We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: ImmunityBio, Inc. (NASDAQ: IBRX)

Today’s penny stock pick is the commercial stage biotechnology company, ImmunityBio, Inc. (NASDAQ: IBRX).

ImmunityBio, Inc. develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases. Its platforms for the development of biologic products and product candidates that include cytokine fusion proteins, DNA and vaccine vectors, and cell therapies. The company’s platform has generated first-in-human therapeutic agents that are planned to be studied in clinical trials in liquid and solid tumors. Its lead biologic product candidate includes Anktiva, an FDA-approved immunotherapy in combination with bacillus calmette-guérin (BCG) for the treatment of adult patients with BCG unresponsive non-muscle invasive bladder cancer with carcinoma in situ, with or without papillary tumors.

Website: https://immunitybio.com/

Latest 10-k report: https://ir.immunitybio.com/static-files/dad9b764-eb37-46ca-a791-49b0c5a2c02f

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for IBRX in the last 3 months, the stock has an average price target of $6.33, which is nearly 84% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The sBLA for BCG-unresponsive NMIBC in papillary disease and the EAP for ANKTIVA in lymphopenia are under FDA review. Any approvals could cause prices to surge higher.

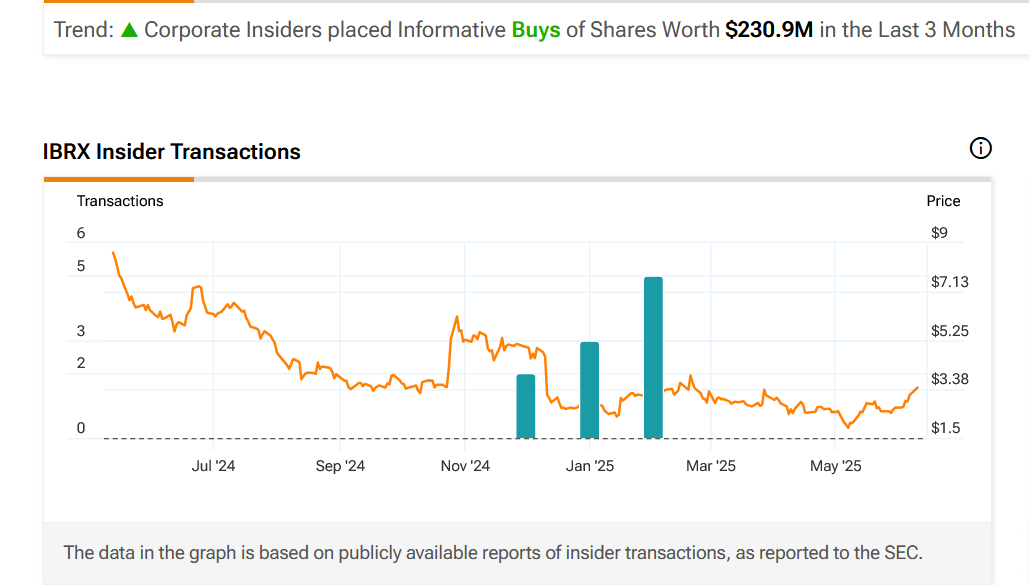

- Corporate Insiders placed Informative Buys of Shares Worth $230.90M in the Last 3 Months.

- Further data releases from ongoing trials, particularly for ANKTIVA in indications like NSCLC, ovarian cancer, or TNBC, could act as catalysts for the stock price. Positive results presented at conferences like ASCO 2025 have already boosted stock sentiment.

- The Serum Institute partnership for BCG supply could lead to updates on global distribution or new rBCG trial results. It could also evolve into broader collaborations for vaccine or immunotherapy development, creating new revenue streams or strategic alliances.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for IBRX is above the price of $3.50.

Target Prices: Our first target is $4.50. If it closes above that level, the second target price is $5.40.

Stop Loss: To limit risk, place a stop loss at $2.90. Note that the stop loss is on a closing basis.

Our target potential upside is 29% to 54%.

For a risk of $0.60, our first target reward is $1.00, and the second target reward is $1.90. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

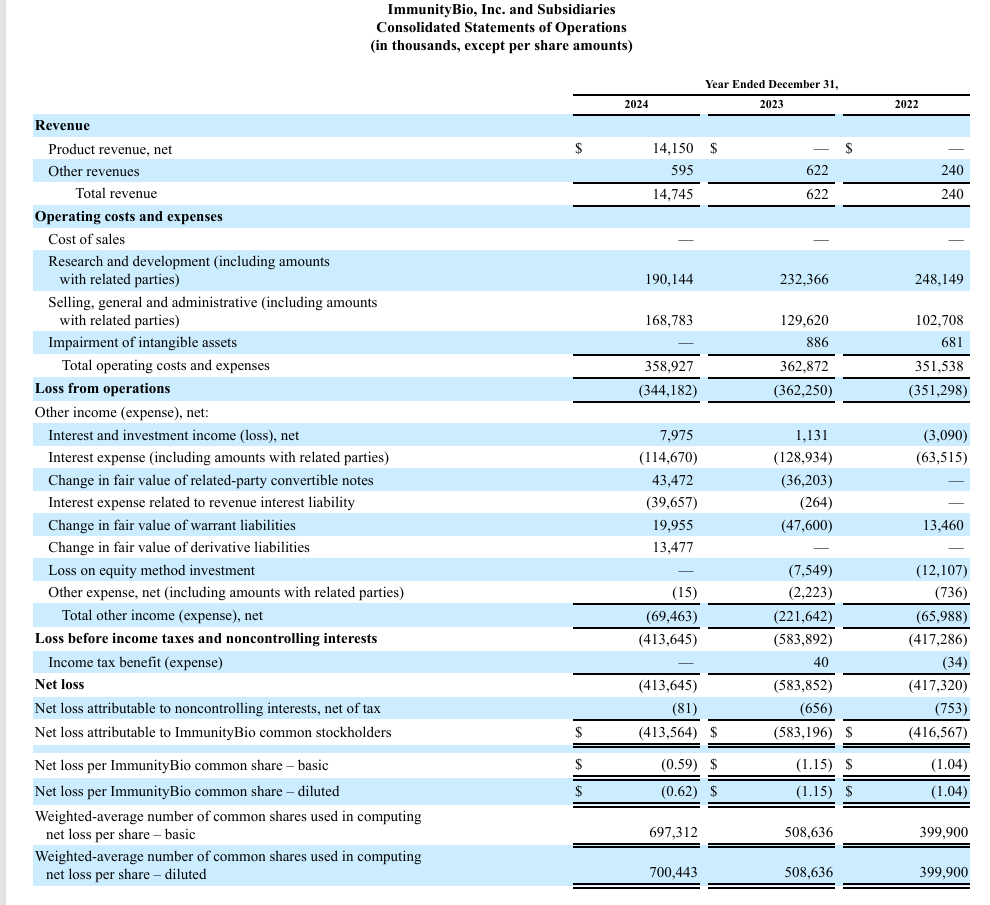

- The company has a history of net losses.

- The company’s lead product, ANKTIVA, is used in combination with Bacillus Calmette-Guérin (BCG) for non-muscle invasive bladder cancer (NMIBC). The company faces risks due to a global BCG shortage, which could hinder ANKTIVA’s commercial adoption. ANKTIVA also faces competition from other treatments, such as Adstiladrin, in the NMIBC market, which could limit market share.

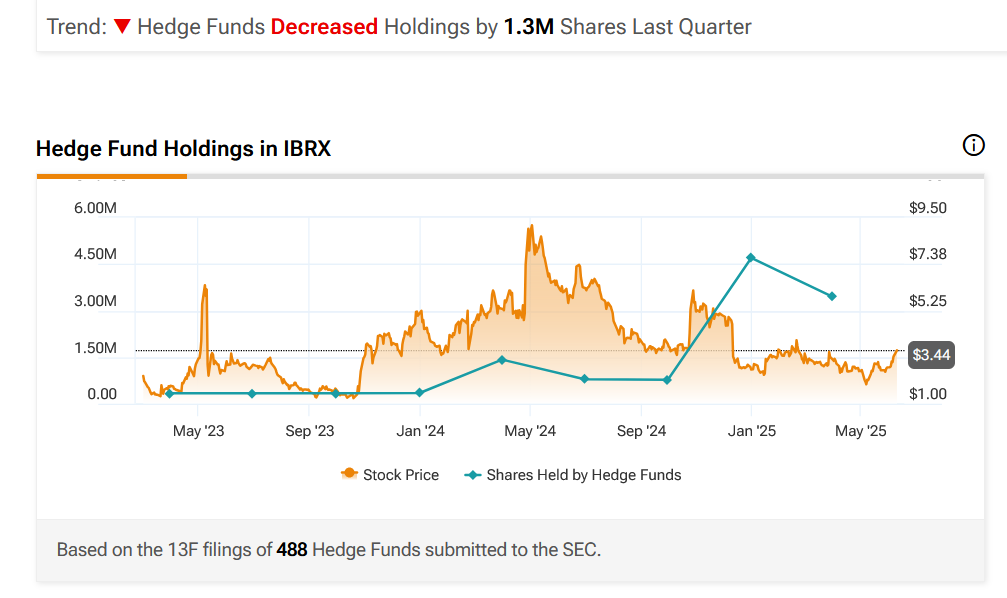

- Hedge Funds Decreased Holdings by 1.3M Shares Last Quarter.

- Potential tariffs or trade disruptions could affect the supply chain for BCG or other critical components, thereby complicating operations.

- The company has a history of legal proceedings, including Shenzhen Beike Biotechnology Co. Ltd. Arbitration; Salzman v. ImmunityBio, Inc. et al., No. 3:23-cv-01216-GCP-VET; Altor BioScience, LLC, and NantCell, Inc. Matters Against Dr. Hing Wong and HCW Biologics, Inc.; Van Luven, Barbieri and Shin Derivative Actions; and Carlson Derivative Action.

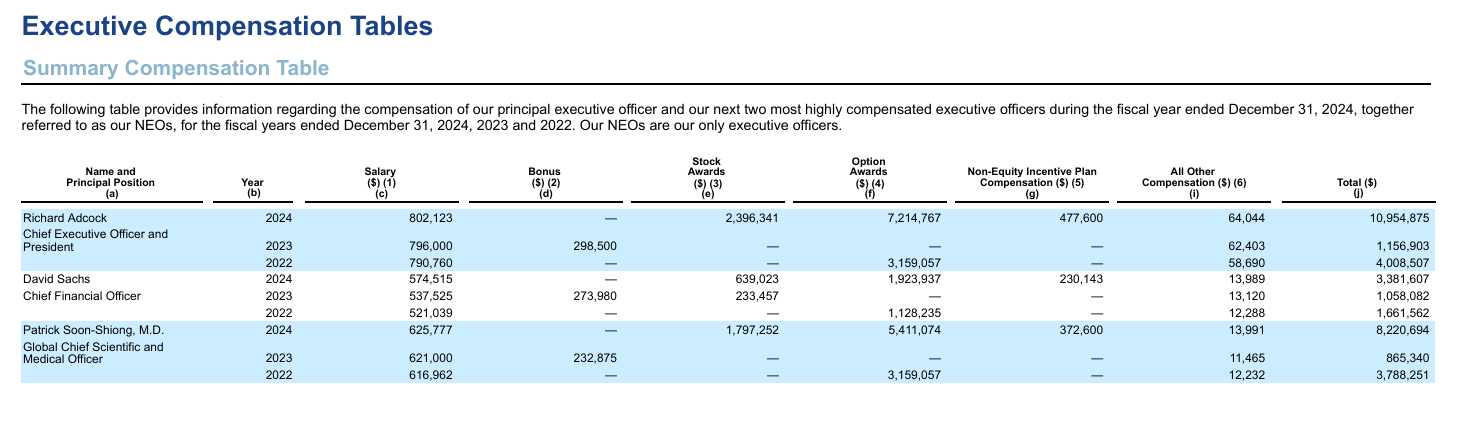

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company has significant debt. As of December 31, 2024, IBRX’s indebtedness included a $505.0 million convertible promissory note held by an entity affiliated with Dr. Soon-Shiong and a revenue interest liability with Oberland in excess of $300.0 million.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day