If you don’t like these 8%, 9% and even 10%+ dividends, well, you’re not really an income investor.

That’s right. As I write, select closed-end funds (CEFs) yield 10.6%.

Ten. Point. Six. Per. Cent!

We contrarians are locking in yields up to nearly 11%. Here’s how, broken down in an 11-step playbook for these 8%, 9%, even 10.6% yields.

CEF Rule #1: Buy the Best

Fixed-income behemoth DoubleLine runs some well-known big mutual funds and ETFs as well as smaller, lesser-known CEFs. There’s a raging dividend party in the ignored CEF corner of DoubleLine’s portfolio, with yields up to 10.6% via DoubleLine Income Solutions Fund (DSL).

This is a no-brainer with “Bond God” Jeffrey Gundlach and his crew at the helm. Gundlach gets the first phone calls on special bond deals. We’ll take the insider advantage—with DoubleLine.

CEF Rule #2: Don’t Buy the “Bond Bear Forever” Narrative

The Federal Reserve’s recent rate hiking mission will bring a recession. And, as the economy slows, Jay Powell’s Fed will ease rates.

And rate-sensitive stocks—like dividend payers—will continue to rip higher.

Federal Reserve Bank of San Francisco President Mary Daly tipped the Fed’s hand during the October 2023 panic:

If financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.

Fed Vice Chair Philip Jefferson then backed up Daly, saying officials can now “proceed carefully” thanks to the recent rise in Treasury yields.

Fedspeak translation: The bond vigilantes did our dirty work for us by tightening monetary conditions. We don’t need to hike again.

No hikes indeed! Next up, cuts.

We knew it, and so did our boy Gundlach. In the midst of the mania last fall, he weighed in with simple advice:

His point: The 10-year rate is high. It won’t be this high for long. Take the deal and the generous distribution.

His point: The 10-year rate is high. It won’t be this high for long. Take the deal and the generous distribution.

Short-term T-Bills pay over 5%, their most generous payouts since 2007. That’s nice, but 10.6% is terrific!

CEF Rule #3: Check the Income Source

Sister fund DoubleLine Yield Opportunities (DLY) yields 9% today. Not bad either!

Nearly 80% of DLY is stashed in bonds that are either below investment grade, or not rated.

On one hand, this is where the best bargains are had! Pension funds can’t touch this stuff.

On the other hand, these second-hand bond bins must be sorted through by experts. Hence our requirement for Gundlach & Co. to verify the income sources powering this 9% yield.

Again, hire the best!

CEF Rule #4: Demand a Discount

DSL trades at a 0.5% premium to its NAV as I write.

DLY trades for a 3% discount to NAV.

Most vanilla investors know Treasury bonds. A select few know DSL. Basically, nobody knows DLY (“dilly”). Hence the markdown!

The herd’s “go to” ticker is the iShares 20+ Year Treasury Bond ETF (TLT). But TLT is an ETF, which means it always trades near par, or fair value. No fun for us deal seekers!

Given the choice between buying a fund for 97 cents on the dollar and a full $1, we contrarians will take the three cents in our pockets. Not to mention the extra 4.6% that DLY pays over TLT! As my nine-year-old basketball players would say, “that is the dilly (DLY) yo.”

CEF Rule #5: Count Your Dividends

We’ve held DSL in our Contrarian Income Report portfolio for years now. Sometimes it trades at a discount. Other times, it fetches a premium.

But either way it always pays—and monthly, to boot!

Yet newbie readers often ask why we are “down” on our DSL purchase. We are not. Our new friends forgot to count the dividends.

Since our April 1, 2016, purchase we’ve collected $13.84 in dividends.

Yup, the fund has already delivered us 81% of our purchase price in dividends. Plus, we still have our capital and should benefit from an upcoming rally (more on this later).

With a 10.6% yield today, DSL is poised to pay us back in less than eight years. At the end of that time, we’ll still own the fund. Plus the income stream. Now that’s an annuity we can retire on.

CEF Rule #6: Project Your Dividends

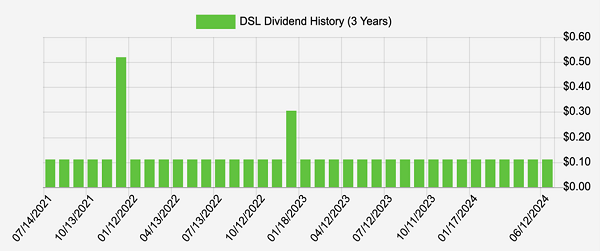

I use our unique in-house tool Income Calendar to track and project the dividend payments for our CIR Portfolio. With IC I can easily see that DSL delivers the goods month after month after month:

The spikes, by the way, are special (extra!) dividends. Many online data sources omit those.

The spikes, by the way, are special (extra!) dividends. Many online data sources omit those.

CEF Rule #7: Mind Your Leverage

DLY is the “conservative sister,” using only 20% leverage. This is on the lower end for a CEF.

With the cost of money high, we’ve been anti-leverage lately. We want bond funds that are less susceptible to “higher for longer” short-term rates.

Another reason to love DLY!

CEF Rule #8: Choose Bonds or Stocks

Income investors tend to fall in love with bonds at exactly the wrong moments. Back in April 2020, Treasuries were safe while stocks were uncertain. The herd clamored for bonds and shunned equities at exactly the wrong moment.

Fast-forward to today, and we have the opposite setup. Investors want nothing to do with bonds.

We contrarians make our living fading the vanilla types. We’ll take bonds over stocks today.

CEF Rule #9: Diversify

Eaton Vance Tax-Managed Diversified Equity Income (ETY) and Eaton Vance Tax-Managed Global Diversified Equity Income (EXG) are two stock-focused CEFs run by the same guys. Each fund’s top holding?

Microsoft (MSFT).

Now, I like MSFT. CEO Santya Nadella smartly invested in ChatGPT during its infancy. Nadella has grown the dividend 168% over the past decade. He’s our kind of guy.

Just know that if you buy ETY and EXG, you own MSFT twice. Which isn’t necessary. Which is why we always read the labels on our CEFs.

CEF Rule #10: Beware of Pretenders

Years ago, we had a 15-month fling with a promising fund. It traded at a generous discount to its net asset value (NAV) and paid a double-digit dividend.

Brookfield Real Assets Income Fund (RA) checked all the boxes. Unfortunately, it failed the all-important “cash-flow smell test.”

RA’s NAV was declining. Not a good sign given the nebulous nature of its holdings.

The “realness” of RA ends with its name. More than half the portfolio is securitized real estate credit.

And actual infrastructure? The “real assets” buyers think they are snaring? Just 30% of its holdings!

Even in 2018, shortly after the fund launched, it was apparent to us second-level thinkers that RA’s dividend was a mirage. The payout would eventually be cut. We were out.

The fund continued to pay its usual monthly dividend for nearly five more years. The payout defied gravity, but really, management was dishing dividends from capital! They continually tapped the piggybank of NAV to keep the monthly dole rolling.

Ultimately the levitating dividend came crashing down. In August, RA announced a 41% payout cut. Of course the fund cratered! Since inception, it’s returned only 4.8% per year. Not enough.

Beware pretenders in CEFland—there are many of them!

CEF Rule #11: Choose Monthly Payments

Do we want to be paid this month, or 90 days from now?

No brainer, right? Show us the money this month and every month.

Monthly dividends are easy to secure with many CEFs. When there’s a choice, we’ll select the monthly option.

Monthly dividends are easy to secure with many CEFs. When there’s a choice, we’ll select the monthly option.

— Brett Owens

Sponsored Link: My favorite monthly dividends to buy today all pay 8% or more annually. Please click here to receive my full monthly dividend research on a risk-free basis.

Source: Contrarian Outlook