We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Immix Biopharma, Inc. (NASDAQ: IMMX)

Today’s penny stock pick is the clinical-stage biopharmaceutical company, Immix Biopharma, Inc. (NASDAQ: IMMX).

Immix Biopharma, Inc. engages in the development of chimeric antigen receptor cell therapy in light chain Amyloidosis and immune-mediated diseases in the United States and Australia. The company’s lead product is NXC-201 for relapsed/refractory AL Amyloidos. It has a clinical collaboration and supply agreement with BeiGene Ltd. for a combination Phase 1b clinical trial in solid tumors of IMX-110 and anti-PD-1 Tislelizumab.

Website: https://www.immixbio.com/

Latest 10-k report: https://s3.amazonaws.com/sec.irpass.cc/2649/0001641172-25-000387.pdf

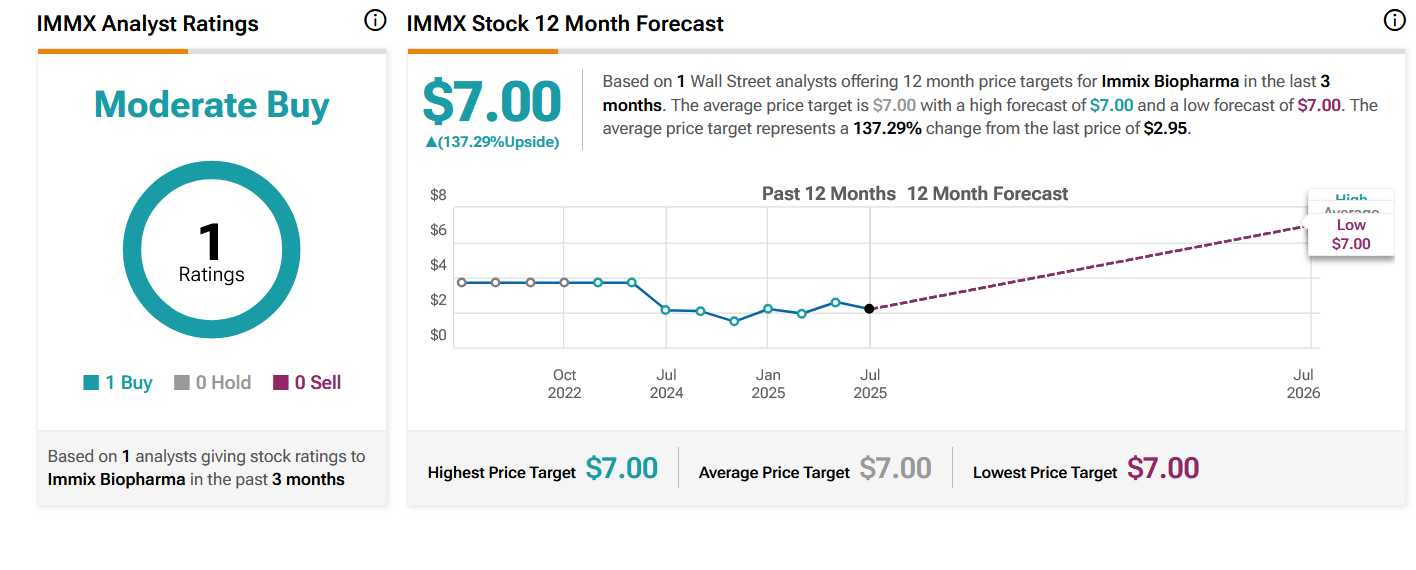

Analyst Consensus: As per TipRanks Analytics, based on 1 Wall Street analyst offering 12-month price targets for IMMX in the last 3 months, the stock has an average price target of $7.00, which is nearly 137% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- Immix’s NXC-201 has shown a class-leading safety profile with no neurotoxicity in low-volume disease patients and a 100% response rate (70% complete response) in the NEXICART-2 trial. The therapy’s Regenerative Medicine Advanced Therapy (RMAT) and Orphan Drug Designations from the FDA and EMA also provide regulatory advantages, potentially accelerating approval timelines.

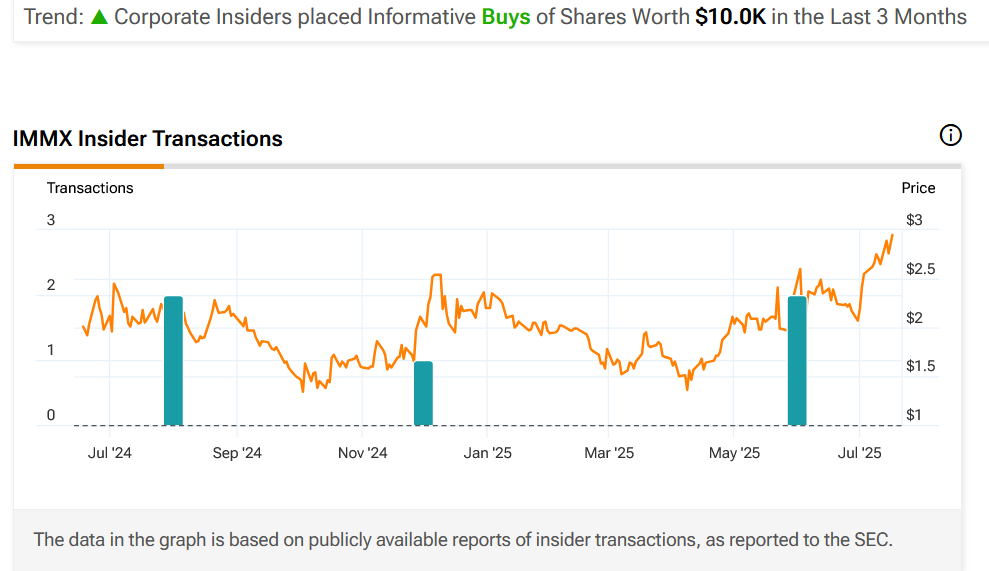

- Corporate Insiders placed Informative Buys of Shares Worth $10.0K in the Last 3 Months.

- The biotech sector benefits from broader healthcare trends, including digital transformation and AI integration, which could indirectly support interest in innovative therapies like NXC-201.

- Immix reported adding 10 new trial sites and a 71% complete response rate in 5/7 patients, reinforcing clinical momentum.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Breakout from Consolidation area: The daily chart shows that the stock has been consolidating within a price range for the past few days. This area is marked as a purple rectangle. The stock has now broken out from this consolidation area and is currently trading above it. The breakout level of this consolidation area typically acts as a good support level.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30 in the weekly chart. This indicates possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for IMMX is above the price of $3.00.

Target Prices: Our first target is $3.90. If it closes above that level, the second target price is $4.80.

Stop Loss: To limit risk, place a stop loss at $2.40. Note that the stop loss is on a closing basis.

Our target potential upside is 30% to 60%.

For a risk of $0.60, our first target reward is $0.90, and the second target reward is $1.80. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

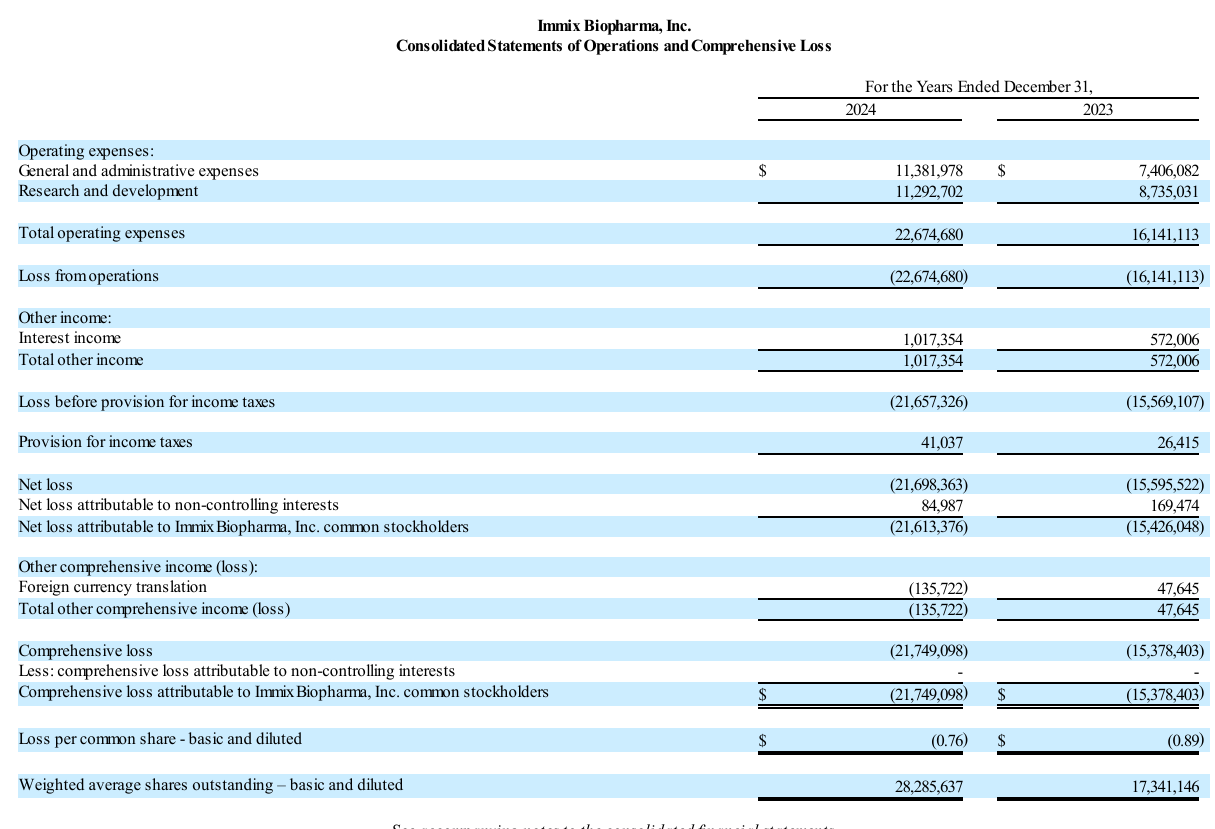

- The company has a history of net losses. As of December 31, 2024, IMMX had an accumulated deficit of $75,024,671.

- As a clinical-stage company, Immix is likely pre-revenue with high cash burn from trial expansion (18 U.S. sites) and R&D. The recent At The Market (ATM) Offering Agreement with Citizens JMP Securities suggests potential share dilution to raise capital, which could pressure the stock price.

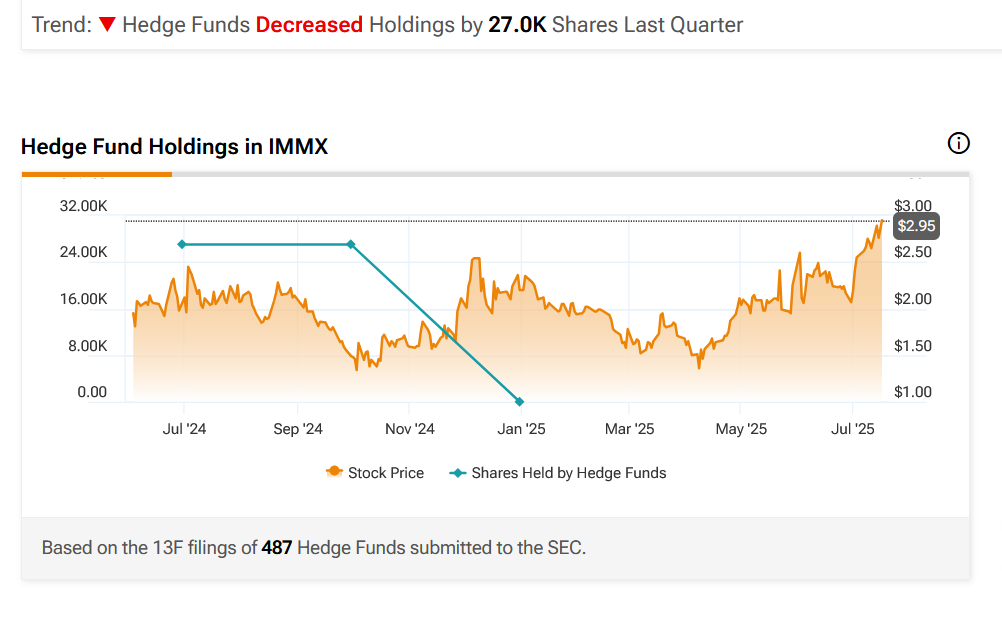

- Hedge Funds Decreased Holdings by 27.0K Shares Last Quarter.

- The company’s lead candidate, NXC-201, is in Phase 1/2 trials (NEXICART-2), and there are risks that further data may not align with the promising interim results (100% response rate, 70% complete response rate). Failure to maintain these outcomes or delays in trial progress could negatively impact the stock.

- The CAR-T therapy space is highly competitive, with the likes of Gilead Sciences and Novartis dominating the market. Although Immix’s niche focus on AL amyloidosis is an advantage, any setbacks could allow competitors to capture market attention.

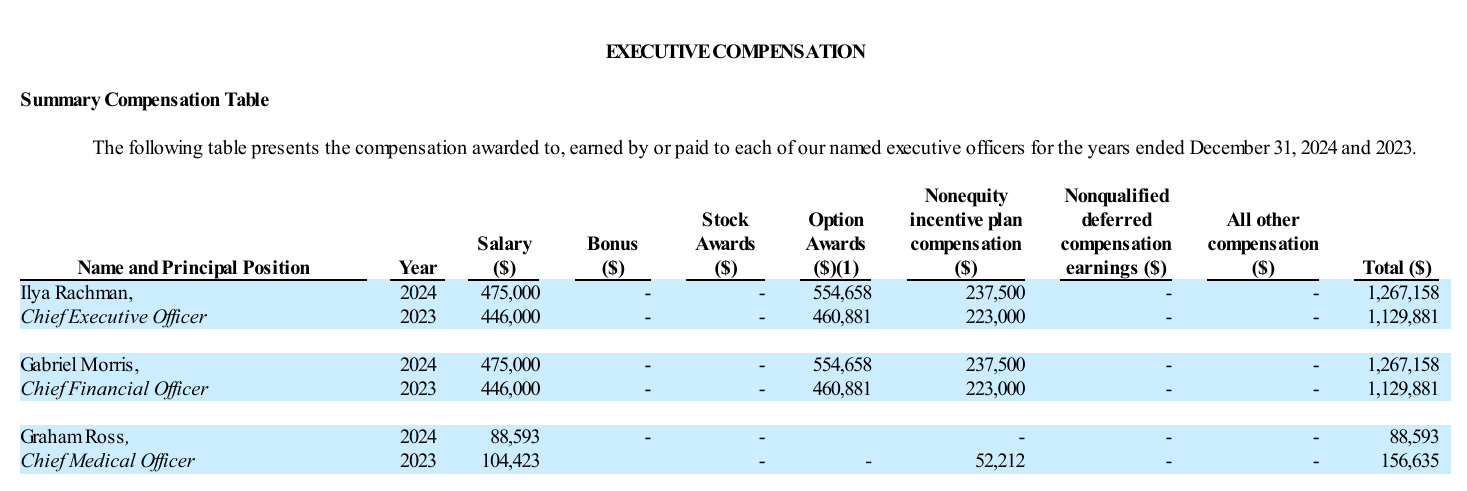

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day