It’s been a while since I last looked at MPLX (NYSE: MPLX). At the time, the stock received a “B” for dividend safety.

The company did not disappoint, as the dividend was not cut. In fact, it grew by 36% over the next three years.

MPLX is a master limited partnership that processes and transports natural gas and oil. It was spun out from Marathon Petroleum in 2012.

The stock pays a quarterly distribution of $0.9565, which comes out to a 7.8% yield. (MLPs pay distributions, not dividends.) It has boosted the distribution every year since it began paying one in 2013. Can it keep that impressive track record intact?

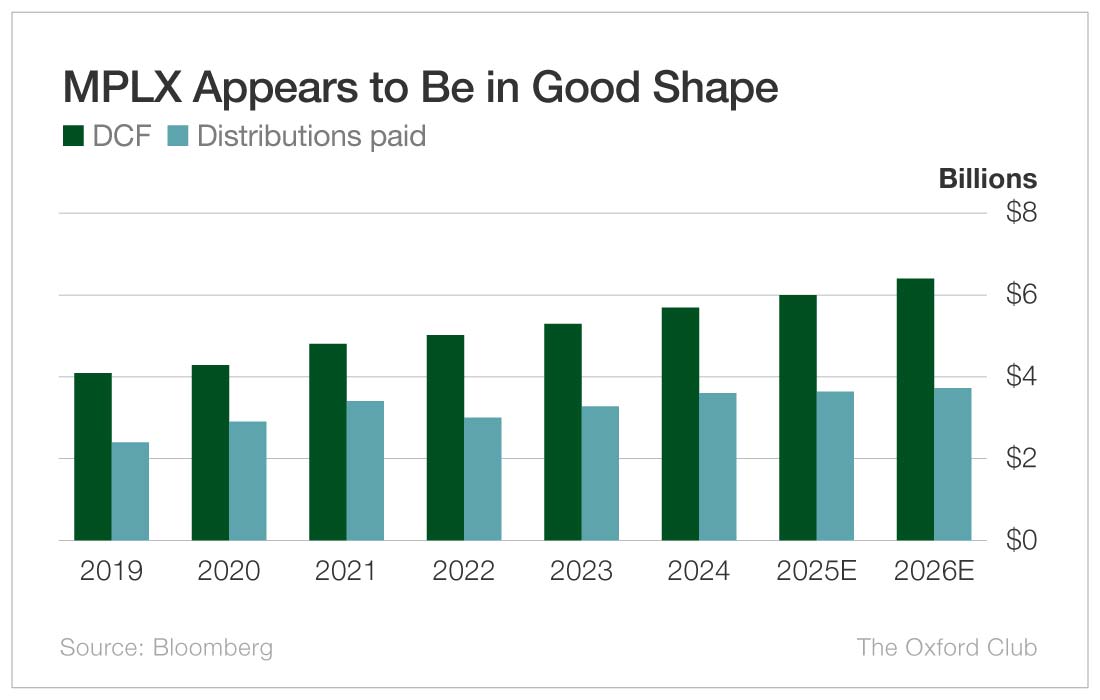

MPLX and many other MLPs use a measure of cash flow called distributable cash flow, or DCF.

Last year, MPLX’s DCF totaled $5.7 billion. This year, it’s expected to come in at $6 billion. In 2026, DCF is forecast to grow another 6% to $6.4 billion.

Meanwhile, the company paid out $3.6 billion in distributions in 2024 for a payout ratio of just 63%. In other words, it paid investors 63% of the cash flow it generated. For MLPs, I’m comfortable with any number below 100%, so 63% is very reasonable.

This year, even though the distributions paid are expected to increase, the payout ratio is projected to dip to 60%.

MPLX has always done a good job of paying a generous distribution without spending all of its cash flow.

MPLX has been growing its DCF and growing its payout to shareholders, but it’s also left plenty of wiggle room should cash flow ever recede.

MPLX has been growing its DCF and growing its payout to shareholders, but it’s also left plenty of wiggle room should cash flow ever recede.

The distribution is very safe.

Dividend Safety Rating: A

— Marc Lichtenfeld

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Wealthy Retirement