Editor’s Note: The following trade alert first appeared in our premium investment advisory, Dividends & Income Select, a little over a month ago. The idea is still timely, so if you’re looking for a high-quality dividend growth stock that’s trading at an attractive valuation, this could be a strong candidate.

In investing, doom and gloom sometimes becomes a metaphorical snowball rolling downhill.

Bad news (or at least perceived bad news) seems to beget more bad news, and the stock price of even a very strong business can be squashed by that ever-larger snowball.

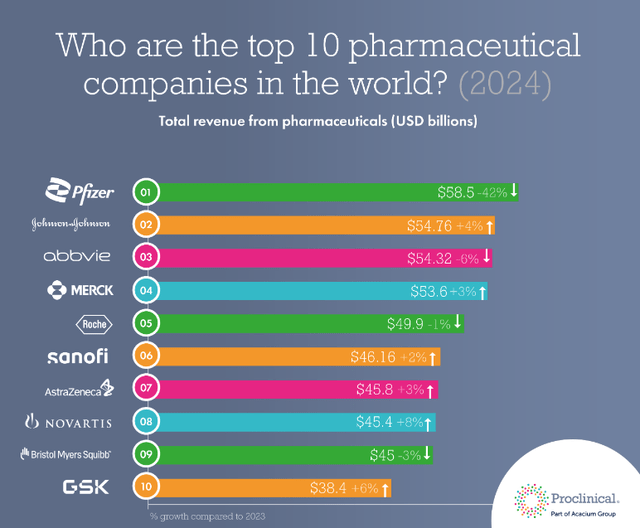

Such has been the case the last few months for Merck (MRK), the world’s fourth-largest pharmaceutical company.

Proclinical

I’ll get into what’s been going on with the company in a moment, but I’ll start by saying that I haven’t been overly concerned about Merck’s business model, economic moat or long-term viability. I recently added to my own Merck holdings, and I also have initiated a MRK position in our Income Builder Portfolio.

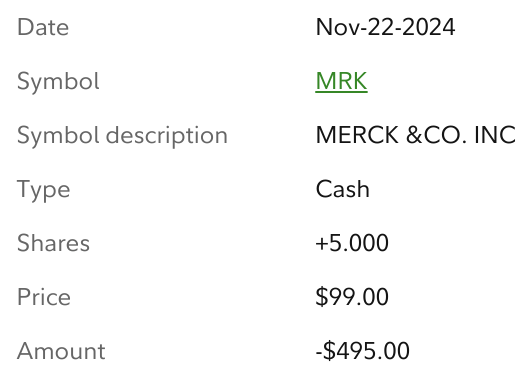

On Friday, Nov. 22, I executed an order for 5 shares at $99 apiece on behalf of Dividends & Income Select CEO (and IBP money man) Greg Patrick.

Fidelity

This was our second November buy of approximately $500 each, as Greg allocates $1,000 per month for the IBP. Merck becomes the portfolio’s 13th component.

Catching Up With Merck

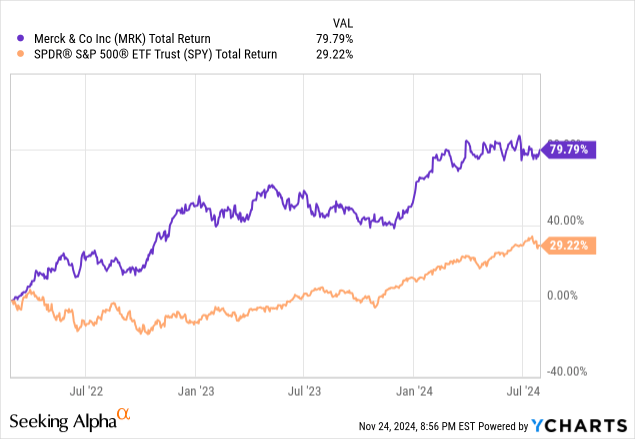

From early 2022 through late July of 2024, Merck had been on a roll. Its blockbuster cancer drug, Keytruda, was already racking up huge sales in 2022, was the best-selling drug in the world last year and is on pace to defend that title in 2024. Riding that performance, the company’s profits surged to an all-time high.

Unsurprisingly, MRK shareholders (including yours truly) benefited handsomely, as the stock’s total return nearly tripled that of the overall market.

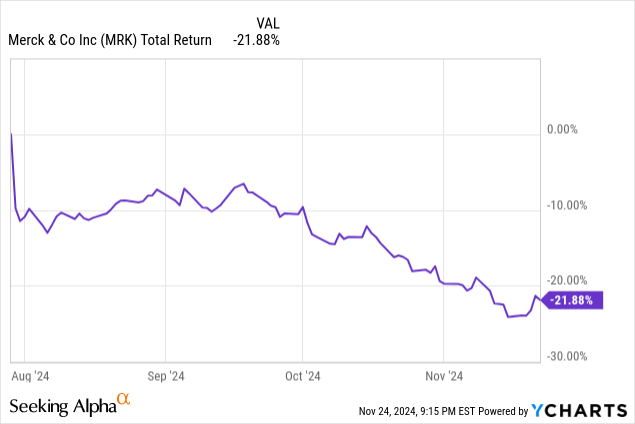

But then the snowball started forming July 30, when Merck announced great Q2 financial results but significantly lowered full-year EPS estimates from an $8.59 range midpoint to $7.99. That was well below the $8.45 analysts had been expecting, and the stock price immediately got hammered.

Things didn’t get much better in the ensuing months. On Oct. 31, the company announced flat Q3 earnings – and, in another gut punch, Merck lowered its full-year EPS guidance again, this time to $7.75 (vs. $7.95 consensus). Revenue guidance also came in slightly lower than expected.

Why the reduced guidance? Covid-related income was drying up; there were a few unsuccessful experimental tests; a proposed 2025 Medicare price cap for Januvia threatened to cut nearly 80% from that diabetes drug’s price; HPV vaccine Gardasil saw sales decline in China; and some investors are already concerned about Keytruda’s U.S. patent expiring in 2028.

Throw in the new president-elect’s choice of anti-vaxxer Robert F. Kennedy Jr. as Health & Human Services secretary – an event that greatly spooked pharma investors – and you can see how MRK has fared since the snowball started downhill on July 30:

The Keytruda patent expiration might be the single biggest concern for investors, and I get it. The drug has been carrying the company to great heights the last few years, accounting for 42% of Merck’s revenue in 2023.

Once its patent expires in 2028, other companies will be free to market lower-costing biosimilars.

Merck is dealing with that in a couple of ways. For one, it is making progress on an injectable version of the drug, as well as other variants, each of which would have their own patents. For another, it already has created several successful medications other than Keytruda and has numerous other promising drugs in its pipeline.

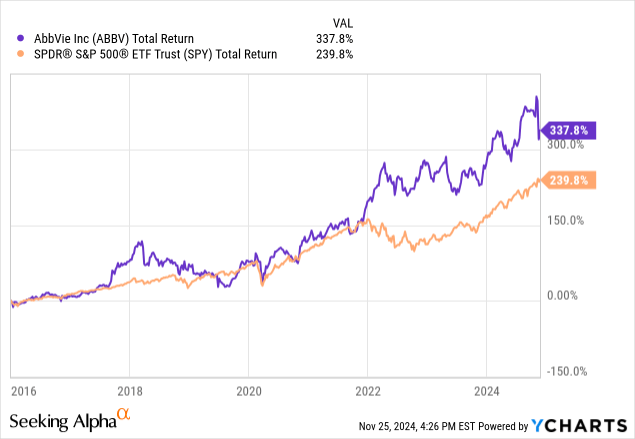

As an investor, I also can look back at how I played similar worries about AbbVie (ABBV) years back when the patent cliff was approaching on its blockbuster drug, Humira. Because ABBV has been such a popular stock among the Dividend Growth Investing community, the concern was the subject of hundreds of Seeking Alpha articles.

I thought AbbVie was a quality biopharm with a promising pipeline, and I thought management had a good strategy to extend Humira exclusivity for as long as possible. So rather than bail on it, I took advantage of the stock being sold off by anxious investors, and I built a larger position. I’m certainly glad I stayed positive and patient with ABBV.

Will Merck be as successful as AbbVie, which successfully delayed Humira’s patent cliff and used that time to come up with other huge money-makers such as Skyrizi and Rinvoq? Also, will Merck be able to overcome anti-vaccine rhetoric in Washington?

We can’t know the answer to those questions yet, but most analysts aren’t jumping ship on Merck.

For example, here’s this from CFRA’s Sel Hardy:

In November, we changed our view on shares of MRK to Buy from Hold. Following the recent selloff in health care stocks, we think MRK shares are attractive at current valuations. As a vaccine maker, we think MRK shares have been under pressure following RFK Jr.’s nomination (a vaccine critic) as secretary of the Health and Human Services Department. While the vaccine portfolio made up 21% of MRK’s sales in 9M 2024, we think the company is well diversified with solid presence in key areas such as oncology, immunology, cardiovascular, diabetes, and animal health. We also see strength in MRK’s cardiology and oncology portfolios, and the possibility of extending the use of Keytruda and Lynparza for a wider set of indications.

Non-Keytruda highlights from the Oct. 31 earnings call included: New pulmonary arterial hypertension drug Winrevair marked nearly $150 million in U.S. sales right out of the gate while receiving approval in Europe; pneumonia vaccine Capvaxive was recommended by the CDC for adults age 50-plus; there were positive results from clinical studies evaluating infant RSV drug Clesrovimab; and Merck’s Animal Health division saw Q3 sales grow by 6% to $1.5 billion.

Quality Abounds

Value Line thinks so highly of Merck that it includes the stock in two of its four model portfolios: “Stocks With Long-Term Price Growth Potential” and “Stocks With Above-Average Dividend Yields.”

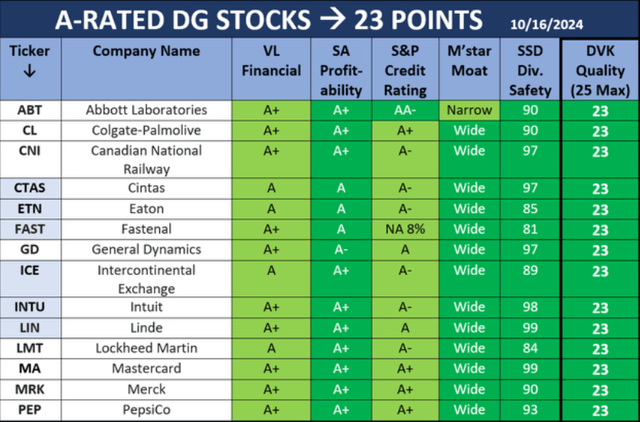

Additionally, my Dividends & Income Select colleague Dave Van Knapp used various quality indicators (from Value Line, Seeking Alpha, Standard & Poor’s, Morningstar and Simply Safe Dividends) to indicate that Merck belongs on his list of A-Rated stocks.

Seeking Alpha

Dave also selected Merck for the September reinvestment into his Dividend Growth Portfolio, citing the company’s “high quality, acceptable valuation, and strong dividend growth record.”

Valuation Station

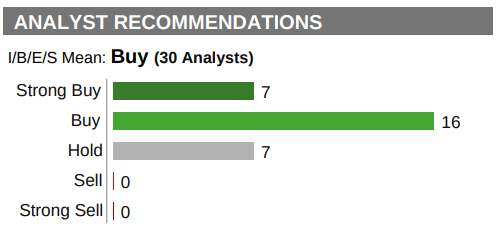

Analysts are generally bullish on MRK, as the following graphic from Refinitiv shows:

Refinitiv, via Charles Schwab | A modern approach to investing & retirement

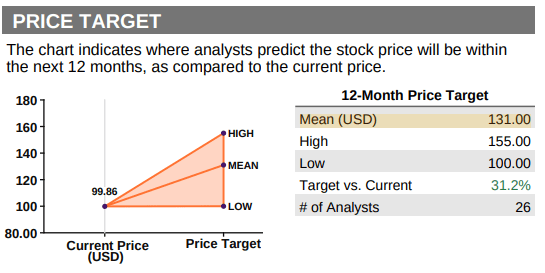

The mean 12-month price target from those analyst is $131, suggesting a 31% upside.

Refinitiv, via Charles Schwab | A modern approach to investing & retirement

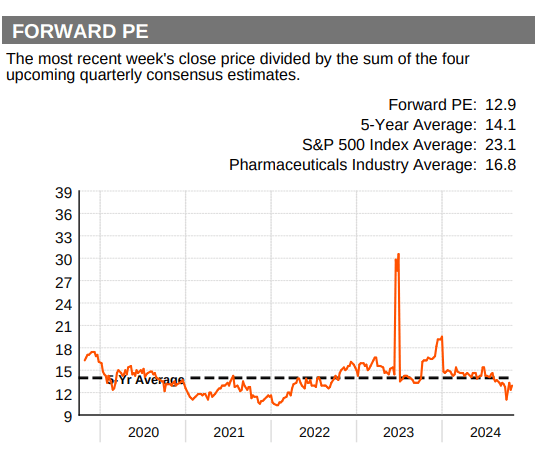

Those forecasts are based partly on the knowledge that MRK is trading at a significant discount to its normal price multiple, as well as to the pharmaceutical industry’s average P/E ratio.

Refinitiv, via Charles Schwab | A modern approach to investing & retirement

In addition to making his argument for Merck having a strong future, the CFRA analyst went on to say that he considered the stock undervalued: Our target price of $108, 11.2x our 2025 EPS view, is a discount to MRK’s historical forward P/ E average.

Morningstar is even higher on MRK, assigning the stock a $120 fair value. Morningstar strategist Karen Andersen explained the thinking this way:

After several years of mixed results, Merck’s R&D productivity is improving as the company shifts more toward areas of unmet medical need … in specialty-care areas, and Keytruda is leading this new direction. We expect Keytruda’s leadership in non-small-cell lung cancer and several other cancers will be a key driver of growth for the firm over the next several years. … Merck’s late-stage pipeline looks increasing well positioned to mitigate the eventual patent loss on Keytruda starting in 2028.

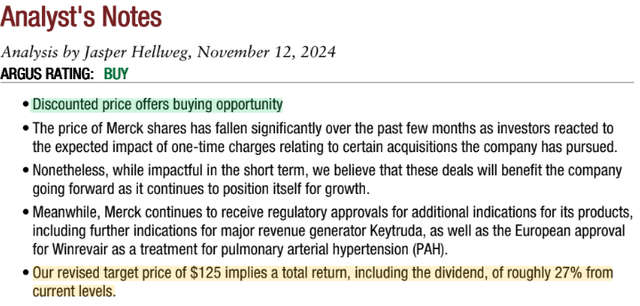

Citing an overreaction to one-time charges Merck made relating to acquisition debt, Argus analyst Jasper Hellweg explained why he views the stock favorably.

Argus, via Charles Schwab | A modern approach to investing & retirement

Value Line’s 18-month target is $134 – 35% higher than the price we just paid to add Merck to the IBP.

Dividend Dealings

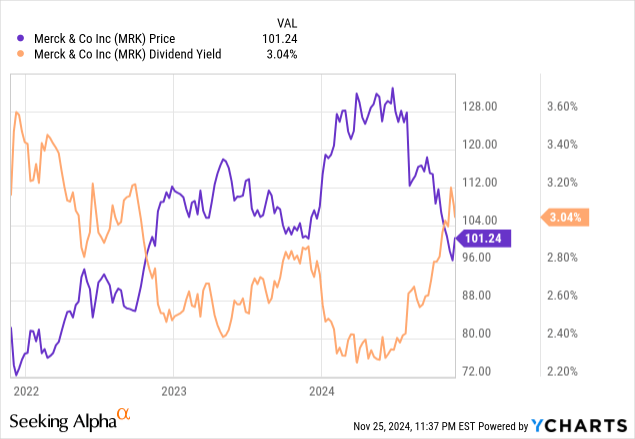

For DGI practitioners (and anyone else who likes a nice dividend), one of the benefits of a pullback in stock price is the accompanying increase in yield.

In the following chart, you can see that Merck’s yield has reached its two-year high mark.

(YCharts uses “current yield” rather than “forward yield,” which most investors and analysts do. Merck’s forward yield is 3.25%.)

If everything else is right – in other words, if a company is a quality business with a strong balance sheet and an attractive valuation – I really like buying its stock after a dividend increase.

Merck did just that last week, hiking its payout 5.2%, marking the 14th consecutive year it has raised its annual dividend.

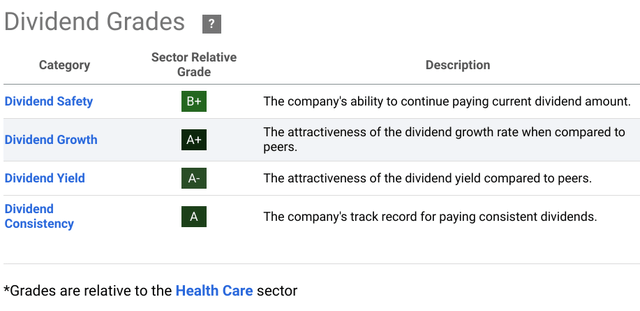

Importantly, Merck’s dividend is dependable. Simply Safe Dividends gives it a “very safe” score of 90, and Seeking Alpha grades MRK high in every dividend-related category.

Seeking Alpha

Because we bought Merck well before its Dec. 16 ex-dividend date, the IBP’s new 5-share position will generate $4.05 in income to be paid Jan. 8. That will be automatically reinvested to buy a fractional share of MRK. Over the course of the next year, the stock will generate more than $16 in income for the IBP.

Wrapping Things Up

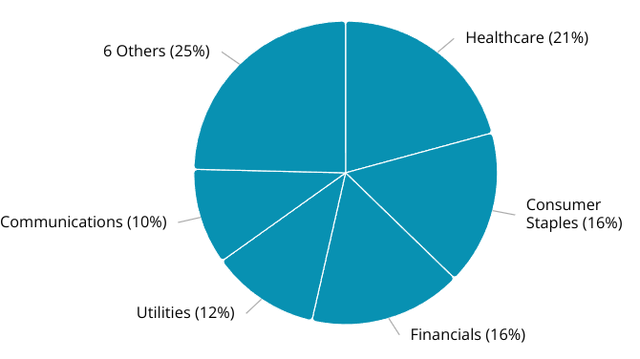

With this purchase, Healthcare now has the largest sector representation in the Income Builder Portfolio.

Simply Safe Dividends

I don’t really consider that to be “good” or “bad,” though I probably will avoid choosing another Healthcare stock for the rest of the year because I don’t want the portfolio to be too reliant on any one sector.

Overall, though, that’s a pretty small consideration. I simply want the IBP to own proven companies with strong business models and growing dividends – and Merck obviously fits the bill.

— Mike Nadel

We’re Putting $1,000/month into Income Builder Portfolio

The primary goal of our Income Builder Portfolio is to build a reliable, growing income stream by making regular investments in high-quality companies, most of which have a track record of paying and increasing dividends. The secondary goal is to build a portfolio that will experience solid total return. You can access our Income Builder Portfolio, and much more, with a free trial to our premium investment advisory, Dividends & Income Select.

The old way of investing in tech giants is over. A NEW strategy unlocks 146X more income on the SAME underlying stocks (like Meta, Apple, and Amazon) -- WITHOUT options trading. Click here to uncover the NEW MAG-7 alternative.