Kinder Morgan (NYSE: KMI) is one of the more popular pipeline companies with investors.

The stock pays a $0.25 per share quarterly dividend, which comes out to a 5% yield.

Kinder Morgan has 84,000 miles of oil and gas pipelines and 157 terminals.

The company generates plenty of cash flow. Cash available for distribution (CAD) is the measure of cash flow used by pipeline companies, and Kinder Morgan’s CAD has been growing over the past few years, albeit slowly.

In 2019 and 2020, CAD is forecast to grow 3% each year. It is forecast to be $4.87 billion this year and $5.03 billion in 2020.

That’s more than enough to pay the projected dividends of $2.15 billion in 2019 and $2.85 billion in 2020.

So cash flow isn’t a problem. What does concern me, though, is the company’s track record.

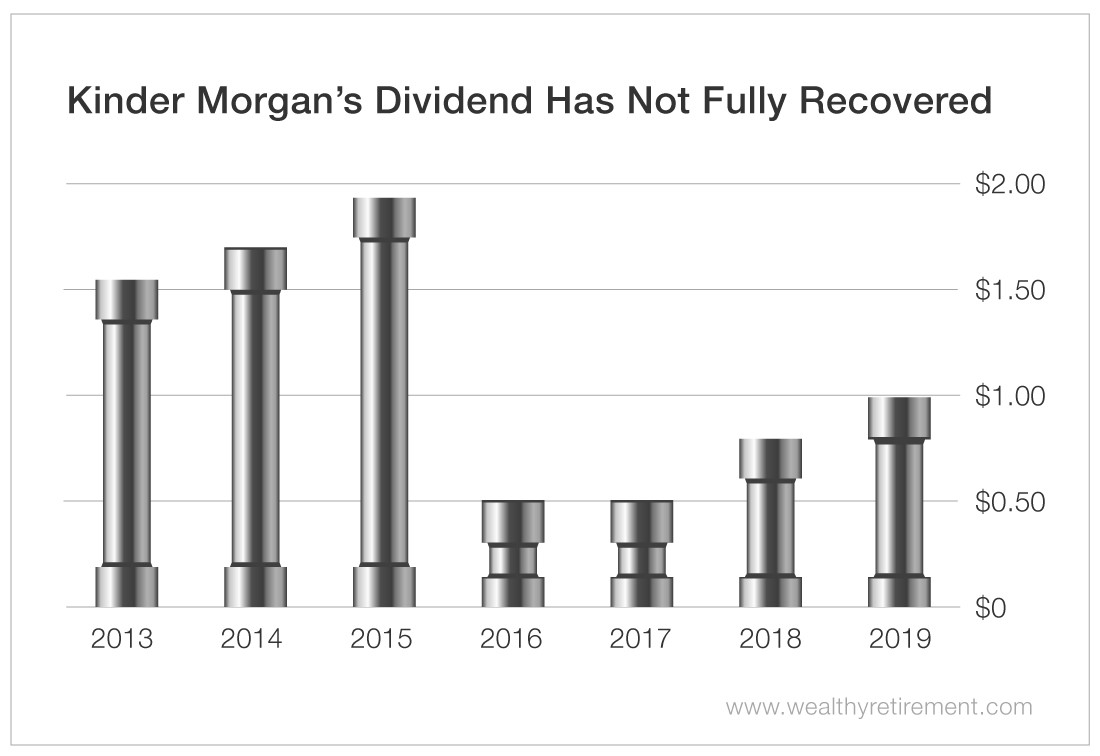

When the oil industry ran into trouble in 2016, the company slashed the dividend. It’s still 48% below where it was in 2015.

Sometimes a dividend cut is necessary when cash flow won’t support the payout. But a company that lowers the dividend is likely to do it again when times get tough.

Companies with long track records of sustained or growing dividends, on the other hand, typically find a way to continue to pay the dividend even during downturns.

Additionally, Kinder Morgan’s debt level is quite high. Its debt is more than four times its EBITDA (earnings before interest, taxes, depreciation and amortization).

Additionally, Kinder Morgan’s debt level is quite high. Its debt is more than four times its EBITDA (earnings before interest, taxes, depreciation and amortization).

That makes it more difficult for the company to sustain the dividend when cash flow decreases because interest payments eat up a meaningful portion of earnings.

I don’t expect Kinder Morgan to cut the dividend in the near future. But the next time cash flow slips, it wouldn’t shock me if the company does in fact reduce the payout to shareholders like it did before.

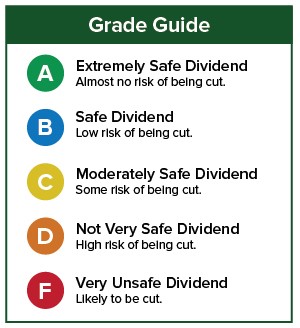

Dividend Safety Rating: C

Good investing,

Marc

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Wealthy Retirement