Lessons In Valuation

Being a value investor at its core really is about taking advantage of the opportunities that investing in equities or common stocks can give you, but doing it at a very controlled level of risk. That’s really what value investing is all about.

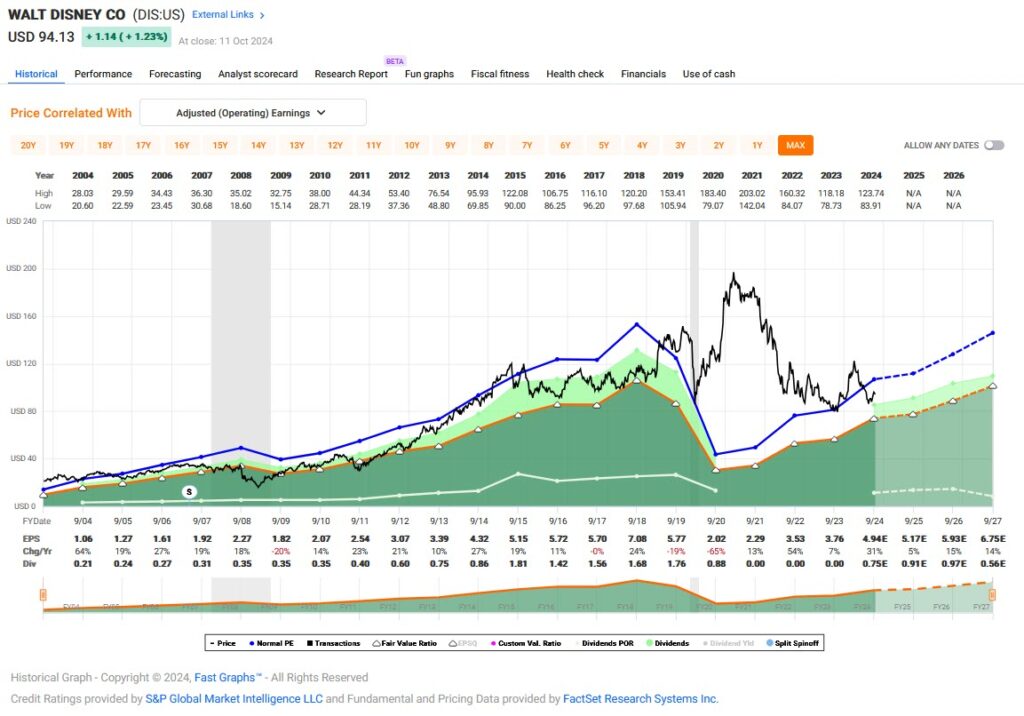

About three years ago Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation did a video where he talked about Nike and Disney, two of the most popular stocks on the planet, especially at that time, they had become excessively overvalued based on any rational estimate of intrinsic value of what a company is worth using things like discounted cash flow analysis, etc.

In that video, Chuck was primarily talking about valuation risks. Again, value investing is all about controlling risk.

Here, three years later, Chuck will show you the results of what that video showed. Chuck was pointing out that both of these stocks, although they were great businesses, were overvalued. However, a couple of things has happened, and Chuck will be covering that in this video.

Here, three years later, Chuck will show you the results of what that video showed. Chuck was pointing out that both of these stocks, although they were great businesses, were overvalued. However, a couple of things has happened, and Chuck will be covering that in this video.

Here is the previous video on Disney and Nike

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price. Get 25% off using Daily Trade Alert's special referral link and coupon code AFFILIATE25

Source: FAST Graphs