The SPDR S&P Regional Banking ETF (KRE) is starting to wake up, and traders should be paying close attention.

This ETF offers exposure to a broad basket of U.S. regional banks, including names like Fifth Third Bancorp (FITB), KeyCorp (KEY), and Regions Financial (RF).

These are smaller, community-focused institutions that tend to be more sensitive to changes in interest rates, lending demand, and overall economic conditions.

For the last three years, regional banks have lagged the broader market. Rising rates crushed mortgage and small business lending, while credit conditions tightened and deposit costs surged. But that narrative is starting to flip.

With the Federal Reserve expected to cut rates in the second half of 2025, the pressure is coming off.

Regional banks have used the last two years to get lean, cutting costs, improving capital ratios, and reining in risk. There’s even speculation of a new wave of M&A in the sector, which could act as a powerful tailwind for share prices.

The Technical Setup Is Getting Bullish

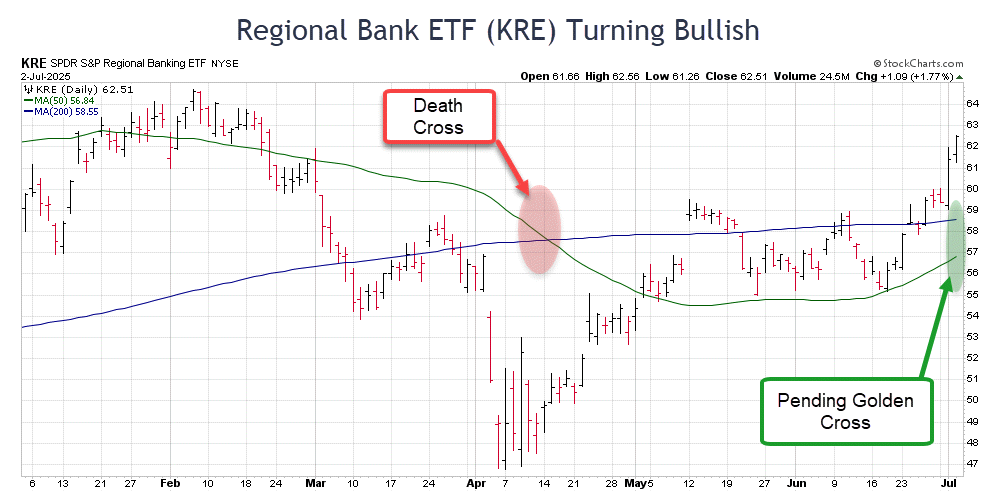

KRE just triggered a bullish shift in its 50-day moving average, indicating that momentum is building for a near-term move higher.

More importantly, the ETF is now on the verge of forming a Golden Cross, a key technical pattern where the 50-day moving average crosses above the 200-day. That pattern often precedes strong multi-month rallies.

Traders should expect this Golden Cross to confirm within the next 10 trading days. When it does, it will likely bring in a new wave of technical buying, with a price target of $75 in play over the next 3–6 months.

Bottom line

KRE offers a compelling setup for both fundamental and technical investors. With interest rates heading lower and consolidation heating up, the regional banks are no longer the laggards, they’re the comeback story.

— Chris Johnson

— Chris Johnson

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Money Morning