We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Village Farms International, Inc. (NASDAQ: VFF)

Today’s penny stock pick is the large-scale, vertically-integrated supplier of high-value, high-growth plant-based Consumer Packaged Good, Village Farms International, Inc. (NASDAQ: VFF).

Village Farms International, Inc. produces, markets, and distributes greenhouse grown tomatoes, bell peppers, cucumbers, and mini-cukes in North America. It operates in five segments: Produce, Cannabis-Canada, Cannabis-U.S., Energy, and Leli. It produces and supplies cannabis products to other licensed providers and provincial governments in Canada and internationally; develops and sells cannabinoid-based health and wellness products, including ingestible, edibles, and topical applications; and produces power.

The company also markets and distributes its products under the Village Farms brand name to retail supermarkets and fresh food distribution companies, as well as tomatoes, peppers and cucumbers produced under exclusive and non-exclusive arrangements from greenhouse supply partners. In addition, it produces and supplies cannabis products to designated coffee shops. The company was formerly known as Village Farms Canada Inc. and changed its name to Village Farms International, Inc. in December 2009.

Website: https://www.villagefarms.com/

Latest 10-k report: https://villagefarms.com/wp-content/uploads/2025/03/Village-Farms-2024-Form-10K.pdf

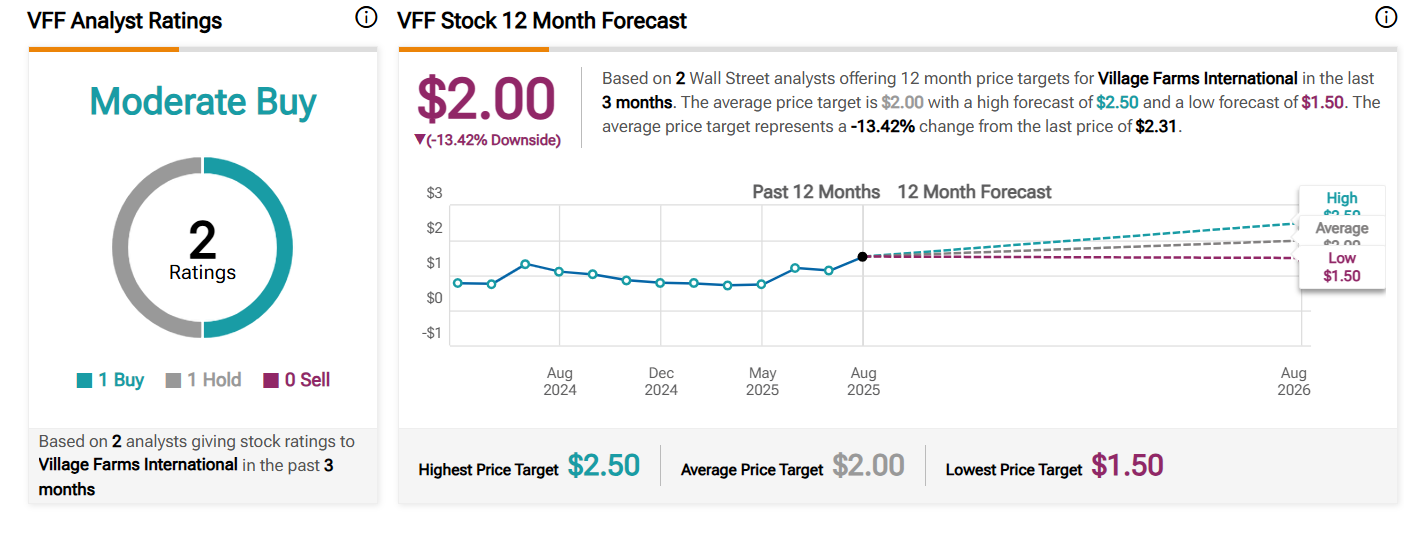

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for VFF in the last 3 months, the stock has an average price target of $2.00.

Potential Catalysts / Reasons for the Hype:

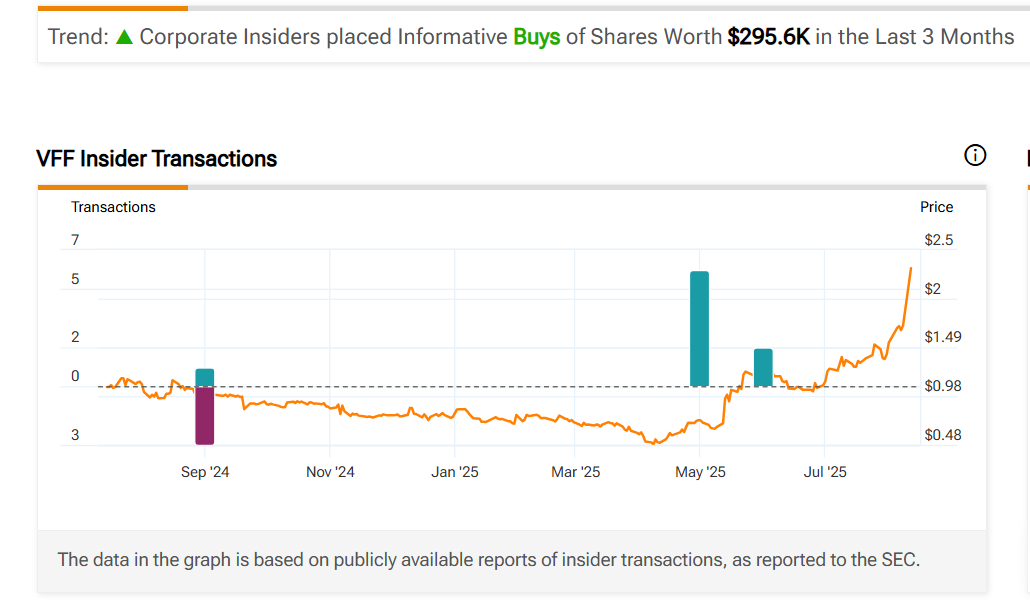

- Corporate Insiders placed Informative Buys of Shares Worth $295.6K in the Last 3 Months.

- VFF’s cannabis subsidiary is anticipated to be a key growth driver, leveraging low-cost production and innovative products like vapes and new packaging. Its research on cannabis potency and international export plans could position it as a leader in Canada’s cannabis market.

- The company’s cultivation operations in the Netherlands are expanding, targeting the promising European medicinal cannabis market.

- Positive U.S. policy developments, such as marijuana reclassification as a Schedule III drug, could drive significant gains, given the retail buzz and VFF’s U.S. exposure.

- The company reported its Q2 2025 results on August 11, 2025, demonstrating strong performance and strategic progress, with consolidated net sales increasing by 12% year-over-year to $59.9 million.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Uptrend Channel Breakout: The daily chart shows that the stock has broken out of an uptrend channel with high volume, which is shown as purple color lines. This is a possible bullish indication.

#2 Price above MAs: The stock is currently above its 50-day and 200-day SMA, indicating that the bulls have currently gained control.

#3 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for VFF is above the price of $2.35.

Target Prices: Our first target is $3.50. If it closes above that level, the second target price is $4.50.

Stop Loss: To limit risk, place a stop loss at $1.70. Note that the stop loss is on a closing basis.

Our target potential upside is 50% to 91%.

For a risk of $0.65, our first target reward is $1.15, and the second target reward is $2.15. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

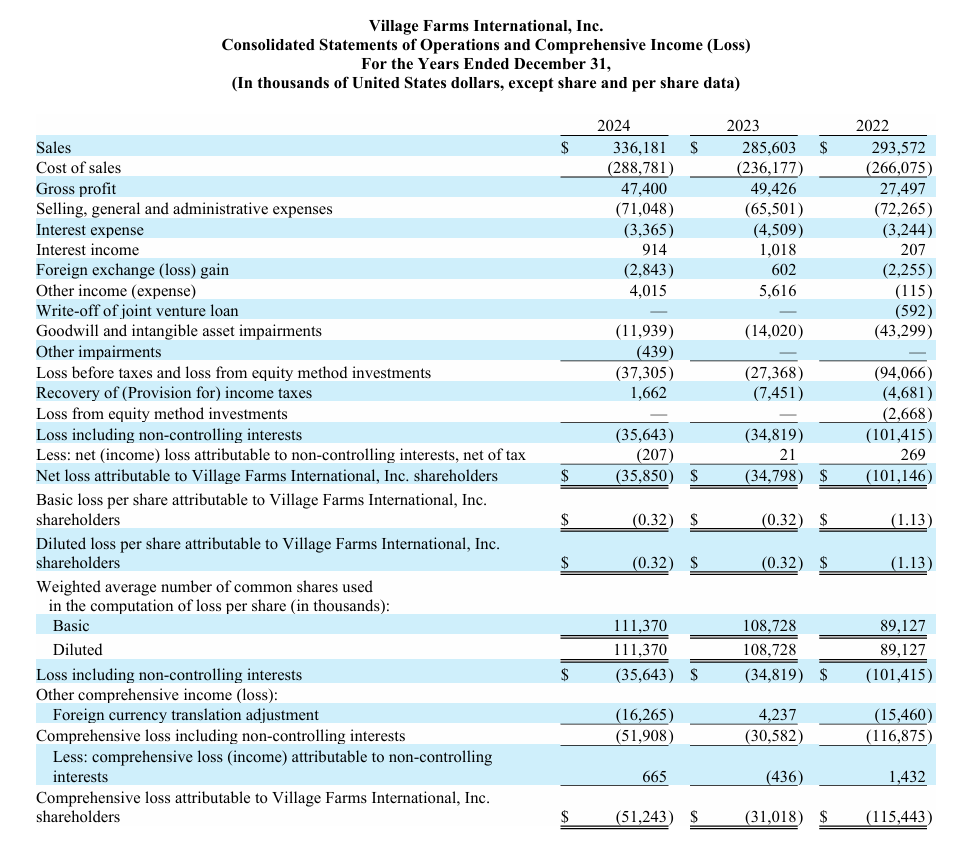

- The company has a history of net losses.

- The $10.5 million non-cash write-down due to inventory quality issues in Q4 2024 highlights the company’s operational challenges in maintaining product quality.

- The cannabis industry is highly competitive, with both established players and new entrants vying for market share. This could pressure VFF’s margins, especially in its cannabis segment through its subsidiary, Pure Sunfarms.

- While VFF has reduced its debt-to-equity ratio to 0.20% as of Q2 2025, its total debt of $65.5 million remains a concern given ongoing losses. Effective debt management will be critical to sustaining financial flexibility.

- The company has customer concentration risk as the top ten produce customers accounted for approximately 52% and 57% of total produce revenue for the years ended December 31, 2024, and 2023, respectively.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day