We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Quantum Computing Inc. (NASDAQ: QUBT)

Today’s penny stock pick is the integrated photonics company, Quantum Computing Inc. (NASDAQ: QUBT).

Quantum Computing Inc. offers accessible and affordable quantum machines. The company offers Dirac systems that are portable, low power, and room temperature qubit and qudit entropy quantum computers (EQC); reservoir computing; remote sensing; and single photon imaging.

It also provides a Quantum random number generator (uQRNG), a portable device that provides genuine random numbers directly from quantum processes; and quantum authentication which eliminates vulnerabilities inherent in classical cryptographic schemes by offering a comprehensive entanglement-based quantum cyber solution that seamlessly integrates into existing telecom fiber and communication infrastructure. The company was formerly known as Innovative Beverage Group Holdings, Inc.

Website: https://www.quantumcomputinginc.com

Latest 10-k report: https://www.sec.gov/ix?doc=/Archives/edgar/data/1758009/000121390024028799/ea0202448-10k_quantum.htm

Analyst Consensus: Not Covered By Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- The company was awarded a fifth project from NASA to develop quantum remote sensing technology for LIDAR missions. The new contract marks a pivotal step towards deploying QCi’s technology on LIDAR flights and establishes its applicability in diverse fields.

- QUBT’s quantum optimization platform, Dirac-3, QUBT is a leader in the field. Another creation of QUBT is the Quantum Photonic Vibrometer which offers better vibration detection, perception and analysis.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern with a high volume, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for QUBT is above the price of $1.17.

Target Prices: Our first target is $2.00. If it closes above that level, the second target price is $2.70.

Stop Loss: To limit risk, place a stop loss at $0.70. Note that the stop loss is on a closing basis.

Our target potential upside is 71% to 131%.

For a risk of $0.47, our first target reward is $0.83, and the second target reward is $1.53. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

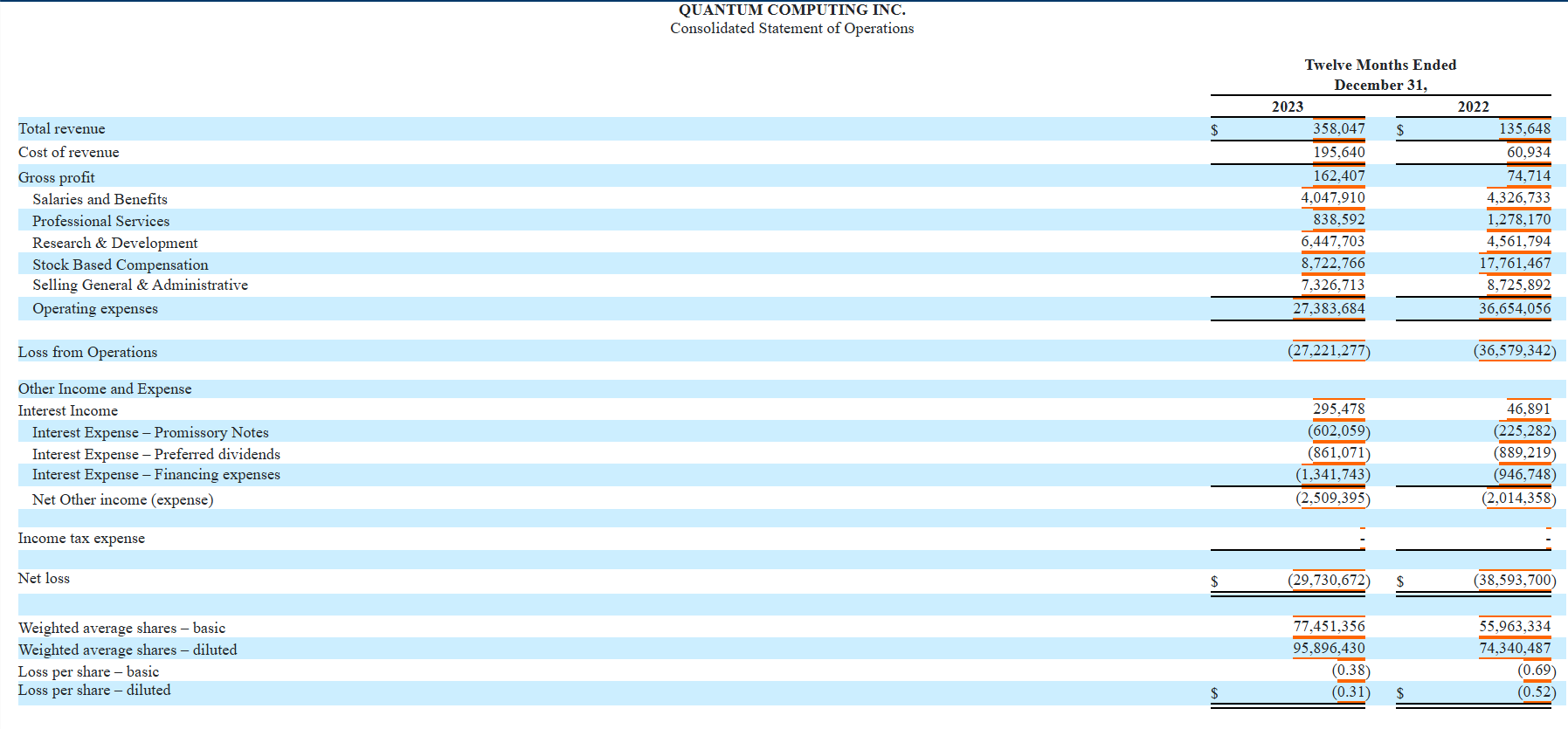

- The company has a history of net losses. As of December 31, 2023, and 2022, QUBT’s accumulated deficit was $149,718,453 and $119,987,781, respectively.

- The company has ongoing legal proceedings.

- On October 13, 2022, BV Advisory filed a petition in the Court of Chancery of the State of Delaware seeking appraisal rights on the shares of common stock of QPhoton it allegedly owns (which shares represented 10% of the shares of common stock of QPhoton outstanding immediately prior to the Company’s acquisition of QPhoton) pursuant to Section 262 of the General Corporation Law of the State of Delaware.

- On August 16, 2022, BV Advisory filed a complaint in the Court of Chancery of the State of Delaware naming the Company and certain of its directors and officers (among others) as defendants for an alleged breach of the Note Purchase Agreement between BV Advisory and QPhoton, as well as monetary damages for alleged breach of an alleged binding letter of intent among Barksdale Global Holdings, LLC, Inference Ventures, LLC, and QPhoton.

- On December 30, 2022, the Company, QPhoton and Robert Liscouski filed suit in the Superior Court of New Jersey against Keith Barksdale, Michael Kotlarz, BV Advisory, BGH, Power Analytics Global Corporation, and Inference Ventures, alleging fraud, aiding and abetting fraud, defamation, and conspiracy to defraud, seeking monetary and injunctive relief.

- On July 27, 2023, BV Advisory and its managing member, Keith Barksdale, as alleged stockholders of and claimants against the Company, filed a petition in the Court of Chancery of the State of Delaware to appoint a receiver for the Company based on allegations that the Company is insolvent due to purported poor corporate governance and cash management. The petition also objects to the Company’s approach to raising capital.

- The company QCi was formed in 2018 and merged with QPhoton in June 2022. As a result of the limited operating history, the company’s ability to accurately forecast its future results of operations is limited and subject to a number of uncertainties, including its ability to plan for and model future growth.

- The company faces significant competition from large, well-established tech companies including IBM, Quantinuum, Google, Microsoft, and Amazon.

- QUBT will very likely require additional funds from future equity or debt financings, which may include the issuance of shares of preferred stock, convertible debt, or warrants to purchase shares of common stock. Existing shareholders may experience dilution of ownership interest due to the future issuance of additional shares of the company’s common stock.

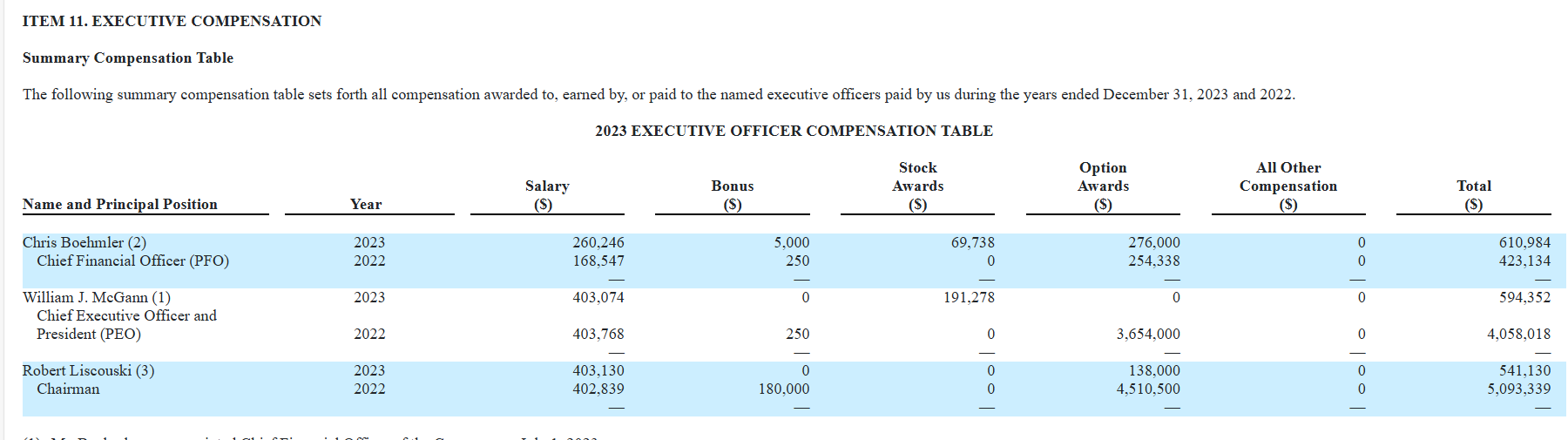

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company had received a notice from the Nasdaq Stock Market LLC indicating it was not in compliance with a listing rule. The non-compliance issue arose because Quantum Computing Inc. did not file its Quarterly Report on Form 10-Q for the period ended June 30, 2024, within the prescribed timeframe.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day