We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Bitfarms Ltd. (NASDAQ: BITF)

Today’s penny stock pick is the cryptocurrency miner, Bitfarms Ltd. (NASDAQ: BITF).

Bitfarms Ltd. engages in the mining of cryptocurrency coins and tokens in Canada, the United States, Paraguay, and Argentina. It owns and operates server farms that primarily validate transactions on the Bitcoin Blockchain and earn cryptocurrency from block rewards and transaction fees.

Website: https://www.bitfarms.com

Latest 10-k report: https://investor.bitfarms.com/sec-filings/all-sec-filings/content/0001213900-24-020602/0001213900-24-020602.pdf

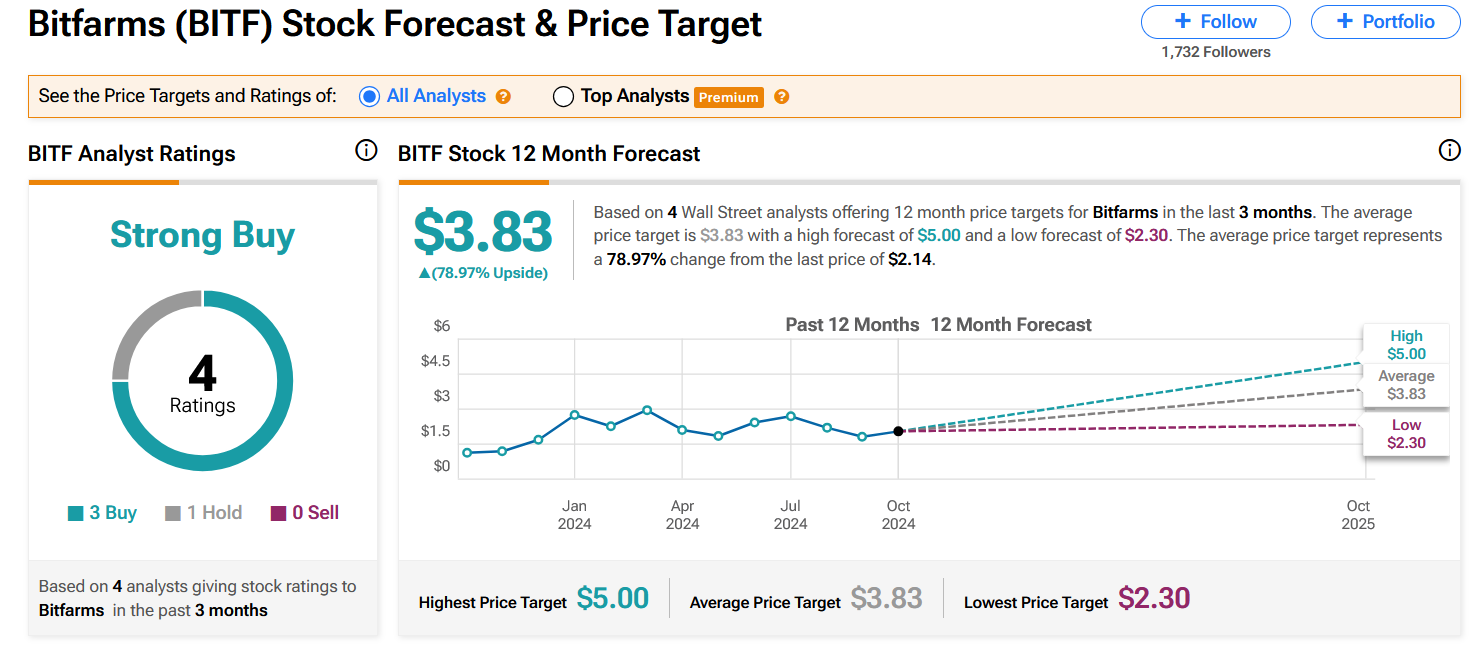

Analyst Consensus: As per TipRanks Analytics, based on 4 Wall Street analysts offering 12-month price targets for BITF in the last 3 months, the stock has an average price target of $3.83, which is nearly 79% upside from current levels.

Potential Catalysts / Reasons for the Hype:

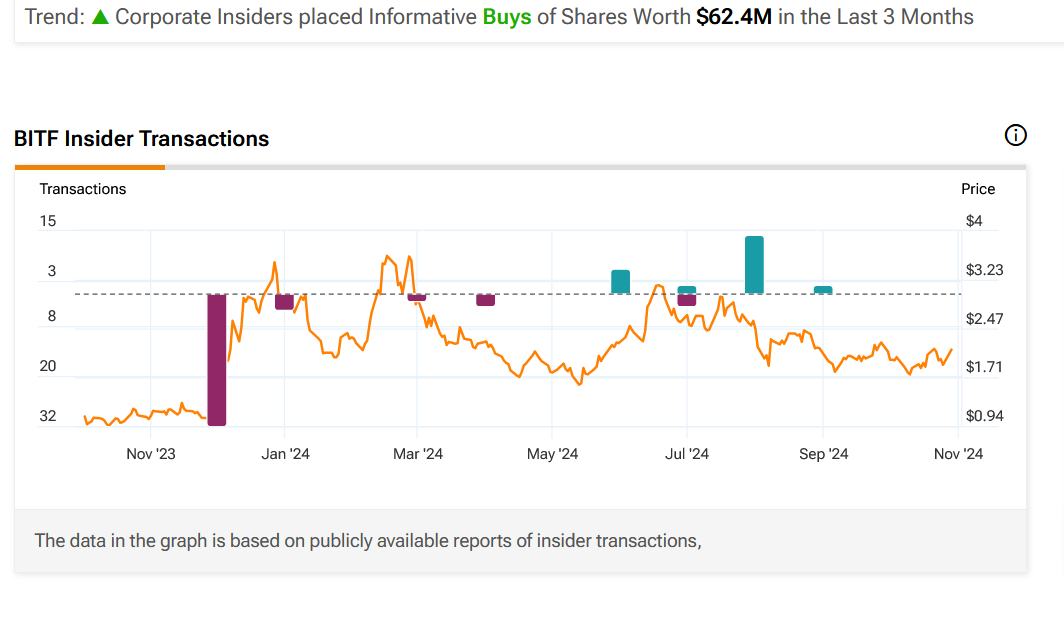

- Corporate Insiders placed Informative Buys of Shares Worth $62.4M in the Last 3 Months.

- The company appointed Rachel Silverstein as U.S. General Counsel, effective November 1, 2024. Silverstein is an attorney with 16 years of experience who also serves as one of the leading Bitcoin mining attorneys in the United States. Silverstein has served as lead counsel for quite a bit of Bitcoin mining, representing over one full gigawatt’s worth of transactions across the United States and internationally.

- Bitfarms and Riot Platforms reached an agreement to end Riot’s bid to take over the Canadian Bitcoin mining firm.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern: The daily chart shows that the stock has currently formed a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MA: The stock is currently above its 50-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for BITF is above the price of $2.20.

Target Prices: Our first target is $3.10. If it closes above that level, the second target price is $3.70.

Stop Loss: To limit risk, place a stop loss at $1.70. Note that the stop loss is on a closing basis.

Our target potential upside is 41% to 68%.

For a risk of $0.50, our first target reward is $0.90, and the second target reward is $1.50. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

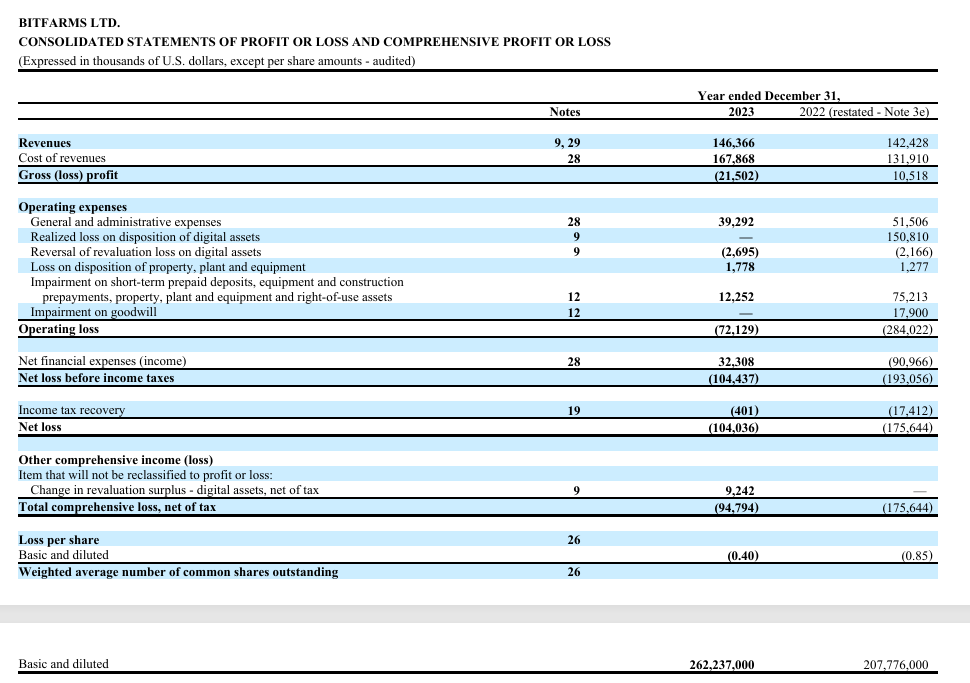

- The company has a history of net losses.

- The company currently participates in only one Mining Pool – Foundry Pool. Foundry Pool is owned indirectly by Digital Currency Group, which also owns Genesis Global Capital. On January 19, 2023, Genesis filed for U.S. bankruptcy protection. In the event that Foundry Pool ceases making payments to Bitfarms for whatever reason, including bankruptcy, insolvency, or cessation of its operations, BITF would need to join a different Mining Pool; or commence Mining independently.

- The Company has only a limited operating history. It is subject to many risks common to venture enterprises, including under-capitalization, potential cash shortages and limitations with respect to personnel, financial, and other resources.

- On December 14, 2022, the Company announced that it received a written notice from Nasdaq indicating that, for the prior thirty days, the bid price for the Common Shares had closed below the minimum US$1.00 per share requirement for continued listing on Nasdaq under Nasdaq Listing Rule 5550(a)(2).

- The cryptocurrency financial system is relatively new and has a limited history. To remain competitive, the Company will continue to monitor the state of available technology and invest in hardware and equipment required for maintaining and enhancing its operations.

- The Company conducts Mining operations in the Province of Québec, Washington State, Paraguay, and Argentina. The Company’s operations are dependent on its ability to maintain reliable and economical sources of power to run its cryptocurrency Mining assets.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Trades of the Day