We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Sirius XM Holdings Inc. (NASDAQ: SIRI)

Today’s penny stock pick is the audio entertainment company, Sirius XM Holdings Inc. (NASDAQ: SIRI).

Sirius XM Holdings Inc. operates in two segments, Sirius XM, and Pandora and Off-platform. The company’s Sirius XM segment provides music, sports, entertainment, comedy, talk, news, traffic and weather channels, and other content, as well as podcast and infotainment services on a subscription fee basis; and live, curated, and exclusive and on demand programming services through satellite radio systems and streamed through applications for mobile and home devices, and other consumer electronic equipment.

This segment also distributes satellite radios through automakers and retailers, as well as its website; podcasts, including true crime, news, politics, music, comedy, sports, and entertainment; and offers location-based services through two-way wireless connectivity, including safety, security, convenience, maintenance and data, remote vehicles diagnostic, and stolen or parked vehicle locator services.

In addition, this segment provides music channels on the DISH Network satellite television service as a programming package; Travel Link, a suite of data services that include graphical weather, fuel prices, sports schedule and scores, and movie listings; graphic information related to road closings, traffic flow, and incident data for consumers with in-vehicle navigation systems; real-time weather services in vehicles, boats, and planes; and music programming and commercial-free music services for office, restaurants, and other business.

Its Pandora and Off-platform segment operates music, comedy, and podcast streaming platform, which offers personalized experience for listeners through computers, tablets, mobile devices, vehicle speakers, and connected devices; and provides advertising services.

Website: https://www.siriusxm.com

Latest 10-k report: https://investor.siriusxm.com/sec-filings/sirius-xm-holdings-inc/content/0000908937-24-000008/0000908937-24-000008.pdf

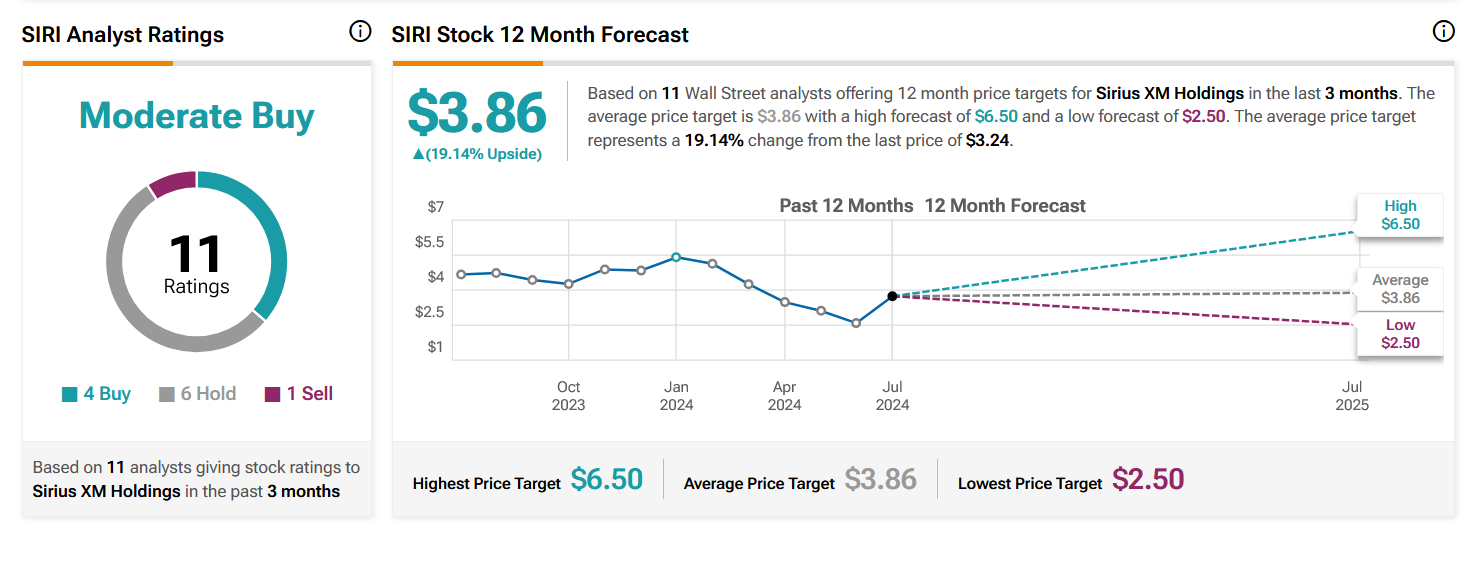

Analyst Consensus: As per TipRanks Analytics, based on 11 Wall Street analysts offering 12-month price targets for SIRI in the last 3 months, the stock has an average price target of $3.86, which is nearly 19% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- Liberty Media Corporation (NASDAQ: LSXMA, LLVYK), recently announced a merger with Sirius XM Holdings (NASDAQ: SIRI) on August 23. Starting September 10, the company will trade under New Sirius and ticker SIRI on the Nasdaq.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern: The daily chart shows that the stock has currently formed a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#4 Above Support Area: The weekly chart shows that the stock is currently trading above a resistance-turned-support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#5 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#6 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for SIRI is above the price of $3.30.

Target Prices: Our first target is $4.30. If it closes above that level, the second target price is $5.30.

Stop Loss: To limit risk, place a stop loss at $2.70. Note that the stop loss is on a closing basis.

Our target potential upside is 30% to 60%.

For a risk of $0.60, our first target reward is $1.00, and the second target reward is $2.00. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

- The company is struggling with its streaming platform, Pandora, which it acquired over five years ago. Pandora has seen a decline in subscribers, with self-pay subscribers for Pandora Plus and Pandora Premium dropping by 41,000 in the second quarter of 2024, ending the period with six million subscribers. Its overall revenue in Q2 also fell by 3% YoY at $3.18 billion. In addition to this, Sirius XM Holdings Inc.’s own subscribers have fallen from 35 million in 2020 to 33 million in the most recent quarter.

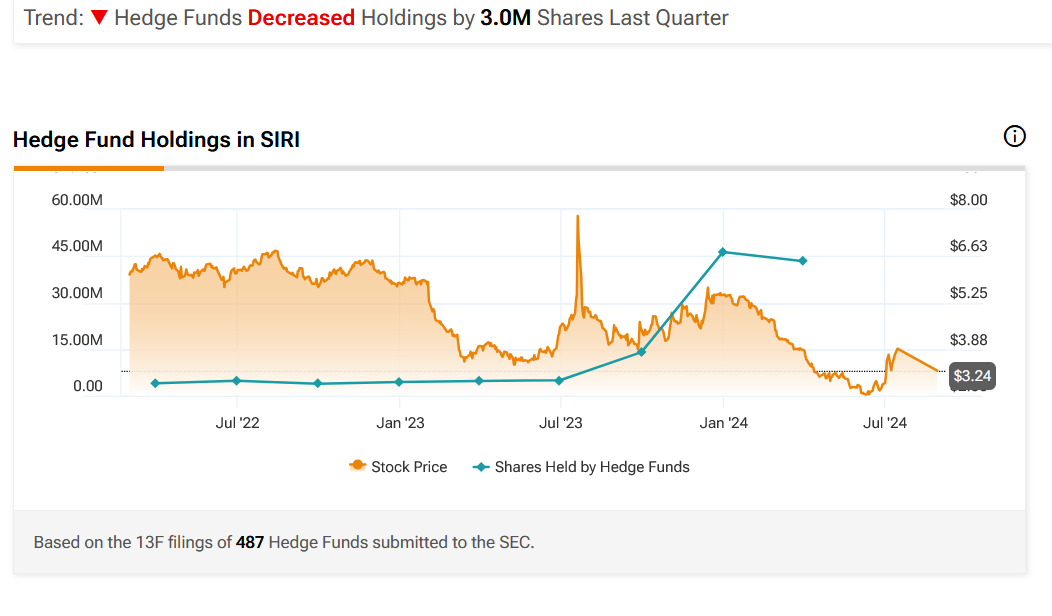

- Hedge Funds Decreased Holdings by 3.0M Shares Last Quarter.

- The company has ongoing legal proceedings. On December 20, 2023, the People of the State of New York, by Letitia James, Attorney General of the State of New York filed a Petition in the Supreme Court of the State of New York, New York County, against SIRI. The Petition alleges various violations of New York law and the federal Restore Online. A number of class actions and mass arbitrations have been commenced against SIRI relating to its pricing, billing, and subscription marketing practices.

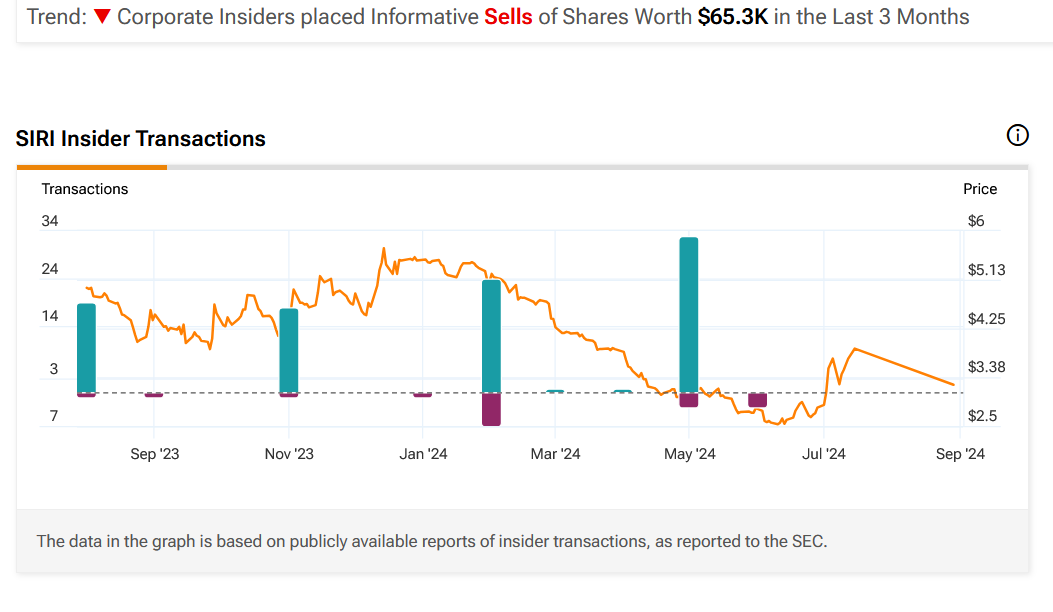

- Corporate Insiders placed Informative Sells of Shares Worth $65.3K in the Last 3 Months.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price. Get 25% off using Daily Trade Alert's special referral link and coupon code AFFILIATE25

Source: Trades of the Day