Right now, history is being made… and I’m not talking about the surprise assassination attempt on former President Donald Trump.

That violent act surprised us all. I’m sure I’m not alone when I say violence has no place in our election process, regardless of your beliefs.

But I’ll let others more qualified discuss that tragic act and its implications. Instead, let’s talk about a massive trade playing out in response to this historic event.

If Wall Street hates anything, it’s uncertainty. After the past weekend, we got a whole lot more confident about the outcome of this year’s election.

And so, with election odds now strongly favoring a Trump victory in 2024, there’s a Trump Trade that you need to be aware of…

Wall Street’s “Trump Trade” is Betting on Cyclical Stocks

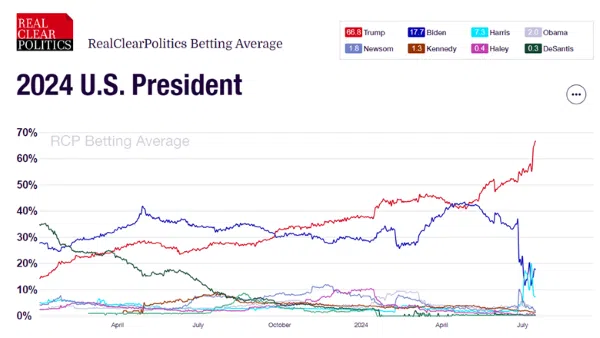

Shortly after the shooting in Pennsylvania, wagers that Trump will take the White House started to increase.

Below shows the betting odds by presidential nominee, with the weekend’s events boosting Trump’s odds to nearly 67%:

This is important, because sometimes you need to look back to see what’s ahead.

This is important, because sometimes you need to look back to see what’s ahead.

If you recall in 2016 when Trump stunned everyone with a White House victory, monster trades took place shortly after.

Trump’s financial policies can be summed up as low regulation and pro-small business… a perfect setup for small-cap stocks.

I remember the massive rotation that took place. Essentially, Wall Street took profits in mega-cap technology to fund wagers on small-caps.

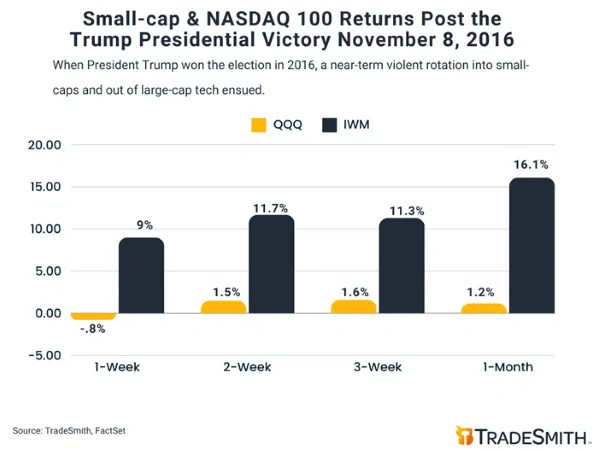

Below shows this Trump Trade beautifully. The small-cap Russell 2000 ETF (IWM) soared, while the mega-cap tech NASDAQ 100 ETF (QQQ) dumped.

But let’s talk hard numbers. After Trump won the 2016 election:

- One week later, small-caps soared 9% while the NASDAQ 100 dropped 0.8%.

- One month later, IWM ripped 16.1% while the NASDAQ 100 gained a measly 1.2%.

This history lesson is important because it’s shaping the investment landscape today.

This history lesson is important because it’s shaping the investment landscape today.

Less than a month ago we prepared you for a tremendous portfolio equalizer moment coming your way. That piece prefaced one of the biggest rotational trades in years, which we discussed earlier this week.

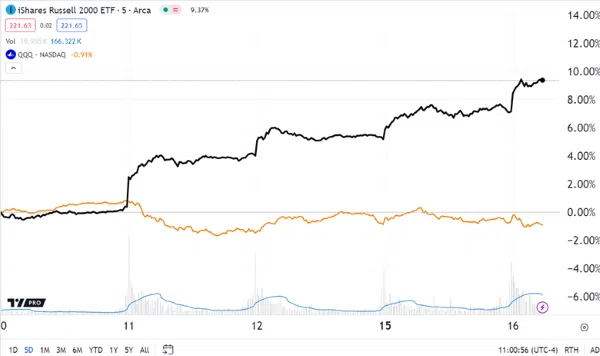

Essentially, the lowest-hanging fruit for your portfolio was down-and-out small-caps. After the weak June CPI report last Thursday, people piled into previously unloved small-caps and fled the ultra-crowded NASDAQ 100.

As you can see below, this trade has only improved. The iShares Russell 2000 ETF (IWM) has gained nearly 10%, while the Invesco QQQ ETF (QQQ) is down slightly in less than four trading days:

This wicked rotation has all the signs of the Trump Trade from nearly eight years ago.

This wicked rotation has all the signs of the Trump Trade from nearly eight years ago.

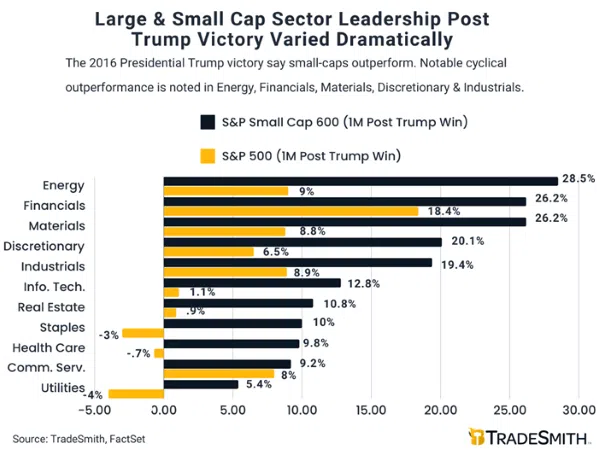

Stay with me, because this is the best chart you’ll see all week!

If we break down the small-cap-sector thrust that occurred when Trump took office in 2016, you’ll see that cyclical sectors like Energy, Financials, Materials, Discretionary, and Industrials jumped in the month after he won the vote.

For sector breakdown, I’m using the more profitable benchmark of the S&P Small Cap 600 (S&P 600 companies must be profitable to be in the index, unlike Russell 2000 companies). Additionally, I’m including the S&P 500 large-cap performance for comparison.

Here are the top-performing small-cap sectors one month after Trump won in 2016:

- Small-cap Energy soared 28.5%, compared to 9% for large-caps

- Small-cap Financials ripped 26.2%, versus 18.4% for larger firms

- Small-cap Materials ramped 26.2%, while large-cap names gained 8.8%

- Small-cap Discretionary lifted 20.1%, versus 6.5% for large-caps

- Small-cap Industrials ripped 19.4%, against an 8.9% climb in large-caps

I’m highlighting these five sectors because this is the Trump Trade I remember… the small-cap revival was epic, to say the least.

I’m highlighting these five sectors because this is the Trump Trade I remember… the small-cap revival was epic, to say the least.

But here’s where it gets interesting for today’s environment…

The small-cap sector leadership the last few days echoes this Trump Trade to a T.

The rotation on everyone’s mind right now began on July 11 – right after the CPI printed a fresh low reading. Couple it with the surging odds that Trump can win in 2024, and the Trump Sector Trade is full steam ahead.

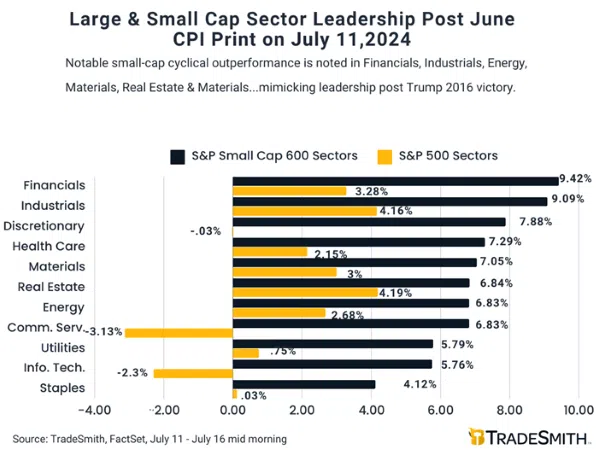

Check out the small-cap sector performance since July 11 versus large caps. The winning groups are notably similar to what worked back in November 2016.

From July 11 through mid-morning July 16, the top S&P Small Cap 600 sectors are:

- Financials, with a 9.42% rip

- Industrials, popping 9.09%

- Discretionary, surging 7.88%

- Health Care, ramping 7.29%

- And Materials, climbing 7.05%

And for good measure you can see the vast underperformance in large-cap Information Technology and Communication Services, each down 2.3% and 3.13%, respectively.

And for good measure you can see the vast underperformance in large-cap Information Technology and Communication Services, each down 2.3% and 3.13%, respectively.

Folks, when it comes to investing, it’s not about who’s gonna win or lose the election… it’s about following the money flows. That’s where the profits are found.

Small-caps are ramping daily as Trump Trade bets are shaping up…and based on what occurred in November 2016, there’s a lot of room for these winning sectors to go.

If you’re only focused on mega-cap tech, you could be setting yourself up for a lot of disappointment as prior unloved groups are awakening: Financials, Industrials, Discretionary, Materials… etc.

This essentially guarantees new single-stock leadership is here and now. Don’t wait for the mainstream financial media to tell you to reallocate to beaten-down small-caps. By the time it makes the headlines, the train has already left the station.

The Equalizer trade is here… please don’t miss it.

Regards,

Lucas Downey

Contributing Editor, TradeSmith Daily

He issued warnings for RNG before it crashed 89%, BYND before it crashed 90%, TDOC before it crashed 84%, and FVRR before it crashed 86%. Now, he's stepping forward to name the popular stock that could go down as one of the worst-performing tickers of the year. It could be the most dangerous stock of 2026. Click here for its name and ticker, 100% free.

Source: TradeSmith