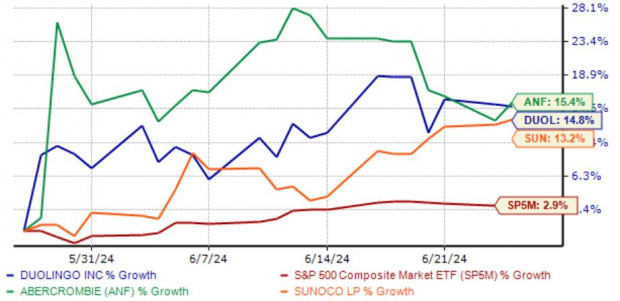

Relative strength focuses on stocks that have performed well compared to the market or another relevant benchmark.

By targeting those displaying outperformance, investors can participate in positive market momentum. Recently, several Zacks top-ranked stocks have shown precisely that.

Abercrombie & Fitch (ANF) , Sunoco (SUN) , and Duolingo (DUOL) have all enjoyed positive price action over the last month, as we can see illustrated below.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

But what’s driving the outperformance? Let’s take a closer look.

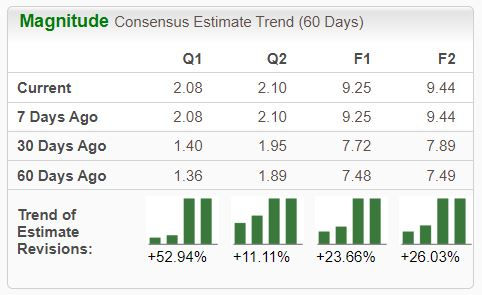

Abercrombie & Fitch Raises Outlook

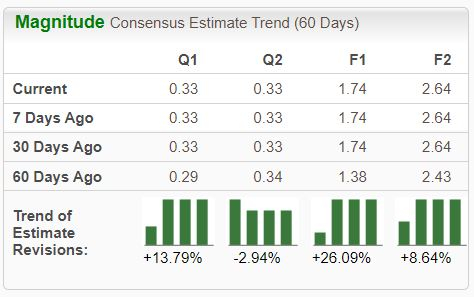

Abercrombie & Fitch, a current Zacks Rank #1 (Strong Buy), has enjoyed notably strong price action thanks to robust quarterly results. Over its last four releases, the apparel favorite has exceeded the Zacks Consensus EPS estimate by an impressive average of 210%.

Analysts have become bullish, raising their earnings expectations across the board.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

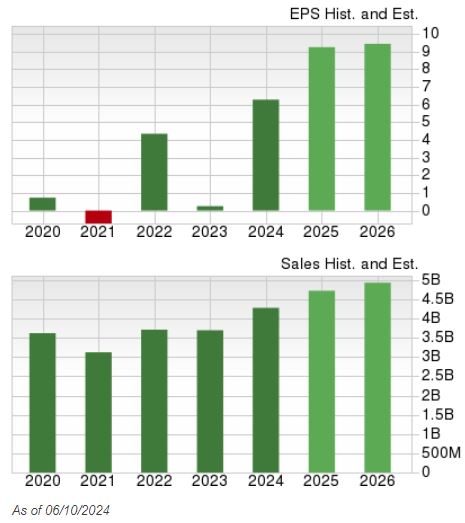

The company recently posted record Q1 sales of $1.0 billion, up 22% on a year-over-year basis thanks to continued brand momentum. Growth was broad-based across regions and brands, with Abercrombie brands showing a 31% improvement from the year-ago period.

ANF raised its full-year sales and operating margin outlook following the strong quarter, helping shares soar post-earnings. The company’s favorable growth outlook will likely continue pushing shares higher, with consensus expectations for its current fiscal year suggesting 48% EPS growth on 10% higher sales.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

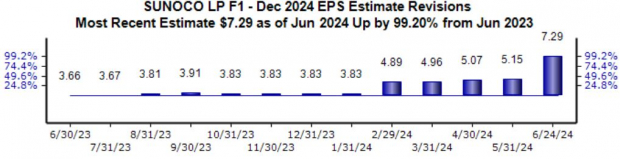

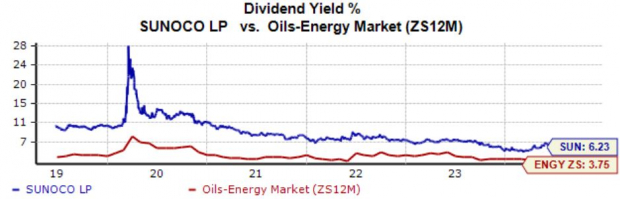

Sunoco Posts Record Q1 Net Income

Sunoco, a current Zacks Rank #1 (Strong Buy), has seen the revisions trend for its current fiscal year shift notably bullish, up 100% to $7.29 per share over the last year. As shown below, the current estimate jumped from the $5.15 per share expected near the beginning of June.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The company recently enjoyed a solid quarter, reporting record Q1 net income of $230 million and adjusted EBITDA of $242 million. The company upped its FY24 adjusted EBITDA guidance following the release, now including the impact of its acquisition of NuStar Energy.

In a shareholder-friendly move, it upped its quarterly dividend payout by 4%, which builds on the 2% increase it delivered last year. Energy companies like Sunoco commonly boast a shareholder-friendly nature thanks to their cash-generating abilities.

Shares currently yield a steep 6.2% annually, above the respective Zacks Oil – Energy sector average of 3.8%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

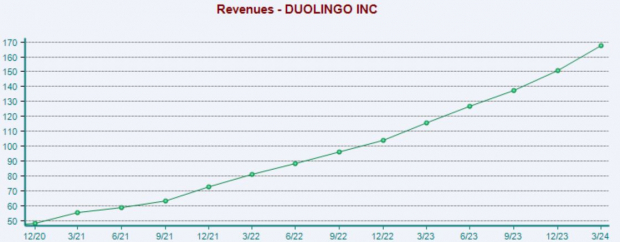

Duolingo Keeps Beating Expectations

Duolingo, a Zacks Rank #1 (Strong Buy), provides a mobile language learning platform. The company’s forecasted growth is robust, with consensus expectations for its current fiscal year alluding to 400% EPS growth paired with a 40% sales bump.

The company’s top line has remained visibly healthy, as seen in the quarterly chart below. The stock sports a Style Score of ‘A’ for Growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Shares faced pressure following the company’s latest quarterly results but have bounced back nicely, as the company’s earnings picture remains bullish overall. It’s also worth noting that all recent quarterly results have exceeded our consensus expectations, with DUOL beating top and bottom line estimates in each of its last ten releases.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Bottom Line

With relative strength, investors can insert themselves in positive market momentum with the wind at their backs.

And that’s exactly what all three stocks above – Abercrombie & Fitch (ANF) , Sunoco (SUN) , and Duolingo (DUOL) – have displayed over the last month.

In addition, all three sport a favorable Zacks Rank, with favorable revisions providing the fuel needed to continue climbing higher.

— Derek Lewis

Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Source: Zacks