We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Luminar Technologies, Inc. (NASDAQ: LAZR)

Today’s penny stock pick is the lidar sensor provider for autonomous vehicles, Luminar Technologies, Inc. (NASDAQ: LAZR).

Luminar Technologies, Inc. provides sensor technologies and software for passenger cars and commercial trucks in North America, the Asia Pacific, Europe, and the Middle East. It operates in two segments, Autonomy Solutions and Advanced Technologies and Services. The Autonomy Solutions segment designs, manufactures, and sells laser imaging, detection, and ranging sensors or lidars, as well as related perception and autonomy software solutions primarily for original equipment manufacturers in the automobile, commercial vehicle, robo-taxi, and adjacent industries.

The Advanced Technologies and Services segment develops application-specific integrated circuits, pixel-based sensors, and advanced lasers. This segment also designs, tests, and provides consulting services for non-standard integrated circuits for use in automobile and aeronautics sector, as well as government spending in military and defense activities.

Website: https://www.luminartech.com/

Latest 10-K report: https://investors.luminartech.com/sec-filings/annual-reports/content/0001628280-25-015432/0001628280-25-015432.pdf

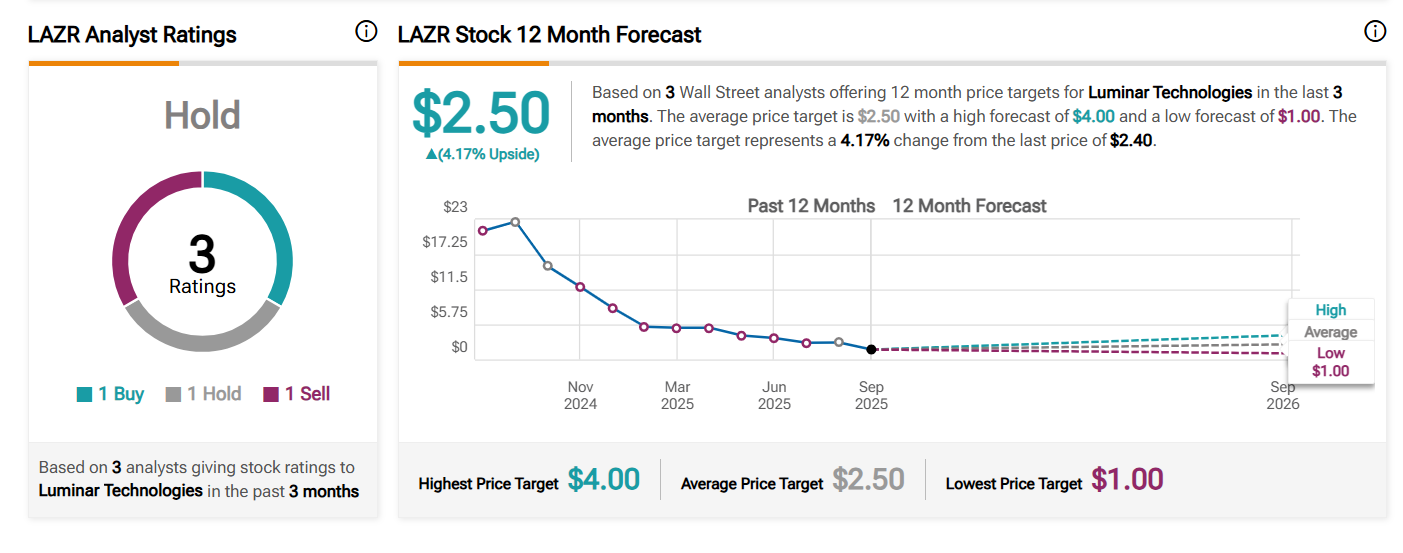

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for LAZR in the last 3 months, the stock has an average price target of $2.50.

Potential Catalysts / Reasons for the Hype:

- Recent Lidar/autonomy tailwinds from EV resurgence and regulatory pushes could help LAZR position itself as a key enabler in this transition.

- The company’s strong Volvo tie-up is advancing production ramps; reporting Q2 progress on industrialization and next-gen lidar tech.

- LAZR is strategically shifting its focus from a slower-than-expected adoption of Level 3+ autonomous passenger vehicles to commercial markets like trucking, defense, and security to generate near-term revenue and diversify its business model for diversified revenue.

- Rumors of takeover and LiDAR ecosystem expansion through software integrations.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern with a high volume. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher.

#5 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for LAZR is above the price of $2.55.

Target Prices: Our first target is $3.60. If it closes above that level, the second target price is $4.50.

Stop Loss: To limit risk, place a stop loss at $1.90. Note that the stop loss is on a closing basis.

Our target potential upside is 41% to 76%.

For a risk of $0.65, our first target reward is $1.05, and the second target reward is $1.95. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

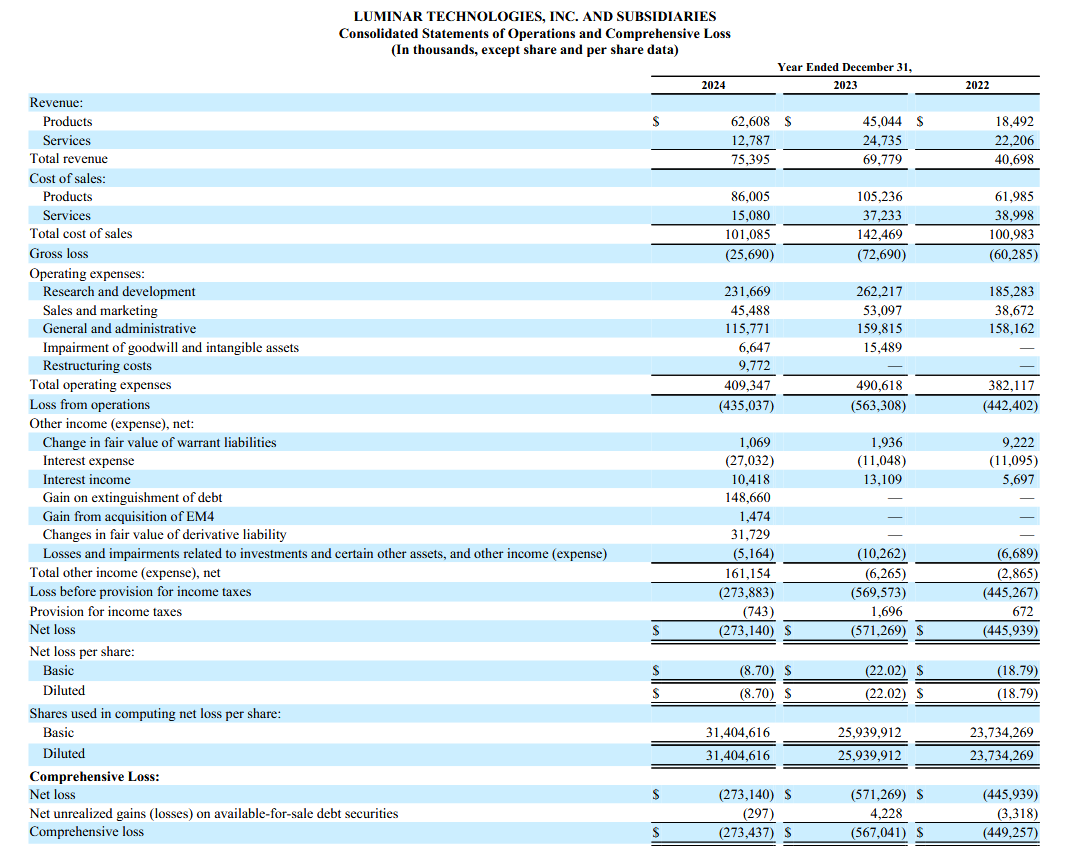

- The company has a history of net losses.

- The company is expected to incur substantial R&D costs and devote significant resources to identifying and commercializing new products, which could significantly reduce its profitability and may never result in revenue.

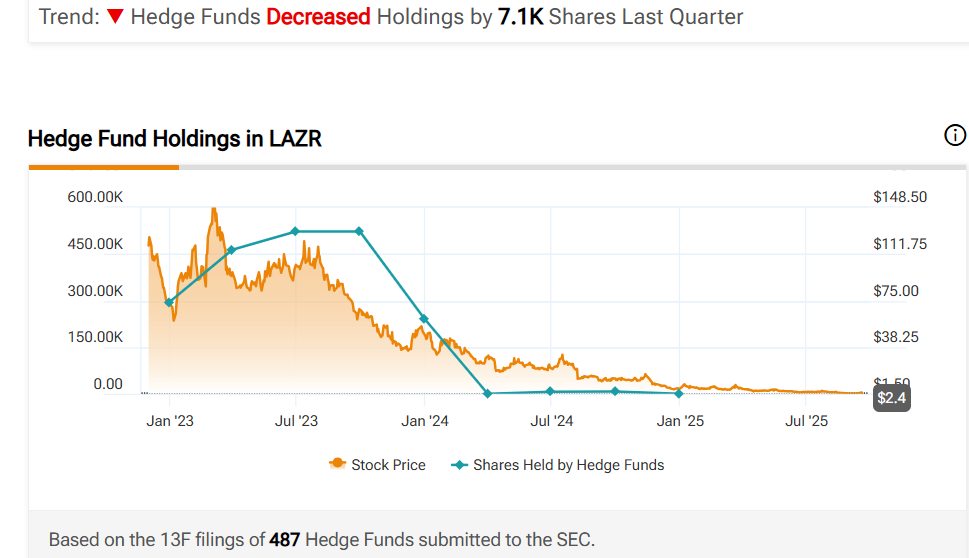

- Hedge Funds Decreased Holdings by 7.1K Shares Last Quarter.

- The company has customer concentration risk. In 2024, 2023, and 2022, LAZR’s top 10 customers represented 70%, 66% and 69% of its revenue, respectively.

- The lidar market is slowly getting crowded with the likes of Velodyne and Livox.

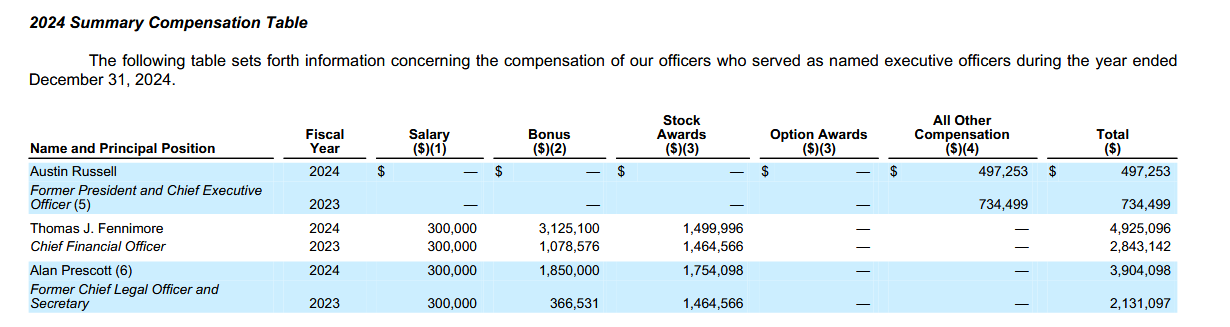

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: Trades of the Day