Social Security income is a necessity for many of the nearly 54 million retired workers currently receiving a monthly benefit. For nearly a quarter century, Gallup has surveyed retirees to gauge how reliant they are on America’s leading social program and found that up to 90% of respondents have needed their Social Security payout, in some capacity, to cover their expenses.

Given how important Social Security income is to the financial well-being of our nation’s aging workforce, you’d think strengthening this program for future generations would be a top priority for our elected officials — but this hasn’t been the case.

Based on annual reports from the Social Security Board of Trustees, Social Security’s financial foundation is tangibly weakening, with the prospect of sweeping benefit cuts becoming a real possibility within the next seven years. While a laundry list of factors is to blame (I’ll cover this in greater detail a bit later), your newest tax break(s), courtesy of the Donald Trump administration, may be contributing to Social Security’s financial woes.

Social Security is facing a $25.1 trillion (and growing) long-term funding shortfall

Since 1985, every Social Security Board of Trustees annual report has cautioned of a long-term (the 75 years following the release of a report) unfunded obligation. In plain English, the projected revenue to be collected over the 75 years following the release of a report is expected to be insufficient to cover outlays over that timeline, which primarily include benefits but also account for the administrative expenses to oversee Social Security.

In the 2025 Social Security Board of Trustees Report, this long-term funding shortfall ballooned to an estimated $25.1 trillion. This figure has grown consistently over the last four decades.

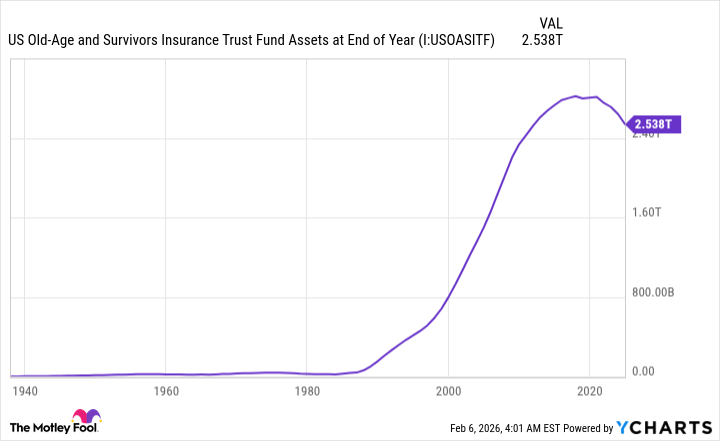

What’s arguably even more worrisome is the short-term forecast for the asset reserves of the Old-Age and Survivors Insurance trust fund (OASI). The OASI is the trust fund that doles out monthly benefits to retired workers and the survivors of deceased workers.

By the Trustees’ estimate, the OASI’s asset reserves — the excess income collected by Social Security since its inception that’s currently invested in special-issue, interest-bearing government bonds, as required by law — are predicted to be exhausted by 2033.

The silver lining is that the OASI doesn’t require a penny in its asset reserves to continue making monthly payments to retired-worker beneficiaries and survivors. Since most of Social Security’s income derives from the 12.4% payroll tax on earned income (salaries and wages, but not investment income), there will always be income to disburse to eligible recipients. Long story short, Social Security is in no danger of going bankrupt, becoming insolvent, or halting benefits.

However, if the OASI’s asset reserves are depleted, it would indicate that the existing payout schedule, inclusive of annual cost-of-living adjustments (COLAs), isn’t sustainable. If the OASI’s asset reserves are gone by 2033, as forecast, retired workers and survivors would see their monthly checks slashed by up to 23%, per the Trustees.

News flash: Your new tax break may be pulling the rug out from beneath Social Security

News flash: Your new tax break may be pulling the rug out from beneath Social Security

How does Social Security transform from a program on solid financial footing to one that’s now in a precarious position? Part of the answer lies with President Trump’s flagship tax and spending law, the “big, beautiful bill.”

This law, signed by Trump on July 4, 2025, introduced or extended several tax breaks. For instance, it made the individual taxpayer brackets under the Tax Cuts and Jobs Act (TCJA) permanent. The TCJA lowered most individual income tax rates.

However, it’s the temporary tax credits and deductions associated with Trump’s big, beautiful bill that have garnered the most attention. From tax years 2025 through 2028:

- Select seniors aged 65 and older can claim an additional $6,000 deduction atop their standard deduction, or $12,000 for senior couples filing jointly.

- Select workers below certain modified adjusted gross income (MAGI) thresholds can deduct up to $25,000 annually in qualified tips.

- Certain workers below preset MAGI thresholds can deduct up to $12,500 in overtime pay annually, or up to $25,000 annually if filing jointly.

While these new tax breaks are designed to allow some low- and middle-income Americans to retain more of the income they receive, it’s coming at the detriment of Social Security.

In early August, following a request from Sen. Ron Wyden (D-OR), the Social Administration’s Office of the Actuary (OACT) published an analysis of how the big, beautiful bill is expected to impact America’s leading retirement program.

According to the OACT, the loss of collectable income from some of these new and extended tax breaks is projected to increase combined costs for the OASI and Disability Insurance trust fund by $168.6 billion from 2025 through 2034. This income loss is expected to shorten the timeline to the OASI’s asset reserve depletion date to the fourth quarter of 2032.

In other words, your new tax break may be partially responsible for moving up the timeline to sweeping Social Security benefit cuts.

The big, beautiful bill is part of a bigger problem

But as noted earlier, there’s a long list of issues at the heart of Social Security’s financial woes. Donald Trump’s flagship tax and spending law is just one of them.

Arguably, nothing has been more deleterious to this leading retirement program than demographic shifts.

Some of these demographic changes are well-known and have been ongoing for some time. For instance, baby boomers have been retiring for more than a decade, which has put pressure on the worker-to-beneficiary ratio.

Additionally, life expectancy has risen substantially since the very first Social Security retired-worker check was mailed in January 1940. To be somewhat blunt, Social Security wasn’t designed to provide benefit checks for multiple decades.

But several other demographic changes that aren’t in the spotlight are decisively hurting Social Security. This includes:

- A historically low U.S. birth rate, which threatens to further pressure the worker-to-beneficiary ratio in the coming decades.

- A rise in income inequality, with more earned income “escaping” the payroll tax when compared to four decades prior.

- A notable decline in net legal migration into the U.S. Since migrants tend to be younger, they’re expected to contribute to Social Security via the payroll tax for decades to come.

Collectively, these demographic shifts are playing a considerably larger role than Trump’s tax law in worsening Social Security’s financial outlook — and there’s no easy fix. The one certainty is that the longer lawmakers wait to tackle the program’s numerous shortcomings, the costlier it’ll be on working Americans and retirees.

— Sean Williams

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: The Motley Fool