We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Omeros Corporation (NASDAQ: OMER)

Today’s penny stock pick is the clinical-stage biopharmaceutical company, Omeros Corporation (NASDAQ: OMER).

Omeros Corporation discovers, develops, and commercializes small-molecule and protein therapeutics, and orphan indications targeting immunologic diseases. The company’s lead products candidate is the Narsoplimab (OMS721/MASP-2) for the treatment of hematopoietic stem-cell transplant-associated thrombotic microangiopathy (TA-TMA); and in a Phase II clinical trial to treat COVID-19 and acute respiratory distress syndrome.

It also develops OMS1029 that has completed phase I clinical trials for mannan-binding lectin-associated serine protease 2 (MASP-2) and lectin pathway disorders; zaltenibart that is in phase 3 clinical trials for Paroxysmal nocturnal hemoglobinuria; in phase 2 clinical trial for the treatment complement 3 glomerulopathy, and other alternative pathway disorders; and OMS527 that is in phase I clinical trials for addictions and compulsive disorders, and movement disorders, as well as cocaine use disorder.

In addition, the company’s products under preclinical development comprise MASP-2, a pro-inflammatory protein target for the treatment of lectin pathway disorders; MASP-3 small-molecule inhibitors for alternative pathway disorders; and Adoptive T-Cell and Immunostimulator Combination Therapies, and Oncotoxins and Immunomodulators for the treatment of various cancers.

Website: https://www.omeros.com/

Latest 10-k report: https://investor.omeros.com/static-files/62d33a87-9b96-461b-9c21-472c8a7acc67

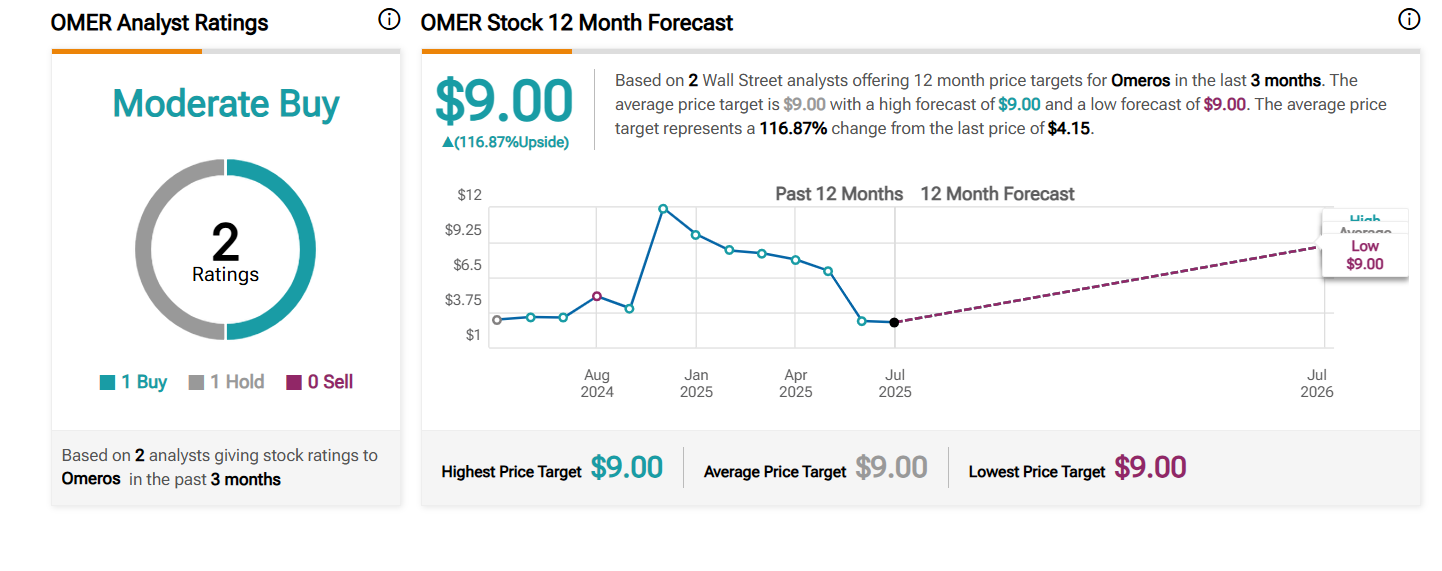

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for OMER in the last 3 months, the stock has an average price target of $9.00, which is nearly 117% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The upcoming Q2 2025 earnings scheduled for August 6, 2025, could provide updates on cash use, pipeline progress, and partnership talks. If earnings reveal partnership progress or strong pipeline data, the stock could rally.

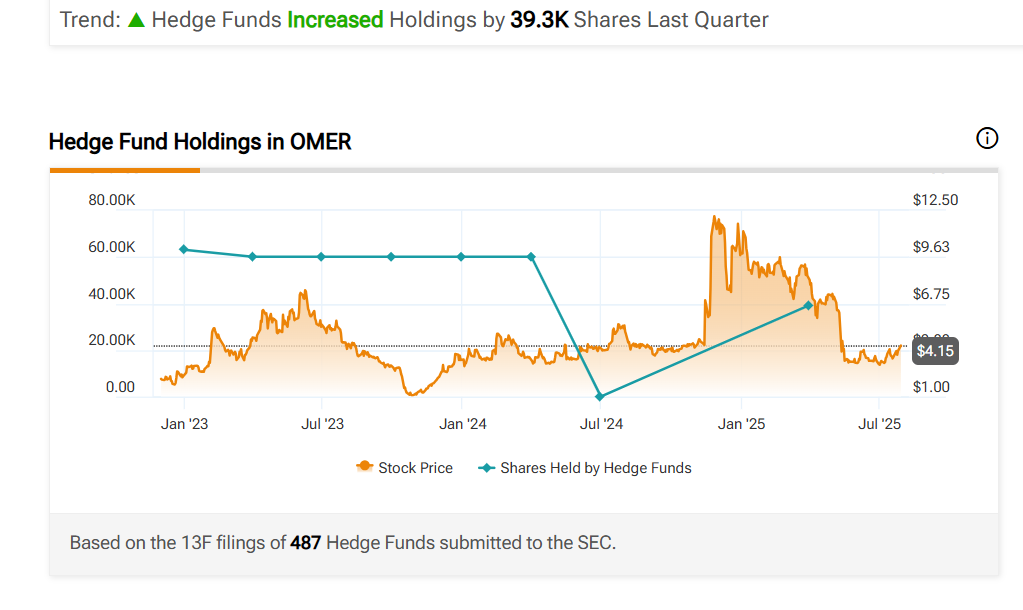

- Hedge Funds Increased Holdings by 39.3K Shares Last Quarter.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Breakout From Consolidation Area: The daily chart shows that the stock had been consolidating within a price range for the past few days. This area is marked as a purple color rectangle. The stock has now broken out from this consolidation area and is currently trading above it. The breakout level of this consolidation area typically acts as a good support level.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for OMER is above the price of $4.40.

Target Prices: Our first target is $5.90. If it closes above that level, the second target price is $6.80.

Stop Loss: To limit risk, place a stop loss at $3.60. Note that the stop loss is on a closing basis.

Our target potential upside is 34% to 55%.

For a risk of $0.80, our first target reward is $1.50, and the second target reward is $2.40. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

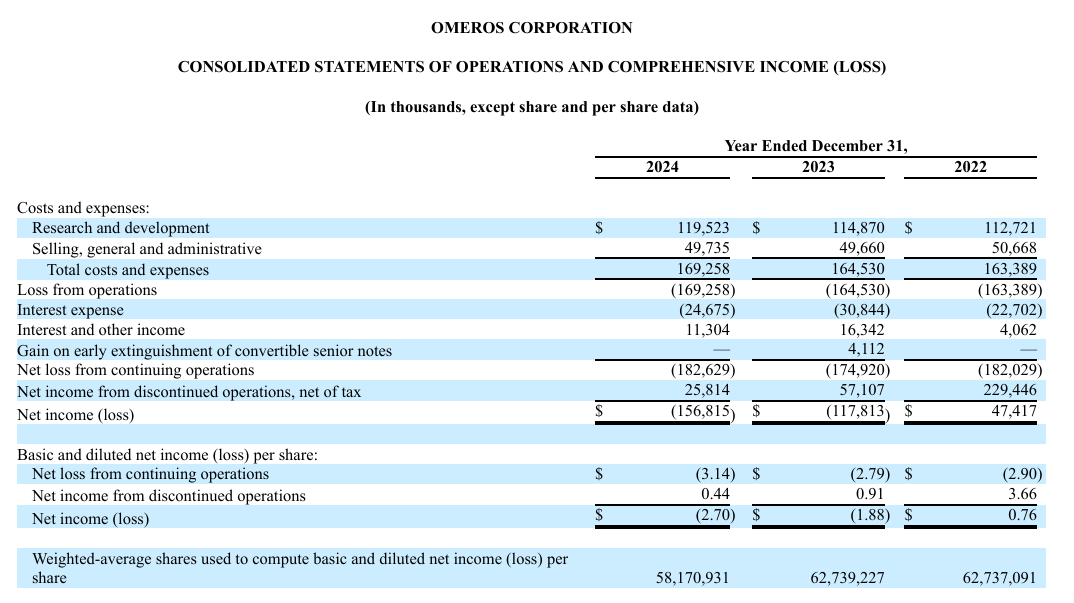

- The company has a history of net losses.

- The company has high cash burn. OMER had reported a net loss of $33.5 million ($0.58 per share) in Q1 2025, with cash reserves at $52.4 million before recent fundraising. This necessitates frequent capital raises.

- Past FDA Complete Response Letters (e.g., 2021 CRL for narsoplimab) may have eroded investor confidence in the stock.

- Originally set for late September 2025, the FDA extended the review for narsoplimab’s BLA to December 26, 2025, due to an information request—potentially signaling scrutiny and delaying commercialization.

- OMER has also priced a $22 million registered direct offering on July 24, 2025, selling 5.37 million shares at $4.10 each (about 9% dilution), with net proceeds of ~$20.3 million for general purposes, including product development. This could pressure the stock short-term.

- Narsoplimab faces potential competition from established complement inhibitors, particularly those developed by larger companies like Alexion/AstraZeneca, if approved for broader use in complement-mediated diseases.

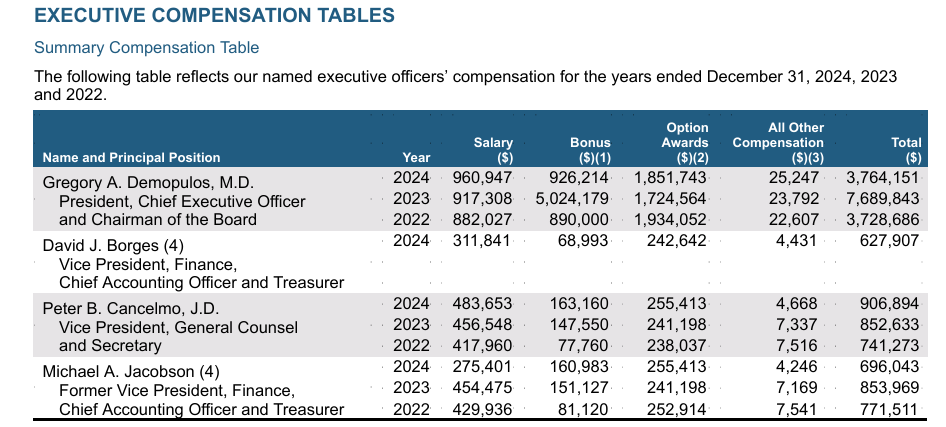

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day