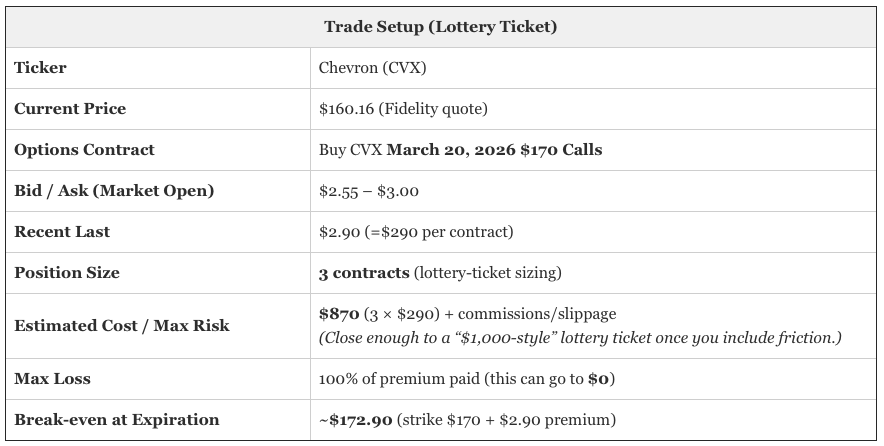

Editor’s Note (Update): This article was updated shortly after the market opened on January 5, 2026 to reflect fresh option pricing and current market conditions. The original shorter-dated call idea became significantly more expensive at the open, so the trade setup has been adjusted to a longer-dated contract that better fits today’s pricing and the broader thesis.

This past weekend delivered the kind of geopolitical headline that normally sends oil traders into full panic mode: U.S. forces kidnapped Venezuelan President Nicolás Maduro and his wife in a military operation.

When a geopolitical story like this breaks out, most traders react the same way: “Buy oil. It’s going to spike.”

Sometimes that’s true. But markets are rarely that clean. And what’s been most interesting to me is this:

The market hasn’t been rewarding the oil proxy — United States Oil Fund (USO) — nearly as much as it’s been rewarding Chevron (CVX).

That’s the key. The crowd is trying to trade crude prices… but the tape has been bidding up the business — the big U.S. producer with scale, cash flow, growing dividends, capital returns, and the ability to benefit even if oil stays range-bound.

So instead of gambling on “oil to the moon,” I’m leaning into the divergence I’ve been watching: Chevron outperforming oil.

The Divergence Setup

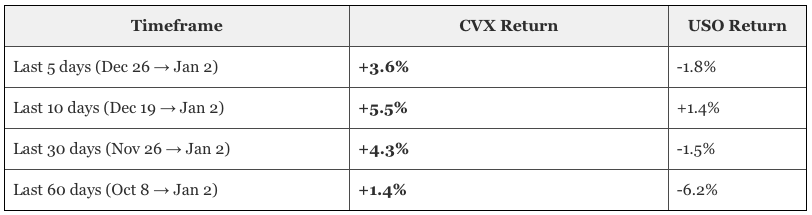

Here’s the simple evidence. Chevron has beaten USO in every timeframe we checked — and the gap has widened over time.

If the “obvious” trade was simply oil ripping higher, USO should be leading the way.

Instead, the market has been rewarding Chevron — which tells me traders may be treating Venezuela as a market share and earnings story for U.S. producers, not necessarily a permanent “oil shock” story.

What Chevron Has Done in Past Crisis Windows

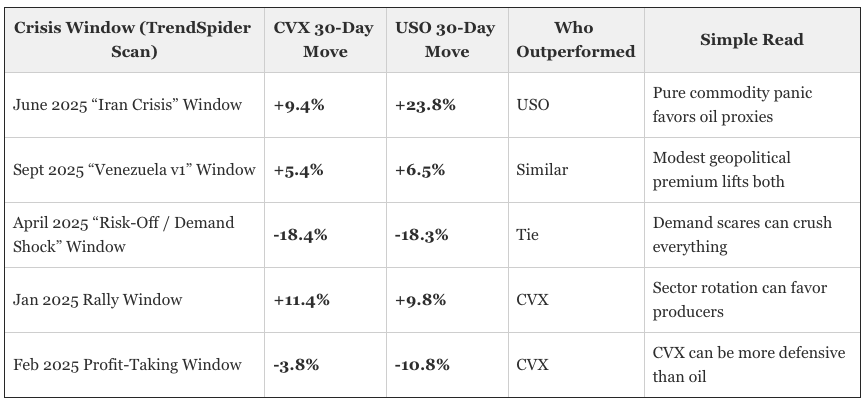

To pressure-test this, I asked TrendSpider to compare Chevron and USO during the same crisis windows we were already looking at for oil. That gave us a clean apples-to-apples look at how CVX behaves when headlines get loud.

Quick note: This isn’t meant to be a perfect “scientific backtest.” It’s a practical look at comparable windows — and it highlights the pattern clearly: USO is the maximum-upside panic vehicle, while CVX often captures a meaningful share of upside with (sometimes) less pain when oil fades.

That’s exactly what we want for a swing trade: a stock that can move on the headline cycle without requiring a full-blown oil price moonshot.

Why We’re Going Out Further in Time

When the market opened, near-term options got expensive fast — the kind of “pay up for the next two weeks of chaos” pricing that can punish you if the move doesn’t happen immediately.

So we’re doing the smarter version of the lottery ticket: we’re giving the thesis time to play out by moving the expiration out to March.

The Trade: March 20 $170 Calls (Lottery Ticket)

With CVX now around $160, these $170 calls are roughly 6% out-of-the-money — still a swing-for-the-fences bet, but with a more realistic path if the stock continues trending higher.

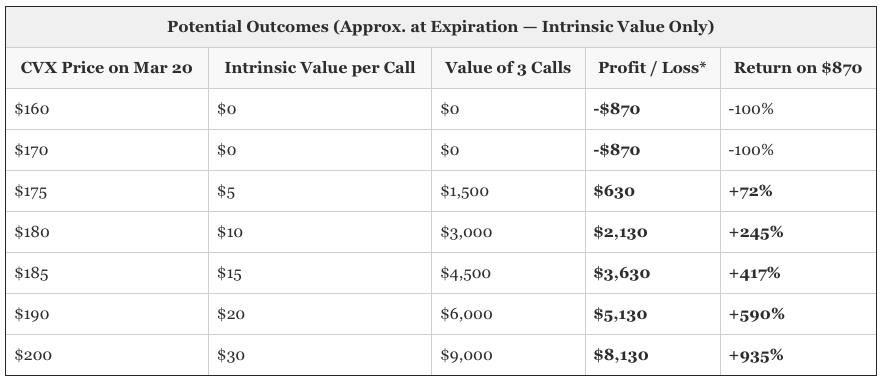

Now for the fun part. What can this turn into if Chevron makes a real move?

What Can This “$1,000-Style” Lottery Ticket Turn Into?

The table below uses intrinsic value at expiration. In real life, you can often sell earlier (and options can carry time value if CVX moves quickly). But this keeps the math clean and honest.

*Profit/Loss assumes an estimated $870 entry cost (3 contracts × $2.90). Actual results may differ due to time value, implied volatility changes, early exits, commissions, and slippage.

This is why options are both dangerous and powerful. If Chevron doesn’t move, you can lose it all. But if CVX runs — even without oil going crazy — the payoff can ramp up fast.

And because we’re using March instead of a shorter-dated contract, we’re not forcing the entire thesis to play out in the next 10 trading sessions.

The Takeaway

The herd is going to trade Venezuela like it’s a simple story: “chaos equals oil up.”

But markets are rarely that neat. The tape has been telling a different story: Chevron has been acting stronger than oil itself, and TrendSpider’s crisis-window scan shows CVX often captures a meaningful share of upside while sometimes holding up better than USO when oil fades.

So this is my updated swing-for-the-fences play: March 20 $170 calls on Chevron — a defined-risk, “$1,000-style” lottery ticket that can go to zero… but can also turn into a several thousand dollars if this divergence keeps widening.

Good trading!

Greg Patrick

P.S. Want to know how I spotted the CVX-vs.-USO divergence (and then structured this lottery-ticket trade around it)? I built the analysis in TrendSpider — it let me quickly compare performance across multiple timeframes, scan unusual options activity (that showed “smart money” leaning into CVX calls rather than betting on a crude spike), and pressure-test the idea using historical moves during past geopolitical spikes (where CVX’s crisis-window behavior gave us a cleaner, stock-specific playbook than guessing crude direction). If you trade swings and like having the charts, data, and alerts in one place, be sure to check out TrendSpider.