We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Algoma Steel Group Inc. (NASDAQ: ASTL)

Today’s penny stock pick is the integrated primary steel producer, Algoma Steel Group Inc. (NASDAQ: ASTL).

Algoma Steel Group Inc. produces and sells steel products in Canada, the United States, and internationally. The company offers flat/sheet steel products, including temper rolling, cold rolled, hot-rolled pickled and oiled products, floor plate, and cut-to-length products for the automotive industry, hollow structural product manufacturers, and the light manufacturing and transportation industries; and plate steel products consisting of rolled, hot-rolled, and heat-treated for use in the construction or manufacture of railcars, buildings, bridges, off-highway equipment, storage tanks, ships, armored products for military applications, diameter pipelines, and wind energy generation equipment. It also provides by-products, such as furnace and buckwheat coke, braize coke, and flue dust; high sulpur beach and kish iron, BOF pit grissly and scrap, BOF and pellet fines, and mill roll scale; light oil and coal tar; granulated and air cooled slag; and machine shop turnings, used mill rolls, recycled oil, non-ferrous metal, and lime fines.

Website: https://algoma.com/

Latest 10-k report: https://ir.algoma.com/static-files/2a279c4c-f41f-4d47-b765-fb74403f7f1d

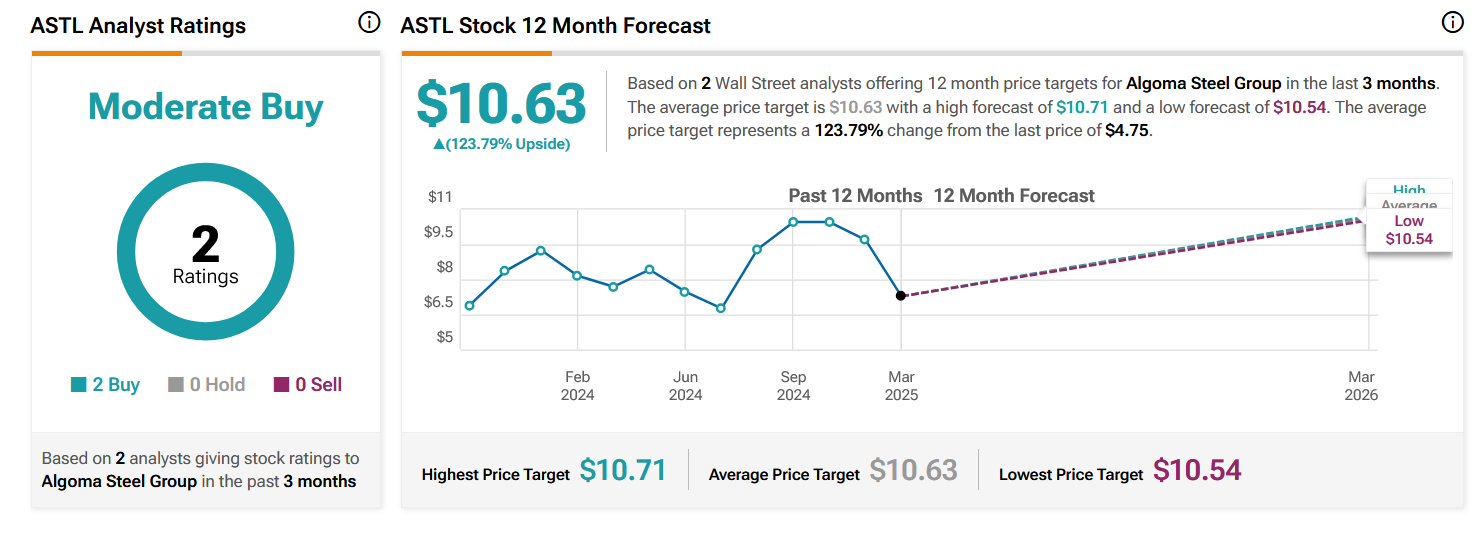

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for ASTL in the last 3 months, the stock has an average price target of $10.63, which is nearly 124% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company’s transformative Electric Arc Furnace (EAF) project is rapidly approaching the first arc in furnace one, with the first steel production still expected in April.

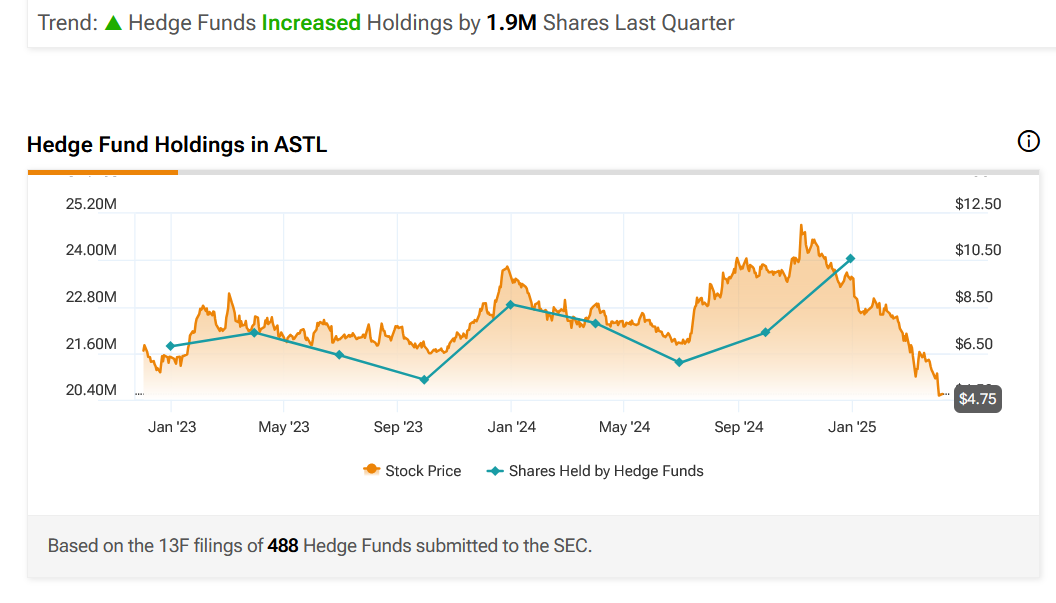

- Hedge Funds Increased Holdings by 1.9M Shares Last Quarter.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock currently looks poised for a breakout from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish RSI: The RSI is currently moving higher from oversold levels, indicating possible bullishness.

#3 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#5 Oversold RSI: In the weekly chart, the RSI is currently near oversold levels. This looks like a good area for a bullish reversal.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for ASTL is above the price of $4.80.

Target Prices: Our first target is $6.00. If it closes above that level, the second target price is $7.00.

Stop Loss: To limit risk, place a stop loss at $4.10. Note that the stop loss is on a closing basis.

Our target potential upside is 25% to 46%.

For a risk of $0.70, our first target reward is $1.20, and the second target reward is $2.20. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

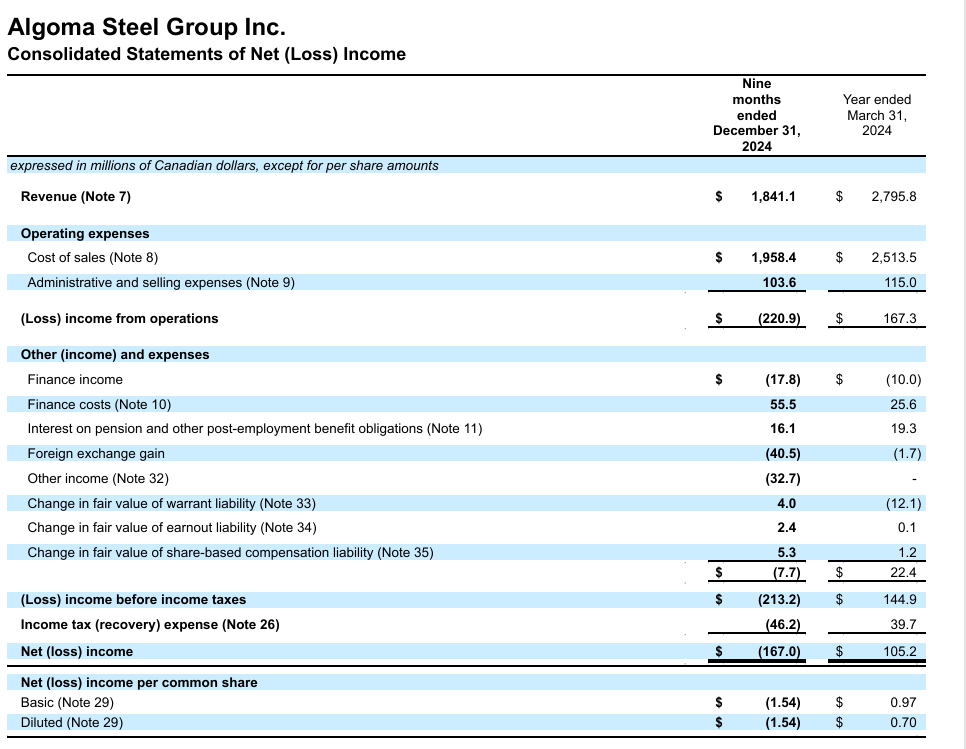

- The company has a history of net losses.

- The ongoing tariffs are expected to have a material and adverse impact on the Company’s financial position, results of operations, and liquidity.

- The company faces significant domestic and international competition from steel producers with greater financial and capital resources.

- All of ASTL’s operations are currently conducted at one facility using one blast furnace and are subject to unexpected equipment failures and other business interruptions.

- The company is dependent on a few key customers. For the nine-month period ended December 31, 2024, ASTL’s top ten customers accounted for approximately 54% of revenue, and sales to one customer represented more than 13% of revenue.

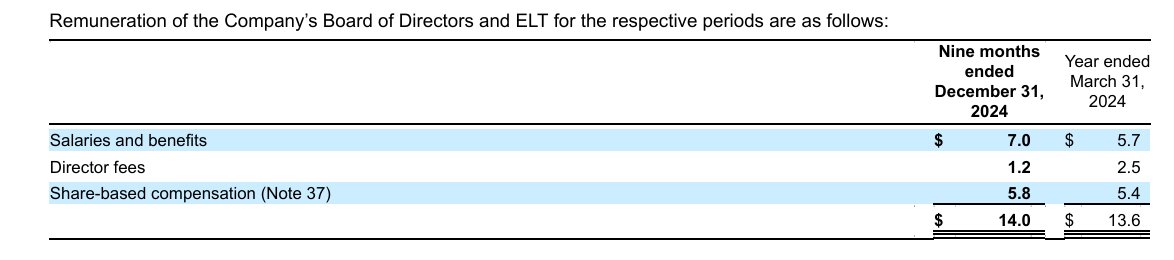

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

The legendary stockpicker who built one of Wall Street's most popular buying indicators just announced the #1 stock to buy for 2026. His last recommendations shot up 100% and 160%. Now for a limited time, he's sharing this new recommendation live on-camera, completely free of charge. It's not NVDA, AMZN, TSLA, or any stock you'd likely recognize. Click here for the name and ticker.

Source: Trades of the Day