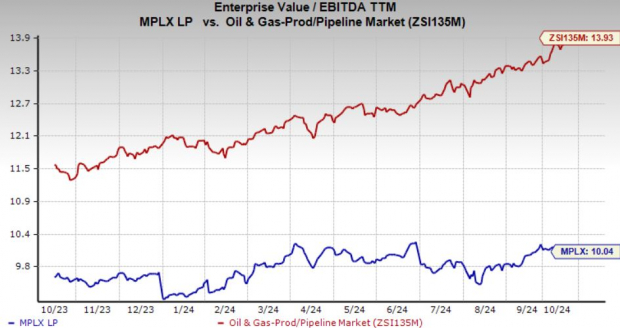

MPLX LP (MPLX) is currently considered undervalued, trading at a 10.04x trailing 12-month enterprise value to earnings before interest, taxes, depreciation and amortization (EV/EBITDA), which is below the broader industry average of 13.93x.

While a discount valuation often presents a potentially profitable opportunity for investors, it is essential to investigate whether the partnership faces any internal challenges requiring a more comprehensive analysis.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

MPLX Boasts a Stable Business Model

Being a large midstream energy player, the partnership’s overall business has lower vulnerability to the volatility in oil and gas prices. This is because shippers generally utilize the midstream assets for the long term to transport and store commodities, thereby having minimal volumes and price risks. Thus, the partnership is expected to generate stable and predictable cash flows.

MPLX’s midstream assets include an extensive network of pipelines that transport crude oil and refined products. Additionally, the partnership’s assets feature storage facilities, crude oil and natural gas gathering infrastructures and refined product terminals. This comprehensive network and facilities support MPLX’s ability to efficiently handle energy transportation and storage, positioning the partnership as a key player in the midstream space.

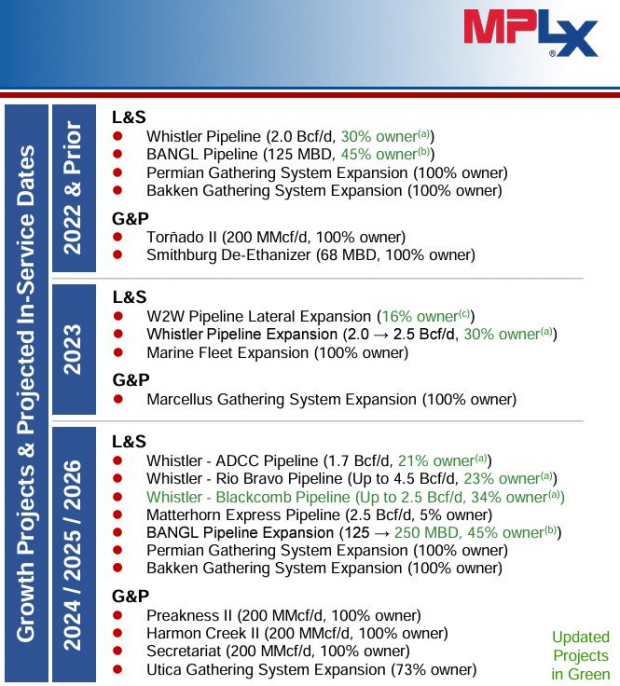

Project Backlog Supports MPLX’s Long-Term Growth

MPLX is poised to deliver additional stable and predictable earnings through several key growth projects, either already operational or scheduled for completion by 2026. This project pipeline is expected to not only ensure steady cash flows but also drive attractive returns for unit-holders.

MPLX’s growing project pipeline includes the Blackcomb pipeline, scheduled to become operational in the second half of 2026. This project is expected to boost distributable cash flow. Spanning 365 miles, the pipeline will transport up to 2.5 billion cubic feet of natural gas daily to the Agua Dulce area in South Texas from the Permian – the most prolific basin in the United States. MPLX will hold approximately a 34% ownership stake in the 42-inch pipeline.

MPLX LPImage Source: MPLX LP

MPLX LPImage Source: MPLX LP

MPLX’s Strong Distribution Coverage Ratio

The partnership boasts an impressive distribution coverage of 1.6x, as reported with its second-quarter earnings. This means that for every dollar MPLX distributes to its investors, it generates $1.60 in cash available to cover those payments. This is a positive indicator, as it demonstrates that the partnership is earning significantly more than required to meet its distribution obligations, reflecting its financial health and ability to consistently deliver returns to its investors.

Should Investors Take a Chance on Undervalued MPLX Stock?

Despite these positive developments, the partnership’s stock is trading at a discount relative to the industry. Also, looking at the year-to-date price chart, the stock lagged the industry. Over the time frame, its units have jumped 28.6%, lagging the industry’s composite stock growth of 31.7%. Prominent midstream companies such as Kinder Morgan Inc. (KMI) and The Williams Companies Inc. (WMB) have also surpassed MPLX, recording gains of 46.5% and 50.1%, respectively, during the same timeframe.

Year-To-Date Price Chart

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

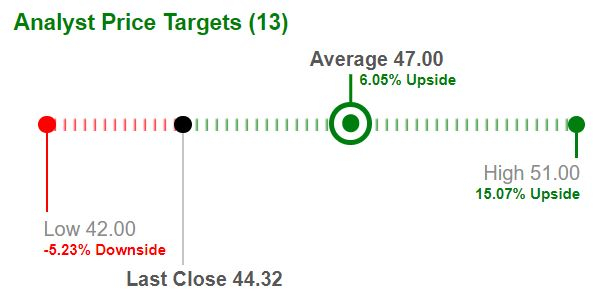

It is apparent that MPLX has the potential to outperform the industry once the stock market begins to acknowledge its true value. Hence, investors should buy the undervalued stock, carrying a Zacks Rank #2 (Buy) at present.

To support this bullish outlook, major brokers have increased MPLX’s short-term price target by 6% from its recent closing price of $44.32, with the highest target set at $51, indicating a potential upside of 15.1%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

— Nilanjan Banerjee

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks