We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Veritone, Inc. (NASDAQ: VERI)

Today’s penny stock pick is the artificial intelligence (AI) computing solutions company, Veritone, Inc. (NASDAQ: VERI).

Veritone, Inc. engages in the provision of artificial intelligence (AI) computing solutions and services in the United States, the United Kingdom, France, Australia, Israel, and India. It develops and operates aiWARE platform, an AI operating system, that uses machine learning algorithms or AI models designed to mimic human cognitive functions, such as perception, prediction, and problem solving and optimization, as well as enables users to transform unstructured data into structured data, and analyze and optimize data to drive business processes and insights.

The company also provides media advertising agency services, including media planning and strategy, media buying and placement, campaign messaging, clearance verification and attribution, and custom analytics directly to advertisers through outbound sales networking, and client and partner referrals, as well as indirectly through advertising agencies or marketing consultants. It serves media and entertainment, government, legal and compliance, energy, and other vertical markets. The company was formerly known as Veritone Delaware, Inc. and changed its name to Veritone, Inc. in July 2014.

Website: https://www.veritone.com

Latest 10-k report: https://investors.veritone.com/sec-filings/all-sec-filings/content/0000950170-24-038819/veri-20231231.htm

Analyst Consensus: Not Covered By Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- The company recently announced the integration of its global job distribution software with Eightfold AI’s talent intelligence platform. The collaboration aims to enhance the efficiency and effectiveness of recruitment processes by delivering a unified, AI-powered solution for job distribution and candidate sourcing.

- VERI also announced a partnership with Midwest Public Safety, a premier provider of public safety technology solutions.

- Renaissance Technologies LLC bought a new stake in Veritone in the 2nd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 MACD above Signal Line: In the weekly chart as well, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for VERI is above the price of $4.70.

Target Prices: Our first target is $6.20. If it closes above that level, the second target price is $7.20.

Stop Loss: To limit risk, place a stop loss at $3.90. Note that the stop loss is on a closing basis.

Our target potential upside is 32% to 53%.

For a risk of $0.80, our first target reward is $1.50, and the second target reward is $2.50. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

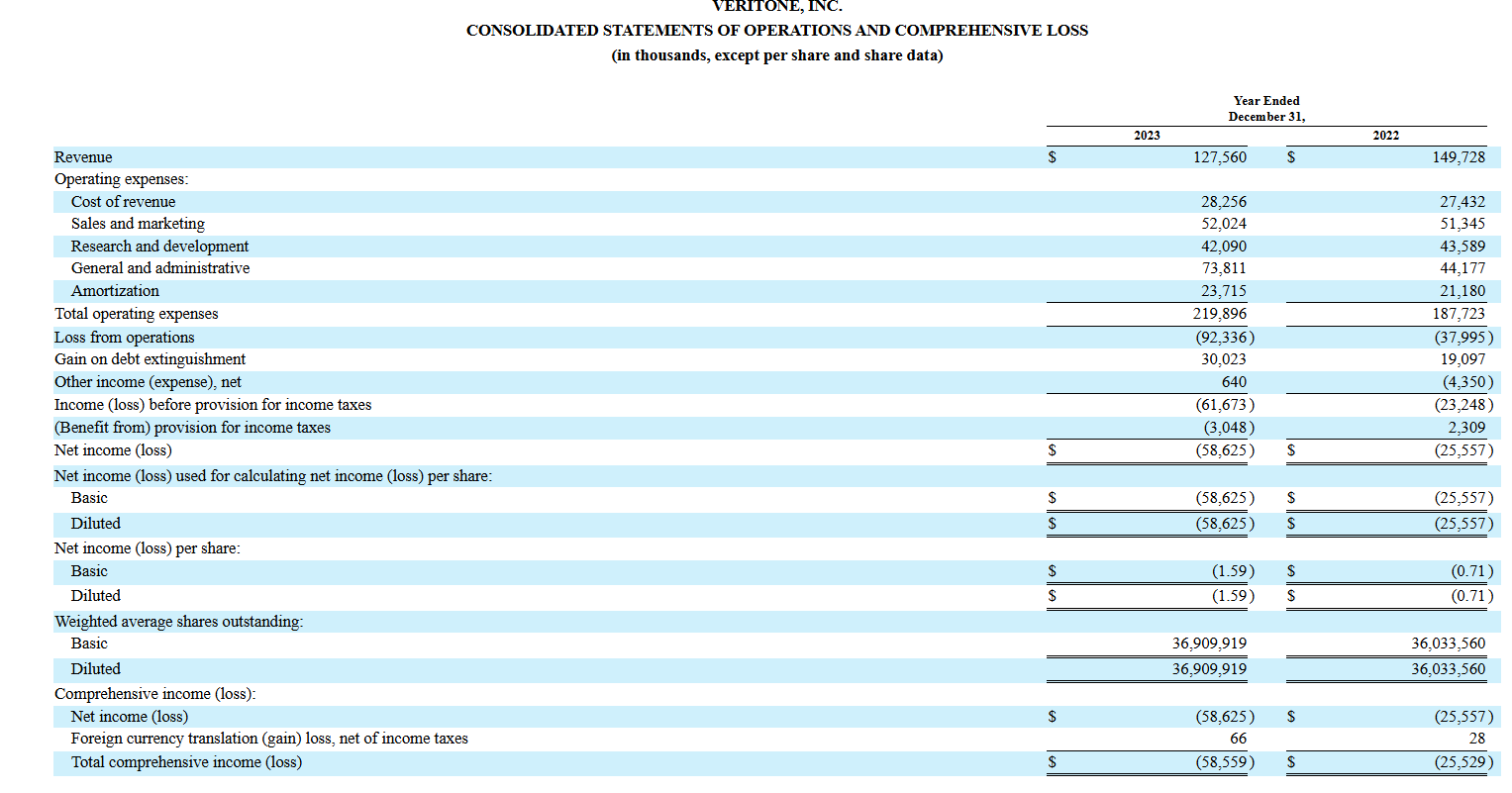

- The company has a history of net losses. VERI reported net losses of $58.6 million and $25.6 million in fiscal years 2023 and 2022, respectively. As of December 31, 2023, VERI had an accumulated deficit of $429.9 million.

- The market for AI-based software applications is relatively new and unproven and may decline or experience limited growth.

- The company has customer concentration risk, as it generates substantial revenue from a single customer, Amazon, for which there is no long-term contract. VERI’s ten largest customers by revenue accounted for approximately 39% and 55% of its net revenues in fiscal years 2023 and 2022, respectively.

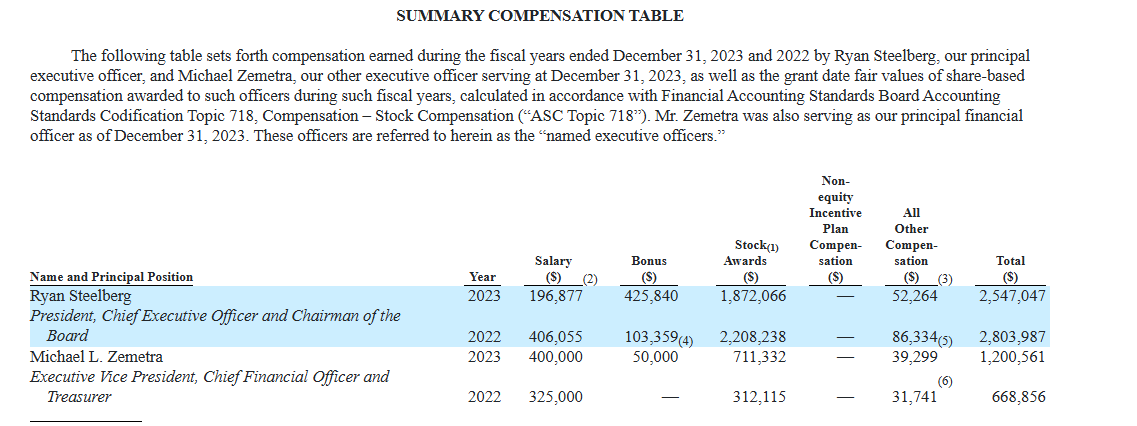

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day