We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Pacific Biosciences of California, Inc. (NASDAQ: PACB)

Today’s penny stock pick is the biotechnology company, Pacific Biosciences of California, Inc. (NASDAQ: PACB).

Pacific Biosciences of California, Inc. designs, develops, and manufactures sequencing solution to resolve genetically complex problems. The company provides sequencing systems; consumable products, including single molecule real-time (SMRT) technology; long-red sequencing; and various reagent kits designed for specific workflow, such as preparation kit to convert DNA into SMRTbell double-stranded DNA library formats, including molecular biology reagents, such as ligase, buffers, and exonucleases.

It also offers binding kits, such as modified DNA polymerase used to bind SMRTbell libraries to the polymerase in preparation for sequencing; and sequencing kits comprise reagents required for on-instrument, real-time sequencing, including the phospholinked nucleotides. In addition, it provides revio system + sequel systems which conduct, monitor, and analyze single-molecule biochemical reactions in real time; SBB short-read sequencing; onso instrument conducts, monitors, and analyzes SBB biochemical reactions; and SBB consumable, including flow cells, clustering, and sequencing reagent kits.

The company serves academic and governmental research institutions; commercial testing and service laboratories; genome centers; public health labs, hospitals and clinical research institutes, and contract research organizations; pharmaceutical companies; and agricultural companies. It markets its products through a sales force and distribution partners in Asia, Australia, Europe, the Middle East, Africa, and Latin America. It has a development and commercialization agreement with Invitae Corporation; and a collaboration with Radboud University Medical to explore genetic causes of rare and genetic diseases.

Website: https://www.pacb.com

Latest 10-k report: https://investor.pacificbiosciences.com/static-files/46cec9c6-a0cf-4227-9b4b-503d056e5970

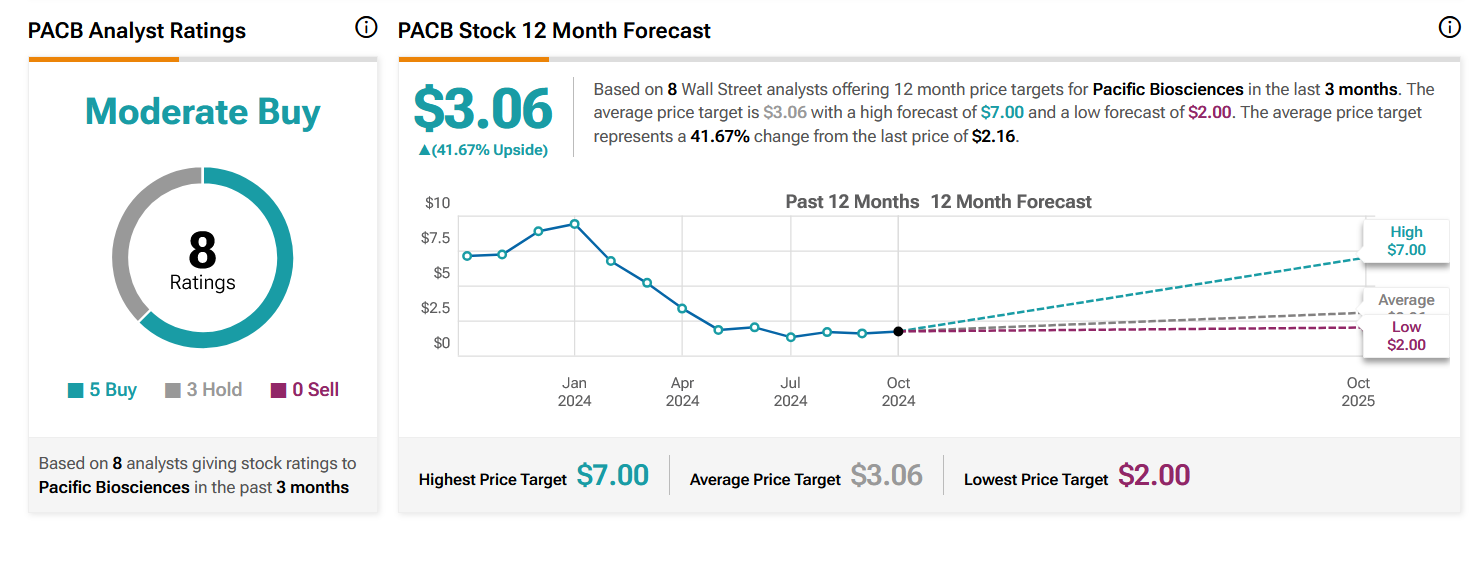

Analyst Consensus: As per TipRanks Analytics, based on 8 Wall Street analysts offering 12-month price targets for PACB in the last 3 months, the stock has an average price target of $3.06, which is nearly 42% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company recently announced SPRQ, an improved sequencing chemistry for its Revio™ long-read sequencing system. At a high level this is what it enables: 120Gb per Revio chip (up from 90Gb) enabling $500 20x Human Genome; Instrument cost has dropped to $599,000; and Lower input requirements (down to 500ng).

- Anticipation of a positive upcoming Q3 report.

- Possible short squeeze.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Consolidation Area: The daily chart shows that the stock has been consolidating within a price range for the past few days. This area is marked as a purple color rectangle. Once the stock breaks out of the consolidation area, it could surge higher. The breakout level of this consolidation area typically acts as a good support level.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for PACB is above the price of $2.25.

Target Prices: Our first target is $3.20. If it closes above that level, the second target price is $4.00.

Stop Loss: To limit risk, place a stop loss at $1.70. Note that the stop loss is on a closing basis.

Our target potential upside is 42% to 78%.

For a risk of $0.55, our first target reward is $0.95, and the second target reward is $1.75. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

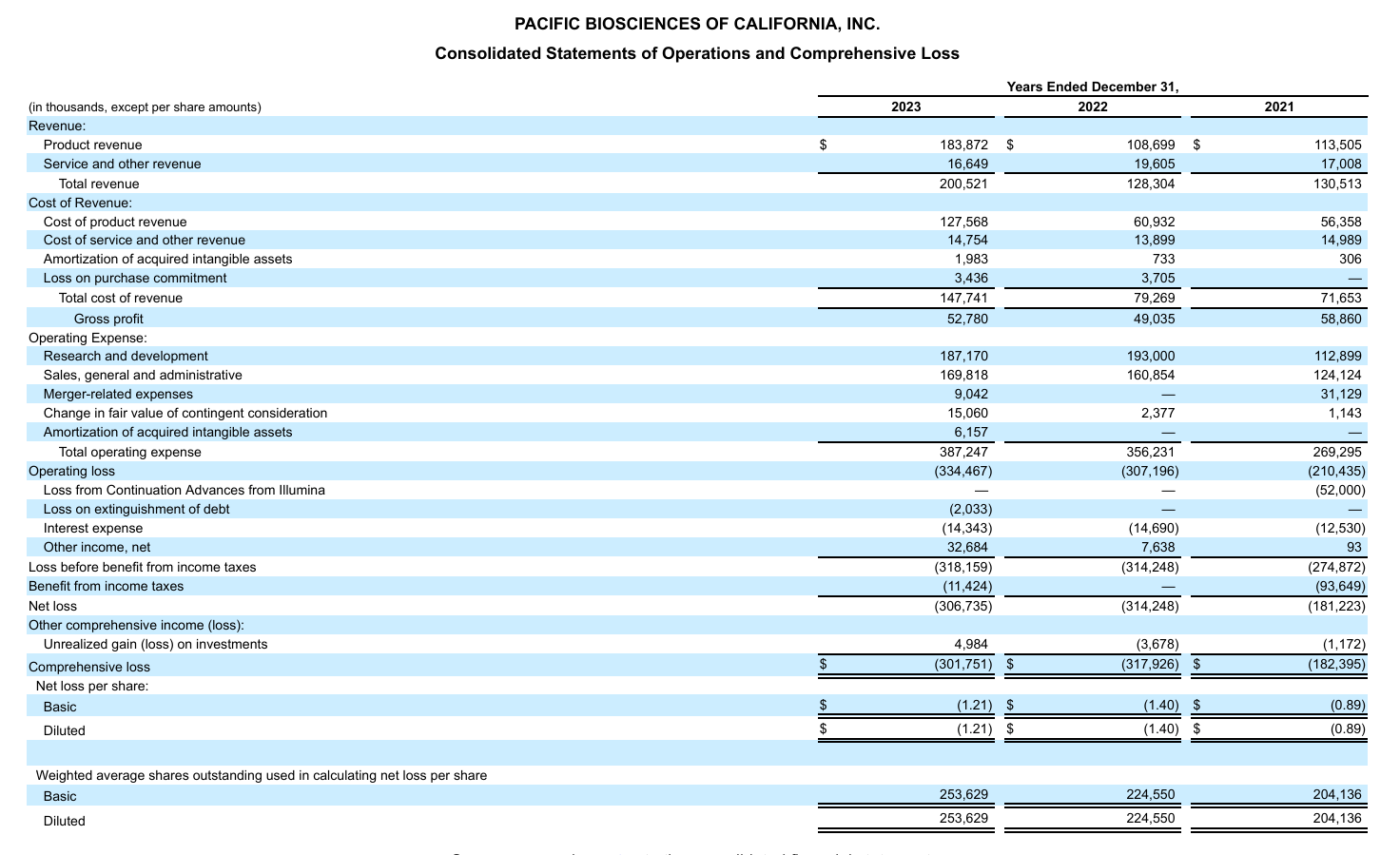

- The company has a history of net losses.

- The company has ongoing legal proceedings – U.S. District Court Proceedings for patent infringement, and proceedings in China alleging infringement of one or more claims of China patent No. CN101743321B.

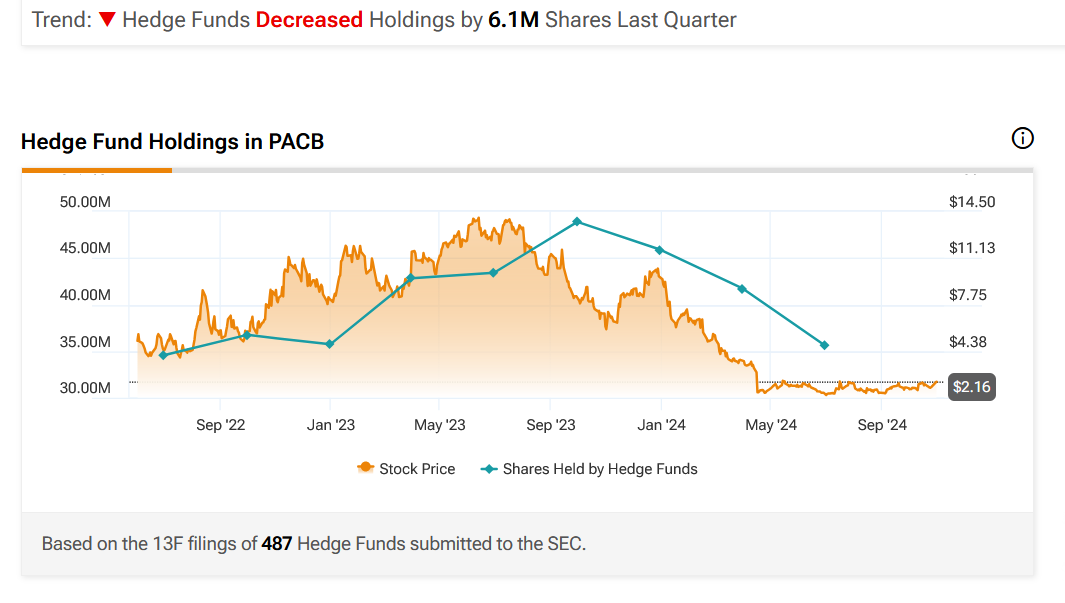

- Hedge Funds Decreased Holdings by 6.1M Shares Last Quarter.

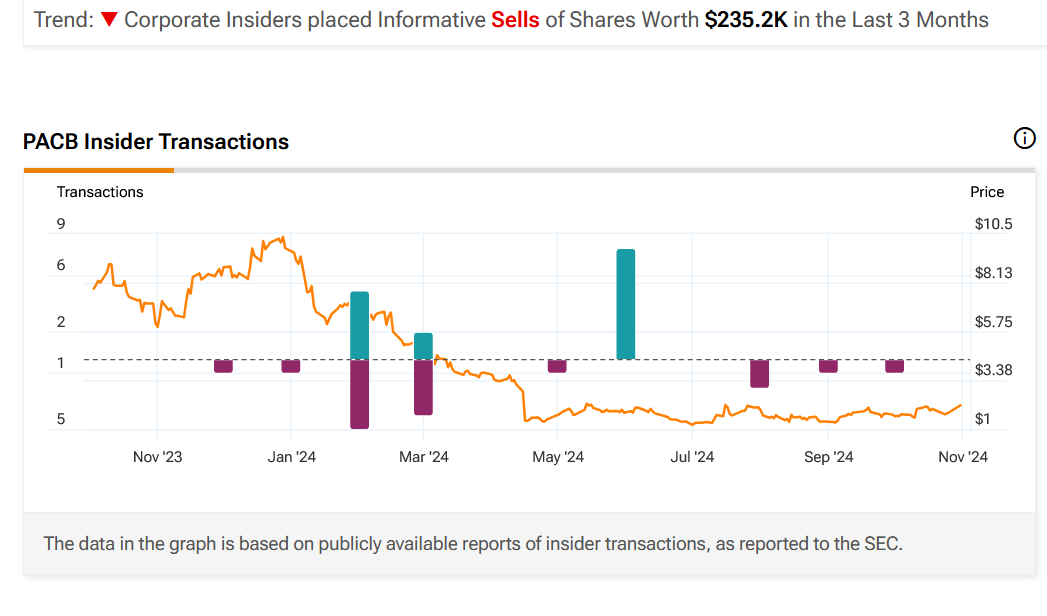

- Corporate Insiders placed Informative Sells of Shares Worth $235.2K in the Last 3 Months.

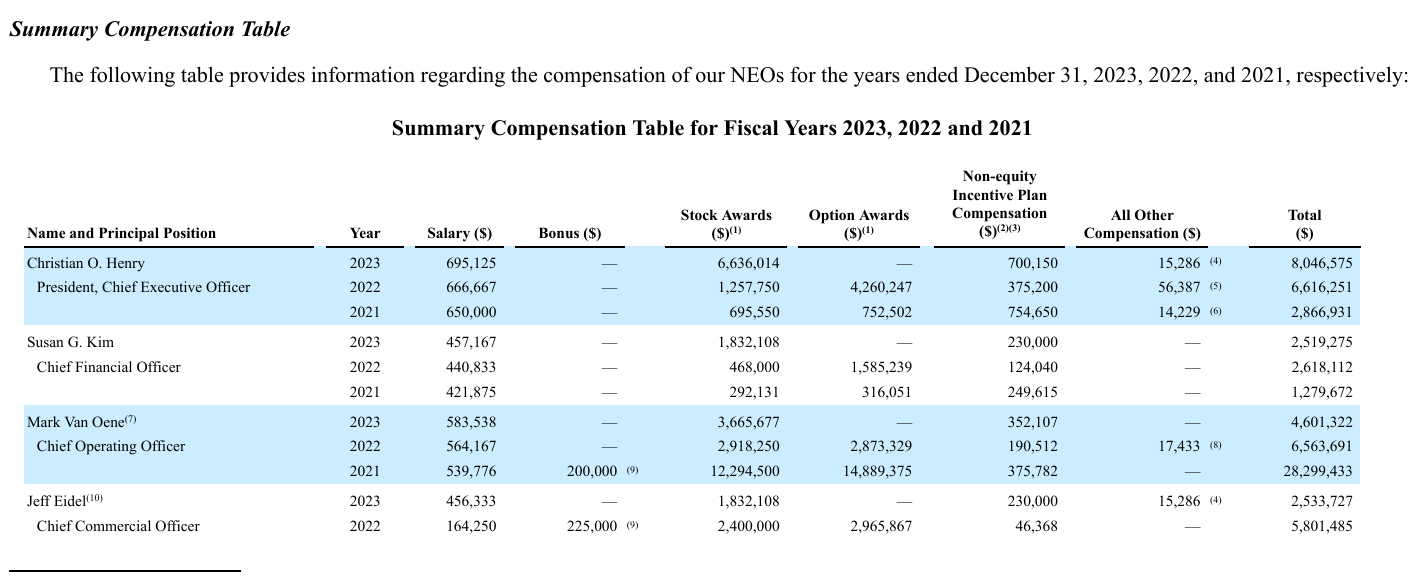

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Trades of the Day