We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Babcock & Wilcox Enterprises, Inc. (NYSE: BW)

Today’s penny stock pick is the energy and emissions control solutions company, Babcock & Wilcox Enterprises, Inc. (NYSE: BW).

Babcock & Wilcox Enterprises, Inc. together with its subsidiaries, provides energy and emissions control solutions to industrial, electrical utility, municipal, and other customers worldwide. The company operates through three segments: Babcock & Wilcox Renewable; Babcock & Wilcox Environmental; and Babcock & Wilcox Thermal. The Babcock & Wilcox Renewable segment offers technologies that divert the waste from landfills for power generation and replacing fossil fuels and recovering metals and reducing emissions.

It offers BrightLoop, a hydrogen generation technology that generates hydrogen from a range of fuels, including solid fuels, such as biomass and coal. This segment also provides technologies for power and heat generation comprising waste-to-energy; OxyBright, an oxygen-fired biomass-to-energy technology; and black liquor systems for the pulp and paper industry. The Babcock & Wilcox Environmental segment offers a range of emissions control and environmental technology solutions for utility, waste to energy, biomass, carbon black, and industrial steam generation applications.

This segment provides systems for cooling, ash handling, particulate control, nitrogen oxides and sulfur dioxides removal, chemical looping for carbon control, and mercury control under the SolveBright, OxyBright, BrightLoop, and BrightGen names. The Babcock & Wilcox Thermal segment offers aftermarket parts, construction, maintenance, engineered upgrades, and field services for its installed bases, as well as the installed base of other OEMs for power generation, oil and gas, petrochemical, food and beverage, metals and mining, and others.

This segment also provides steam generation systems, including package boilers, watertube and firetube waste heat boilers, and other boilers to medium and heavy industrial customers.

Website: https://www.babcock.com

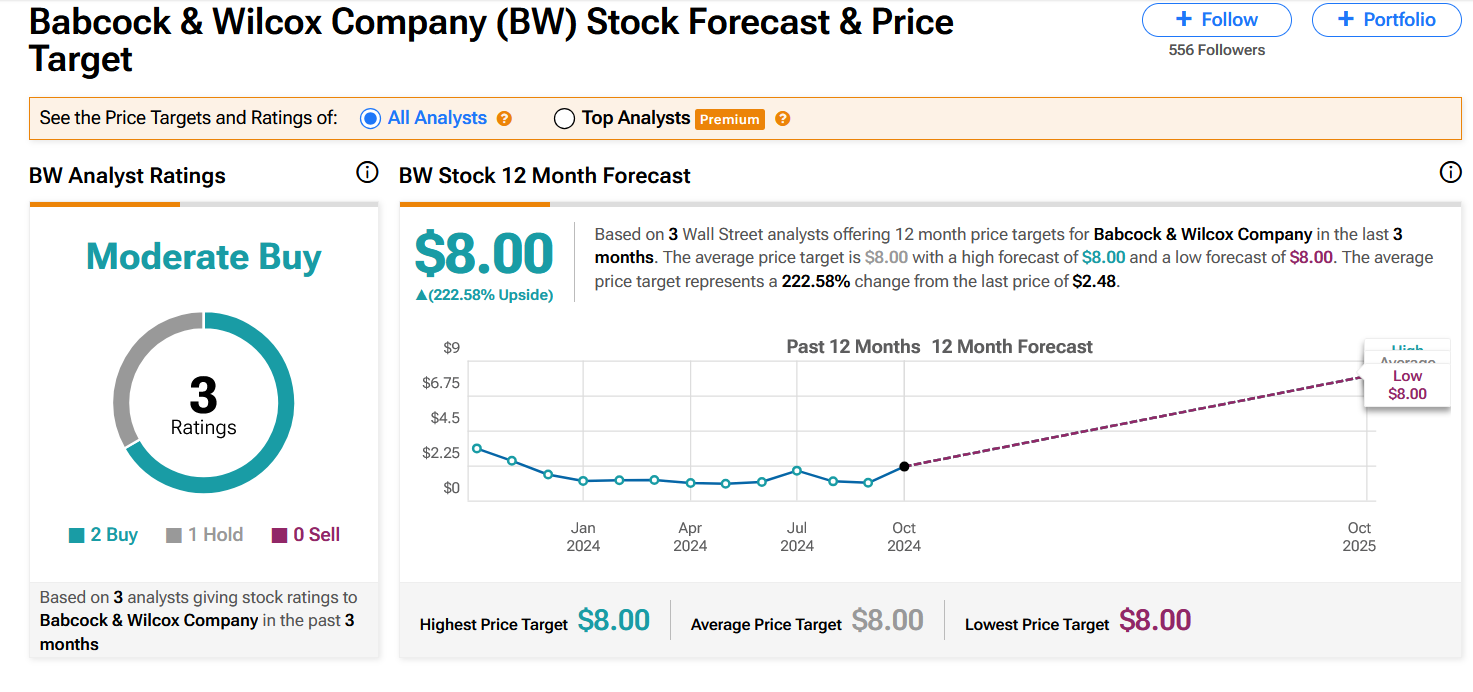

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for BW in the last 3 months, the stock has an average price target of $8.00, which is nearly 223% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company has a sizable backlog of orders. BW’s backlog was $530.5 million as of December 31, 2023 and $549.1 million at December 31, 2022.

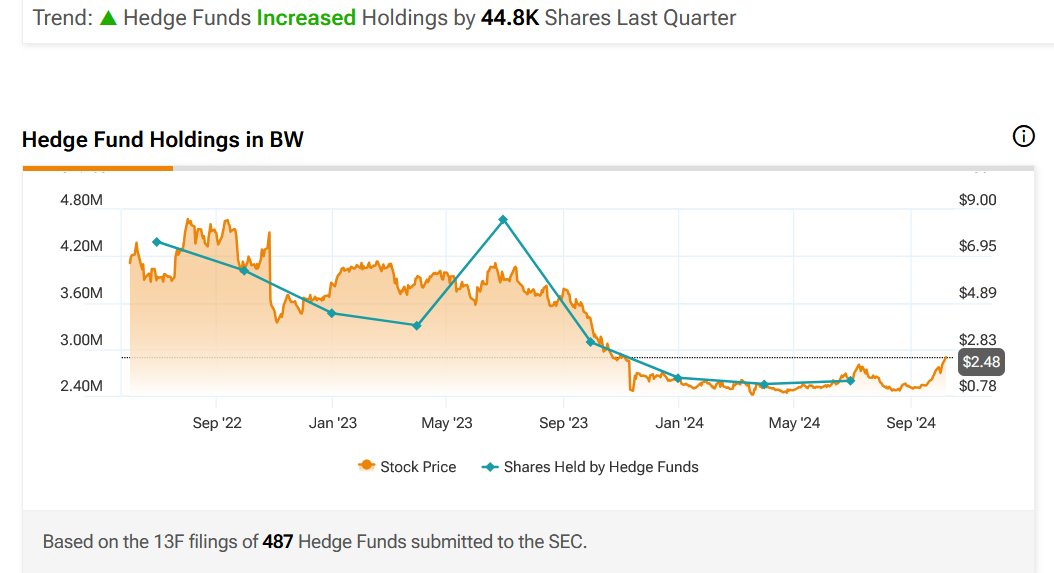

- Hedge Funds Increased Holdings by 44.8K Shares Last Quarter.

- B&W Environmental business segment was recently awarded a contract for more than $8 million to design and supply a cooling system for a U.K. renewable energy facility.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Aroon: The value of Aroon Up (orange line) is above 70 while Aroon Down (blue line) is below 30. This indicates bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for BW is above the price of $2.70.

Target Prices: Our first target is $4.20. If it closes above that level, the second target price is $5.50.

Stop Loss: To limit risk, place a stop loss at $1.80. Note that the stop loss is on a closing basis.

Our target potential upside is 56% to 104%.

For a risk of $0.90, our first target reward is $1.50, and the second target reward is $2.80. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

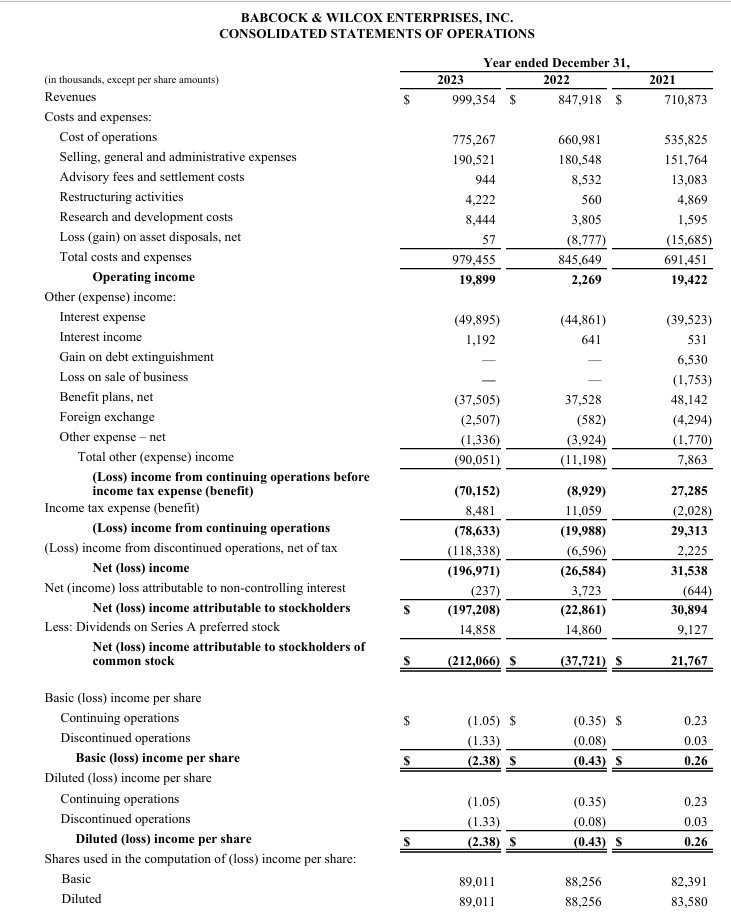

- The company has a history of net losses.

- Riley has significant influence over the company, as it controls approximately 30.7% of the voting power.

- The company has ongoing legal proceedings like Litigation Relating to Boiler Installation and Supply Contract (Case No. 1:19-cv-02215-JPW); and Stockholder Derivative and Class Action Litigation (captioned Parker v. Avril, et al., C.A. No. 2020-0280-PAF).

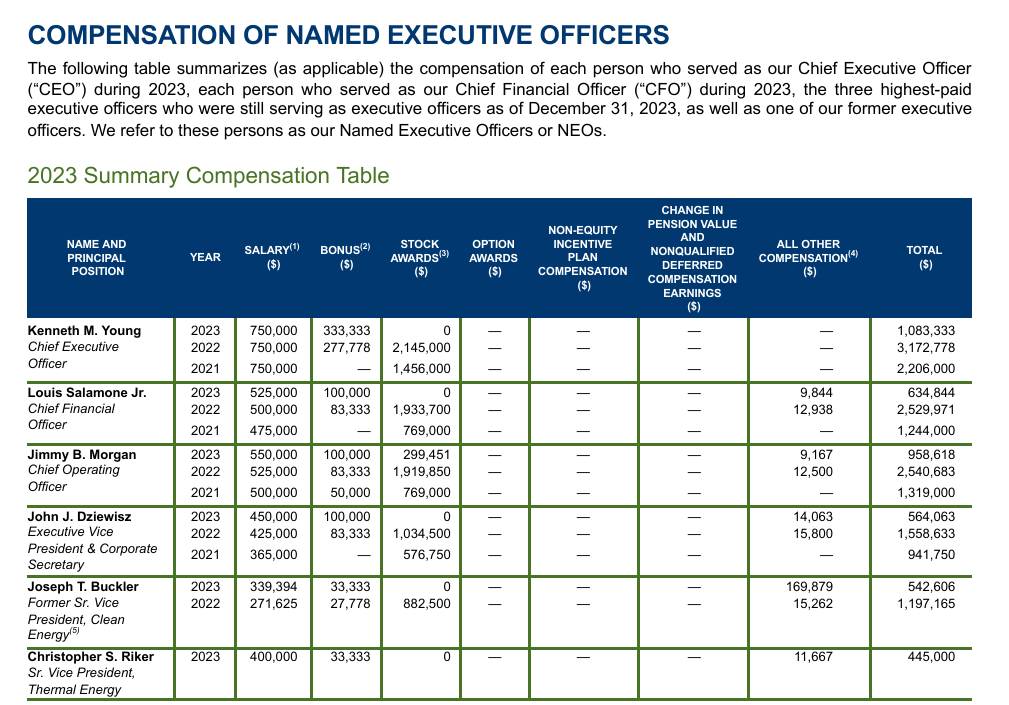

- Despite being a loss-making company, the executives are being paid significant compensation.

- The company’s financial condition raises substantial doubt as to its ability to continue as a going concern. The company will require additional financing to fund working capital, failing which there could be an adverse effect on the company’s financial position, results of operations and/or ability to continue as a going concern.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day