peaked out above 70 at the end of last week – that’s high enough to start handing out nosebleeds, and it indicates a stock is severely overbought. It’s a clear signal that a reversal is coming, and that’s exactly what happened.

But – and this is where it gets interesting – the stock has overcome that initial sell-off and gone on to make fresh all-time highs, sitting above $88.30 as I write this on Thursday afternoon.

But – and this is where it gets interesting – the stock has overcome that initial sell-off and gone on to make fresh all-time highs, sitting above $88.30 as I write this on Thursday afternoon.

We’re getting a rare second shot at this one.

That RSI reading is creeping back up, too; it’s not technically above 70, it’s less than 1.5 points below at 68.6, but the stock is overbought once again, which gives us a chance to own it cheap.

S.C.A.N. is telling me that the smart money is either positioned to get out of this stock imminently or is waiting for the pullback that, for all intents and purposes, looks it like could happen any second now.

Buy this stock on any pullback, and buy even more if it falls below $80. If you’re feeling aggressive, it’s possible to construct a bull put spread on this stock – though I have to save my specific research recommendations and detailed instructions for my paid subscribers. A bull put spread would be two YETI puts, both expiring on the same day – you’d sell one YETI put at a higher strike and buy one YETI put at a lower strike, pocketing the credit you’d get from selling the more expensive of the two. If the stock is at or above the strike of the put you sold, you profit.

— Andrew Keene

Source: Money Morning