We recently started a series called “Penny Stock of the Day”. These ideas are geared toward traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Chegg, Inc. (NYSE: CHGG)

Today’s penny stock pick is the direct-to-student learning platform, Chegg, Inc. (NYSE: CHGG).

Chegg, Inc. helps learners build essential life and job skills to accelerate their path from learning programs in the United States and internationally.

Its subscription services include Chegg Study, which offers personalized step-by-step learning support from AI, computational engines, and subject matter experts, as well as Tinger Gold and DashPash Student services; Chegg Writing which provides students with a suite of tools, such as plagiarism detection scans, grammar and writing fluency checking, expert personalized writing feedback, and premium citation generation; Chegg Math, a step-by-step math problem solver and calculator that helps students to solve problems; Chegg Study Pack, a bundle of various subscription product offerings, including Chegg Study, Chegg Writing, and Chegg Math services; and Busuu, an online language learning platform that offers comprehensive support through self-paced lessons, live classes with expert tutors, and a community of members to practice alongside.

The company also provides a skills-based learning platform to learn technical skills comprising AI, coding, data analytics, and cybersecurity, as well as competencies consisting of emotional intelligence, mindset, emerging leadership, and decision making. In addition, it rents and sells print textbooks and eTextbooks; and offers advertising services. The company serves students and companies through direct marketing channels and social media.

Website: https://www.chegg.com/

Latest 10-k report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001364954/680bfe93-a346-4734-a4d0-3070efd11364.pdf

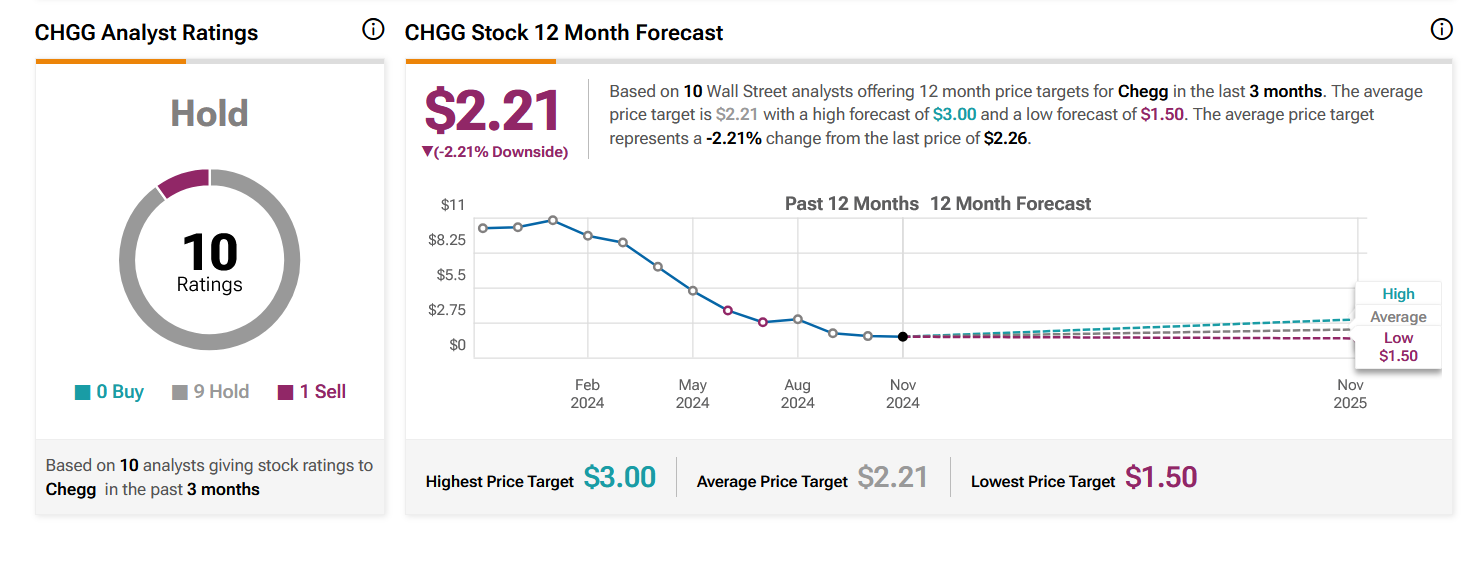

Analyst Consensus: As per TipRanks Analytics, based on 10 Wall Street analysts offering 12-month price targets for CHGG in the last 3 months, the stock has an average price target of $2.21.

Potential Catalysts / Reasons for the Hype:

- The company announced a repurchase agreement for its 0% convertible senior notes due in 2026. CHGG will repurchase approximately $116.6 million of its outstanding 0% convertible senior notes due 2026 for a cash price of $96.2 million.

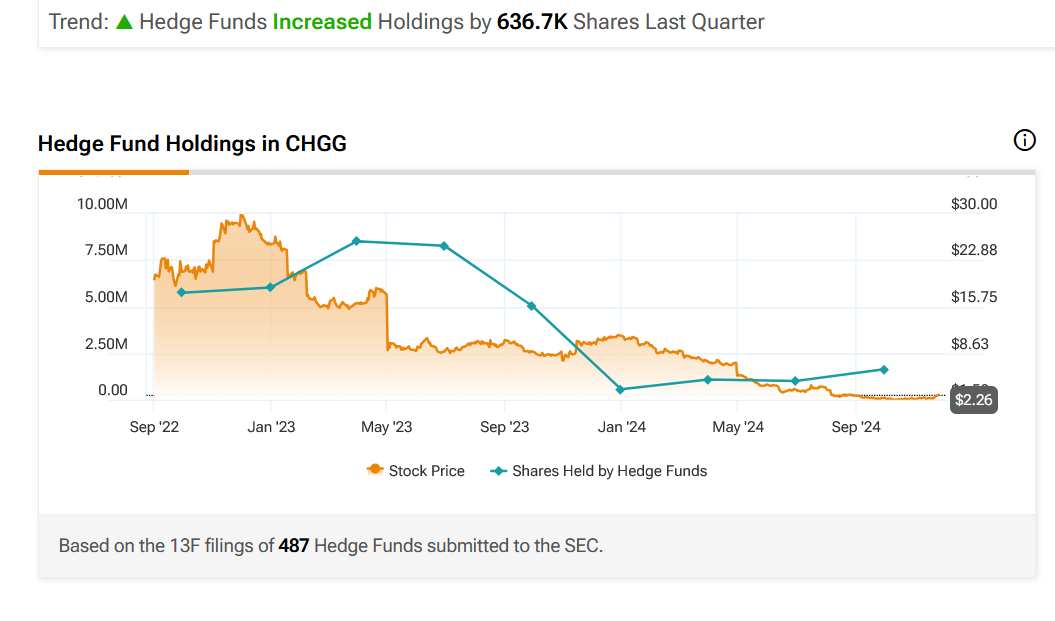

- Hedge Funds Increased Holdings by 636.5K Shares Last Quarter.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This is a possible bullish indication.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for CHGG is above the price of $2.35.

Target Prices: Our first target is $3.50. If it closes above that level, the second target price is $4.40.

Stop Loss: To limit risk, place a stop loss at $1.70. Note that the stop loss is on a closing basis.

Our target potential upside is 49% to 87%.

For a risk of $0.65, our first target reward is $1.15, and the second target reward is $2.05. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

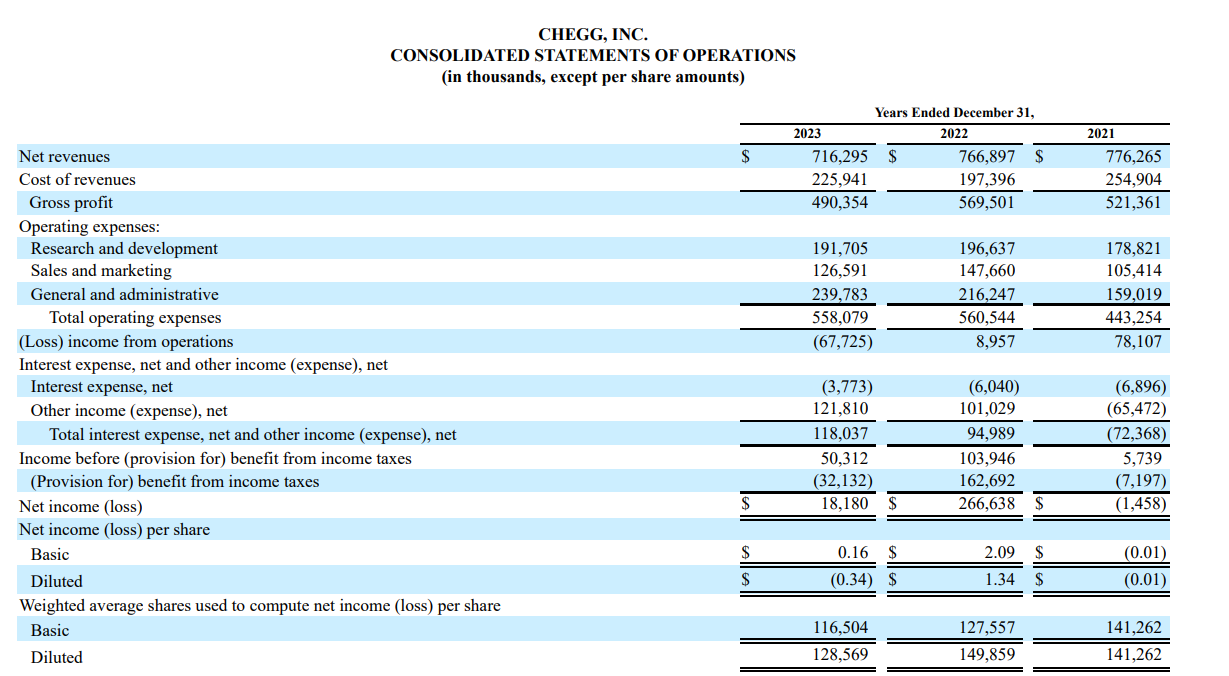

- The company has a history of losses. As of December 31, 2023, CHGG had an accumulated deficit of $52.4 million.

- CHGG has ongoing legal proceedings.

- On March 1, 2023, Plaintiff Shiva Stein filed a stockholder derivative complaint in the Court of Chancery of the State of Delaware (Case No. 2023-0244-NAC) asserting breach of fiduciary duty, unjust enrichment, and waste of corporate asset claims against members of Chegg’s Board and certain Chegg officers.

- On December 22, 2022, JPMorgan Chase Bank, N.A. asserted a demand for repayment by the Company of certain investment proceeds received by the Company in its capacity as an investor in TAPD, Inc.

- On November 9, 2022, Plaintiff Joshua Keller filed a putative class action in the United States District Court for the Northern District of California (Case No. 22-cv-06986) on behalf of individuals whose data was allegedly impacted by past data breaches.

- On June 18, 2020, CHGG received a Civil Investigative Demand from the Federal Trade Commission (FTC) regarding certain alleged deceptive or unfair acts or practices related to consumer privacy and/or data security.

- Since 2023, the company has spent a significant amount on marketing, yet reported lower returns, translating to lower revenue projection in 2024.

- The company faces competition in all aspects of its business, including with respect to AI, and such competition is expected to increase.

- S. colleges have faced, and may continue to face, reduced enrollment, which could negatively impact the company’s business and results of operations.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day