We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Taseko Mines Limited (NYSE: TGB)

Today’s penny stock pick is the mining company, Taseko Mines Limited (NYSE: TGB).

Taseko Mines Limited acquires, develops, and operates mineral properties. It explores for copper, molybdenum, gold, niobium, and silver deposits. The company’s principal assets consist of 100% owned the Gibraltar mine located in central British Columbia; and the Florence Copper project in Arizona. It also owns interests in the Yellowhead copper, the New Prosperity gold-copper, and the Aley niobium projects located in British Columbia.

Website: https://www.tasekomines.com/

Latest 10-k report: https://www.sec.gov/ix?doc=/Archives/edgar/data/0000878518/000106299324007253/form40f.htm

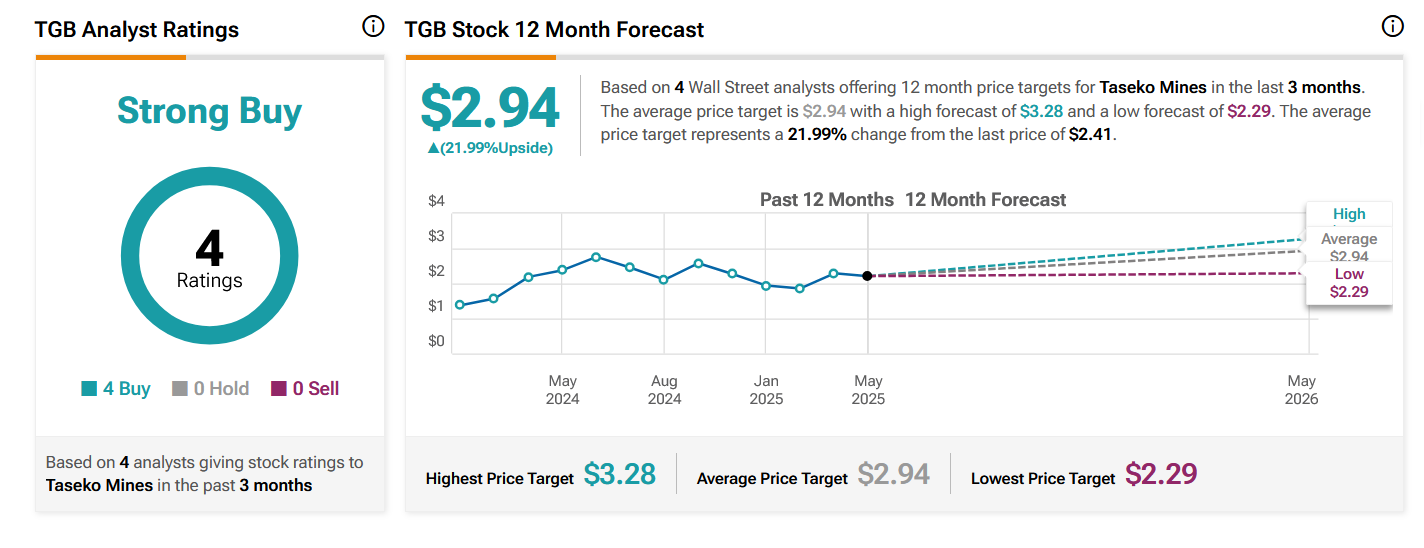

Analyst Consensus: As per TipRanks Analytics, based on 4 Wall Street analysts offering 12-month price targets for TGB in the last 3 months, the stock has an average price target of $2.94, which is nearly 22% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- Rising global demand for copper, driven by green energy and emerging technologies, supports TGB’s core business.

- The Florence Copper Project is on track to produce its first copper cathode by the end of 2025, potentially transforming TGB into a multi-asset producer. This is a significant growth driver, with analysts optimistic about its impact.

- Taseko expects Gibraltar’s copper output to increase to 120-130 million pounds in 2025, with performance improving in the second half. The restart of the SX/EW plant is expected to add 3-4 million pounds of cathode production.

- Taseko secured a minimum floor price per pound for most of its 2025 production, mitigating downside risk from copper price volatility.

- Institutional investors like Dimensional Fund Advisors, Barclays PLC, and Russell Investments increased their holdings in Q4 2024, signaling confidence in TGB’s long-term potential.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week and 200-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for TGB is above the price of $2.45.

Target Prices: Our first target is $3.30. If it closes above that level, the second target price is $4.00.

Stop Loss: To limit risk, place a stop loss at $2.00. Note that the stop loss is on a closing basis.

Our target potential upside is 35% to 63%.

For a risk of $0.45, our first target reward is $0.85, and the second target reward is $1.55. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

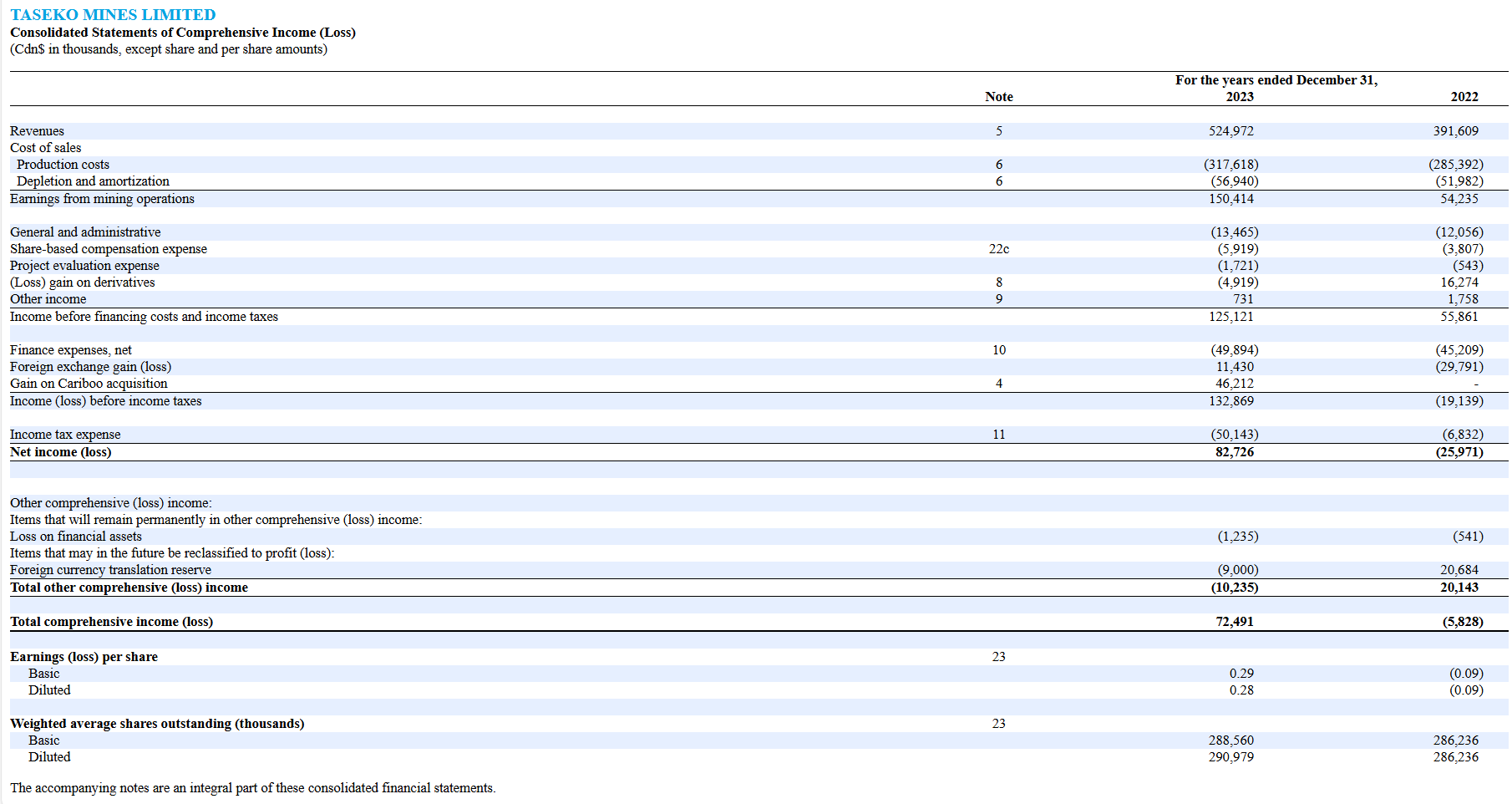

- The company has a history of net losses.

- Taseko reported a Q1 2025 earnings per share (EPS) of -$0.02, missing analyst estimates of -$0.015, with revenue also falling short, resulting in investor concerns about profitability.

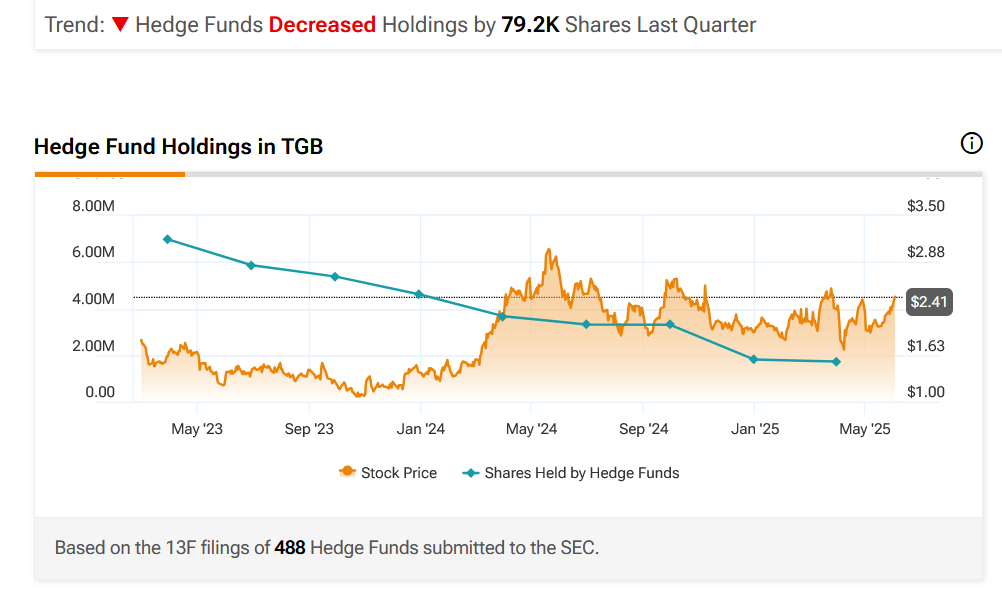

- Hedge Funds Decreased Holdings by 79.2K Shares Last Quarter.

- The Gibraltar Mine faced setbacks in Q1 2025, particularly in the connector pit, impacting copper production. A labor strike in Q3 2024 also reduced output, and similar operational risks could persist.

- Macroeconomic factors, such as potential trade tariffs or global demand fluctuations, could further pressure the stock.

- According to InvestingPro data, three analysts have recently revised their earnings estimates downward for the upcoming period, suggesting continued challenges ahead.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day