We recently started a series called “Penny Stock of the Day”. These ideas are geared toward traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Nerdy, Inc. (NYSE: NRDY).

Today’s penny stock pick is the live online learning company, Nerdy, Inc. (NYSE: NRDY).

Nerdy, Inc.’s purpose-built proprietary platform leverages technology, including artificial intelligence to connect students, users, parents, guardians, and purchasers of various ages to tutors, instructors, subject matter experts, educators, and other professionals, delivering value on both sides of the network. Its learning destination provides learning experiences across various subjects and multiple formats, including one-on-one instruction, small group tutoring, large format classes, tutor chat, essay review, adaptive assessment, and self-study tools. The company’s flagship business, Varsity Tutors, operates platforms for live online tutoring and classes. Its solutions are available directly to learners, as well as through education systems.

Website: https://www.nerdy.com/

Latest 10-k report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001819404/d75dce74-9cd5-43df-9f0a-2a1bac3c30ae.pdf

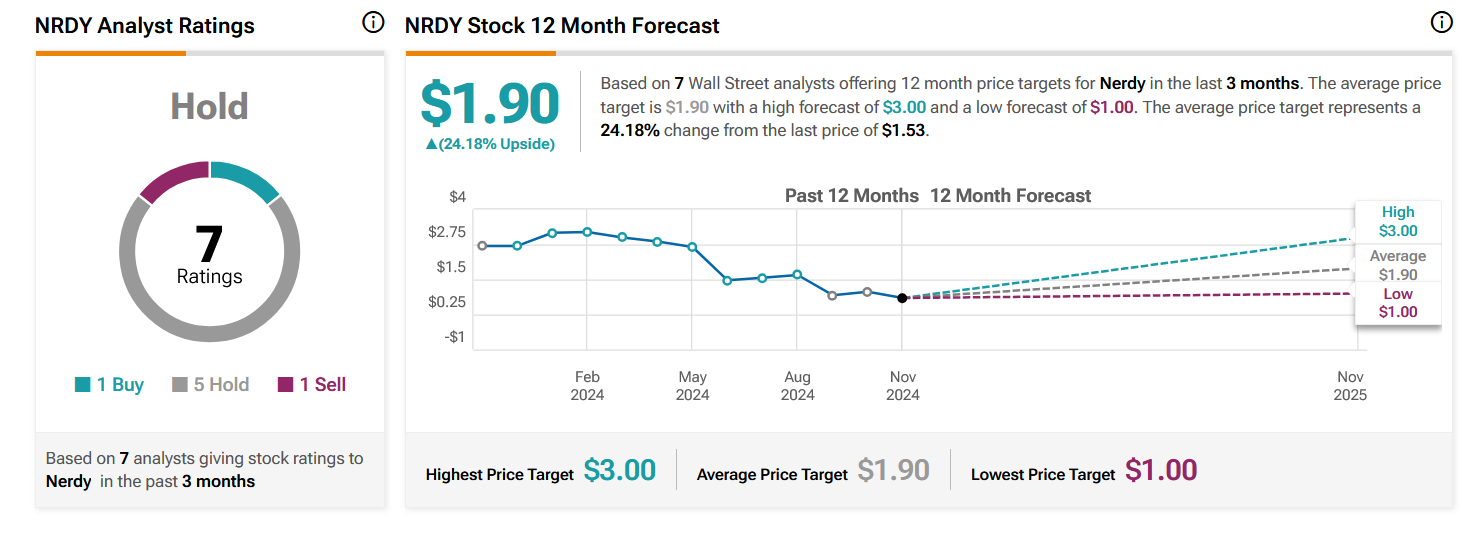

Analyst Consensus: As per TipRanks Analytics, based on 7 Wall Street analysts offering 12-month price targets for NRDY in the last 3 months, the stock has an average price target of $1.90, which is nearly 24% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company recently invested in product enhancements to improve the quality and reliability of live learning and expanded access to its Varsity Tutors for Schools platform, reaching 1.1 million students, bringing the total to 4.4 million.

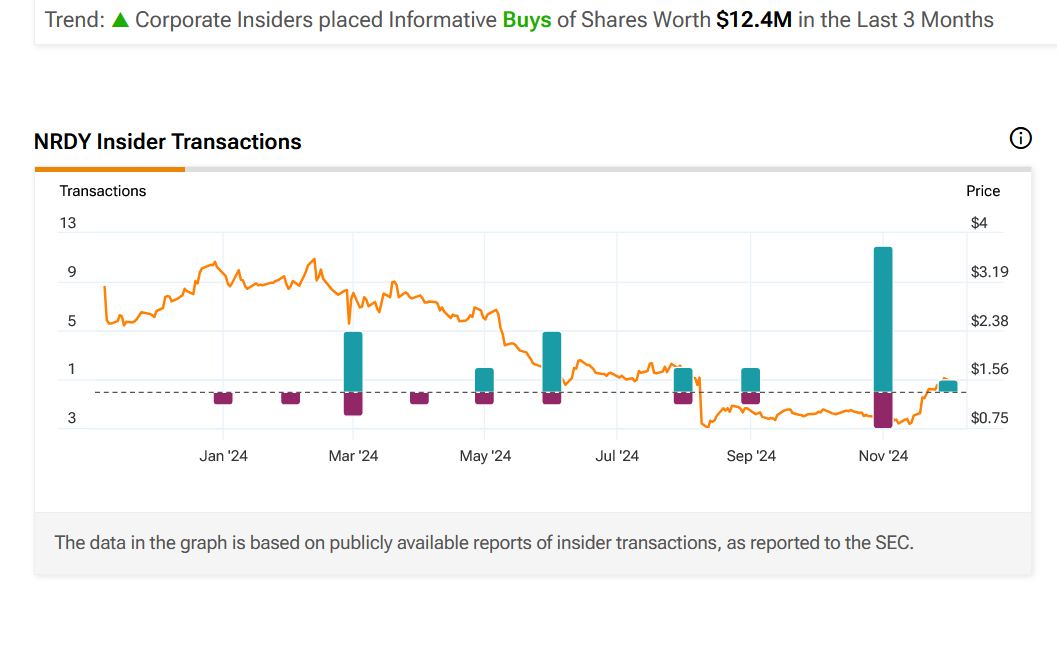

- Corporate Insiders placed Informative Buys of Shares Worth $12.4M in the Last 3 Months.

- There is a growing demand for live, AI-powered tutoring.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Downtrend Channel Breakout: The daily chart shows that the stock has broken out of a downtrend channel, which is shown as purple color lines. This is a possible bullish indication.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This is a possible bullish indication.

#6 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for NRDY is above the price of $1.60.

Target Prices: Our first target is $2.60. If it closes above that level, the second target price is $3.50.

Stop Loss: To limit risk, place a stop loss at $0.98. Note that the stop loss is on a closing basis.

Our target potential upside is 63% to 119%.

For a risk of $0.62, our first target reward is $1.00, and the second target reward is $1.90. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

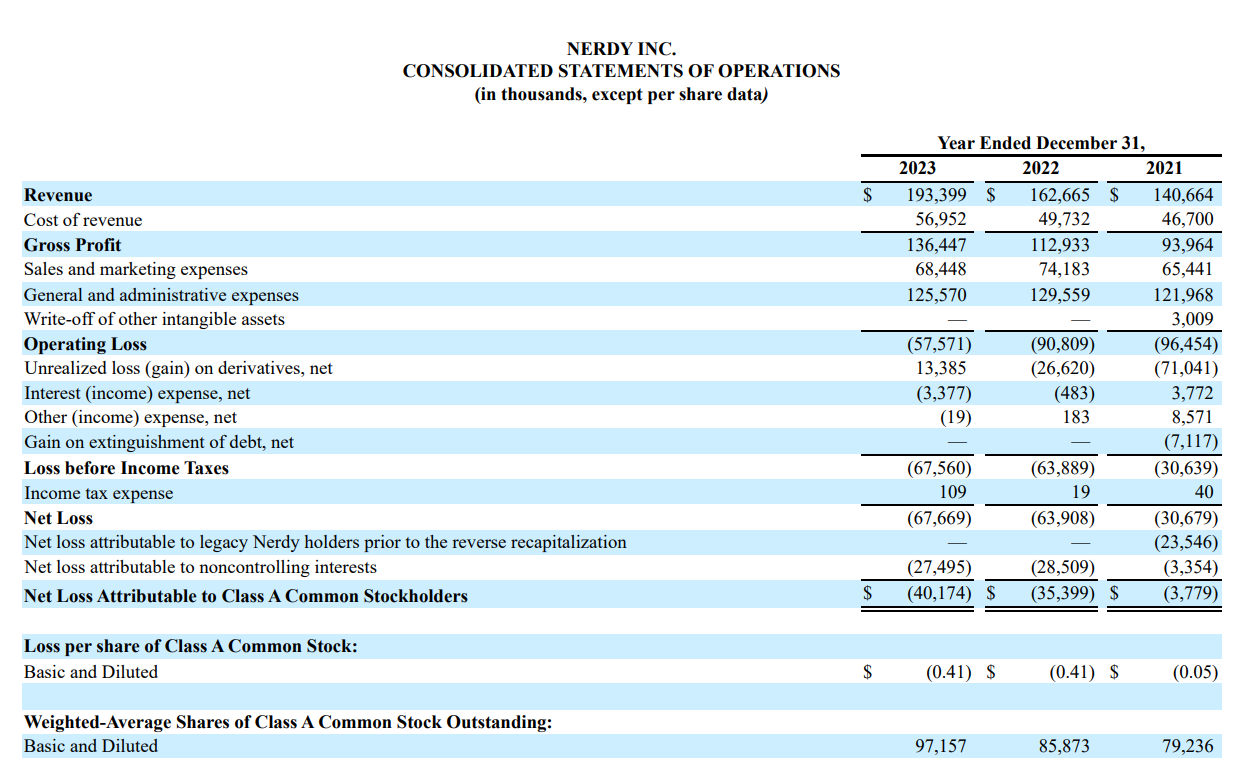

- The company has a history of net losses. NRDY’s net losses for the years ended December 31, 2023, 2022, and 2021 were $67,669 thousand, $63,908 thousand, and $30,679 thousand, respectively.

- The company received a notice from the New York Stock Exchange on November 12, 2024, that it is not in compliance with the continued listing criteria under Section 802.01C of the NYSE Listed Company Manual because the average closing price of the Company’s Class A Common Stock was less than $1.00 over a consecutive 30 trading-day period.

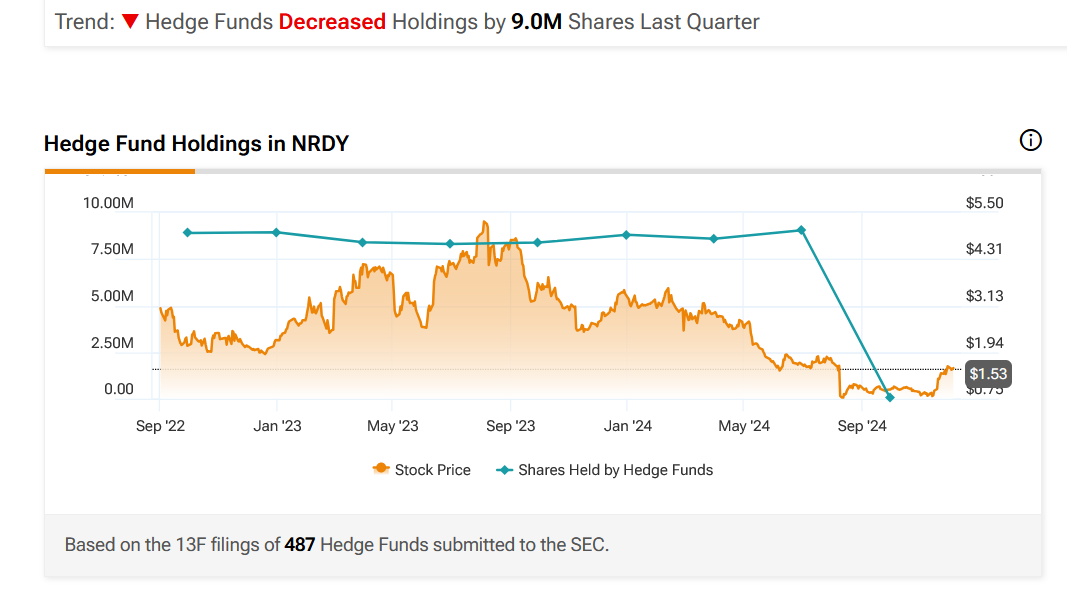

- Hedge Funds Decreased Holdings by 9.0M Shares Last Quarter.

- In 2019, a Complaint was filed in a Superior California Court against Varsity Tutors alleging that Varsity Tutors misclassified California tutors as independent contractors as opposed to employees in violation of the California Labor Code and seeking penalties and other remedies under California’s Private Attorneys General Act.

- The company faces competition from established, as well as other emerging companies, which could divert customers to NRDY’s competition, resulting in pricing pressure, and significantly reducing the company’s revenue.

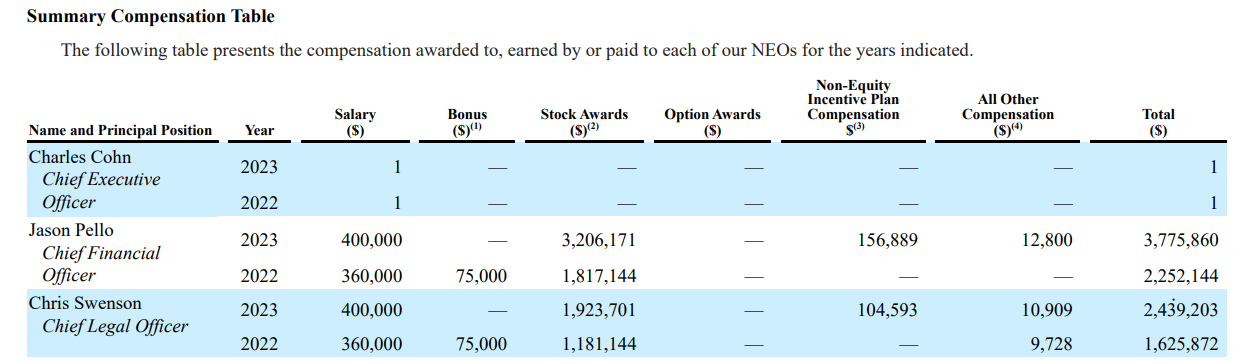

- Despite being a loss-making company, company executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Karim Rahemtulla, the trader behind a 400% gain in 24-months on Rolls-Royce, has uncovered another potential multi-bagger. This under-$20 stock gives you exposure to over 1-oz of gold with the lowest production costs in the industry. And an upcoming announcement could send this stock soaring. Get Karim's urgent briefing - click here now.

Source: Trades of the Day