Believe it or not, your favorite income strategist once had a multi-year stint as the head of human resources for a US-based software company.

It was, coincidentally, my last regular “day job” before I drifted into the world of stocks and startups.

When my old boss, our managing director, handed me the task of hiring our new employees, he gave me this piece of wisdom.

“I trust you to make the call. Just one thing…” he winked at me.

“The kids must be graduates from Berkeley, Cornell, MIT or Stanford.”

Gee, thanks boss. Like it was an easy task to convince a new graduate from an elite engineering school to skip the offer from Google to work with us. We had a fun workplace, with annual company kickoffs in Hawaii and regular happy hours on Fridays. But we were not Google or Facebook.

Over time, however, I understood his point and the reason for his requirement. We didn’t actually have an HR department. I was already working as a consultant and salesperson. Head of HR was my third hat, so it had to be automated.

We let the schools “filter” the crop for us. The cream rises to the top but we didn’t have time to sort it. So we used common sense. If someone got accepted to Cornell, they were probably smart enough to work for us. (I later learned this is why I was hired so quickly by the company!)

Cornell can fill its classrooms many times over with top-notch engineers. As an alumni volunteer, I interview three high school applicants every year. I am always amazed at the quality of my conversation with the bright 17 and 18-year-olds, and disappointed that none of them is ever accepted.

The school’s 10.9% acceptance rate does not mislead. One out of ten gets in—and many more are deserving.

Elite schools like Cornell can be picky when they have a limited number of seats and incredible flow of highly qualified applicants. MIT and Stanford are even pickier.

Scant acceptance rates are frustrating. If your child or grandchild is applying to Ivy League schools, you can relate. This pickiness, however, works in our favor as income investors when we buy a stock like Ares Capital (ARCC). (I call it the Cornell of the BDC world, but really, it might be Stanford!)

Ares is the choosiest business development company (BDC) on the board. The lender finances only about 5% of the new deals that its credit team reviews. (Twice as stingy as Cornell admissions!) Ares’s cherry-picking results in a secure, profitable portfolio. The firm always collects because it only funds the best of the best.

Let’s pause our fruit gathering to discuss what a BDC actually is. Many financial websites skirt the topic. Many income investors, likewise, fawn at a stock like Ares and its 9.1% yield but never take the time to understand what the company actually does. And why its loan portfolio is so reliable.

Let’s pause our fruit gathering to discuss what a BDC actually is. Many financial websites skirt the topic. Many income investors, likewise, fawn at a stock like Ares and its 9.1% yield but never take the time to understand what the company actually does. And why its loan portfolio is so reliable.

BDCs lend to small businesses. You know, like traditional banks used to back in the day of George Bailey. These days it is nearly impossible to get a business loan from a bank, so BDCs have stepped in to fill the gap, providing debt, equity, and other finance solutions to small businesses.

Congress whipped up BDCs with a few pen strokes in 1980, creating a structure incentivized to provide smaller companies with financing. BDCs receive special tax privileges, and in exchange, they must return at least 90% of their taxable profits to shareholders as dividends. They trade just like regular common stocks, with tickers we buy and sell.

Congress whipped up BDCs with a few pen strokes in 1980, creating a structure incentivized to provide smaller companies with financing. BDCs receive special tax privileges, and in exchange, they must return at least 90% of their taxable profits to shareholders as dividends. They trade just like regular common stocks, with tickers we buy and sell.

If this sounds familiar, that’s because that same tradeoff is enjoyed by real estate investment trusts (REITs), which were formed by the same Congressional pens 20 years earlier.

As with REITs, the provision that BDCs must dish out 90% of their income as dividends leads to super-sized yields. Now, many of these payouts are paper tigers, and longtime readers know I have been harsh on the BDC space at large for not building shareholder value because they chase too many bad loans.

Prospect Capital (PSEC) has been a regular target in these pages. Bloomberg has recently joined us in questioning Prospect’s cash flow. We agree—we consider Prospect the GED of the sector.

Ares is better. We’re talking ivory tower superiority. This BDC builds real long-term value. It was one of the only BDCs that kept on lending in 2020. The industry remembers that Ares powered through the global shutdown.

Revenues have increased 16% over the past year. The company earns a weighted average of 11.1% on its investments. And its 61 cents a share earnings last quarter easily covered the 48-cent per share dividend. A 79% payout ratio is great in the land of BDCs.

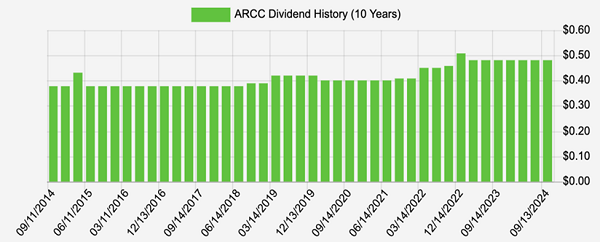

If there’s anything better than a 9.1% divvie like Ares’s, it’s one with a bit of upside. Ares has a history of gradually hiking its payout. It’s rare to see any growth from a 9% payer—in fact, many big dividends turn out to be disasters! Not so with Ares, which is built for the long haul:

Ares Gradually Raises Its 9.1% Divvie

Source: Income Calendar

Source: Income Calendar

The “bump” at the end of 2022 was a special dividend. Ares keeps a “spillover” of extra earnings that it pays out to shareholders periodically. It ended last year with $1.05 per share in spillover, more than two dividend payments, or 5% of the current share price. Ares can pay that out as a special or keep it on hand for a rainy lending day.

Plus, Ares increased its net asset value (NAV) 6% over the past year. Contrast with problematic Prospect, which saw its NAV decline by 2.6% over the same period. The latter trades at a discount to NAV, but then again, why would it not given the trend!

Our elite BDC Ares, on the other hand, continues to stack value. And get this—its NAV gains may begin to accelerate with a reheating economy.

Wait, what? How can small businesses borrow more after a Fed tightening cycle?

Well, the government’s deficit spending is completely out of control. It is possible, perhaps probable, that Uncle Sam will overwhelm Jay Powell. For fiscal 2024, the Congressional Budget Office (CBO) projects a $1.9 trillion deficit on $4.9 trillion in tax receipts. (And yes, this is the CBO that paints its projections with rose-colored ink.)

So we have nearly $5 trillion in revenues, and almost $7 trillion in expenditures. A 40% overshoot.

Give me an extra $2 trillion, and I’ll show you a good economy, too! Small business borrowing is coming back, baby. And Ares is here for it.

For our ETF fans, VanEck BDC Income ETF (BIZD) pays an electric 11%. Ares is BIZD’s top holding—its 21% of the fund. Buyers will need to hold their noses at some of its smaller BDCs, like dog Prospect at 3%.

Still, we saw panic selling in BDCs just last month. The Japanese yen popped and the financial media pretended it was 2008 for a day. Vanilla investors dropped BIZD holdings like hot potatoes.

Lower rates will help many of BIZD’s holdings, which boast fixed-rate portfolios. Their income streams will become more valuable as rates decline. Ares, however, has more floating-rate exposure, but I’m inclined to favor the big-dog BDC in a scenario where the debate between hard or soft economic landing may end up with no landing and an accommodative Fed.

— Brett Owens

Sponsored Link: I hate to bring up inflation already but, let’s face it, price increases are going to come back sooner than everyone thinks. Which means we need to crisis-proof our retirement portfolios right now—here’s how.

Source: Contrarian Outlook