Editor’s Note: The following is an excerpt from our premium investing service, Dividends & Income Select. To access our real-money portfolios and start receiving our buy and sell alerts, sign up for a 14-day free trial.

As a former sportswriter and a decades-long sports fan, I’ve learned to trust the best coaches, general managers, quarterbacks, point guards and other leaders. They remain calm when the game’s on the line, they are rational and intelligent, they inspire others, they create a culture of excellence, they work hard, they are proven winners.

As an investor in individual companies, I often have the same feeling about top CEOs. No matter what’s happening around them, they not only survive but thrive. They innovate, they motivate, they produce results, they have great vision, they win. They have earned my trust.

One such leader is Satya Nadella, now in his second decade heading up Microsoft (MSFT).

He is one of the main reasons that MSFT is my largest holding – I trust him and his team to take the company in the right direction, not just this year or next year, but into the 2030s and beyond.

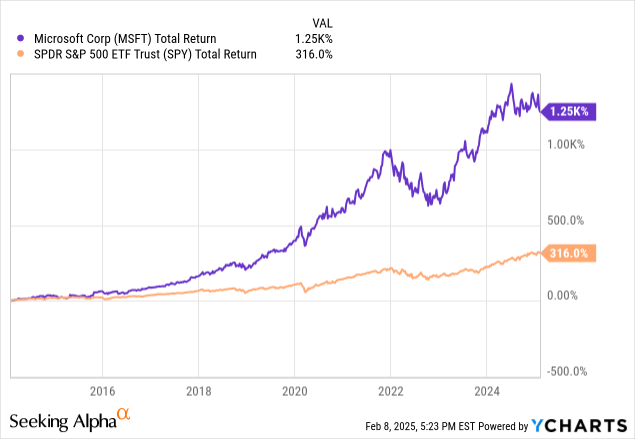

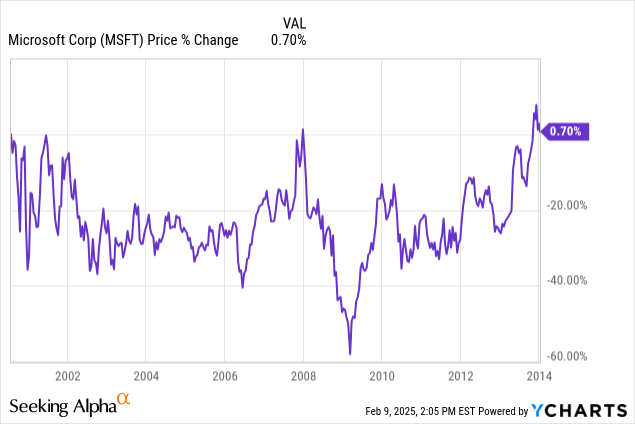

Nadella, who spent 22 years working his way up the ladder at Microsoft, was named CEO on Feb. 4, 2014. All MSFT has done since then is nearly quadruple the S&P 500 Index in total return.

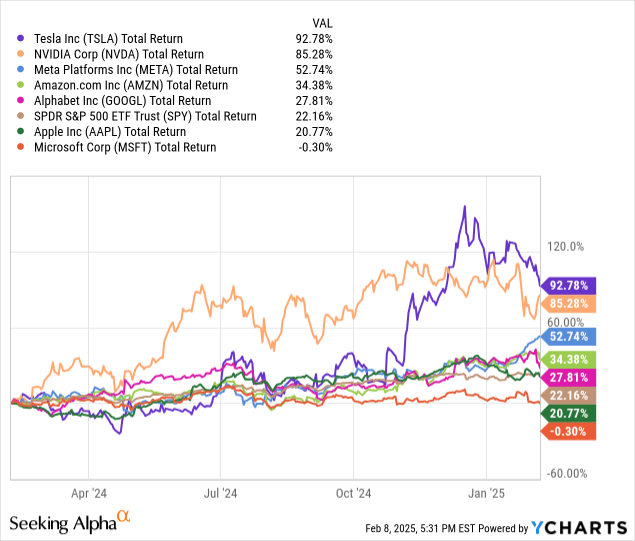

If you looked closely at the above chart, you might have noticed that MSFT has been flat over the last year or so.

Indeed, while most other tech stocks in the so-called Magnificent Seven have soared, Microsoft has languished.

Some investors might use that information to dump MSFT in favor of stocks that have been flying higher. I’m going in the other direction.

I’m a long-term investor who isn’t moved by short-term market trends, I know that Microsoft is one of the world’s great companies, and I have learned to trust Nadella and his team.

So I not only added to my MSFT stake recently, I also initiated a Microsoft position in the Income Builder Portfolio. On Feb. 7, I executed an order of the stock on behalf of Dividends & Income CEO (and IBP money man) Greg Patrick.

MSFT & AI

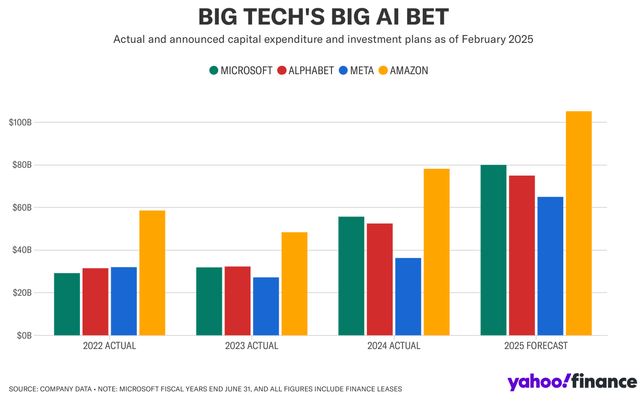

As has been the case with other major tech firms, Microsoft is all-in on artificial intelligence. The company has outspent most others the last three years, and only Amazon (AMZN) is expected to bet more on AI in 2025.

Yahoo Finance

The nuts and bolts of what AI does for Microsoft (and vice versa) can be complex. I won’t pretend it’s in my sphere of expertise, but I did like this synopsis from Morningstar analyst Dan Romanoff after the company released Q2 2025 earnings after market close Jan. 29:

With its leadership in public cloud with Azure, partnership with OpenAI, and unmatched distribution, we believe Microsoft is currently a leader in AI and will remain so in the coming years. We see a looming catalyst in accelerating Azure revenues in the second half of fiscal 2025 that we think investors will welcome after capacity constraints limited growth, impressive as it actually was, over the last several quarters. Given early demand signals, good AI revenue traction, and the massive success of similar Azure investments more than a decade ago, we believe the current wave of investments into capital expenditures will pay off for the company and investors.

Romanoff also said:

We think the stock is set up well for 2025, with relatively stagnant performance over the last 12 months. Our long-term thesis centers on the expansion of hybrid cloud environments, the proliferation of artificial intelligence, and Azure. The firm continues to use its on-premises dominance to allow clients to move to the cloud at their own pace. We center our growth assumptions around Azure, Microsoft 365 E5 migration, and traction with the Power Platform for long-term value creation.

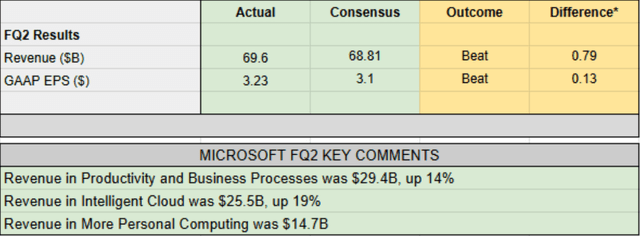

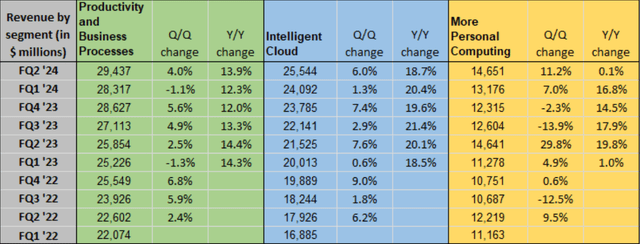

Microsoft posted both top- and bottom-line beats overall, and the Intelligent Cloud segment really racked up the year-over-year revenue growth.

Seeking Alpha

Seeking Alpha

During the company’s earnings call, Nadella was as positive as one might expect, saying:

Azure is the infrastructure layer for AI. We continue to expand our data center capacity in line with both near-term and long-term demand signals. We have more than doubled our overall data center capacity in the last three years and we have added more capacity last year than any other year in our history.

One thing that took a bite out of the price of Microsoft and other big-tech stocks recently was the revelation that Chinese company DeepSeek had made significant strides in AI optimization at a fraction of the cost.

Rather than be cowed by that, Nadella and his company have embraced the competition’s innovation. Asked about DeepSeek during the earnings call, he said:

We are working super hard on all the software optimizations. … I mean, just not the software optimizations that come because of what DeepSeek has done, but all the work we have done to, for example, reduce the prices of GPT models over the years in partnership with OpenAI. … One of the key things to note in AI is you just don’t launch the frontier model – but if it’s too expensive to serve, it’s no good. … It won’t generate any demand. So, you’ve got to have that optimization so that inferencing costs are coming down and they can be consumed broadly. And so, that’s the fleet physics we are managing. … So, I feel very good about the investment we are making, and it’s fungible, and it just allows us to scale more long-term business.

I know, I know … a lot of that is what we in the sportswriting business used to call “coach-speak.” None of us expect Nadella to say, “Oh crap … we’re screwed!” But again, this is where an effective CEO who has absolutely earned our trust gets the benefit of the doubt.

Once AI really becomes established in our lives, I’ll be thoroughly surprised if Microsoft is not among the leaders – just as the company has been a leader in the intelligent cloud, the internet of things, business and consumer software, gaming, etc.

Despite MSFT-the-stock’s flat year, Microsoft-the-company has been doing pretty darn well. 2024 was its best year ever for earnings per share, sales and free cash flow, and Q2 2025 was its best quarter ever for revenue (and second-best ever for EPS). This is a business that is still executing at a high level.

Quality, Thy Name Is Microsoft

It’s almost impossible to talk about investing in high-quality businesses without mentioning Microsoft.

It’s one of only two companies to earn Standard & Poor’s AAA credit rating – joining another IBP holding, Johnson & Johnson (JNJ). Morningstar gives MSFT its top ratings for moat (wide) and capital appreciation (exemplary). And Simply Safe Dividends says no company beats Microsoft when it comes to dividend reliability.

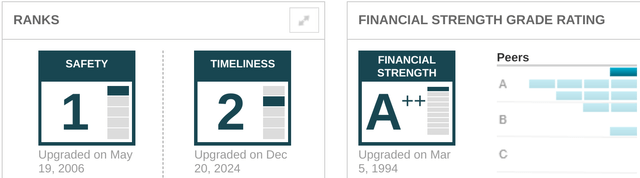

Value Line assigns Microsoft top scores for safety and financial strength, and VL recently upgraded the stock’s “timeliness” – a reflection of probable price appreciation over the next 6-12 months.

Value Line

Naturally, MSFT is on my colleague Dave Van Knapp’s list of the 46 highest-quality dividend growth stocks (accessible to Dividends & Income Select subscribers).

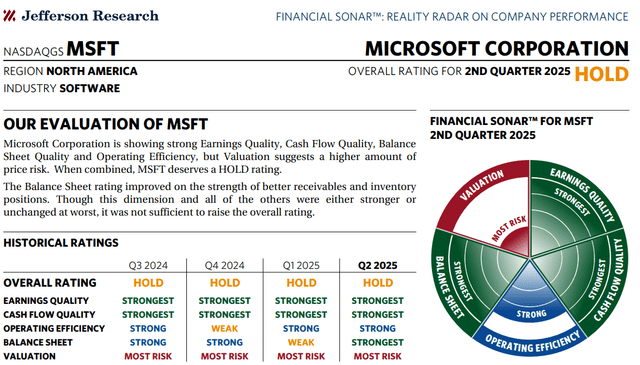

In addition, not many companies feature a better “financial sonar” from Jefferson Research than Microsoft does.

Jefferson Research, via Fidelity

In the above graphic, you might have noticed that despite Microsoft’s financial strength, Jefferson Research only calls MSFT a “hold” due to valuation concerns.

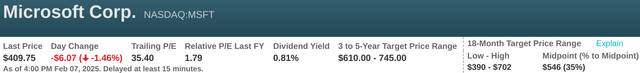

And, looking at the stock’s 30-ish forward price/earnings ratio, I get it. However, MSFT is a company that usually has a premium valuation, and its P/E ratio has come down quite a bit lately. So it’s hardly surprising that analysts are bullish on Microsoft.

Valuation Station

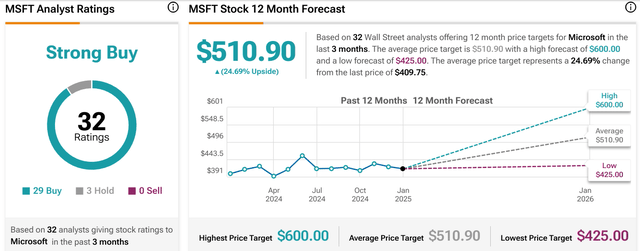

Of the 32 analysts monitored by TipRanks, 29 call MSFT a buy, and their average 12-month target price of $511 suggests a 25% upside.

TipRanks

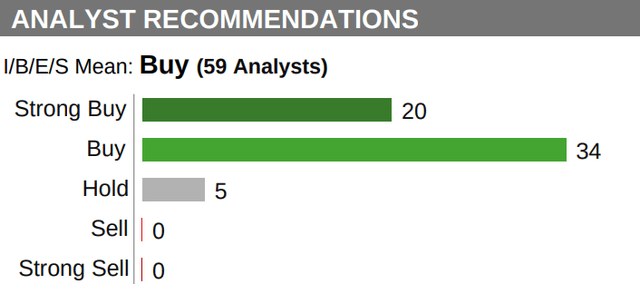

LSEG looks at even more analyst calls – and an astounding 54 of 59 say Microsoft is either a strong buy or buy.

LSEG, via Schwab

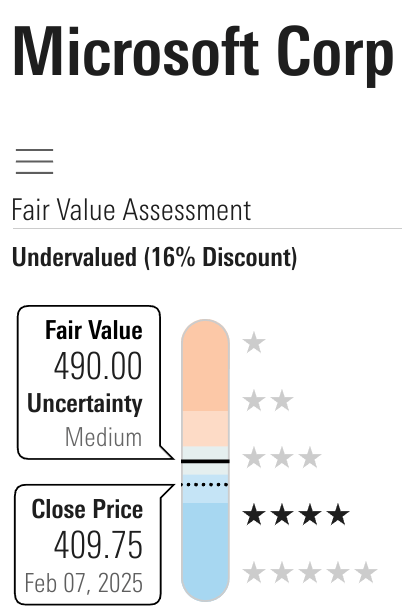

Given its analyst’s comments about the second half of 2025 setting up well for Microsoft, Morningstar saying MSFT is 16% undervalued makes sense.

Morningstar

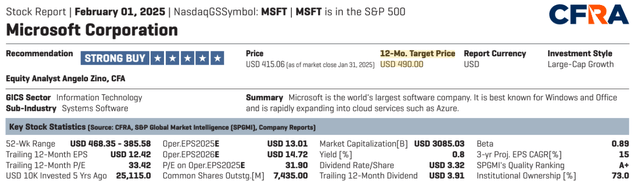

CFRA also is high on Microsoft, with analyst Angelo Zino citing the company’s ability to integrate artificial intelligence into much of what it does:

Our Strong Buy is based on AI opportunities, as MSFT is riding a wave of investment with its complete AI stack, from AI infrastructure to AI development services like Azure AI and AI applications like Microsoft Copilot. Many of these applications are now being deployed and are or will be moving into production in the coming quarters. We see a slew of diverse ways that MSFT will be able to monetize the explosion of generative AI (e.g., cloud, Agentic AI/Copilots, OpenAI, Search expansion), driving upside potential to long term consensus growth expectations. We believe that MSFT will reap greater scale efficiencies through cloud adoption and see Activision unlocking higher growth potential in gaming over time. Despite elevated AI spending, we see MSFT sustaining elevated margins. We see lower downside risk – both probability and magnitude – for MSFT vs. many of its faster-growing peers, especially given its very strong balance sheet, providing more downside cushion than most large-cap stocks in any sector, in our view. … Our 12-month target of $490 is based on a P/E of 32.8x our CY 26 view, which compares to its three-/five-year historical forward averages of 30.1x/31.1x given AI growth prospects.

CFRA, via Schwab

Beyond its $490 target price, CFRA says MSFT is currently valued at $452 per share – about 10% higher than we just paid to add the stock to the Income Builder Portfolio.

Value Line’s analysts are really ga-ga about Microsoft.

First, MSFT is on VL’s list of Highest Growth Stocks. (To be included, a company’s annual growth of sales, cash flow, earnings, dividends and book value must together have averaged 10% or more over the past 10 years and be expected to average at least 10% in the coming 3-5 years.)

Additionally, Microsoft is included in three of Value Line’s four model portfolios: Stocks With Above-Average Year-Ahead Price Appreciation(primarily suitable for more aggressive investors); Stocks For Income And Potential Price Appreciation (primarily suitable for more conservative investors); and Stocks With Long-Term Price Growth Potential (primarily suitable for investors with a 3-5 year horizon).

As the following graphic shows, Value Line projects 3-5 year growth of as much as 80%, and the midpoint of its 18-year target price ($546) suggests 35% near-term upside.

Value Line

So while MSFT might not be “cheap” when looking at a traditional measure such as P/E ratio, its combination of financial strength and potential growth certainly can be seen as appealing – especially considering the recent price pullback.

Income Report

Given how spectacular Microsoft’s stock-price rise was during Nadella’s first decade as CEO, some folks might have forgotten that it languished for some 14 years after the dot-com bust.

When I initiated the MSFT position in my portfolio on March 12, 2015 at $41.33/share, the stock had a 3% dividend yield. I was fairly early in my Dividend Growth Investing journey, and I saw Microsoft – which at that time had a 13-year history of growing its payout – as a true “DGI-type” stock.

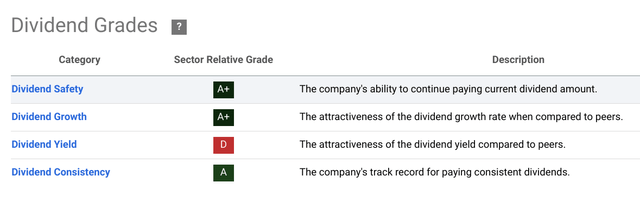

The company is now approaching Dividend Aristocrat status, with a 23-year streak of annual increases, but I’m not sure how many of today’s investors are buying MSFT as an income vehicle. Although the dividend has grown nearly 1,700% since I first bought Microsoft, the stock’s stupendous price appreciation has pushed the yield down to 0.8% – which no doubt turns off many DGI proponents.

Unsurprisingly, Seeking Alpha gives Microsoft high grades in every dividend category except one – yield.

Seeking Alpha

I’ve always felt that a well-rounded, diversified DGI portfolio can include some low-yielding stocks. The dividends of such companies often grow faster than those of higher yielders, but I’m realistic about them; I consider their dividends to be “bonuses” rather than significant contributors to the portfolio’s overall income stream.

Wrapping Things Up

Even the greatest leaders aren’t perfect – as the Super Bowl demonstrated. Few doubt the credentials of Kansas City coach Andy Reid and his wondrous quarterback Patrick Mahomes, yet their Chiefs were just stomped into submission by the Philadelphia Eagles.

Cooper Neill/Getty Images

So hey, maybe Satya Nadella is due to lose one of these years. Maybe I trust him and his team too much. Maybe it’s just a matter of me liking that my last name is spelled out in the first five letters of his. Whatever. I’m willing to keep riding a company that’s powered my portfolio for years.

Value Line’s inclusion of MSFT in portfolios suitable for both aggressive and conservative investors underscores something I said several years ago about Microsoft: It’s the one company I’d own if I could own only one.

Nothing has happened since then to convince me that my thesis was incorrect.

— Mike Nadel

P.S. I just bought shares of another stock for the Income Builder Portfolio — a company that’s been a successful business for more than a century. The company’s diverse market applications, its commitment to growth through R&D, and its reliable dividend all contribute to the stock being an appealing investment right now. To get my full analysis on this new purchase — and to access the Income Builder Portfolio (and more) — consider joining us at Dividends & Income Select.

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.