We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Butterfly Network, Inc. (NYSE: BFLY)

Today’s penny stock pick is the Butterfly Network, Inc. (NYSE: BFLY).

Butterfly Network, Inc. develops, manufactures, and commercializes ultrasound imaging solutions in the United States and internationally. It offers Butterfly iQ, a handheld and single-probe whole body ultrasound system; Butterfly iQ+ and iQ3 ultrasound devices that can perform whole-body imaging in a single handheld probe integrated with the clinical workflow, and accessible on a user’s smartphone, tablet, and almost any hospital computer system; and Butterfly iQ+ Vet, a handheld ultrasound system designed for veterinarians.

The company also provides Butterfly system, which includes probes, and related accessories and software subscriptions to healthcare systems, physicians, and healthcare providers through a direct sales force, distributors, and eCommerce channel.

In addition, it offers cloud-based software solutions to healthcare systems, teleguidance, in-app educational tutorials, and formal education programs through its Butterfly Academy software, as well as professional services for large scale deployments; and ScanLab, an education-only app that provides written walkthroughs and reference imagery to guide real-time educational scanning, enhancing the learning process.

Website: https://www.butterflynetwork.com

Latest 10-k report: https://d18rn0p25nwr6d.cloudfront.net/CIK-0001804176/e7767507-3d3b-436b-a8c0-0289fa1c77b2.pdf

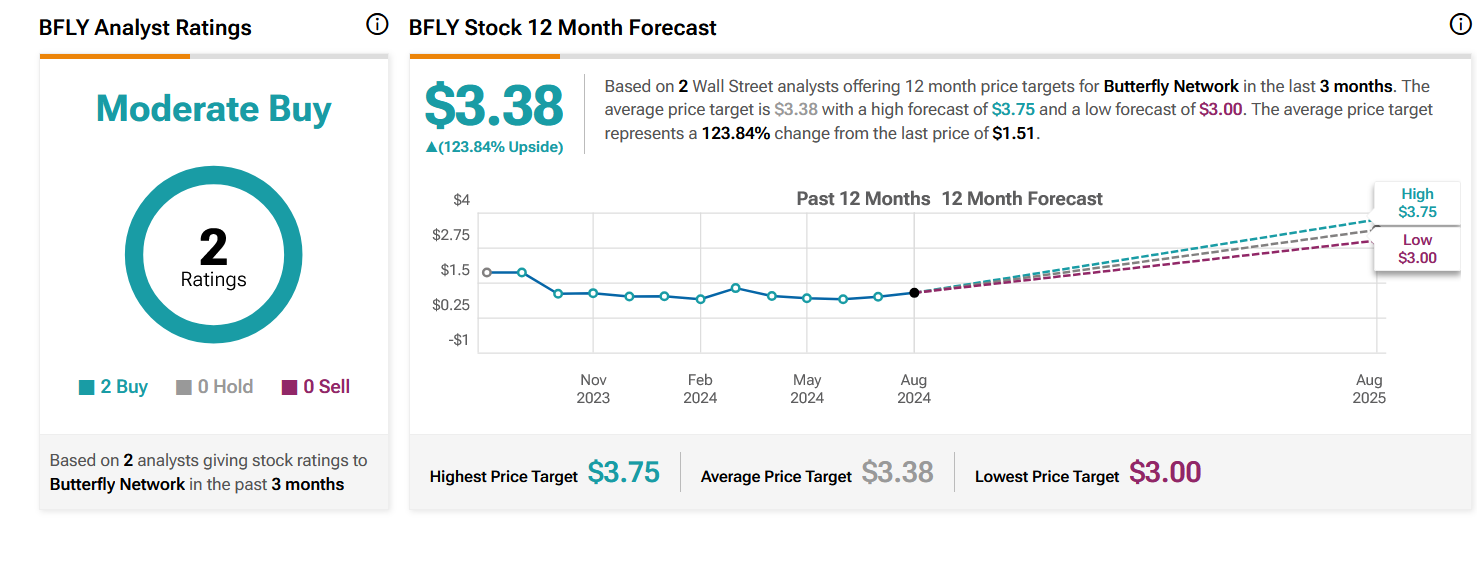

Analyst Consensus: As per TipRanks Analytics, based on 2 Wall Street analysts offering 12-month price targets for BFLY in the last 3 months, the stock has an average price target of $3.38, which is nearly 124% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company announced the commercial launch of its third-generation handheld point-of-care ultrasound (POCUS) system, Butterfly iQ3™ in Europe.

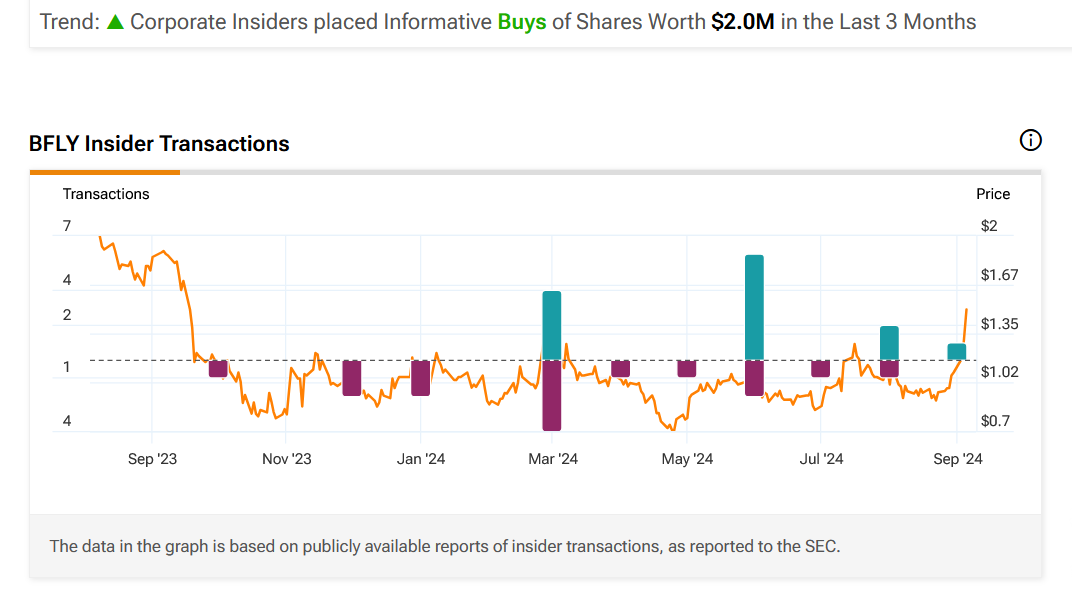

- Corporate Insiders placed Informative Buys of Shares Worth $2.0M in the Last 3 Months.

- Rumors of acquisition.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern with a high volume. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart as well, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for BFLY is above the price of $1.55.

Target Prices: Our first target is $2.10. If it closes above that level, the second target price is $2.60.

Stop Loss: To limit risk, place a stop loss at $1.20. Note that the stop loss is on a closing basis.

Our target potential upside is 36% to 68%.

For a risk of $0.35, our first target reward is $0.55, and the second target reward is $1.05. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

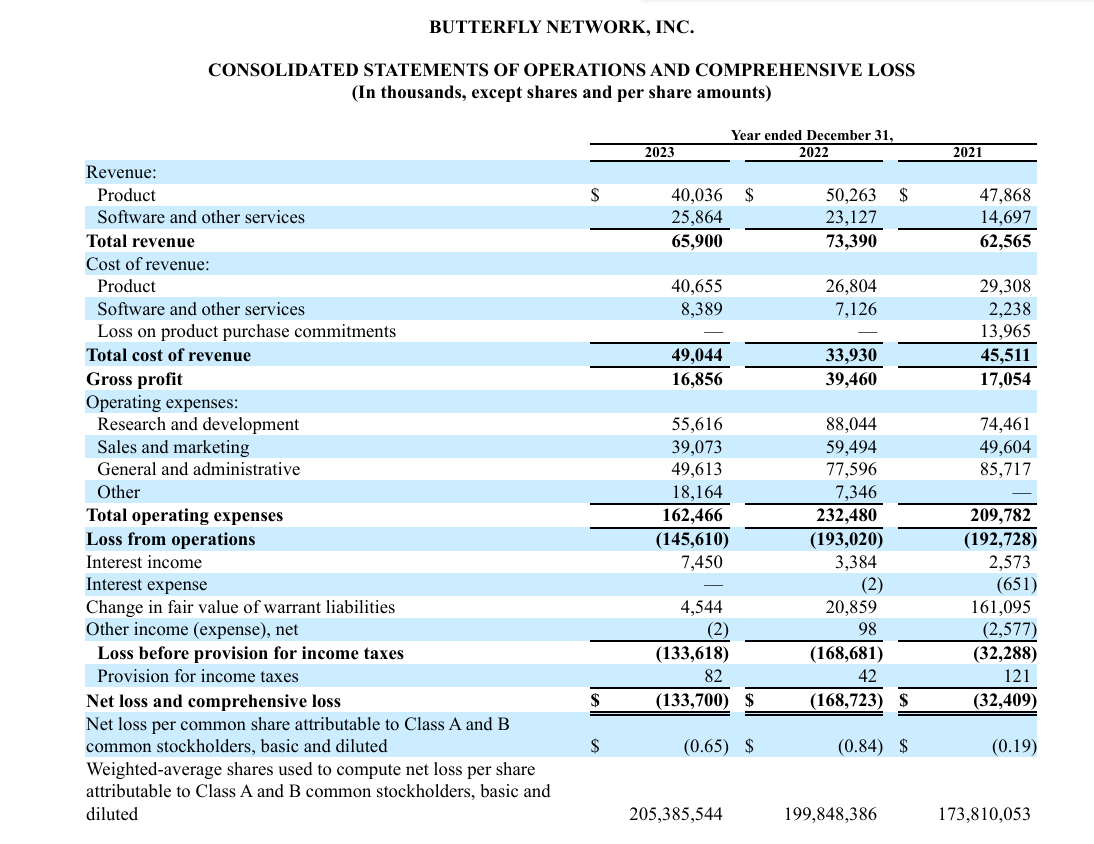

- The company has a history of net losses. BFLY incurred net losses of $133.7 million and $168.7 million for the years ended December 31, 2023, and 2022, respectively.

- The company relies on limited or sole suppliers for some of the materials and components used in its products.

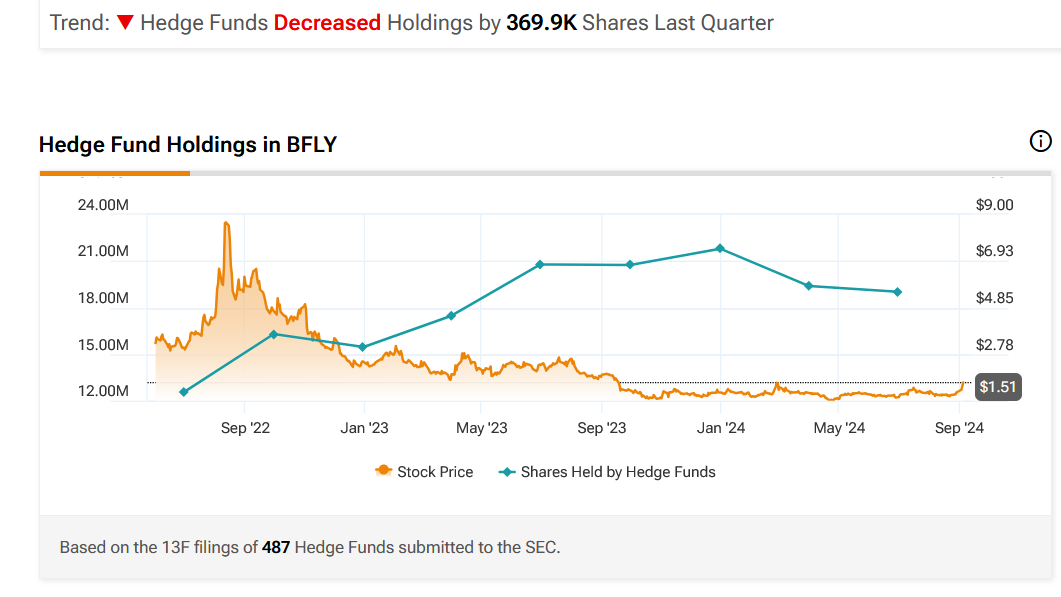

- Hedge Funds Decreased Holdings by 369.9K Shares Last Quarter.

- On February 16, 2022, a purported class action lawsuit was filed against BFLY, certain of its executive officers and directors, and certain of Longview’s executive officers and directors prior to the Business Combination, alleging violations of the Exchange Act and Rule 10b-5 and Rule 14a-9 promulgated thereunder.

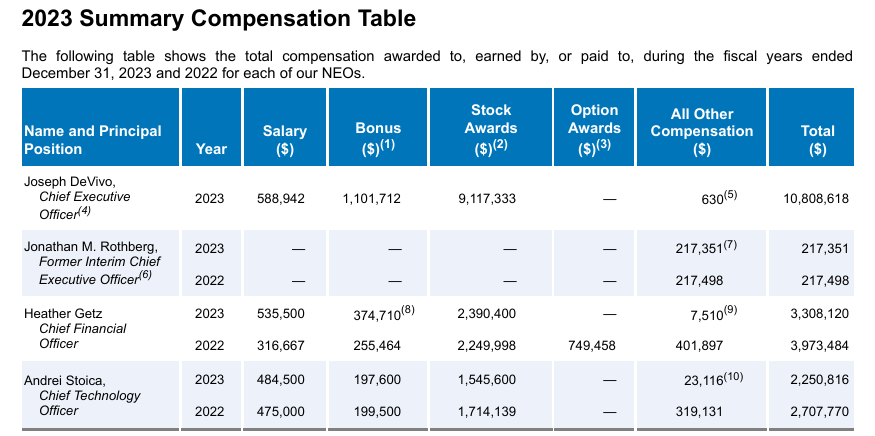

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

To carry out Trump's Executive Order #14196 initiative, the administration will have to partner with a handful of U.S. companies that control the "reserve accounts" sitting on trillions of dollars' worth of untapped natural resources. I've spent months digging into this – and I've identified three companies that have already been granted "emergency status" and fast-track approvals. I believe their shares could skyrocket once new capital starts moving into the sector. See the three stocks that I expect to be the biggest winners as this plan rolls.

Source: Trades of the Day