Some of our favorite high-yield dividends just did something stunning: They sent their investors’ payouts soaring—in some cases by more than 30% overnight.

All of these high-paying dividend growers are municipal bond funds, a corner of the market many folks see as boring—if they know about it at all.

I don’t know what’s “boring” about a payout that leaps double-digits in one go—and hands us a 7%+ tax-free dividend, to boot!

That’s exactly what’s happened at a slew of “muni” focused closed-end funds (CEFs) in the last month or so. (Municipal bonds are issued by state and local governments to fund infrastructure projects). At the top of the list are those from leading muni-bond CEF manager Nuveen.

For example, the Nuveen AMT-Free Quality Municipal Bond Fund (NEA), a holding in my Contrarian Income Report service, just hiked its payout 37%, driving its yield up to a stout 7.7%.

That’s an earthquake in Muni-Bond Land, where we’re used to seeing yields in the “mid-fives.” That, of course, is before the fund’s tax advantage comes into play.

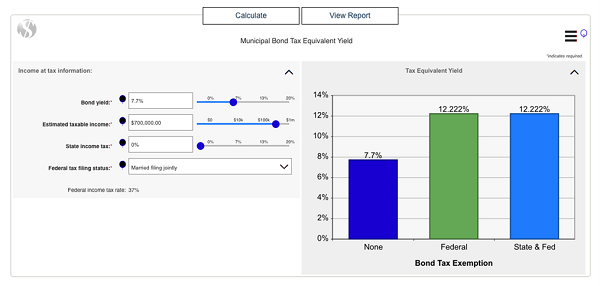

With the big jump in yield we’ve seen at NEA and friends, those yields are now in the double digits for those in the top tax bracket:

Source: Raymond James taxable-equivalent yield calculator

Source: Raymond James taxable-equivalent yield calculator

A 12.2% taxable-equivalent yield. Twelve. Point. Two. Percent!

This is what I point to when folks ask why they shouldn’t just grab the “safe” 5% yield available in money-market funds now. With munis (which regularly move counter to stocks, giving our portfolios a bit of extra ballast), we can easily top that.

Heck, depending on your tax bracket, you may be able to double it!

That stability and high (tax-free) income is why we hold NEA and its “cousins,” the Nuveen Quality Municipal Income Fund (NAD) and Nuveen Municipal Credit Income Fund (NZF), in Contrarian Income Report.

(Well-connected Nuveen is our go-to manager when it comes to munis, as the firm often gets the first call when new issues roll out—something ETFs can’t match.)

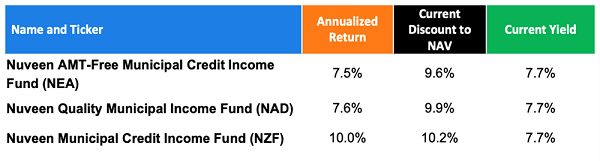

This trio has done just what we asked them to, “returning their yields” and then some since we bought. Our first pickup was NZF in April 2023, when it yielded 4.3%. We followed up with NAD and NEA in October 2023, when they yielded 5.8% each.

Here’s where things stand today:

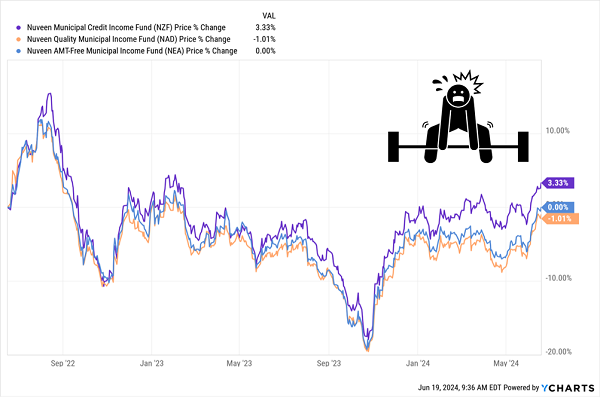

This, by the way, reminds me of something: When looking at the performance of CEFs like these, make sure you’re looking at total-return and not price-only charts (the latter of which you get from free screeners like Yahoo! Finance and Google Finance).

This, by the way, reminds me of something: When looking at the performance of CEFs like these, make sure you’re looking at total-return and not price-only charts (the latter of which you get from free screeners like Yahoo! Finance and Google Finance).

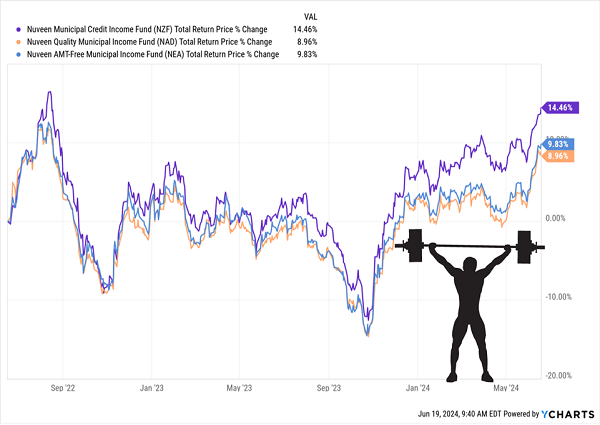

That’s because their big dividends make all the difference here, something you can’t see when you look at price alone:

Price-Only Charts Make Muni Funds Look Wimpy …

… Until You Add Their Dividends!

… Until You Add Their Dividends!

And remember, this is before the tax break, so your personal return would likely be higher!

And remember, this is before the tax break, so your personal return would likely be higher!

CEF Discounts, Unsuspecting Fed Will Drive Future Gains

But that’s the past. What can we expect from our muni-bond CEFs from here? Well, we’ve got two things working in our favor:

- Our CEFs’ discounts to net asset value (NAV, or the value of their underlying portfolios), and …

- The Federal Reserve (even if Powell & Co. don’t realize it yet!)

Let’s take those discounts first.

CEFs, unlike ETFs and mutual funds, tend to have more or less fixed share counts for their entire lives. As a result, they often trade at different levels in relation to NAV—and often at discounts.

That’s certainly the case with our three muni-bond plays, whose discounts all sit right around the 10% mark as I write this—so we’re essentially buying for 90 cents on the dollar!

It gets better—and this is where the Fed comes in.

Don’t buy the central bank’s caution on rate cuts—this economy is slowing down. And the longer the Fed denies it, the faster it’ll be forced to cut when the (inevitable) recession comes.

That’s great for bonds (including munis)—and one of the reasons why we contrarian income investors favor them over stocks these days.

Retail sales rose just 0.1% in May. And April’s numbers were revised down to a 0.2% contraction from the flat reading we got a month ago. So even though Jay Powell & Co. forecast just one rate cut at their last rate decision, expect them to change their tune.

Even if they don’t, that’s fine. After all, the longer the Fed holds, the faster rates will fall!

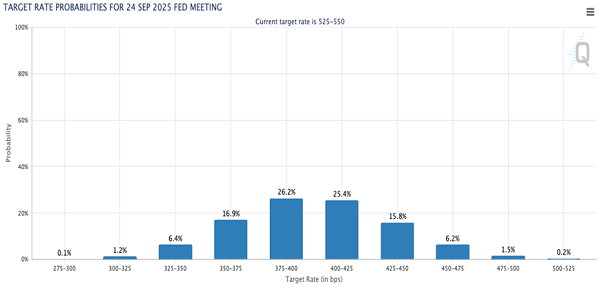

As we discussed last week, futures traders are already calling BS on Jay, forecasting at least two rate cuts by the end of the year—and now at least six “quarter pointers” by September 2025, as of this writing:

Source: CME Group

Source: CME Group

As rates fall, bonds will rally—it’s just the way it works with bonds! That’ll be a tailwind for all bond CEFs.

There’s only one thing that’s keeping me from pounding the table on this trio today: Following their big payout hikes, all three have rallied hard. You can see that on the right side of the chart we looked at a second ago, showing our three muni-bond funds’ total returns (including reinvested dividends).

I still expect this trio to provide the price stability we need to collect their dividends in peace going forward. But if you want to add more price upside to that return (and we do!), hold out just a bit longer and be ready to buy these high yielding—and freshly hiked—payouts on the next dip.

— Brett Owens

Hold Off on Munis for Now—But Grab These Cheap 9.3% Payers Right Away [sponsor]

Kevin Wallen here. I’m the publisher of Brett’s Contrarian Income Report service.

Great news! We don’t have to wait around for our top 3 muni-bond CEFs to go through a pullback. Because Michael Foster, our resident expert on CEFs, is pounding the table on 4 other urgent buys kicking out big—and monthly—dividends right now.

These 4 CEFs boast 9.3% average dividends, and Michael is calling for 20%+ price upside in the next 12 months. We can thank these funds’ outsized (and completely unsustainable) discounts for that.

Source: Contrarian Outlook