We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Nuvation Bio Inc. (NYSE: NUVB)

Today’s penny stock pick is the clinical-stage biopharmaceutical company, Nuvation Bio Inc. (NYSE: NUVB).

Nuvation Bio Inc. focuses on developing therapeutic candidates for oncology. Its lead product candidate is taletrectinib, an ROS1 inhibitor for the treatment of patients with ROS1+ non-small cell lung cancer. The company is also developing Safusidenib, an inhibitor of mutant isocitrate dehydrogenase 1 in phase 2 clinical trials; NUV-1511, a drug-drug conjugate for use in chemotherapy agents that suppresses the growth of various advanced solid tumors; and NUV-868, a binding domain 2 bromodomain and extra-terminal inhibitor that inhibits bromodomain-containing protein 4.

Website: https://www.nuvationbio.com/

Latest 10-K report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001811063/27ba01e1-5c10-4bd8-85cd-7fa26c7e39e2.pdf

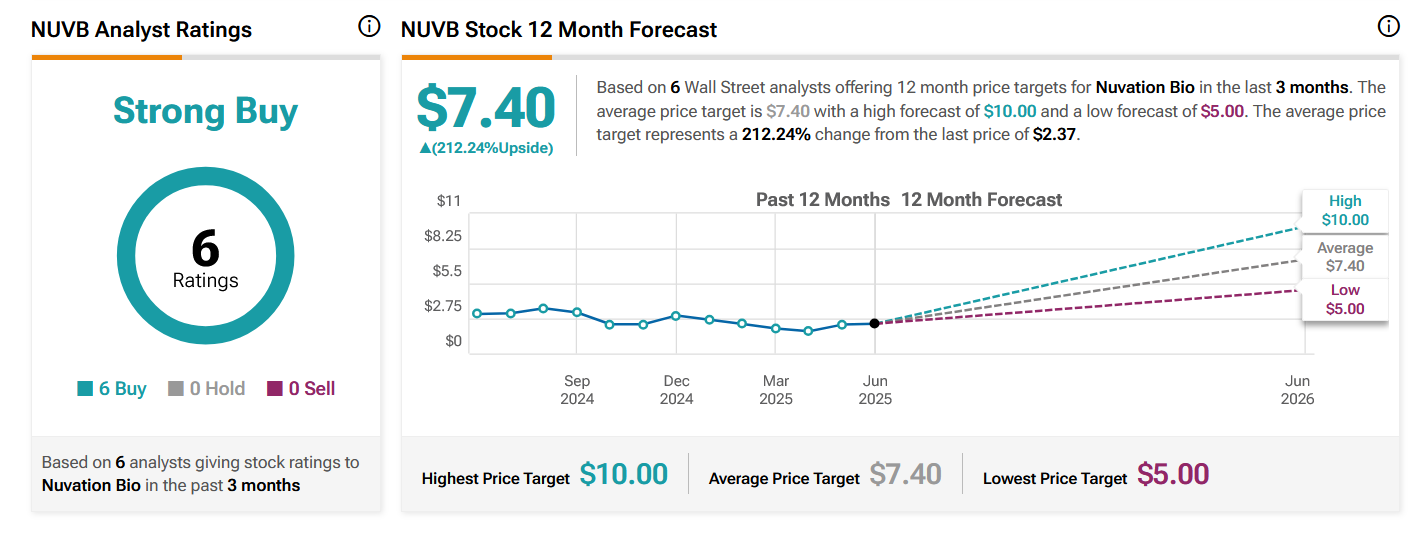

Analyst Consensus: As per TipRanks Analytics, based on 6 Wall Street analysts offering 12-month price targets for NUVB in the last 3 months, the stock has an average price target of $7.40, which is nearly 212% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The FDA approval of IBTROZI for ROS1-positive NSCLC in 2025 is a major milestone, positioning Nuvation as a commercial-stage company. The drug’s approval in China by the NMPA in January 2025 further expands its market potential. IBTROZI demonstrated an 89% objective response rate (ORR) and a 46-month progression-free survival (PFS) in clinical trials, with significant efficacy in brain metastases and minimal CNS adverse events, giving it a competitive edge.

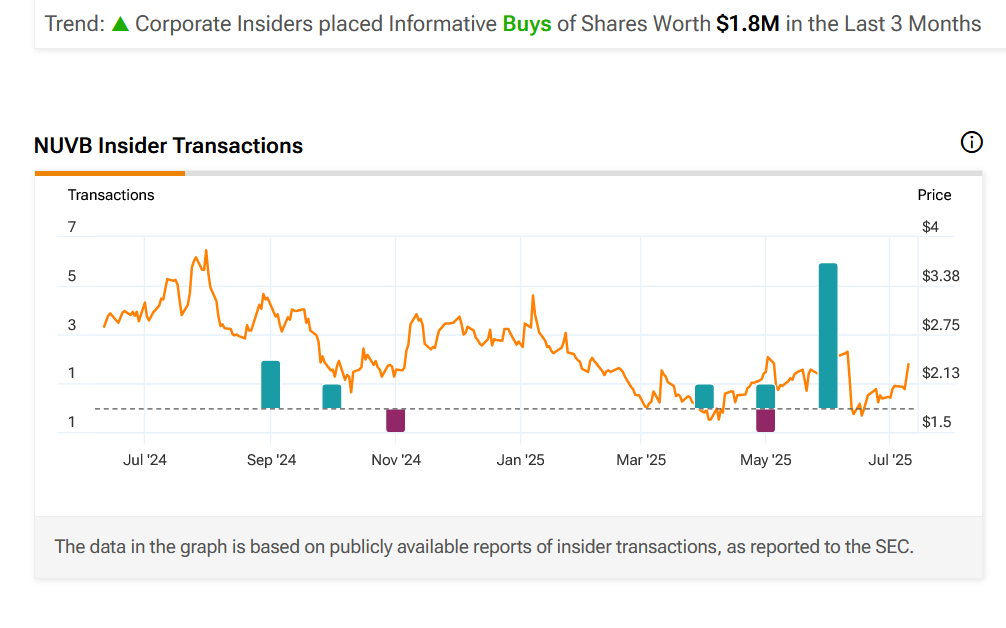

- Corporate Insiders placed Informative Buys of Shares Worth $1.8M in the Last 3 Months.

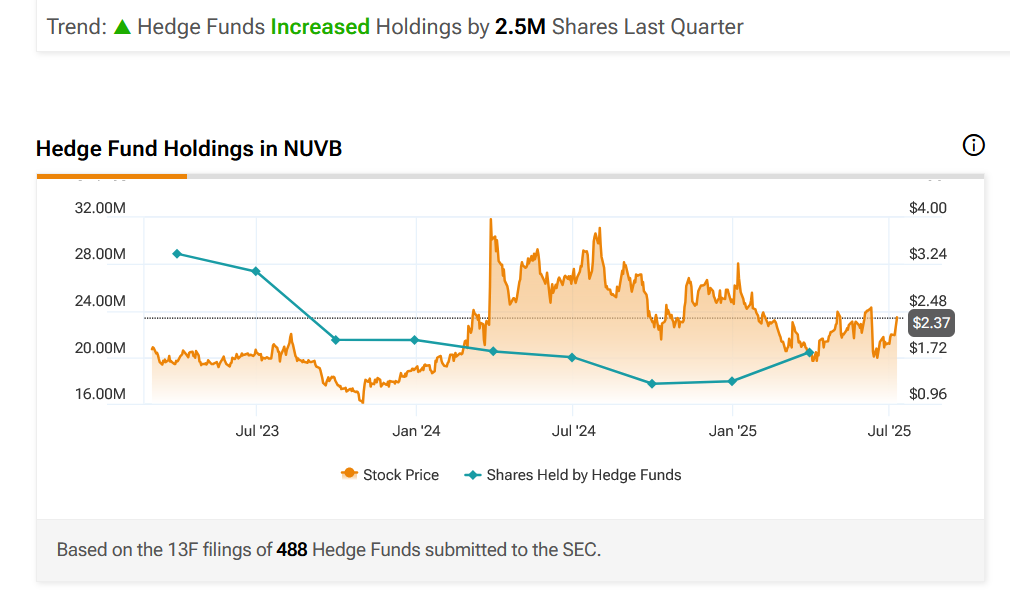

- Hedge Funds Increased Holdings by 2.5M Shares Last Quarter.

- Nuvation maintains a strong balance sheet with more cash than debt, bolstered by a $250 million non-dilutive financing deal, providing runway for commercialization and pipeline development.

- Beyond IBTROZI, Nuvation is advancing other clinical-stage candidates, including a BET inhibitor, mIDH1 inhibitor, and drug-drug conjugate (DDC), diversifying its oncology portfolio.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock currently looks poised for a breakout from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day and 200-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for NUVB is above the price of $2.45.

Target Prices: Our first target is $3.20. If it closes above that level, the second target price is $4.00.

Stop Loss: To limit risk, place a stop loss at $2.00. Note that the stop loss is on a closing basis.

Our target potential upside is 31% to 63%.

For a risk of $0.45, our first target reward is $0.75, and the second target reward is $1.55. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

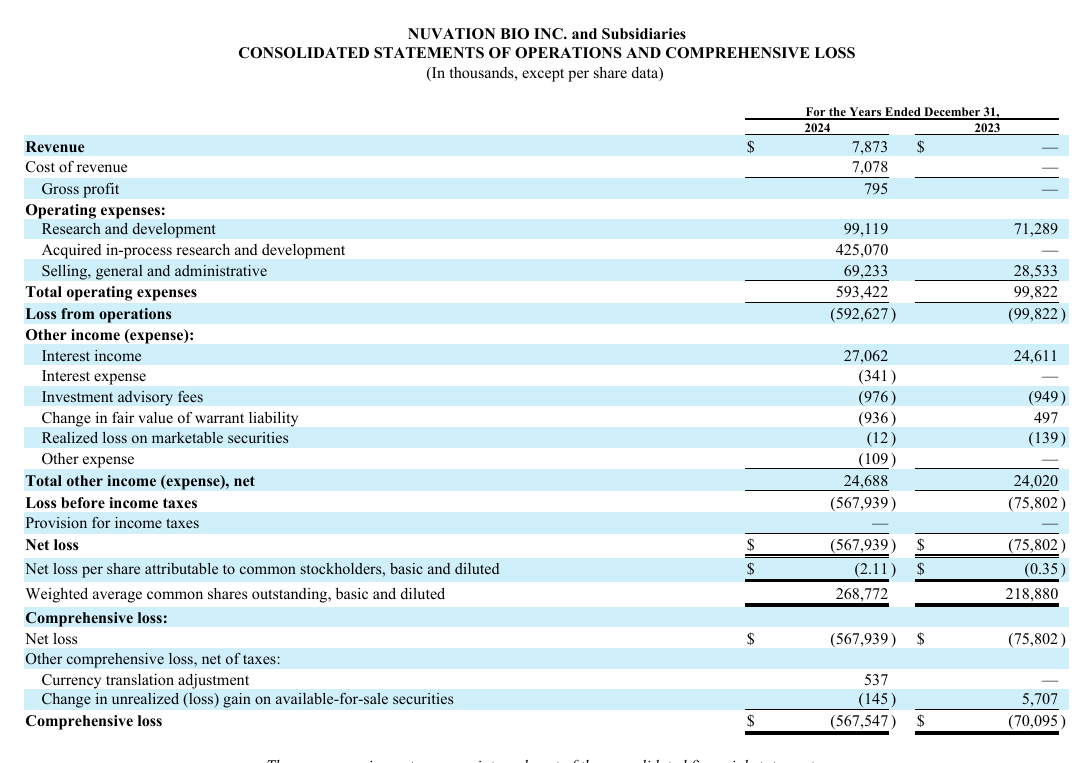

- The company has a history of net losses.

- Finding eligible patients for IBTROZI, particularly those with ROS1-positive NSCLC, may be difficult due to the need for specific genetic testing, potentially slowing adoption.

- IBTROZI faces near-term competition in the ROS1-positive NSCLC market, which could challenge market penetration. Other therapies may have established footholds or different dosing advantages.

- IBTROZI’s once-daily dosing requires fasting, which may be less convenient compared to competitors with twice-daily dosing, potentially affecting patient compliance.

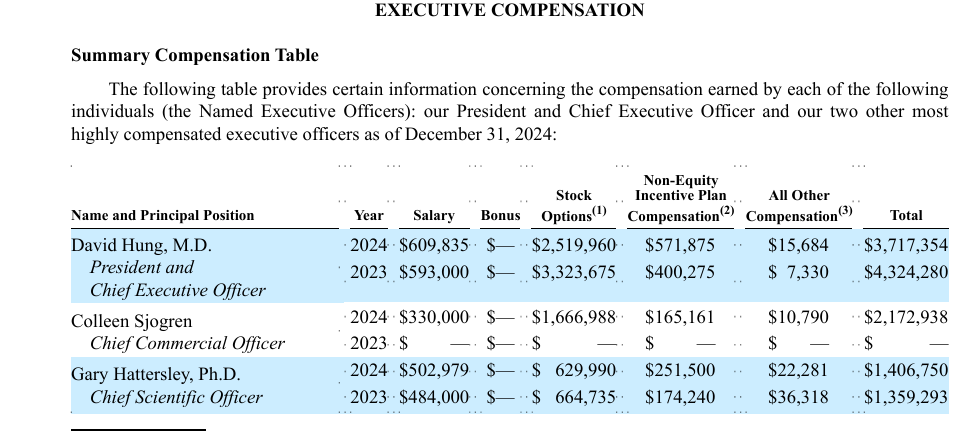

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

He issued warnings for RNG before it crashed 89%, BYND before it crashed 90%, TDOC before it crashed 84%, and FVRR before it crashed 86%. Now, he's stepping forward to name the popular stock that could go down as one of the worst-performing tickers of the year. It could be the most dangerous stock of 2026. Click here for its name and ticker, 100% free.

Source: Trades of the Day