We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Houston American Energy Corp. (NYSE: HUSA)

Today’s penny stock pick is the oil and gas company, Houston American Energy Corp. (NYSE: HUSA).

Houston American Energy Corp. engages in the acquisition, exploration, exploitation, development, and production of natural gas, crude oil, and condensate. Its principal properties are located primarily in the Texas Permian Basin, the South American country of Colombia, and the onshore Louisiana Gulf Coast region. The company is based in Houston, Texas.

Website: https://houstonamerican.com

Latest 10-k report: https://www.sec.gov/ix?doc=/Archives/edgar/data/1156041/000149315224012685/form10-k.htm

Analyst Consensus: Not covered by Wall Street Analysts.

Potential Catalysts / Reasons for the Hype:

- The company is drilling six wells on the State Finkle Unit in Reeves County, Texas, targeting the Wolfcamp formation. All wells are expected to spud by September 1, 2024.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Falling Wedge Pattern Breakout: The daily chart shows that the stock has been forming a falling wedge pattern for the past several months. These are marked as purple color lines. It has typically taken support at the bottom of the wedge before bouncing back. The stock has currently broken out from the falling wedge pattern. Once the stock breaks out of the falling wedge pattern, it could move higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart as well, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for HUSA is above the price of $1.60.

Target Prices: Our first target is $2.40. If it closes above that level, the second target price is $3.10.

Stop Loss: To limit risk, place a stop loss at $1.10. Note that the stop loss is on a closing basis.

Our target potential upside is 50% to 94%.

For a risk of $0.50, our first target reward is $0.80, and the second target reward is $1.50. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

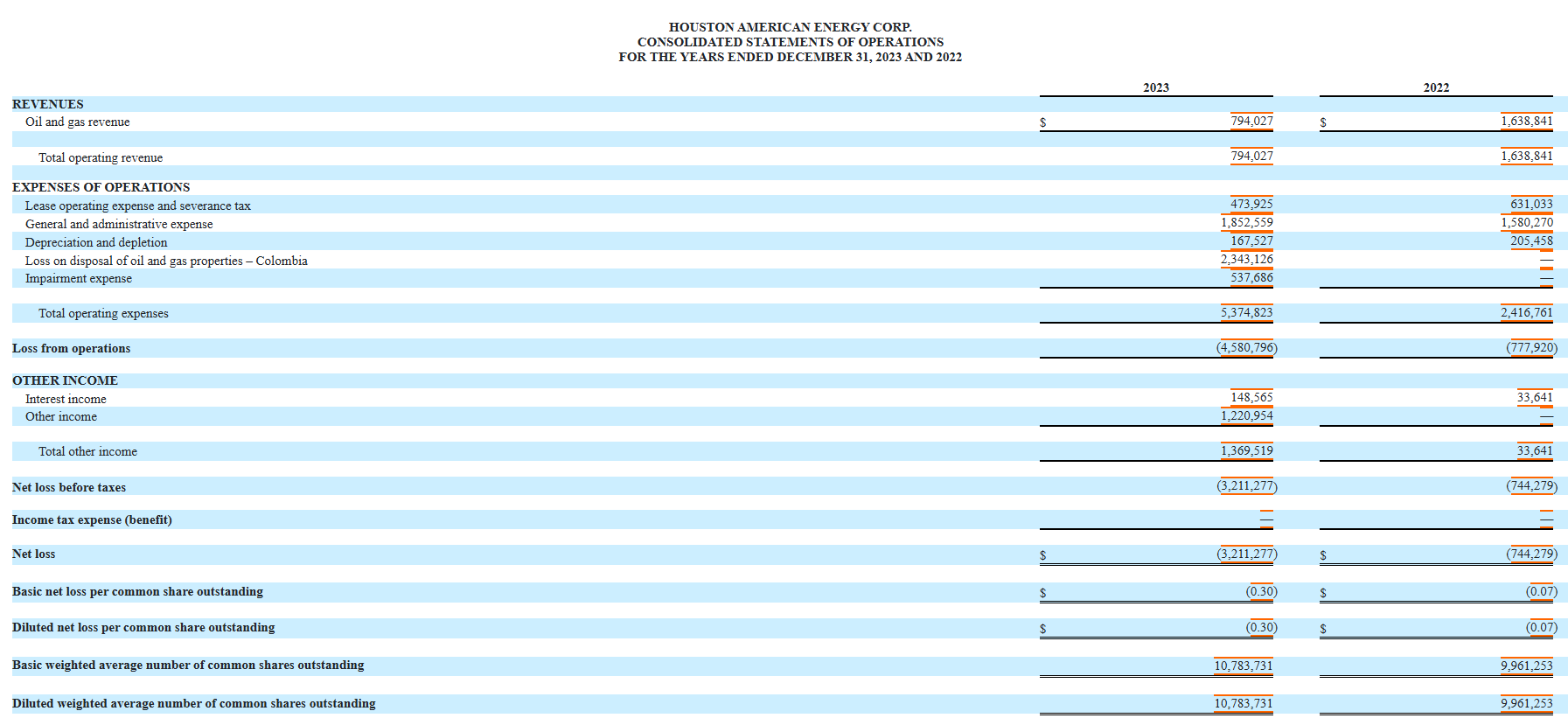

- The company has a history of net losses. As of December 31, 2023, HUSA had an accumulated deficit of $76,998,997.

- The company’s financial condition and profitability are highly dependent on energy prices. Despite that, HUSA has not historically entered into any hedges or other derivative commodity instruments or transactions designed to manage or limit exposure to oil and gas price volatility.

- A substantial percentage of the company’s properties are unproven and/or undeveloped. HUSA would require significant capital to prove and develop such properties before they may become productive.

- HUSA may issue additional shares of its common stock or equity-related securities to secure capital to support its future drilling plans. This could adversely affect the prevailing trading prices of the company’s stock.

- The company has decreasing annual revenue. Total oil and gas revenues decreased 52% to $794,027 in 2023 from $1,638,841 in 2022.

- It was revealed by an SEC investigation that HUSA’s current President and CEO, John Terwilliger profited the company through exaggeration of a South American prospect’s oil reserves while secretly paying a firm to promote it.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

$3 billion+ in operating income. Market cap under $8 billion. 15% revenue growth. 20% dividend growth. No other American stock but ONE can meet these criteria... here's why Donald Trump publicly backed it on Truth Social. See His Breakdown of the Seven Stocks You Should Own Here.

Source: Trades of the Day