The last few years have been eye opening for millions of people.

Due to a variety of factors, prices across the board have risen dramatically.

Pretty much everything – food, housing, insurance, etc. – is a lot more expensive than only a few years ago.

This has taught us all a valuable lesson.

The lesson is, we must invest in assets that can grow over time and protect/increase our purchasing power.

A dollar is slowly losing its value and purchasing power in the marketplace.

Hoarding dollars won’t help.

Instead, we must use those dollars to buy assets that can rise even faster than inflation.

This brings me to dividend growth investing, which is a long-term investment strategy that prioritizes the idea of buying shares in wonderful businesses that pay safe, growing dividends to shareholders.

You can find hundreds of examples of stocks that qualify for the strategy by perusing the Dividend Champions, Contenders, and Challengers list.

That list has compiled data the US-listed stocks that have raised dividends each year for at least the last five consecutive years.

Collecting safe, growing dividends is a simple but powerful way to protect yourself against inflation, as many of the companies on that list are growing their dividends far faster than the rate of inflation.

Passive dividend income is nice.

Passive dividend income is nice.

Passive dividend income that grows faster than inflation and slowly improves your purchasing power is awesome.

I’ve been using this strategy for nearly 15 years, and it’s greatly increased my wealth and passive income over that time frame.

It’s done so through the building of the FIRE Fund.

That’s my real-money portfolio which generates enough five-figure passive dividend income for me to live off of.

I’ve actually been in the extremely fortunate position of being able to live off of dividends since I quit my job and retired in my early 30s.

If you’re interested in reading more about how that was made possible, my Early Retirement Blueprint delves into it a bit more.

Now, a key component to this strategy, which must be considered carefully before every investment, is valuation.

Price is only what you pay, but it’s value that you get.

Price is only what you pay, but it’s value that you get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Prices will continue rising over time, which is why it’s incumbent on us to buy great assets – such as undervalued high-quality dividend growth stocks – that can keep up with, or even outpace, this rising.

The preceding section does presume that one already has a basic understanding of how valuation works.

If that basic understanding isn’t already in place, Lesson 11: Valuation is definitely worth a read.

Written by fellow contributor Dave Van Knapp, it simplifies the entire valuation concept and even provides an easy-to-follow valuation template that can be used to estimate the fair value of almost any dividend growth stock out there.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

Bristol-Myers Squibb Co. (BMY)

Bristol-Myers Squibb Co. (BMY)

Bristol-Myers Squibb Co. (BMY) is an American multinational pharmaceutical company that discovers, develops, and markets drugs for various therapeutic areas.

Founded in 1887, Bristol-Myers Squibb is now a $108 billion (by market cap) Big Pharma giant that employs approximately 34,000 people.

Roughly 70% of sales are derived from the US.

Bristol-Myers Squibb has three areas of focus: cardiovascular, immunology, and oncology.

The company currently has three top drugs: Revlimid, Eliquis, and Opdivo.

These three products combined to generate ~60% of FY 2023 revenue.

Bristol-Myers Squibb has been around for nearly 140 years.

Not only that, but its a very significant and successful company all these years later.

Surviving as a corporate entity for more than a century is extremely difficult; thriving for that long is nearly impossible.

How is it doing this?

Well, I think a lot of it has to do with the fact that what it develops and sells – pharmaceutical products – are in a constant state of demand that is also rising.

This comes down to the human condition.

Humans are biological creatures that sometimes require medical intervention in order to maintain health and/or life.

This was true in 1887, it’s true today, and it’ll be true 100 years from now.

There’s a base level of constant demand for medicines right there.

And we human beings, as a collective species, are living longer than ever – partially thanks to all of the wonderful advancements in medicine.

Moreover, our global population is larger and richer than ever before.

This larger pool of older and wealthier human beings is causing a natural rise in base demand for quality healthcare, including life-saving/life-lengthening medicines.

If all of that weren’t enough to wind up excitement, this company is aggressively investing in treatments for rare diseases and oncology, which are areas of healthcare that, broadly speaking, have great need for breakthrough treatments and can have favorable timelines for approvals from the FDA.

All of that bodes well for Bristol-Myers Squibb and its ability to continue thriving and growing its revenue, profit, and dividend.

Dividend Growth, Growth Rate, Payout Ratio and Yield

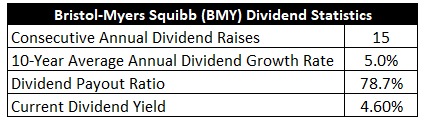

To date, the company has increased its dividend for 15 consecutive years.

The 10-year dividend growth rate is 5%, and the company has been fairly consistent with this.

For instance, the most recent dividend raise was 5.3%.

Is mid-single-digit dividend growth enough in this case?

Is mid-single-digit dividend growth enough in this case?

Well, it could be argued that it is.

That’s because the stock yields a market-smashing 4.6%.

This yield, by the way, is a stunning 140 basis points higher than its own five-year average.

Assuming no changes to valuation, the sum of growth and yield should approximate one’s total return.

With a ~5% yield and ~5% dividend growth, that gets you to a market-average 10%.

Not bad at all.

And for income-oriented investors who prefer to receive a large chunk of their total return in the form of cold, hard cash, this stock’s outsized yield is attractive.

A payout ratio of 78.7%, factoring out a large Q1 charge related to acquisition and collaboration costs, is elevated, but the dividend does not appear to be unsafe.

What we have here is a storied name in the Big Pharma space offering a yield typically reserved for the likes of utilities and REITs.

For dividend growth investors who like their total return prospects almost evenly divided between yield and growth, this is a very interesting idea.

Revenue and Earnings Growth

As interesting as the numbers may look, though, many of them are looking into the past.

However, investors must always be looking toward the future, as today’s capital gets risked for tomorrow’s rewards.

Thus, I’ll now build out a forward-looking growth trajectory for the business, which will come to aid when the time comes later to estimate intrinsic value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past with a future forecast in this way should give us the information necessary to make a reasonable determination of where the business could be going from here.

Bristol-Myers Squibb advanced its revenue from $15.9 billion in FY 2014 to $45 billion in FY 2023.

That’s a compound annual growth rate of 12.3%.

As great as this looks (and it is great), the company’s top line was significantly increased by the 2019 $74 billion acquisition of Celgene Corporation.

This acquisition combined firms with overlap in the oncology, immunology, and inflammation therapeutic areas.

This was a massive deal that almost immediately doubled Bristol-Myers Squibb’s revenue upon closing.

The deal, which was financed through both debt and equity, resulted in dilution and a more leveraged balance sheet.

Celgene’s crown jewel was Revlimid, a drug used to treat cancers of the blood and lymph nodes, primarily multiple myeloma.

Revlimid instantly became one of Bristol-Myers Squibb’s biggest products, accounting for nearly 30% of annual revenue at its 2021 peak, but this drug is facing increasing competition after patents started expiring in 2022 (unrestricted competition is expected starting in 2026).

This acquisition was a curious one, as Celgene’s main drug was nearing the end of protected sales (leading to Revlimid’s worldwide sales for FY 2023 being down nearly 40% YOY).

Meanwhile, earnings per share increased from $1.20 to $3.86 over this period, which is a CAGR of 13.9%.

This is impressive and shows some accretion, and it comes in the face of severe dilution (the outstanding share count jumped by more than 30% between FY 2019 and FY 2020).

However, EPS has been extremely lumpy for many years, so the growth picture greatly depends on which starting and ending points one uses.

Different points indicate something closer to a mid-single-digit bottom-line growth rate, which would be more in line with dividend growth over the last decade.

It’s worth noting that Bristol-Myers Squibb has been aggressively repurchasing shares and brining its float back down to normal levels, with the outstanding share count falling by approximately 8% between FY 2020 and FY 2023.

Looking forward, CFRA believes that Bristol-Myers Squibb will compound its EPS at an annual rate of 3% over the next three years.

This would be disappointing against the 10-year EPS growth rate seen above, but it’s actually not that far off from the demonstrated dividend growth over the last decade.

In my view, taking the totality of data into account, I see Bristol-Myers Squibb as capable of something in the range of a mid-single-digit rate of growth over longer stretches of time.

Revlimid competition is a major near-term headwind, especially since the company took on so much dilution and debt in order to acquire Celgene.

On the other hand, more recent acquisitions may go down as far better examples of thoughtful capital allocation from management.

This year, Bristol-Myers Squibb acquired Karuna Therapeutics for $12.7 billion and Mirati Therapeutics for $4.8 billion.

These two smaller acquisitions gave the company exposure to new therapeutic areas and exciting pipelines with lots of possible upside.

Speaking of the pipeline, Bristol-Myers Squibb has 55 compounds in development.

In particular, Cobenfy, a a novel treatment for adults with the psychiatric disorder schizophrenia, just received FDA approval in late September.

This drug came with the acquisition of Karuna, and it could give the company a nice injection of fresh growth (the list price of Cobenfy is $1,850/month, and some analysts are pointing to peak sales of over $3 billion/year).

In addition, Opdivo, a key oncology drug for the firm, showed 11% YOY growth in worldwide sales for the most recent quarter.

With legacy drugs holding up decently well and recent acquisitions showing much promise, Bristol-Myers Squibb appears to be position for, at worst, low-single-digit growth over the coming years.

Again, I think a reasonable expectation would be something closer to a 5% growth rate over the long run.

And if you can get that along with a starting yield of near 5%, that’s not bad at all – especially if your preference leads toward yield and current income.

Financial Position

Moving over to the balance sheet, Bristol-Myers Squibb has a decent financial position.

The long-term debt/equity ratio is 1.2, while the interest coverage ratio is currently negative (because of a GAAP loss due to the aforementioned IPRD impact).

The company had historically had a great balance sheet, but leverage picked up meaningfully after the Celgene acquisition.

It’s worth noting that a deleveraging process has been playing out since that acquisition went through, and long-term debt has been reduced by nearly 25% since peaking in FY 2020.

Also, there’s enough cash on the balance sheet to offset 1/3 of long-term debt.

Netting that out, a ~$24 billion long-term debt load isn’t overly concerning for a company of this size.

Although the balance sheet isn’t a major worry, I’d be keenly interested in seeing the deleveraging continue.

Profitability is okay, but this could also be improved.

Return on equity has averaged 6.6% over the last five years, while net margin has averaged 4.6%.

If these were “true” numbers, they’d be highly disappointing.

Fortunately, they appear to be inaccurate.

Both numbers have been negatively impacted by lumpy GAAP numbers (including losses) over the last several years, but normalizing things out indicates that ROE is typically coming in somewhere around 20% – a very acceptable result.

Overall, Bristol-Myers Squibb is a deserving member of Big Pharma.

And with global economies of scale, patents, R&D, IP, and an entrenched salesforce, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Litigation, regulation, and competition are omnipresent risks in every industry.

I view all three risks as elevated relative to the typical company.

Competition is a two-pronged risk for the company: Bristol-Myers Squibb operates against highly capable Big Pharma competitors looking to bring new products to market, and it also faces competition from generic players trying to take easy sales from aging legacy drugs coming off of patent protection.

Regulation is a major risk in this space, and drug approval can be a long and expensive process that plays out over years.

And litigation is a constant threat for the company.

R&D spending has uncertain outcomes, as it’s unknown how successful any compounds in development will ultimately be.

Major drugs, especially Revlimid, are coming off of patent protection.

The Celgene acquisition diluted shareholders and heavily leveraged the balance sheet.

Any major changes in US healthcare legislation, particularly around drug pricing/spending, could have significant ramifications on the company.

Technological changes, such as AI, may make it easier, faster, and cheaper to develop drugs in the future, which could reduce R&D spending and help with profitability but also bring about new competition from less-well-heeled upstarts.

While there are considerable risks to think over, this company hasn’t thrived for more than a century for no reason.

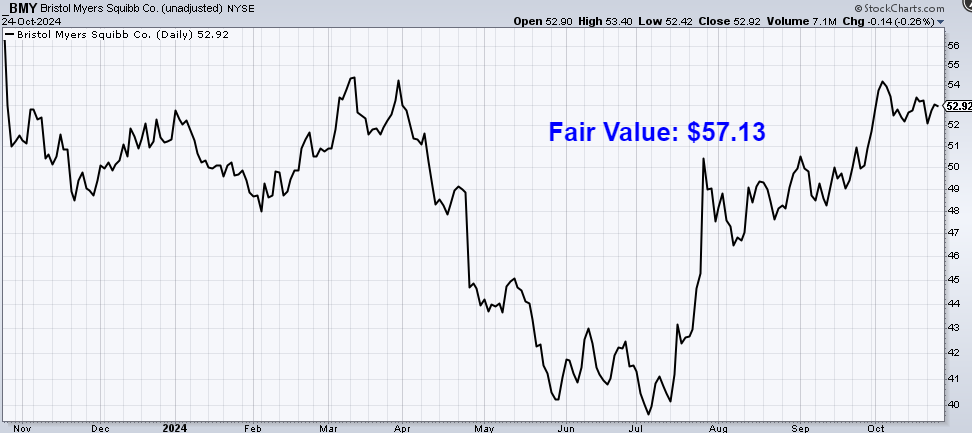

Plus, with the stock down 35% from all-time highs, the low valuation is also very much worth thinking over…

Valuation

The P/E ratio is only 17.4, based on TTM EPS that takes out the IPRD impact.

That is undemanding against the broader market.

Taking another approach, the sales multiple of 7.1 is low in absolute terms and also relatively low in comparison to its own five-year average of 9.6.

And the yield, as noted earlier, is significantly higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 5%.

If you’ve been following along, this is an easy call.

As I pointed out earlier, expecting a mid-single-digit growth rate out of this business over the long run seems to be sensible and fair.

It’d be shocking to see it come in materially lower than that.

All the same, I don’t think it’s wise to expect much more.

That said, with the yield being as high as it is, not much growth needs to be had in order to make sense of the stock and valuation.

What I’m modeling in is exactly in line with the demonstrated dividend growth over the last decade, and I don’t see why the next decade would be all that different.

The DDM analysis gives me a fair value of $50.40.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

The stock looks reasonably priced to me.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates BMY as a 4-star stock, with a fair value estimate of $63.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates BMY as a 4-star “BUY”, with a 12-month target price of $58.00.

I came out super low, even though the modeled expectations line up well. Averaging the three numbers out gives us a final valuation of $57.13, which would indicate the stock is possibly 7% undervalued.

Bottom line: Bristol-Myers Squibb Co. (BMY) deserves its place among its Big Pharma brethren, with scale, a huge pipeline, exciting products now coming to market, and a roster of very successful legacy drugs still under its belt. It has thrived for more than a century already, and there’s nothing to indicate it won’t repeat that over the next 100 years. With a market-smashing yield, a payout ratio within reason, inflation-beating dividend growth, 15 consecutive years of dividend increases, and the potential that shares are 7% undervalued, long-term dividend growth investors who lean toward yield and income could have a cheap opportunity on their hands with this stock still down heavily from recent highs.

Bottom line: Bristol-Myers Squibb Co. (BMY) deserves its place among its Big Pharma brethren, with scale, a huge pipeline, exciting products now coming to market, and a roster of very successful legacy drugs still under its belt. It has thrived for more than a century already, and there’s nothing to indicate it won’t repeat that over the next 100 years. With a market-smashing yield, a payout ratio within reason, inflation-beating dividend growth, 15 consecutive years of dividend increases, and the potential that shares are 7% undervalued, long-term dividend growth investors who lean toward yield and income could have a cheap opportunity on their hands with this stock still down heavily from recent highs.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is BMY’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 70. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, BMY’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Source: Dividends & Income

Disclosure: I’m long BMY.