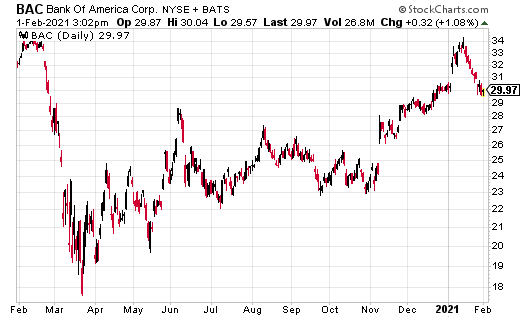

Shares of Bank of America (BAC) reached “oversold” levels after falling for eight-straight sessions. It held its 50-day moving average while recently announcing fourth-quarter earnings.

The chart below shows the RSI (relative strength index) for the stock recently hitting 40, as well as levels from late October. You will also see RSI reached 30 in late September. This is important to note as there could be continued weakness in Bank of America if a downtrend resumes, despite its bounce off the 50-day moving average.

The relative strength index is a momentum indicator often used by traders to evaluate whether a stock is oversold. The RSI is displayed as an oscillator (a line graph that moves between two extremes) and can have a reading from 0 to 100.

Typically, RSI considers 70 or above as an indicator that a stock is becoming overbought and may be setting up for a trend reversal or pullback. An RSI reading of 30 or below usually indicates an oversold and undervalued opportunity.

With that said, while there is still risk of lower lows for Bank of America, shares are looking attractive at current levels.

On a fundamental basis, the company reported fourth-quarter earnings of $0.55 per share on revenue of $20.1 billion. Wall Street was expecting $0.55 per share on revenue $20.68 billion.

The results represented the third straight quarterly beat with a six-cent miss in the year-ago quarter.

Bank of America also announced book value per common share rose 5% to $28.72, while tangible book value rose 6% to $20.60. The company didn’t announce any changes to its dividend of $0.72 per share and represents a current yield of 2.4%.

As far as coverage, 31 analysts follow the stock, with seven strong buy ratings, 16 buys, seven holds, and one sell recommendation. There were two upgrades in January, with one analyst upgrading Bank of America from Neutral to Overweight with a $40 price target.

Another brokerage firm raised the price target from $28 to $37 while keeping an Outperform rating on the shares after.

Conservative traders should consider a longer-term position in Bank of America while aggressive traders can target the BAC March 32 calls, which are currently trading for $0.95. If shares can make a run towards the mid-January high of $34.37 by mid-March, these options will easily double from current levels as they would be more than $2 in the money.

— Rick Rouse

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Investors Alley