We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Innoviz Technologies Ltd. (NASDAQ: INVZ)

Today’s penny stock pick is the LiDAR sensor manufacturer, Innoviz Technologies Ltd. (NASDAQ: INVZ).

Innoviz Technologies Ltd. manufactures and sells automotive-grade LiDAR sensors and perception software to enable safe autonomous driving at a mass scale. The company offers InnovizOne, a solid-state LiDAR sensor designed for automakers and robotaxis, shuttles, trucks, and delivery companies requiring an automotive-grade and mass-producible solution to achieve autonomy.

It also provides InnovizTwo, an automotive-grade LiDAR sensor that offers a solution for all levels of autonomous driving, as well as an option to integrate the perception application in the LiDAR sensor; and perception application, a software application that raw point cloud data from Innoviz LiDAR products into perception outputs. The company operates in Europe, Asia Pacific, the Middle East, Africa, and North America.

Website: https://www.innoviz.tech

Latest 10-k report: https://ir.innoviz.tech/sec-filings/all-sec-filings/content/0001178913-25-000817/0001178913-25-000817.pdf

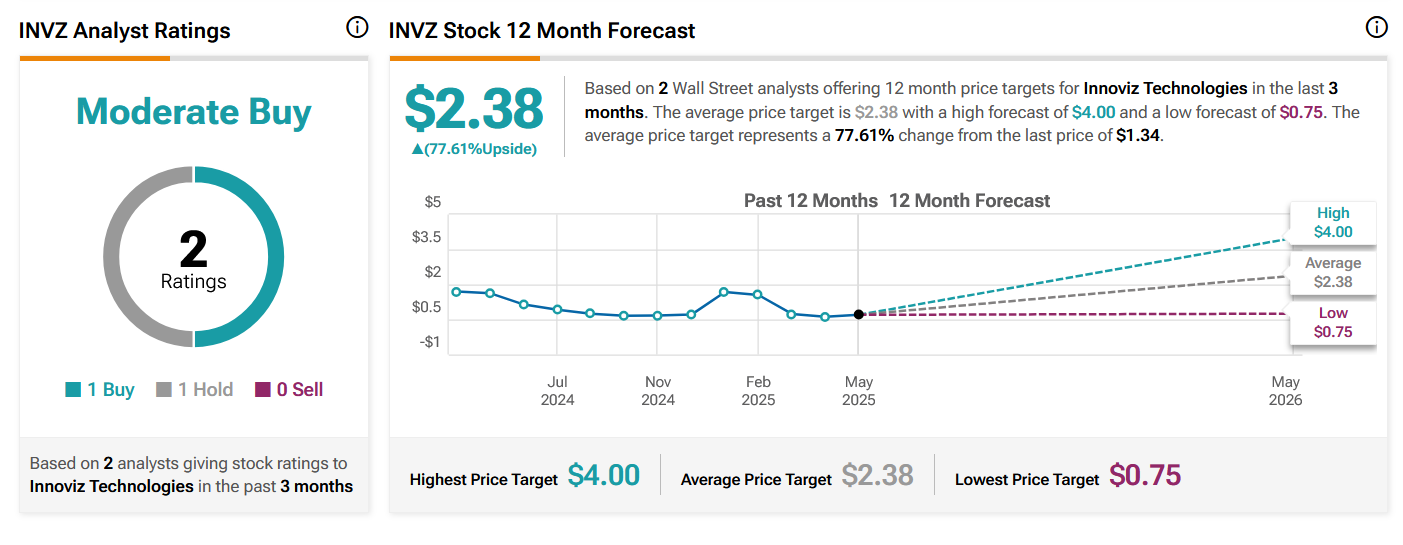

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for INVZ in the last 3 months, the stock has an average price target of $2.38, which is nearly 78% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company’s Q1 2025 revenue surged 144% year-over-year to $17.4 million, driven by automotive and cross-industry segments. This growth signals increasing adoption of Innoviz’s technology.

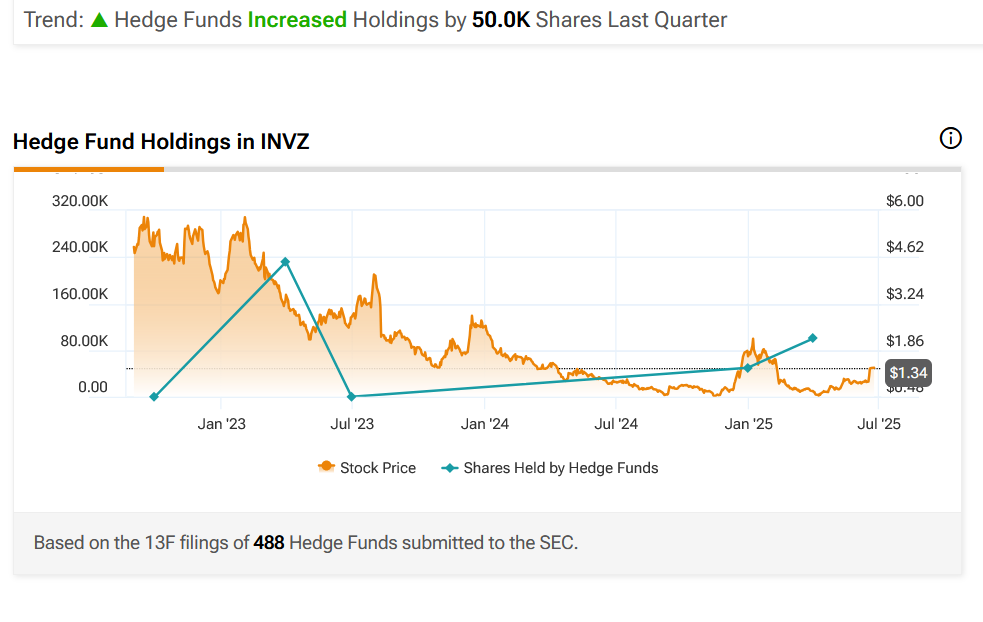

- Hedge Funds Increased Holdings by 50.0K Shares Last Quarter.

- Innoviz signed a Statement of Development Work with a Top 5 global automaker for Level 3 autonomous driving LiDAR systems, boosting credibility and future revenue potential. Ties with Mobileye and the Top 5 automaker could lead to further collaborations, positioning Innoviz as a key player in autonomous ecosystems.

- The company secured $95 million in customer-backed NRE funding, providing financial support for development without diluting shareholders.

- The autonomous driving sector is gaining traction, with LiDAR seen as critical for Level 3+ systems. Analyst optimism for AI and tech-driven stocks could spill over to Innoviz. Innoviz’s LiDAR is also expanding beyond automotive to sectors like robotics and industrial automation, potentially opening new revenue streams.

- Rumors of additional OEM contracts in Q3 2025.

- The company’s perception software, paired with LiDAR, enhances its value proposition, differentiating it from hardware-only competitors.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern, which is marked as purple lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for INVZ is above the price of $1.37.

Target Prices: Our first target is $2.20. If it closes above that level, the second target price is $3.00.

Stop Loss: To limit risk, place a stop loss at $0.90. Note that the stop loss is on a closing basis.

Our target potential upside is 61% to 119%.

For a risk of $0.47, our first target reward is $0.83, and the second target reward is $1.53. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

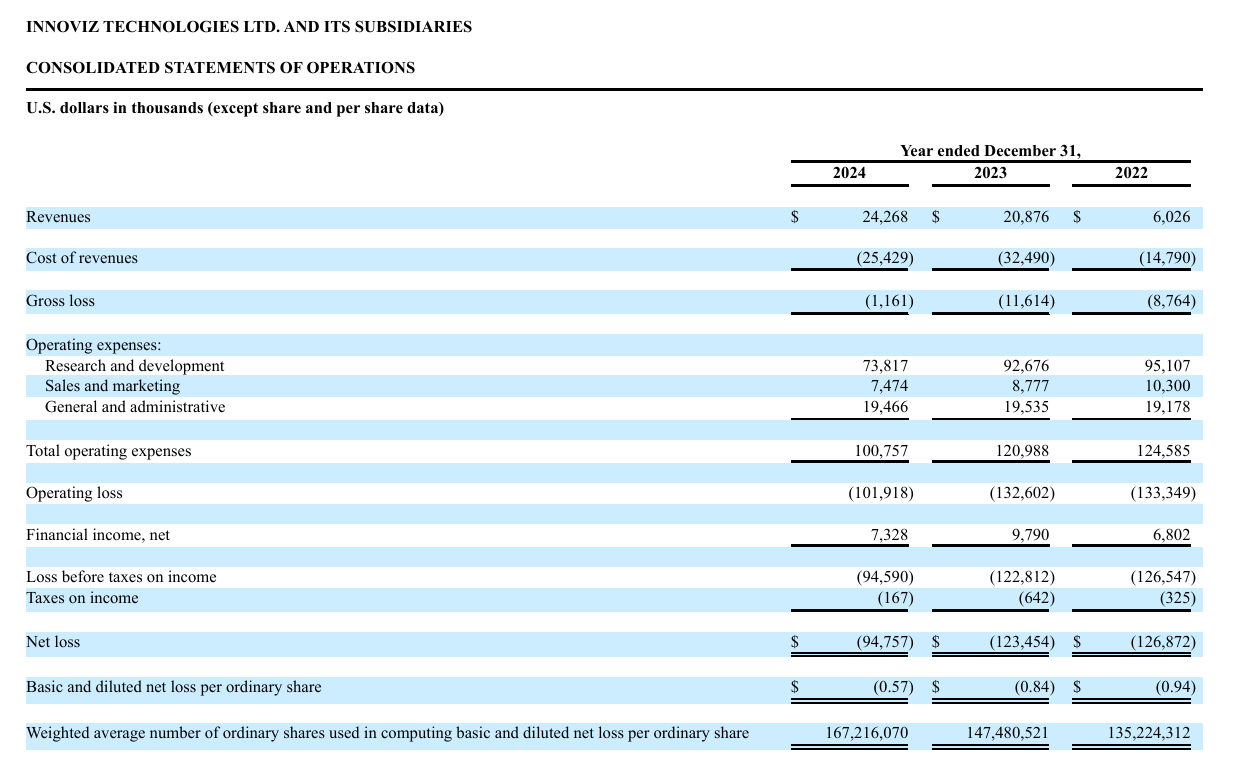

- The company has a history of net losses.

- The LiDAR industry is crowded, with competitors like Luminar, Velodyne, and Ouster vying for contracts. Established players and lower-cost alternatives could erode Innoviz’s market share.

- The company has a history of legal proceedings. On March 28, 2024, a putative class action lawsuit was filed in the Delaware Court of Chancery against several former officers and directors of Collective Growth which relates to events preceding the Transactions. The lawsuit generally alleges that the Defendants impaired Collective Growth’s public stockholders’ ability to exercise their redemption on an informed basis in connection with the Transactions, by failing to disclose material information in the proxy statement concerning the Defendants’ interests relating to the Transactions and the net cash per share that Collective Growth could contribute to the Transactions.

- Geopolitical tensions and steady interest rates may dampen automotive industry investments, impacting demand for LiDAR systems.

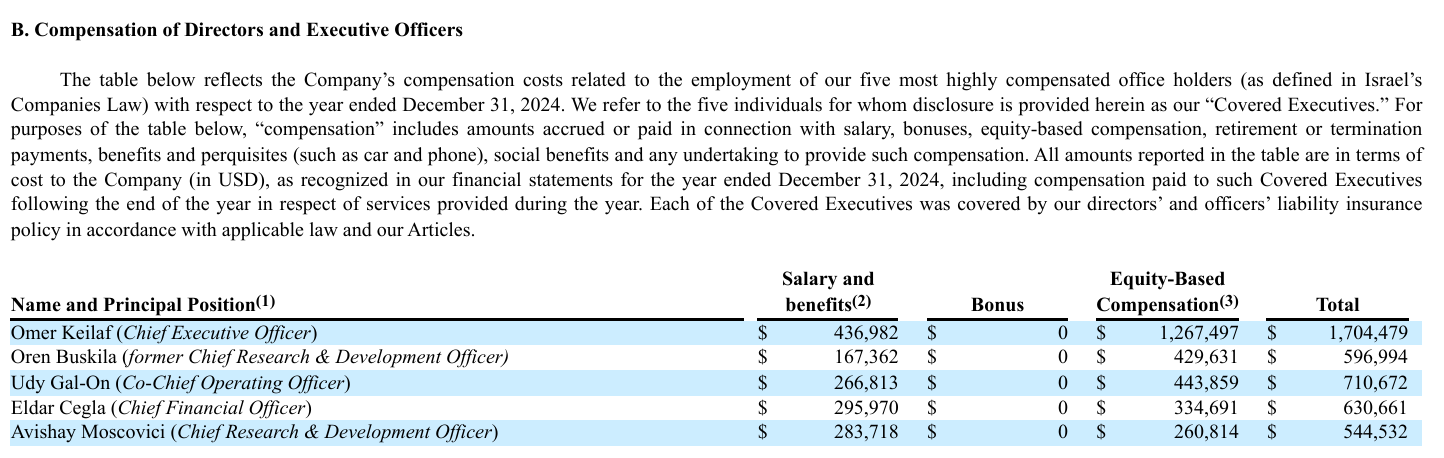

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day