While 2020 started out firing on all cylinders, it did a quick about-face in last week. The stock market fell sharply again on Friday, with the Dow at one point sinking more than 500 points.

Fears of the coronavirus seem to be the main culprit behind the recent weakness, as investors tend to “act first” and “think later.”

And while this issue is certainly one to keep an eye on, the stock market has bounced back after every major epidemic in recent years, and I expect this to be no different.

If you’ve only been listening to the bears, you’d likely think that the sky is falling.

But the truth of the matter is that the sky is not falling and there is even a group of stocks that is not only surviving but thriving in this environment: the utilities.

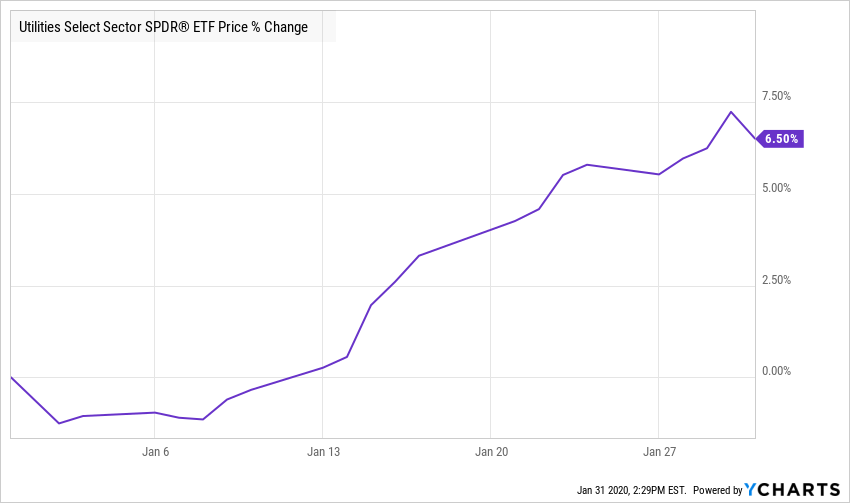

The Utilities Select Sector SPDR ETF (NYSEARCA:XLU) is up nearly 7% for January. In comparison, the Invesco QQQ Trust (QQQ), which tracks the biggest tech stocks, is up just 3.6%.

In fact, the sector had its best month since June 2016. (Utilities also have the third highest-paying dividends in the S&P 500, which is a key benefit for long-term investors.)

For those of us who’ve been at this awhile, it’s not too surprising. Historically, at times when volatility was even worse and the S&P 500 fell at least 10% in one month during the market’s 11-year bull run, the best-performing sector was (again) the utilities, according to CNBC.

The truth of the matter is that utilities provide safe havens during bouts of market volatility. This ultra-low interest rate environment is great for them, too, as the S&P 500 currently yields more than the Treasuries.

No wonder utilities have been outperforming all other sectors.

That’s the big picture, and based on the fundamentals, I found a stock in my Growth Investor service that’s well-positioned to profit from the current environment: NextEra Energy, Inc. (NYSE:NEE).

Based out of Florida, NextEra Energy is the world’s largest utility. The company focuses on sustainable sources of energy; in fact, it generates more wind and solar energy than any other company in the world!

Because Florida is an ideal place to generate wind and solar power, power generation from solar and wind farms is much cheaper to sustain in the long term — which is a key advantage for this revolutionary company.

Formally known as the Florida Power & Light Company, the company was created in 1925. NEE played a key role in the United States throughout the twentieth century, from powering NASA’s Apollo 11 mission to setting new power plant emissions standards. By 1992, their power plant emissions were 70% lower than the national average for all utilities. In 2018, NextEra Energy was recognized by Fortune magazine as one of the top 25 companies globally that “Change the World”.

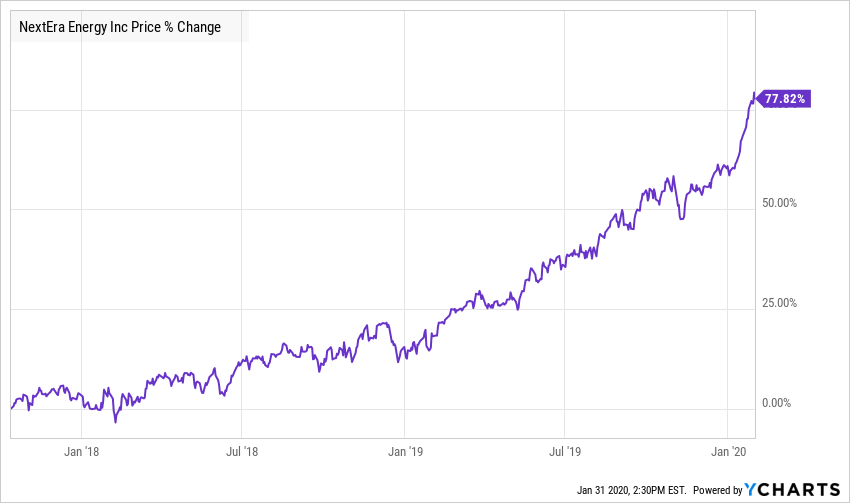

Just to further prove my point, their total shareholder return over the last 15 years is 945%. Since I recommended the stock in my Growth Investor Buy List, it is up 78%.

NEE’s growth-to-income ratio is also worth noting. In the last 15 years, its dividend has been steadily rising. The average dividend growth rate is almost 12% per year.

I’m a numbers guy, and there’s a few other credentials I look at, too, to get a clear picture of whether a stock is a good buy. By looking at a few key aspects of a company’s fundamentals, I’m able to target only the best growth plays.

So, here’s how NEE — one of my Growth Investor recommendations — is looking now.

NEE released its fourth-quarter and fiscal year 2019 results on January 24. Fourth-quarter adjusted earnings came in at $706 million, or $1.44 per share, down from $718 million, or $1.49 per share, in the same quarter a year ago. That fell short of analysts’ estimates for $1.49 per share by 3.4%.

But for the full fiscal year 2019, NextEra Energy announced adjusted earnings of $4.06 billion, or $8.37 per share, up from $3.67 billion, or $7.70 per share. That represents 10.6% annual earnings growth.

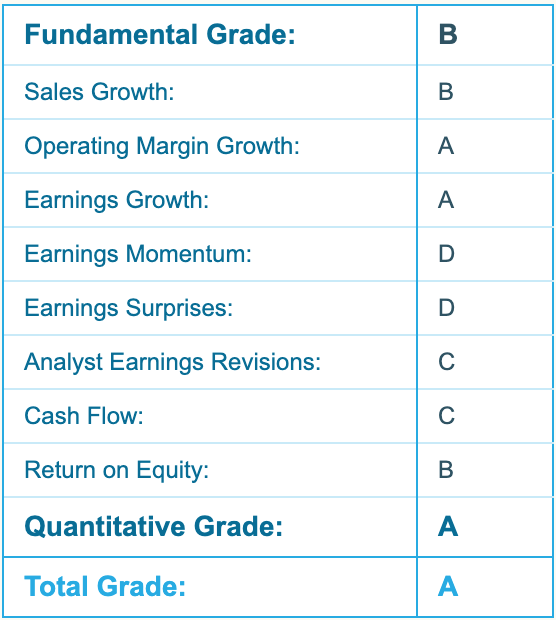

Despite falling short of estimates last Friday, the stock held its A-rating in my Portfolio Grader. This is no surprise, considering the stock hit a 52-week high of $270.66 on Friday, while the rest of the market was plummeting. As you may recall, the Portfolio Grader is made up of the key fundamentals I use to analyze every stock I research, as well as my proprietary measure of money flow into the stock, which is reflected in its Quantitative Grade.

NextEra Energy Inc.’s earnings reports are reflected in the current report card. As you can see above, both the Earnings Momentum and the Earnings Surprises are scored as a D due to the fourth-quarter drop in earnings, which missed estimates.

However, the third earnings factor — Earnings Growth — is A-rated. And that’s the heart of all good financial analysis. As long as any company is able to grow its earnings year-after-year and attract big money on Wall Street, its stock should continue to trek higher.

NextEra Energy has done just that, as have my other Growth Investor stocks. It just goes to show why analyzing the data is so important. Even after so-so earnings last quarter, NEE still remains a great pick because of its overall strong fundamentals, its popularity on Wall Street — reflected in its Quantitative Grade of A — and its solid 1.9% dividend yield.

Speaking of fundamentals, right now, it’s my favorite time of year: when companies release their fourth-quarter results. I’m not going to be scared out of the market during earnings season. And I hope that you won’t be either.

— Louis Navellier

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Investor Place