We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Lifeward Ltd. (NASDAQ: LFWD)

Today’s penny stock pick is the medical device company, Lifeward Ltd. (NASDAQ: LFWD).

Lifeward Ltd. designs, develops, and commercializes technologies that enable mobility and wellness in rehabilitation and daily life for individuals with physical and neurological conditions in the United States, Europe, the Asia-Pacific, and internationally.

It offers ReWalk personal exoskeleton and rehabilitation exoskeleton devices; ReStore, a soft exo-suit intended for use in the rehabilitation of individuals with lower limb disability due to stroke; AlterG Anti-Gravity System for use in physical and neurological rehabilitation and athletic training; MyoCycle devices; and ReBoot, a personal soft exo-suit for home and community use by individuals post-stroke.

The company markets and sells its products directly to institutions and individuals, as well as through third-party distributors. The company was formerly known as ReWalk Robotics Ltd. and changed its name to Lifeward Ltd. in September 2024.

Website: https://golifeward.com/

Latest 10-k report: https://ir.golifeward.com/static-files/bc5fe4e9-b533-42f9-886d-ccc03a98c90f

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for LFWD in the last 3 months, the stock has an average price target of $8.00, which is nearly 266% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company’s recent historic deal with BARMER, one of Germany’s top health insurers.

- In Q3 FY24, the company posted a 39% year-over-year increase in revenue.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Downtrend Channel: The daily chart shows that the stock looks poised for a breakout from the downtrend channel, which is shown as purple color lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#8 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for LFWD is above the price of $2.30.

Target Prices: Our first target is $3.50. If it closes above that level, the second target price is $4.50.

Stop Loss: To limit risk, place a stop loss at $1.60. Note that the stop loss is on a closing basis.

Our target potential upside is 52% to 96%.

For a risk of $0.70, our first target reward is $1.20, and the second target reward is $2.20. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

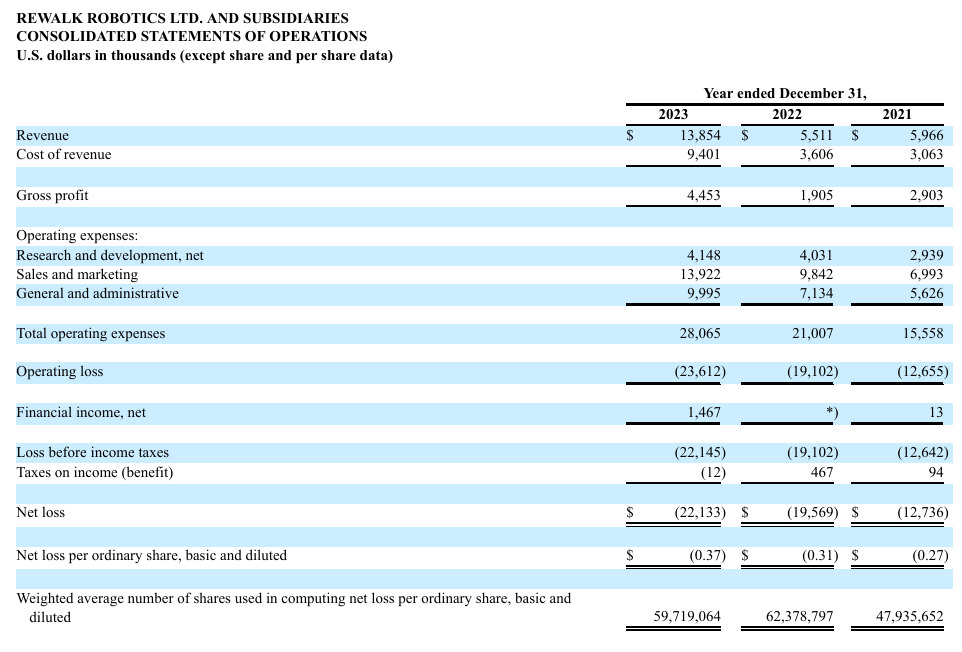

- The company has a history of net losses.

- On October 10, 2022, the company received a notification letter from Nasdaq that it had failed to evidence a minimum closing bid price of $1.00 per share for the prior 30-consecutive business day period in contravention of Nasdaq Listing Rule 5550(a).

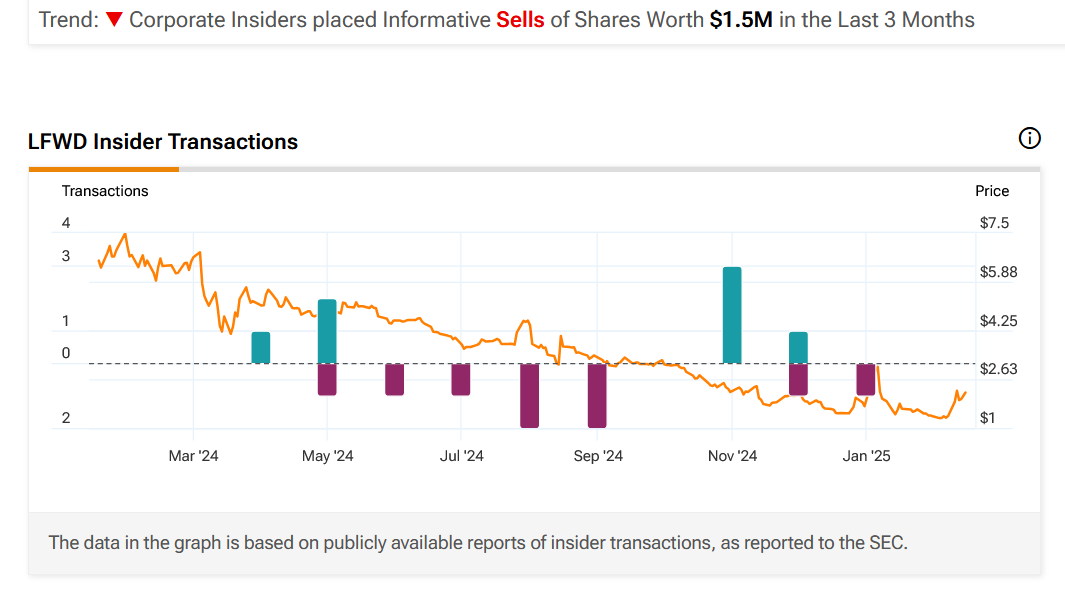

- Corporate Insiders placed Informative Sells of Shares Worth $1.5M in the Last 3 Months.

- The company’s technology development and quality headquarters and the manufacturing facility for its products are located in Israel and, therefore, the company’s results may be adversely affected by economic restrictions imposed on, and political and military instability in, Israel.

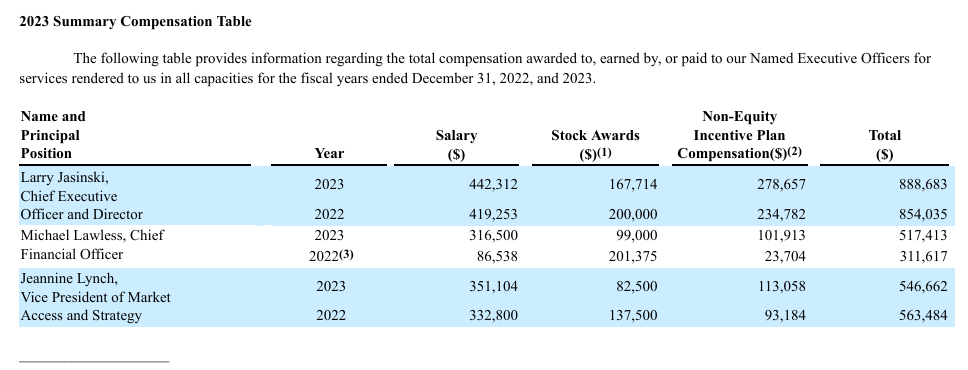

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day