We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Applied Digital Corporation (NASDAQ: APLD)

Today’s penny stock pick is the digital infrastructure firm, Applied Digital Corporation (NASDAQ: APLD).

Applied Digital Corporation designs, develops, and operates datacenters in North America. The Company provides three primary business streams, including artificial intelligence (AI) cloud services, high performance computing (HPC) datacenter hosting, and crypto datacenter hosting.

The Company’s AI Cloud service operates through its Sai Computing brand and provides cloud services applicable to artificial intelligence. The high-performance computing datacenter business designs, builds, and operates datacenters, which are designed to provide computing power and support high-compute applications within a cost-effective model. The crypto datacenter hosting business provides infrastructure and colocation services to crypto mining customers. It has developed a pipeline of potential power sources across its sites in Jamestown, North Dakota; Garden City, Texas, and Ellendale, North Dakota.

The company was formerly known as Applied Blockchain, Inc. and changed its name to Applied Digital Corporation in November 2022. The company was founded in May 2001 and is headquartered in Dallas, TX.

Website: https://applieddigital.com

Latest 10-k report: https://ir.applieddigital.com/sec-filings/all-sec-filings/content/0001144879-23-000176/0001144879-23-000176.pdf

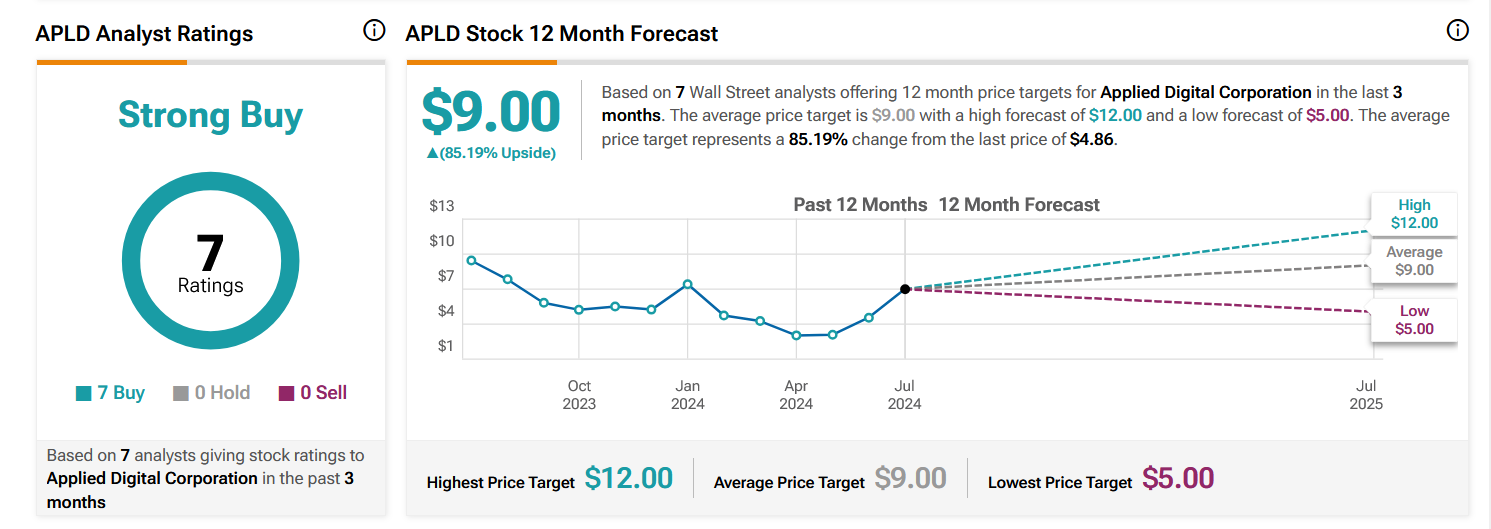

Analyst Consensus: As per TipRanks Analytics, based on 7 Wall Street analysts offering 12-month price targets for APLD in the last 3 months, the stock has an average price target of $9.00, which is nearly 85% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The company extended its exclusivity agreement with a leading U.S. hyper scaler for the leasing of its upcoming data center campus in Ellendale, North Dakota.

- Rumors of a potential buyout.

- APLD reported strong fourth-quarter earnings, exceeding expectations due to the swift re-energization of its Ellendale project and the expansion of its GPU operations. This resulted in a significant increase in revenue and adjusted EBITDA.

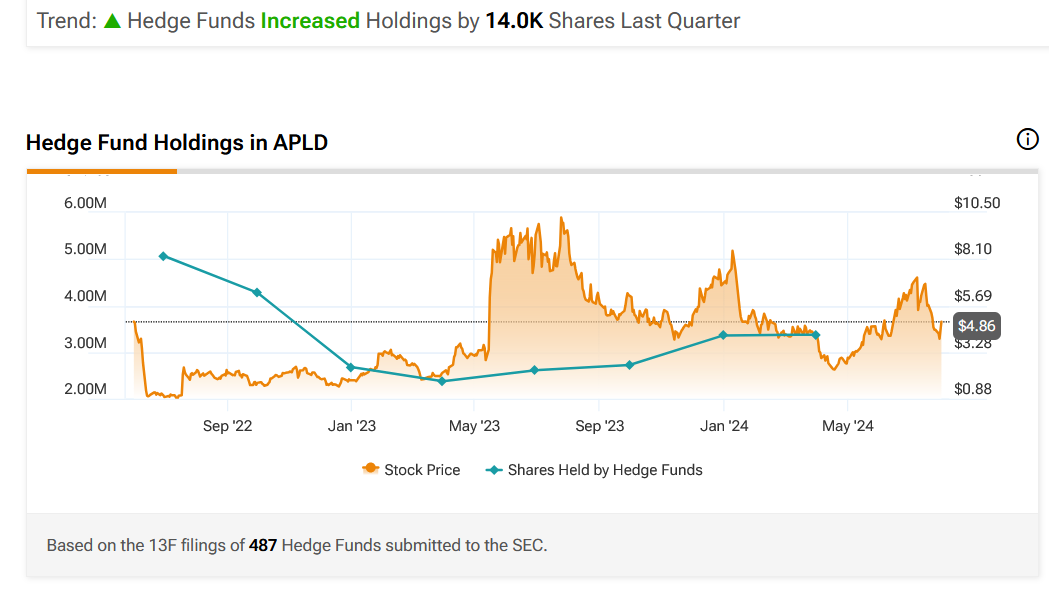

- Hedge Funds Increased Holdings by 14.0K Shares Last Quarter.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Flag Pattern: The daily chart shows that the stock has been forming a flag pattern for the past several days. This is marked as purple color lines. The stock currently looks poised for a breakout from the flag pattern. Once the stock breaks out of the flag pattern, it could move higher.

#2 Price above MA: The stock is currently above its 200-day SMA, indicating that the bulls are currently in control.

#3 Bullish RSI: The RSI is currently near 50 and moving higher, indicating possible bullishness.

#4 Bullish Stoch: The %K line of the stochastic is above the %D line, and has also moved higher from oversold levels, indicating possible bullishness.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher.

#6 MACD above Signal Line: In the weekly chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for APLD is above the price of $4.95.

Target Prices: Our first target is $6.30. If it closes above that level, the second target price is $7.20.

Stop Loss: To limit risk, place a stop loss at $4.20. Note that the stop loss is on a closing basis.

Our target potential upside is 27% to 45%.

For a risk of $0.75, our first target reward is $1.35, and the second target reward is $2.25. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

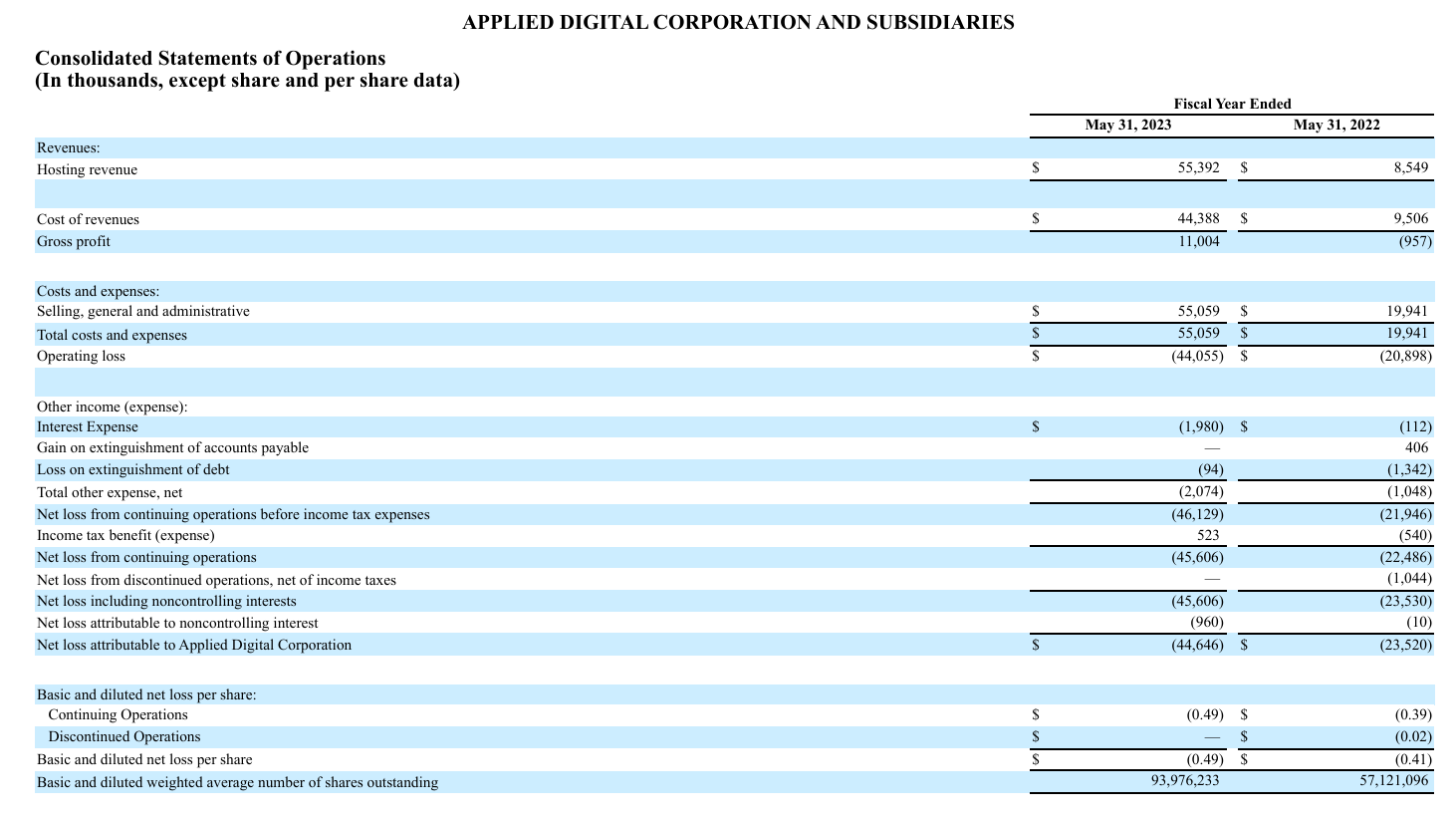

- The company has a history of net losses.

- The company is at an early stage of development of its hosting business, currently has limited sources of revenue, and may not become profitable in the future.

- APLD may need to raise substantial additional capital to expand its operations, pursue its growth strategies, and respond to competitive pressures or unanticipated working capital requirements. Any future issuance of additional equity in the company could result in the dilution of current stockholders’ relative ownership.

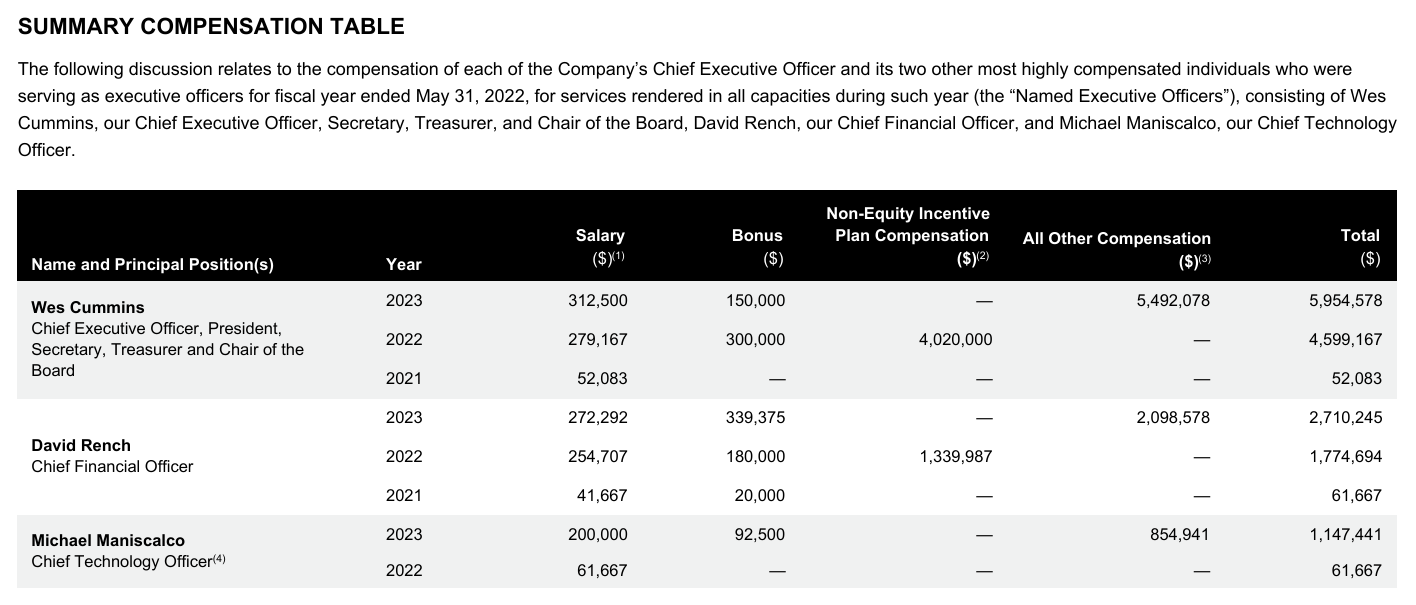

- Despite being a loss-making company, the executives are being paid significant compensation.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

Imagine having 12 new monthly income checks, carrying the potential of up to 21% yields.This is possible because of a tested strategy to get paid out regularly, like a paycheck. For over a decade, I have helped more than 26,000 investors secure 12 new monthly payouts. Meaning, you know exactly how much you'll make every month... Because of some stocks that pay us 8%,13.4%, and even 21.6% yields. See it for yourself here.

Source: Trades of the Day