One of the neat things about selling options is that you can collect income whether a stock goes up… stays flat… or even goes down a little.

To show you how this works with a real-life example, let’s take a look at the option trade I made with Hershey (HSY) back in July…

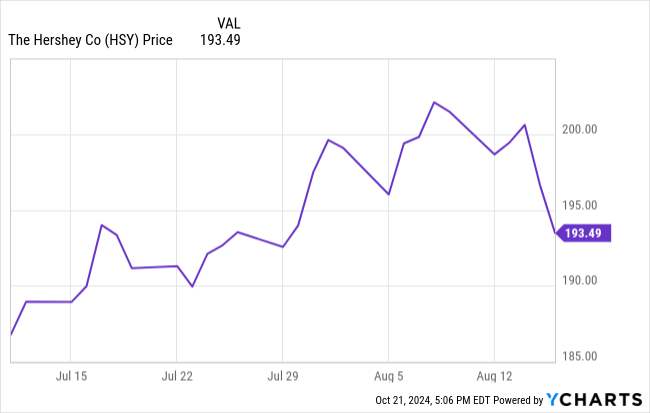

At the time I placed my trade on July 11, HSY was selling for $186.86 per share and the August 16, 2024 $180 put options were going for about $3.20 per share. My trade involved selling one of these put options.

By selling the option, I collected $320 in instant income. In exchange for that payment, I entered into a contract with the buyer of the put option that would obligate me to purchase 100 shares of HSY at $180 IF the stock were to fall below $180 by the August 16 expiration date and IF the buyer chose to exercise the contract. This meant that I would collect income and have no purchase obligation if HSY traded higher… stayed flat… or even fell to as low as $180, which was a 4% discount to its $186.86 price at the time.

As you can see in the following chart, throughout the duration of the trade, HSY stayed above $180. As a result, the contract expired “worthless” and I walked away with the $320 and no obligation to purchase HSY. The trade was completely closed out. If you are a Dividends & Income Select subscriber and followed along with this trade, we made $320 without ever owning shares of HSY.

Another neat thing about all of this though is that even if HSY had fallen below $180 and we were obligated to buy the stock, we would be purchasing a very high-quality dividend growth stock at a near 20% discount to its estimated fair value price.

In my eyes, selling options like this on select stocks (high-quality dividend growers) and under select conditions (when we can own these stocks at attractive prices) is one of my favorite ways to generate relatively safe, high income.

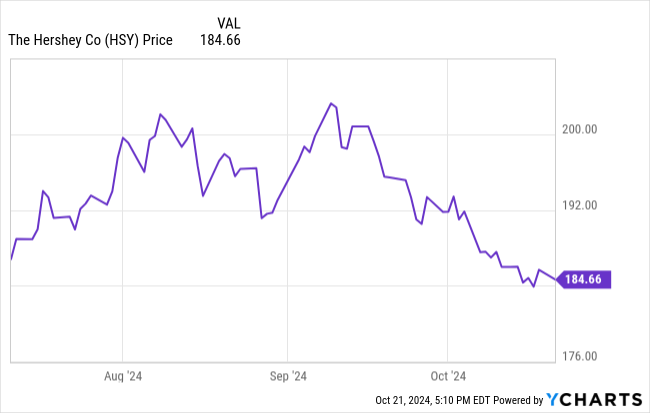

I realize that this kind of trading isn’t for everyone, but if it’s something you think you could benefit from, then you may be interested in my newest option trade. In short, right now we have a setup similar to what we had back in July that allows us to generate attractive income from Hershey… with the possibility of owning the stock at an attractive price.

You see, after rising to over $200 per share in recent months, Hershey has since fallen and is currently trading near the price it was back when we made our July income trade. Take a look at this price chart…

In case you missed out the first time around, we now have a second chance at an attractive income trade with Hershey.

With this in mind, near closing bell this past Friday, I pulled the trigger on a brand new Hershey trade and generated a quick $435 in instant income. To be fair to our paid subscribers at Dividends & Income Select, I can’t reveal the details of the trade here. But I can tell you this: If you’re looking for relatively safe, high income from high-quality dividend growth stocks, consider selling options.

-Greg Patrick

P.S. Below is a spreadsheet of all the trades I’ve made to date since launching Dividends & Income Select back in January. As you can see, we have an open trade with GOOGL from last month… and now this new trade with HSY. If you’d like to follow along and get an alert whenever I make a new trade, come join us!

| Month | Ticker | Action | Income Generated | Annualized Yield | Status |

| February | GPC | Sold put | $310 | 73.5% | Closed |

| March | VZ | Sold calls | $190 | 45.7% | Closed |

| April | VZ | Sold calls | $154 | 70.9% | Closed |

| April | GPC | Sold put | $183 | 238.7% | Closed |

| May | SBUX | Sold put | $310 | 17.6% | Closed |

| May | JNJ | Sold put | $500 | 8.8% | Closed |

| May | VZ | Sold calls | $146 | 22.9% | Closed |

| May | GPC | Sold put | $150 | 16.3% | Closed |

| June | BMY | Sold call | $176 | 36.5% | Closed |

| July | HSY | Sold put | $320 | 18.0% | Closed |

| August | V | Sold put | $500 | 11.7% | Closed |

| September | GOOGL | Sold call | $690 | 34.4%-39.7% | Open |

| October | HSY | Sold put | $435 | 14.0% | Open |

| Total: | $4,064 |

Source: Dividends & Income