We recently started a series called “Penny Stock of the Day”. These ideas are geared toward traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Bionano Genomics, Inc. (NASDAQ: BNGO)

Today’s penny stock pick is the genome analysis software company, Bionano Genomics, Inc. (NASDAQ: BNGO).

Bionano Genomics, Inc. provides genome analysis software that enables genomics labs to analyze and interpret data across a range of platforms to generate informative data visualizations for streamlined and simple reporting of causal variants. It offers Saphyr, a sample-to-result solution for structural variation analysis by optical genome mapping for genome analysis and understanding of genetic variation and function; Saphyr instrument, a single-molecule imager; Saphyr Chip, a consumable that packages the nanochannel arrays for DNA linearization; and Bionano Prep Kits and DNA labeling kits, which provide the reagents and protocols for extracting and labeling ultra-high molecular weight DNA.

The company also provides Saphyr and Bionano compute servers; and VIA software, which offers one system for analysis and interpretation of genomic variants from microarray and next-generation sequencing data for cytogenetics and molecular genetics.

In addition, it offers testing and laboratory services comprising FirstStepDx PLUS, a chromosomal microarray for identifying an underlying genetic cause in individuals with autism spectrum disorder, developmental delay, and intellectual disability; Fragile X syndrome (FXS) testing services; NextStepDx PLUS, a exome sequencing test to identify genetic variants that are associated with disorders of childhood development; OGM-Dx HemeOne testing; OGM-Dx FSHD, a test for individuals suspected of having FSHD type 1; and OGM-Dx Postnatal Whole Genome SV and OGM-Dx Prenatal Whole Genome SV for comprehensive testing.

Website: https://www.bionano.com/

Latest 10-k report: https://ir.bionano.com/static-files/802262c5-a6d5-4788-adc8-dae44b70f7e2

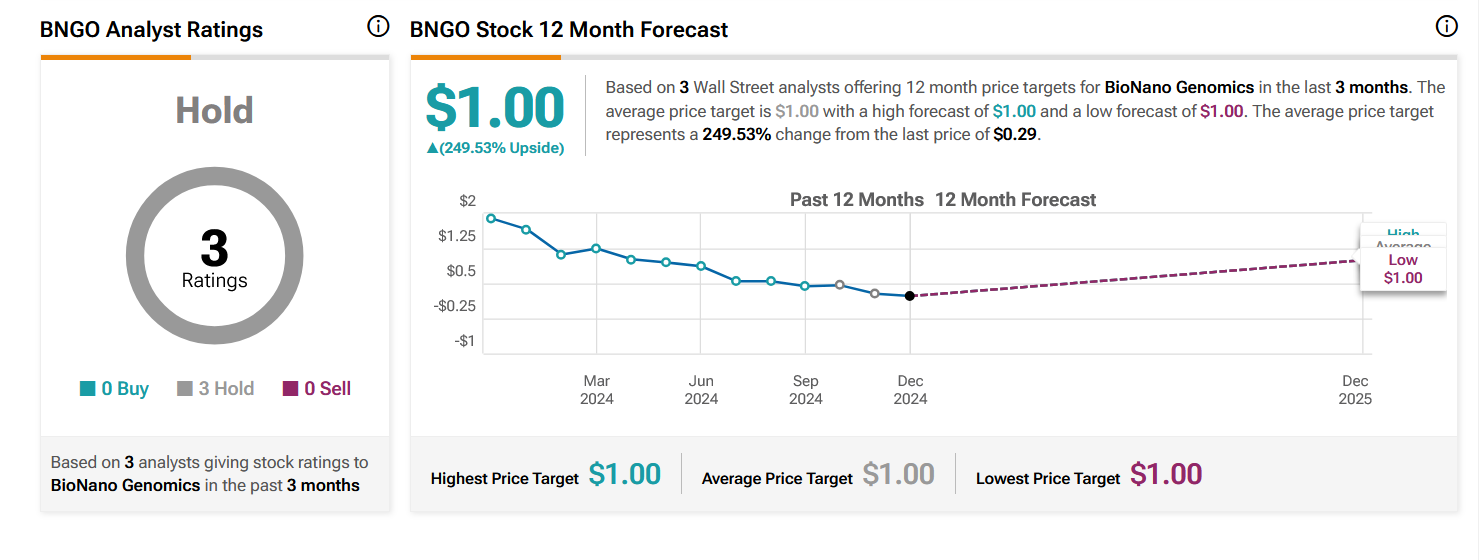

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for BNGO in the last 3 months, the stock has an average price target of $1.00, which is nearly 250% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- Rumors of positive upcoming Q4 numbers.

- The company had announced a new Category I Current Procedural Terminology (CPT®) code for the use of optical genome mapping in cytogenomic genome-wide analysis to detect structural and copy number variations related to hematological malignancies. The Category I CPT code is expected to be included in the next CPT codebook and to be effective January 1, 2025.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern with a high volume. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This is a possible bullish indication.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart and is also moving higher from oversold levels, indicating possible bullishness.

#7 Oversold RSI: The RSI is currently moving higher from oversold levels, indicating bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for BNGO is above the price of $0.30.

Target Prices: Our first target is $0.55. If it closes above that level, the second target price is $0.70.

Stop Loss: To limit risk, place a stop loss at $0.18. Note that the stop loss is on a closing basis.

Our target potential upside is 83% to 133%.

For a risk of $0.12, our first target reward is $0.25, and the second target reward is $0.40. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

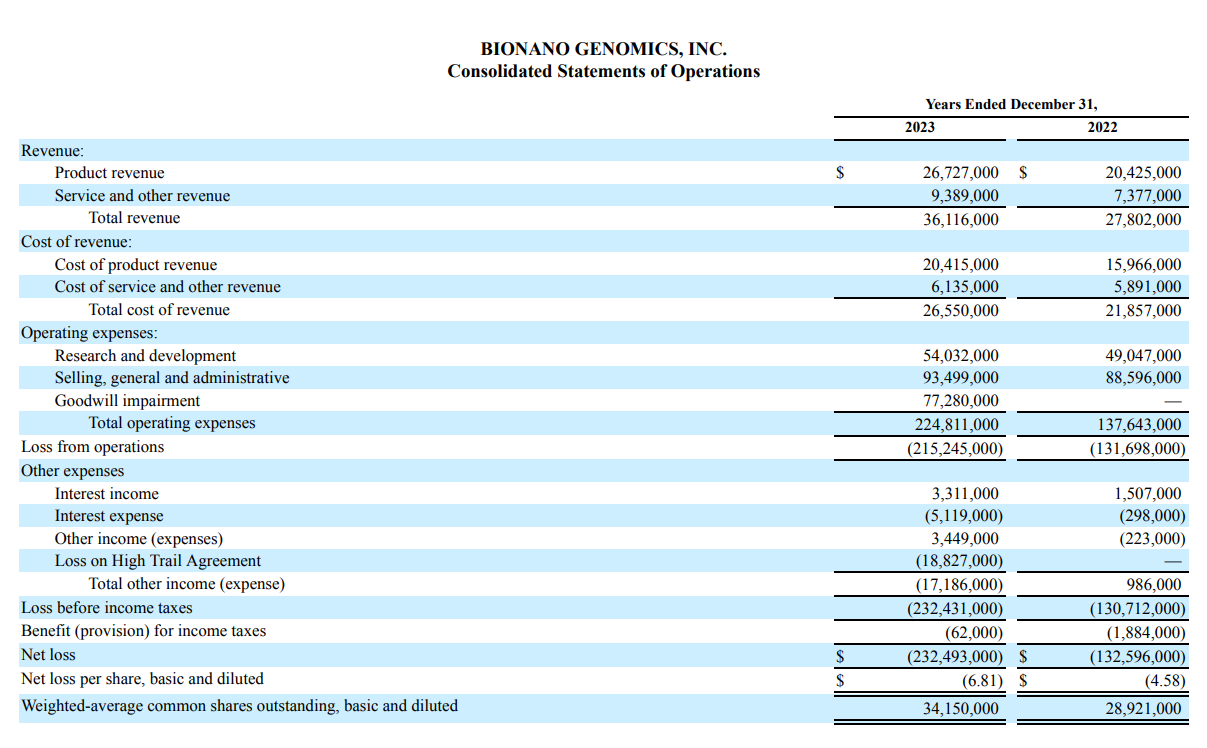

- The company has a history of net losses. BNGO incurred net losses of $232.5 million and $132.6 million for the twelve months ending December 31, 2023, and 2022, respectively.

- BNGO is an early commercial-stage company with a limited commercial history. This makes it difficult to evaluate its current business and predict future performance.

- The company failed to comply with the per share minimum required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2). On May 30, 2023, BNGO received a letter from Nasdaq advising that for 30 consecutive trading days preceding the date of the Notice, the bid price of its common stock had closed below the Minimum Bid Price Requirement.

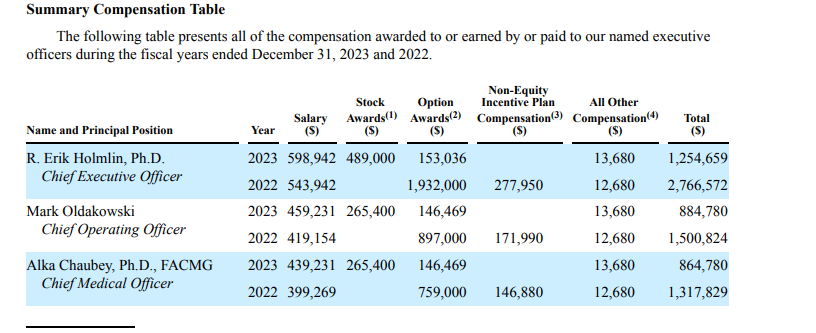

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company’s recurring losses, negative cash flows, and significant accumulated deficit have raised substantial doubt regarding its ability to continue as a going concern.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day