Nvidia (NASDAQ:NVDA) has been a beast in the markets of late. When investors were throwing in the towel during the panic of March, many inadvertently sold some of the best companies in the stock market.

Although shares were crushed in March along with the rest of the market, Nvidia stock has since surged more than 80% from the March low to this week’s high.

Why did shares undergo such a large rally — was it earnings or a big news announcement?

No. In fact, earnings aren’t until next week. Nvidia has come roaring back to life simply because it’s a best-in-class stock that has multiple long-term growth themes in play.

Of course, it helps that sales have likely remained strong amid the novel coronavirus outbreak. This stock was an absolute steal below $200 and investors would only be so lucky to get another chance near that price again.

Breaking Down Nvidia Stock

The coronavirus has been devastating. It’s killed tens of thousands and infected millions. It’s cost people their jobs — even if only temporarily — as many struggle to pay the bills. Companies are going belly up or issuing “going concern” warnings. It’s not a good situation, even if the stock market has rebounded tremendously thus far.

With Nvidia though, the situation is a bit different. Sure, some of its automotive partners may cut back a bit on spending and there are a few areas of its business that will slow. But by and large, long-term catalysts are in play here.

Nvidia is the backbone of future technology. It operates in artificial intelligence and machine learning, data centers, autonomous driving and gaming and graphics.

Ask yourself, is there more or less data being created? That goes for right now during the coronavirus pandemic and long-term. The answer is more data. Are people playing more video games or less? Given that the industry just had its best month in a decade, it seems evident they’re playing more.

Those short-term catalysts combined with long-term secular growth themes are a huge boon for a company like Nvidia. That’s why analysts are so bullish on the stock right now.

Earnings estimates stand at $7.59 per share for fiscal year 2021 (this calendar year). If achieved, that figure would be up 31% year over year. More importantly though, that figure is up from $7.26 per share, the average earnings estimate from 90 days ago. Of course, it’s only fair to mention that the estimate is down from $7.61 and $7.60 per share from seven days and 30 days ago, respectively. Still, that’s impressive growth. It comes alongside an expected rise of 19.2% in revenue.

For 2022, analysts expect revenue to grow another 16%, fueling 20.3% earnings growth.

What Investors Are Missing About Nvidia

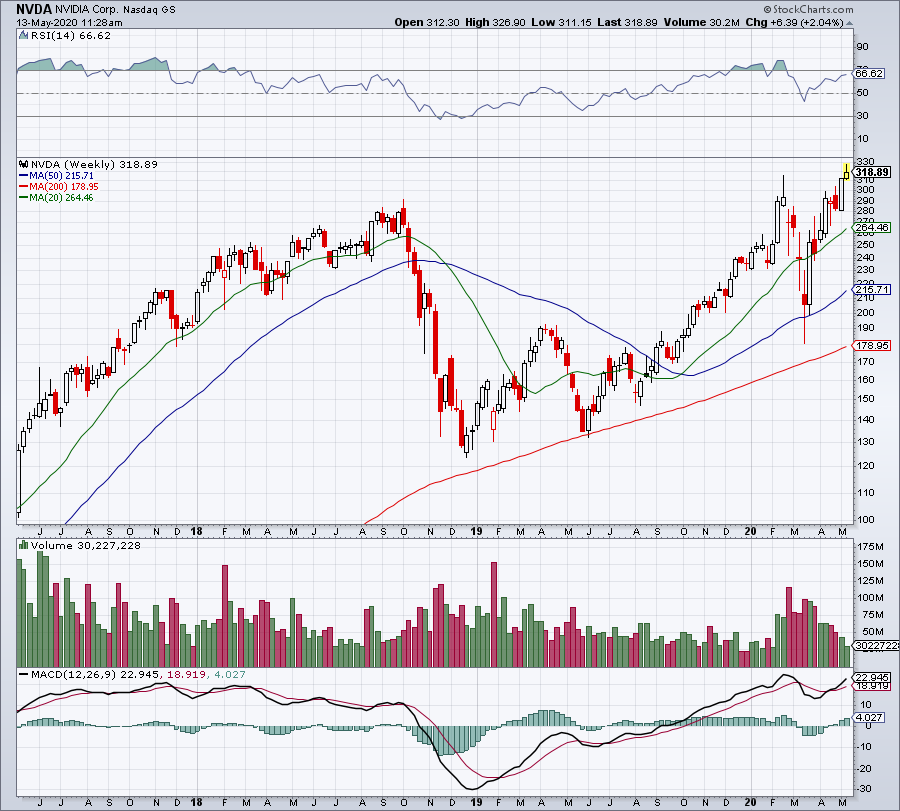

Source: Chart courtesy of StockCharts.com

Source: Chart courtesy of StockCharts.com

There’s a bevy of investors complaining about the market right now. Many are frustrated because they sold on the decline thinking they could preserve some capital and buy at lower prices. What they didn’t expect was a robust 35% rebound in the S&P 500 from the lows.

I’m not going to pretend I expected such a rebound, although I’ve always believed in buying the highest quality companies when they go on sale. But here’s the thing investors are missing about the market, and in particular, about many tech stocks: they’re worth more.

They’re worth more because they’re worth a premium. And they’re worth that premium because they have growth prospects. Most stocks will be lucky to make flat revenue and earnings growth this year. But the fact of the matter is most will have negative growth in 2020 and many will be lucky to see their 2021 results get back to 2019 levels.

Now look at a company like Nvidia, that’s expected to grow revenue 19% this year and 16% next year. Or the fact that the company is forecast to grow earnings 57% over a two-year period.

Folks, that type of growth is worth a premium and it’s why Nvidia stock has been surging lately.

Keep this in mind: Tech stocks like Nvidia, PayPal (NASDAQ:PYPL) and others may trade at a high price-to-earnings valuation. But that’s because there’s a thinning group of stocks that have any growth at all, let alone robust growth.

Bottom Line on Nvidia

There’s no need to complicate matters here. Nvidia stock is hitting new all-time highs because it has short-term and long-term catalysts. It’s growing when most others are struggling.

The company just closed on its Mellanox deal. Remember, Mellanox is immediately accretive to earnings, margins and free cash flow. Now, the company reportedly plans to acquire Cumulus Networks, a software play.

Cumulus is a partner with Mellanox, so the deal is simply another integrative play as Nvidia continues to build an ecosystem for its customers. It’s this vision — which plays on long- and short-term opportunities — that makes Nvidia stock such a valuable long-term holding.

When it comes, buy the dip.

— Matt McCall

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Investor Place