If there’s anything I’ve learned over the last 15 years of investing, it’s that you want to protect your downside.

A lot of people jump into investing and start immediately dreaming of riches.

It’s all about how much money they can make.

It’s all about how much money they can make.

It’s all about the upside.

But the downside must always be considered and protected first.

Like Warren Buffett said years ago, the first rule of investing is to not lose money (and the second rule is to not forget the first rule).

This is why I’m such an ardent fan of dividend growth investing.

It’s a long-term strategy that advocates buying and holding shares in high-quality businesses that pay safe, growing dividends to shareholders.

You can see many examples of these businesses by perusing the Dividend Champions, Contenders, and Challengers list – a grand compilation of data on hundreds of US-listed stocks that have raised dividends each year for at least the last five consecutive years.

Because growing dividends generally require growing profits (in order to fund and sustain those dividend payments), and because growing profits tend to emanate from great businesses, and because it’s hard to lose money when investing in great businesses, it’s a great strategy when it comes to protecting the downside.

This is a big part of why I’ve been using this strategy when it comes to my own money, even allowing it to guide me as I’ve gone about building my FIRE Fund.

That’s my real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

In fact, I’ve been able to live off of dividends since I retired in my early 30s.

In fact, I’ve been able to live off of dividends since I retired in my early 30s.

My Early Retirement Blueprint spells out how I was able to do such a thing.

All that said, there’s more to the strategy and protecting downside than investing in great businesses that pay safe, growing dividends.

There’s also valuation to consider.

After all, price is only what you pay, but it’s value that you actually get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Finding great businesses that pay safe, growing dividends, and then buying the shares when they’re priced at less than fair value, is a great way to protect the downside while simultaneously setting things up nicely for plenty of upside over time.

But the whole conversation around valuation assumes one already understands how it works.

Well, if you don’t have that understanding in place already, do make sure to read through Lesson 11: Valuation.

Put together by fellow contributor Dave Van Knapp, it lays out valuation in simple-to-understand terms, even providing a template that can be used to estimate the fair value of almost any dividend growth stock you’ll run across.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

FactSet Research Systems Inc. (FDS)

FactSet Research Systems Inc. (FDS)

FactSet Research Systems Inc. (FDS) is an American financial data and software company.

Founded in 1978, FactSet is now a $16 billion (by market cap) financial data powerhouse that employs more than 12,000 people.

The company breaks down revenue by geography: Americas, 64% of FY 2023 revenue; EMEA, 26%; and Asia-Pacific, 10%.

FactSet has 208,000 users, and most of its clients are institutional buy side (i.e., institutional asset management).

The company is heavily diversified across clientele, with its largest client accounting for approximately 3% of annual revenue.

What’s so great about FactSet is the business model.

Put simply, it’s a capital-light provider of high-value financial data/software/analytics through subscriptions to customers (such as asset managers, bankers, wealth managers, hedge funds, and private equity firms) who demand this information and are able and willing to pay for it.

That ability and willingness is important, as FactSet’s full suite costs approximately $12,000 per year.

That’s no small chunk of change.

But even that kind of money can end up being an immaterial cost of doing business for some large asset manager that pools together billions of dollars and needs as much information as possible.

FactSet provides both proprietary and third-party data, including estimates, news, and historical information.

The company offers a range of solutions to clients that include investment research, portfolio analysis, performance evaluation, and risk management assessment.

FactSet is nearly guaranteed ongoing business.

The company’s customers need these solutions, and the subscriptions lock in the suites.

FactSet is among of a cadre of companies that, essentially, undergird the global capital markets.

When the global equity markets alone have a combined market cap of somewhere around $120 trillion, being at the table and engraining your offerings is highly lucrative.

This is why FactSet has been able to grow its revenue, profit, and dividend like clockwork for years.

Dividend Growth, Growth Rate, Payout Ratio and Yield

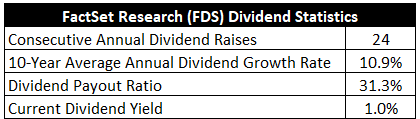

The company has already increased its dividend for 24 consecutive years.

It’s a fantastic track record of dividend growth, and it sets the company up to become a Dividend Aristocrat soon (FactSet joined the S&P 500 in 2021, officially becoming eligible to become a Dividend Aristocrat after its 25th consecutive year of dividend increases).

Upon its entry into that exclusive dividend club, it’ll fit in well.

The 10-year dividend growth rate is 10.9%, which is just very solid.

And with a payout ratio of only 31.3%, there’s plenty of headway here for the dividend to continue rising at an aggressive pace.

The one minor drawback here regarding the dividend is the stock’s yield of 1%.

The one minor drawback here regarding the dividend is the stock’s yield of 1%.

Of course, the lowish yield is partially a function of the popularity of the stock and its great performance over the years (cheaper stocks representing equity in junky businesses can offer far higher yields).

Worth noting is the fact that this yield is 10 basis points higher than its own five-year average, showing how this yield is not at all atypical for this particular stock (and actually a bit higher than usual).

Personally, I’m not dismayed by the yield at all.

To the contrary, low yields often strike me as auspicious.

A 1% yield is not going to draw in income-seeking investors, but those who like growth and safety (and the total return that tends to emanate from these characteristics) will find a lot to like about this upcoming Dividend Aristocrat.

Revenue and Earnings Growth

As much as there is to like, though, many of these metrics are backward looking.

However, investors must always be looking forward, as today’s capital gets put on the line and risked for tomorrow’s rewards.

As such, I’ll now build out a forward-looking growth trajectory for the business, which will come in handy when the time comes to estimate the fair value of the business.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

And I’ll then reveal a professional prognostication for near-term profit growth.

Lining up the proven past with a future forecast in this manner should give us enough information to make an educated call on where the business could be going from here.

FactSet has moved its revenue from $920 million in FY 2014 to $2.1 billion in FY 2023.

That’s a compound annual growth rate of 9.6%.

Very strong top-line growth here.

I also think it’s the consistency, not just the rate, that separates FactSet from a lot of other businesses.

This company has increased its annual revenue for 45 consecutive years.

Even in 2020, during the global pandemic, when a lot of other companies suffered temporary YOY drops in revenue, FactSet still grew its revenue.

FactSet is relentless.

Meanwhile, earnings per share grew from $4.92 to $12.04, which is a CAGR of 10.5%.

Routine but modest share buybacks helped to drive some excess bottom-line growth.

The outstanding share count has been reduced by nearly 10% over the last decade.

Looking forward, CFRA believes FactSet will compound its EPS at an annual rate of 10% over the next three years.

This would be a continuation of the status quo.

Nothing crazy here.

My favorite passage from CFRA is this one: “In the medium to long term, we think organic revenue growth will continue at a fairly consistent rate as [FactSet]’s products continue to resonate with both the buy-side and the sell-side, resulting in market share gains.”

If you didn’t notice, that word “consistent” pops up again.

As I’ve looked into this business and become familiar with it, that’s my big takeaway: FactSet is remarkably consistent in all aspects of operations.

And that’s exactly why CFRA putting up a 10% number, lining up well with what’s transpired over the last decade, makes a lot of sense.

Betting on FactSet to do anything other than what they’ve been doing would be a bad bet, in my view.

This is because the core offering is “sticky”, as it’s practically necessary for big market players to access certain information and there are costs to switching.

Indeed, FactSet enjoys a client retention rate that’s over 90%.

This high retention rate allows management to focus its efforts on winning new clients (rather than just trying to stay afloat with current business).

This brings me to market share gains.

If FactSet’s $12,000/year offering seems high, your jaw will drop when you realize that Bloomberg – a chief competitor for FactSet and the market leader (~33% share) – charges somewhere around $27,000/year for its Bloomberg Terminal.

That’s more than twice as much as what FactSet charges.

CFRA also notes how FactSet “…offers a differentiated sought-after product…”, so I think FactSet has an opportunity to take share by providing both differentiation and a better value.

The market share gains also indicate that FactSet’s brand and reputation work.

What’s also great about FactSet is how it operates a capital-light business model.

Capital expenditures are less than 4% of revenue.

And because of the near-infinite scalability of its offerings at almost no incremental cost, each additional client brought on basically allows that new revenue to drop straight down to the bottom line.

Overall, I’m willing to take CFRA’s number as the base case.

That sets up the dividend for like growth.

It would be more of the ~10% dividend growth that shareholders have become accustomed to, setting up shares for more double-digit annualized total return over the years to come (the stock’s 10-year CAGR is 13.7%, with dividends reinvested).

Again, income-oriented investors might not be interested in something like this, but those who want strong returns and understand how long-term compounding works should be more than satisfied.

Financial Position

Moving over to the balance sheet, FactSet has a very good financial position.

The long-term debt/equity ratio is 1, while the interest coverage ratio is over 10.

Net long-term debt is barely over $1 billion, which is relatively immaterial for a company of this size.

I’m not troubled at all by this balance sheet.

Profitability is stellar.

Return on equity has averaged 40.7% over the last five years, while net margin has averaged 24%.

Excellent numbers here.

ROE hasn’t been overly juiced by high leverage, and the business sports world-class margins.

Love the high returns on capital.

From what I can see, FactSet is a capital-light, high-margin, high-quality business.

And with economies of scale, a “sticky” offering, switching costs, brand recognition, and IP, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

Competition, in particular, is a key risk, as it’s a crowded field with extremely competitive players.

While the company’s core subscription is a cheaper option in comparison to some of the competition, the pervasively high prices throughout the industry could be subject to deflation and disruption over time.

The company is exposed to the health of and interest in capital markets, and any deterioration across markets that harm the financial health of clients would likely negatively impact FactSet.

This capital markets exposure also exposes the company to broader macroeconomic trends and the overall health of the global economy.

FactSet’s international footprint involves foreign markets and fluctuating currency exchange rates.

A secular trend within the financial industry of assets moving from active to passive management could eventually lead to deteriorating demand for the kind of information that FactSet provides, although this trend, which has been playing out for years already, seemingly hasn’t had a major negative impact on FactSet.

While these risks should be thought over, the quality of this business is very high.

And with the stock down 15% from recent highs, the valuation doesn’t currently seem to be fully reflecting that quality…

Valuation

The stock is trading hands for a P/E ratio of 31.1.

While that’s a high earnings multiple in absolute terms, it actually compares quite favorably to its own five-year average of 34.7.

This is a stock that routinely commands a healthy premium, yet that premium is not as healthy right now.

The cash flow multiple of 21.5 is also below its own five-year average of 24.6.

And the yield, as noted earlier, is higher than its recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a two-stage dividend discount model analysis.

I factored in a 10% discount rate, an 11% dividend growth rate for the next 20 years, and a long-term dividend growth rate of 8%.

I’m extrapolating out FactSet’s 10-year dividend growth rate into the next couple of decades.

I usually don’t run a higher growth rate like this out so far into the future, but FactSet’s relentless consistency allows me to give them the benefit of the doubt.

The company has basically compounded its EPS and dividend at ~11% over the last decade, and CFRA’s near-term forecast for more low-double-digit EPS growth over the next few years opens the dividend up for more of the same (especially with the payout ratio being as low as it is).

All of this doesn’t seem like a stretch for a business generating so much bottom-line growth and very high returns on capital.

Regardless, I am assuming this kind of growth rate eventually slows into a more reasonable high-single-digit range, which is a common growth rate for high-quality but mature firms.

The DDM analysis gives me a fair value of $360.83.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

My model reveals a stock that, despite its greatness, isn’t quite as attractively valued as I’d like it to be.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates FDS as a 3-star stock, with a fair value estimate of $395.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates FDS as a 4-star “BUY”, with a 12-month target price of $520.00.

Quite a range here, and I came out low. Averaging the three numbers out gives us a final valuation of $425.28, which would indicate the stock is possibly 3% undervalued.

Bottom line: FactSet Research Systems Inc. (FDS) is a capital-light, high-quality business generating high returns on capital and fat margins. Client retention is almost 100%, it’s taking market share, and its core offering is very “sticky”. With an acceptable yield, a low payout ratio, double-digit dividend growth, nearly 25 consecutive years of dividend increases, and the potential that shares are 3% undervalued, it’s time to consider investing in this soon-to-be Dividend Aristocrat.

Bottom line: FactSet Research Systems Inc. (FDS) is a capital-light, high-quality business generating high returns on capital and fat margins. Client retention is almost 100%, it’s taking market share, and its core offering is very “sticky”. With an acceptable yield, a low payout ratio, double-digit dividend growth, nearly 25 consecutive years of dividend increases, and the potential that shares are 3% undervalued, it’s time to consider investing in this soon-to-be Dividend Aristocrat.

-Jason Fieber

Note from D&I: How safe is FDS’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 95. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, FDS’s dividend appears Very Safe with a very unlikely risk of being cut. Learn more about Dividend Safety Scores here.

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Source: Dividends & Income

Disclosure: I have no position in FDS.