We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Origin Materials, Inc. (NASDAQ: ORGN)

Today’s penny stock pick is the science-driven technology company, Origin Materials, Inc. (NASDAQ: ORGN).

Origin Materials, Inc. operates as a carbon-negative materials company. The company develops a proprietary biomass conversion platform to convert biomass, or plant-based carbon into building block chemicals chloromethylfurfural and hydrothermal carbon, as well as other oils and extractives and other co-products. Origin Materials, Inc. is headquartered in West Sacramento, California.

Website: https://www.originmaterials.com

Latest 10-k report: https://investors.originmaterials.com/static-files/e837c4b8-478e-49ce-bfb1-e21e51a94fba

Analyst Consensus: Not covered by Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- The company is scaling up operations and establishing contracts with production tollers in the United States and Europe, including Reed City Group and Bachmann Group. Notably, analysts anticipate the company’s earnings before interest, taxes, depreciation, and amortization (EBITDA) to reach breakeven in 2027, two years earlier than previously expected.

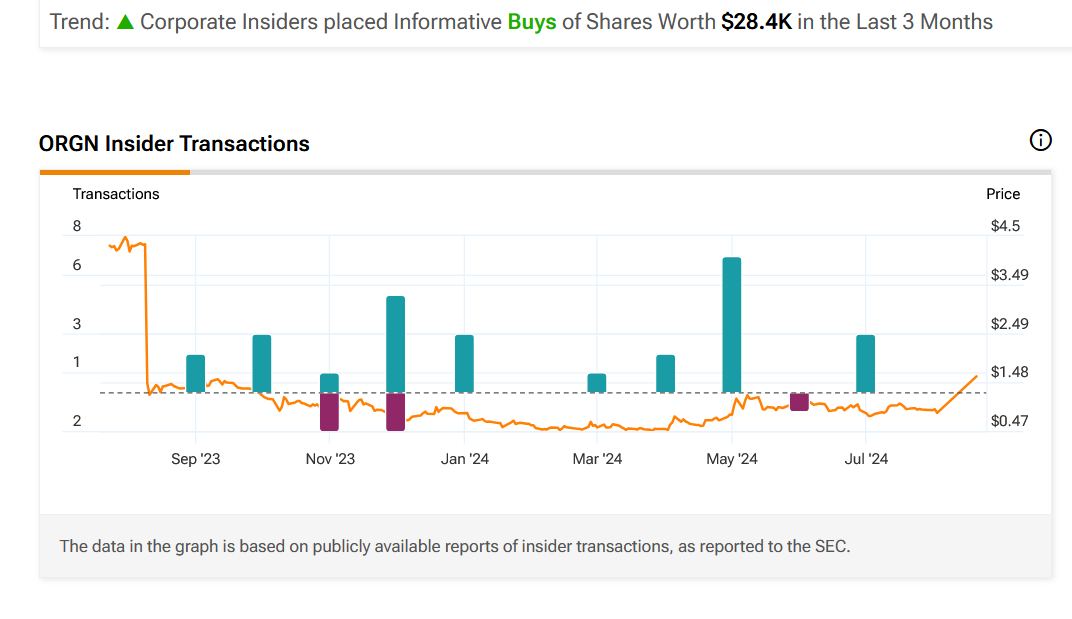

- Corporate Insiders placed Informative Buys of Shares Worth $28.4K in the Last 3 Months.

- Origin Materials has signed its first major customer for PET caps and closures, with the deal projected to generate over $100 million in revenue over the initial two-year term. Commercial production of PET caps is expected to commence in Q4 2024, with revenue ramping up from Q1 2025.

- BofA Securities analyst Steve Byrne upgraded the company to Buy from Neutral rating and raised the price target to $3.00 from $1.35.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Symmetrical Triangle Pattern Breakout: The daily chart shows that the stock has currently broken out a symmetrical triangle pattern, which is marked as purple color lines. A symmetrical triangle pattern represents a period of consolidation before the price breaks out. This is typically formed when there is indecision in the price movements and uncertainty among the buyers and sellers. Once a breakout from the upper trend line occurs, it usually signifies the start of a new bullish trend.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart as well, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for ORGN is above the price of $1.65.

Target Prices: Our first target is $2.80. If it closes above that level, the second target price is $3.70.

Stop Loss: To limit risk, place a stop loss at $1.00. Note that the stop loss is on a closing basis.

Our target potential upside is 70% to 124%.

For a risk of $0.65, our first target reward is $1.15, and the second target reward is $2.05. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

- The company has a history of net losses and only recently begun generating revenue.

- The company has customer concentration risk, as it relies on a limited number of customers for a significant portion of the company’s near-term revenue.

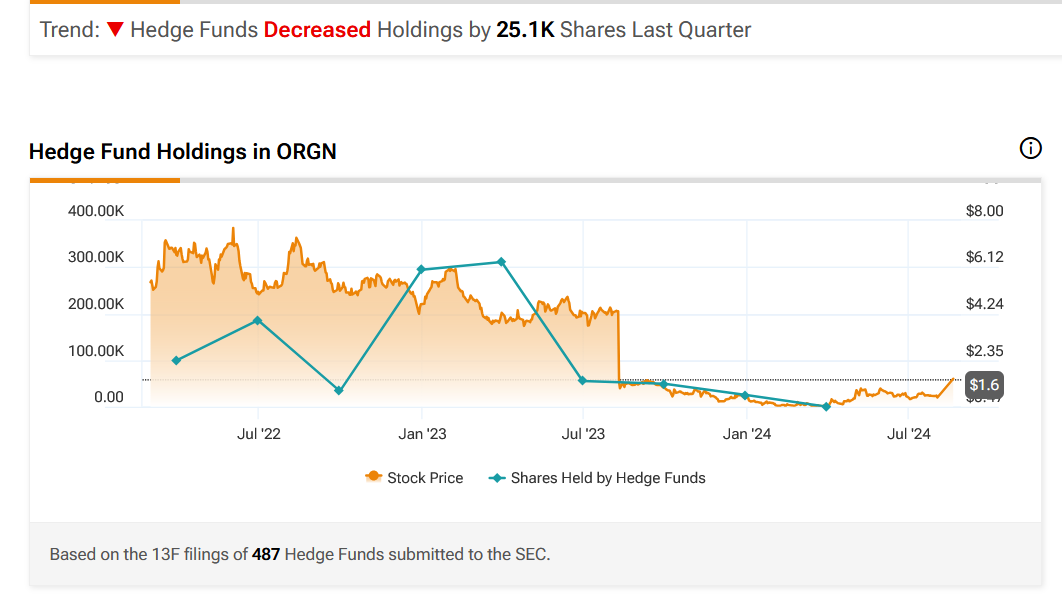

- Hedge Funds Decreased Holdings by 25.1K Shares Last Quarter.

- The specialty chemicals industry is highly competitive, and ORGN faces significant competition from both large established producers of fossil-based materials, recycled fossil-based materials, and a variety of current and future producers of low-carbon, biodegradable, or renewable resource-based materials.

- ORGN has only recently commenced commercial-scale production. There are significant technological and logistical challenges associated with producing, marketing, selling, and distributing products in large commercial quantities.

- The company’s earnings are forecast to decline by an average of 49.7% per year for the next 3 years. Shareholders have also been diluted in the past year.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Motley Fool Stock Advisor's average stock pick is up over 350%*, beating the market by an incredible 4-1 margin. Here’s what you get if you join up with us today: Two new stock recommendations each month. A short list of Best Buys Now. Stocks we feel present the most timely buying opportunity, so you know what to focus on today. There's so much more, including a membership-fee-back guarantee. New members can join today for only $99/year.

Source: Trades of the Day