Growth Stocks At A Reasonable Price

In this video, Chuck Carnevale, co-founder of FAST Graphs, aka Mr. Valuation discusses Growth at a Reasonable Price (GARP) and presents five small- to mid-cap growth stocks at a reasonable price he believes are worth researching. These companies combine solid growth potential with attractive valuations, offering the possibility of strong annualized returns through earnings growth, dividends, and P/E multiple expansion.

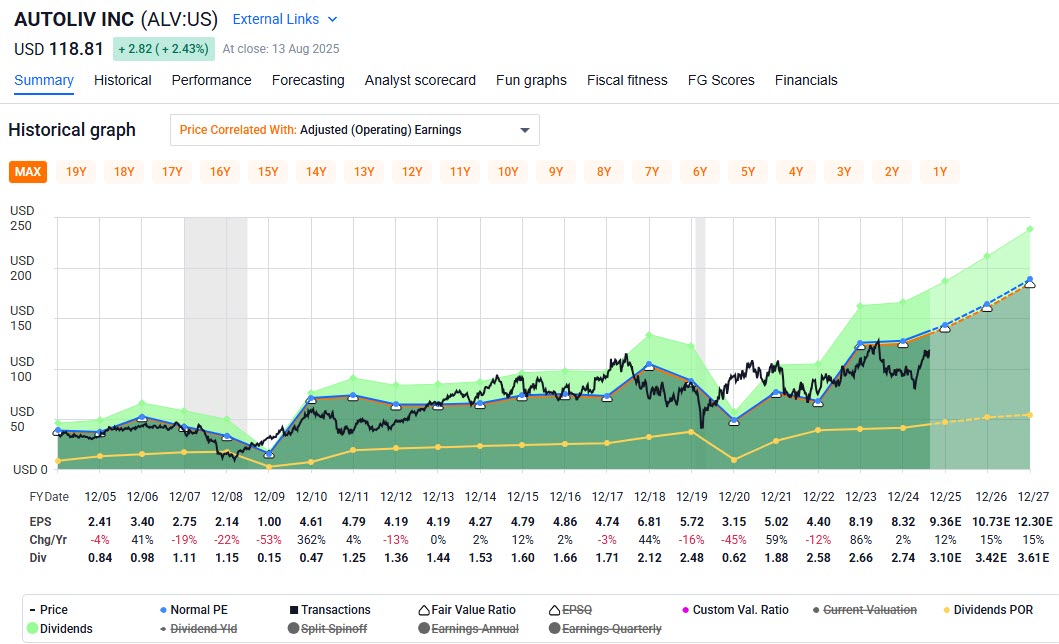

Autoliv (ALV), a maker of automotive safety systems like airbags and seatbelts, has grown earnings around 7% long-term, 10% over the last decade, and 16% in recent years. Analysts forecast roughly 14% annual growth ahead. With a blended P/E near 13 compared to a historical norm of 16, potential returns could reach 24–30% annually if valuation reverts. The stock yields nearly 3% and carries modest debt, though its dividend record is spotty and free cash flow coverage inconsistent due to cyclicality.

Growth Stocks At A Reasonable Price

H.B. Fuller Company (FUL), which produces specialty chemicals and adhesives for markets like aerospace, automotive, and packaging, has grown about 10% historically and is projected to grow 16% annually going forward. It trades at a P/E of 14 with an earnings yield near 7% and a 1.6% dividend yield. Debt is around 50% of capital, and margins have been low recently, so verifying the reasons behind analysts’ optimism is important. Historically overvalued, the stock now trades near fair value, making it a candidate to watch.

H.B. Fuller Company (FUL), which produces specialty chemicals and adhesives for markets like aerospace, automotive, and packaging, has grown about 10% historically and is projected to grow 16% annually going forward. It trades at a P/E of 14 with an earnings yield near 7% and a 1.6% dividend yield. Debt is around 50% of capital, and margins have been low recently, so verifying the reasons behind analysts’ optimism is important. Historically overvalued, the stock now trades near fair value, making it a candidate to watch.

Oshkosh Corp. (OSK), a construction and heavy equipment manufacturer with products ranging from specialty vehicles to electric mobility solutions, has low debt at 18% of capital and a modest dividend yield. While cyclical, analysts expect 13% annual growth after a down year, aligning with its historical 15x multiple and offering over 24% potential annualized returns if growth materializes.

Sonoco Products (SON), which makes paper and plastic packaging, saw two years of negative earnings that pushed valuations down. Analysts expect a turnaround with over 20% growth this year followed by around 7.5% annually. Trading at a blended P/E near 8 versus a historical 15, the stock could deliver more than 44% annualized returns through earnings growth, multiple expansion, and a dividend yield above 4.5%. Further research is needed to confirm the recovery’s sustainability.

Verint Systems (VRNT), an application software company with strong AI-related customers, has historically grown slowly but is now forecast for double-digit growth. It carries almost no debt and pays no dividend, making it a pure growth play. Its current P/E is well below its historical 15x average, creating the potential for annualized returns above 50% if growth occurs and valuation normalizes. Investigating why the market is undervaluing it is key.

Chuck stresses that these are research candidates, not buy recommendations. His approach focuses on identifying fundamentally strong companies trading below fair value, allowing long-term business performance—not short-term price swings—to drive returns. The FAST Graphs “orange line,” representing fair value at a P/E of 15, serves as a guide to spotting attractive entry points. Buying quality companies below this line supports the GARP principle of buying low and selling high.

— Chuck Carnevale

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.

Source: FAST Graphs