We recently started a series called “Penny Stock of the Day”. These ideas are geared towards traders with an extremely high risk appetite.

Our Penny Stock of the Day is chosen by screening for stocks under $5 and then applying technical analysis on the shortlisted set of penny stocks showing unusual volume. When making these trades, please make sure to pay vigilant attention to pricing moves and have a strict stop loss in place to avoid significant losses.

Penny Stock of the Day: Scilex Holding Company (NASDAQ: SCLX)

Today’s penny stock pick is the drug manufacturing company, Scilex Holding Company (NASDAQ: SCLX).

Scilex Holding Company focuses on acquiring, developing, and commercializing non-opioid pain management products for the treatment of acute and chronic pain. Its commercial products include ZTlido (lidocaine topical system) 1.8% (ZTlido), a prescription lidocaine topical product for the relief of neuropathic pain associated with postherpetic neuralgia (PHN), which is a form of post-shingles nerve pain; ELYXYB, a ready-to-use oral solution for the acute treatment of migraine with or without aura in adults; and GLOPERBA, a liquid oral version of the anti-gout medicine colchicine indicated for the prophylaxis of painful gout flares in adults.

The company is also developing three product candidates, including SP-102 (10 mg dexamethasone sodium phosphate viscous gel) (SEMDEXA), a novel viscous gel formulation of a used corticosteroid for epidural injections, which has completed a Phase 3 study to treat lumbosacral radicular pain or sciatica; SP-103 (lidocaine topical system) 5.4% (SP-103), a formulation of ZTlido for the treatment of chronic neck pain and low back pain (LBP) that has completed a Phase 2 trial; and SP-104 (4.5 mg low-dose naltrexone hydrochloride delayed-release capsules) (SP-104), a novel low-dose delayed-release naltrexone hydrochloride, which has completed Phase 1 trials for the treatment of fibromyalgia.

Website: https://www.scilexholding.com

Latest 10-k report: https://scilexholding.gcs-web.com/static-files/b7ef5832-b6e0-422f-a494-885eb09bac40

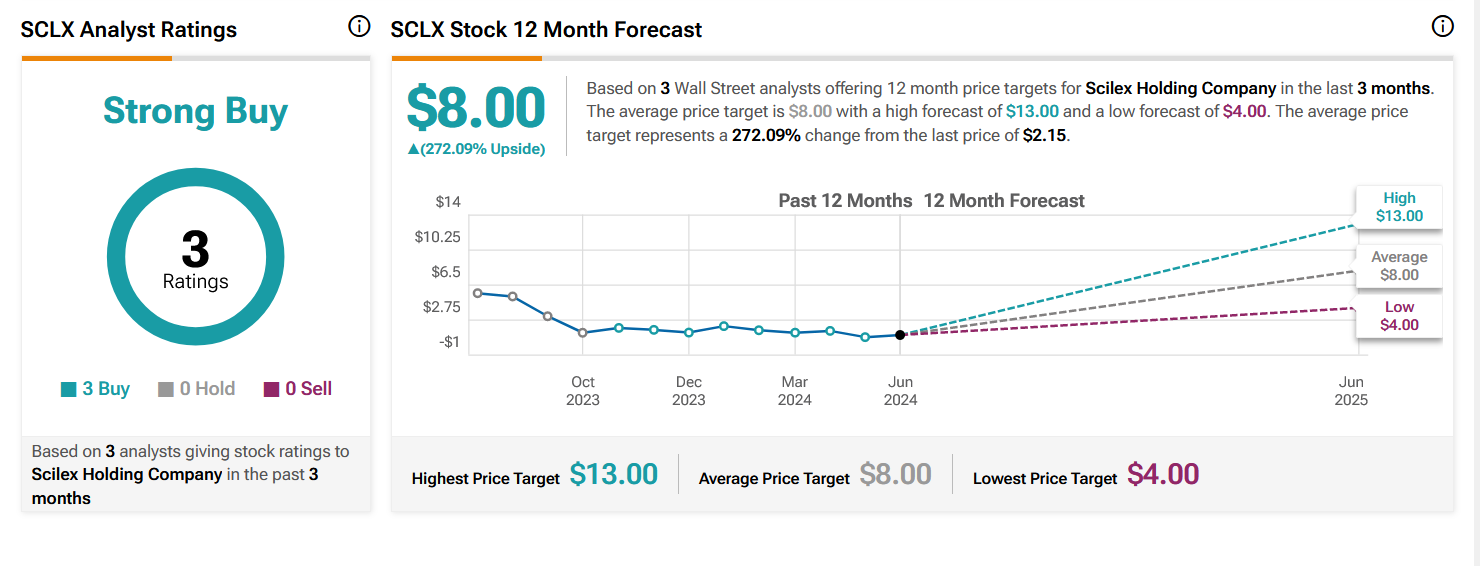

Analyst Consensus: As per TipRanks Analytics, based on 3 Wall Street analysts offering 12-month price targets for SCLX in the last 3 months, the stock has an average price target of $8.00, which is nearly 272% upside from current levels.

Potential Catalysts / Reasons for the Hype:

- The U.S. FDA approved the sNDA for commercial manufacturing of Gloperba®.

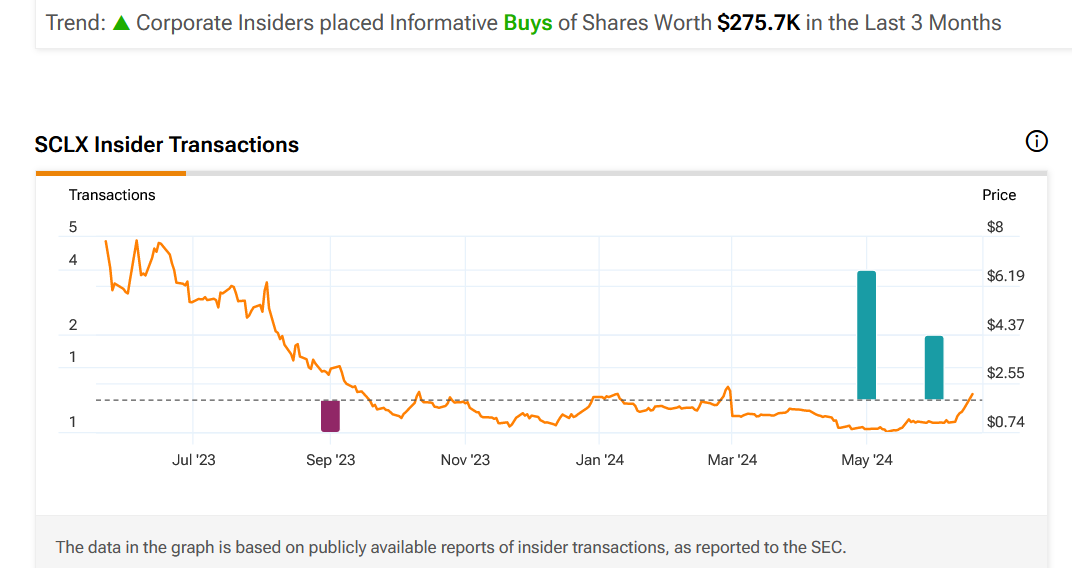

- Corporate Insiders placed Informative Buys of Shares Worth $275.7K in the Last 3 Months.

On analyzing the company’s stock charts, there seem to be multiple bullish indications…

Bullish Indications

#1 Consolidation Area: The daily chart shows that the stock has been consolidating within a price range over the past several days. This is marked as a purple color rectangle in the daily chart. Whenever a stock breaks out of the consolidation area, it could surge higher.

#2 Bullish ADX and DI: The ADX indicator shows bullishness as the +DI line is above the -DI line, and the ADX line is currently moving higher from below the +DI and -DI lines.

#3 Price above MAs: The stock is currently above its 50-day as well as 200-day SMA, indicating that the bulls have currently gained control.

#4 MACD above Signal Line: In the daily chart, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

#5 Above Support Area: The weekly chart shows that the stock is currently trading above a support area, which is marked as a pink color dotted line. This looks like a good area for the stock to move higher. The stock is also trading above its 50-week SMA, indicating that the bulls are gaining control.

#6 Bullish Stoch: The %K line is above the %D line of the stochastic in the weekly chart, indicating possible bullishness.

#7 MACD above Signal Line: In the weekly chart as well, the MACD (light blue color) is currently above the MACD signal line (orange color). This indicates a possible bullish setup.

Recommended Trade (based on the charts)

Buy Levels: If you want to get in on this trade, the ideal buy level for SCLX is above the price of $2.25.

Target Prices: Our first target is $3.50. If it closes above that level, the second target price is $4.50.

Stop Loss: To limit risk, place a stop loss at $1.50. Note that the stop loss is on a closing basis.

Our target potential upside is 56% to 100%.

For a risk of $0.75, our first target reward is $1.25, and the second target reward is $2.25. This is a nearly 1:2 and 1:3 risk-reward trade.

In other words, this trade offers 2x to 3x more potential upside than downside.

Potential Risks / Red Flags:

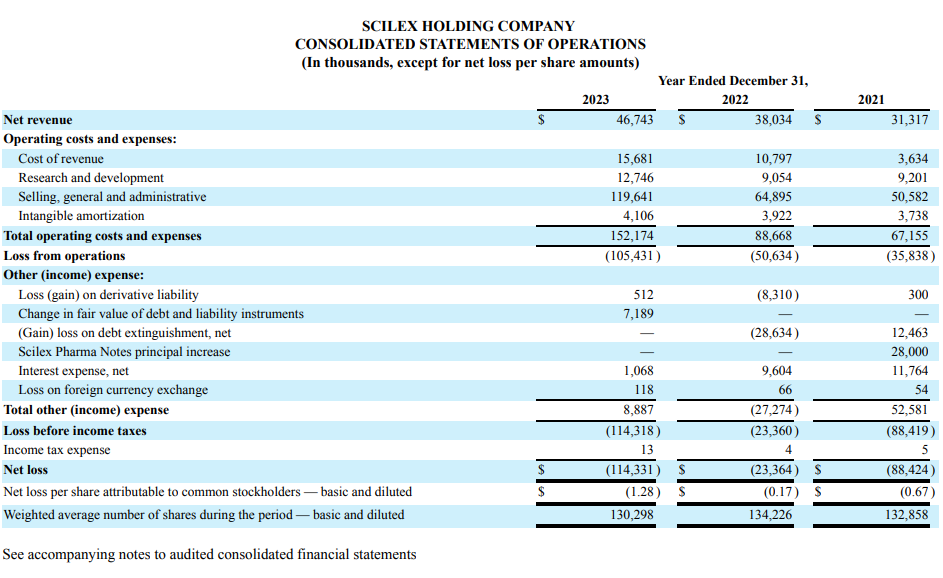

- The company has a history of net losses. SCLX reported net losses of $114.3 million, $23.4 million, and $88.4 million for the years ended December 31, 2023, 2022, and 2021, respectively.

- The company has ongoing legal proceedings. This includes Sanofi-Aventis U.S. LLC and Hisamitsu America, Inc. Litigation; ZTlido Patent Litigation; GLOPERBA Patent Litigation; and a lawsuit by Scilex Pharma and Sorrento.

- The company has a limited operating history. It makes any assessment of its future success and viability subject to significant uncertainty.

- The biotechnology and pharmaceutical industries are characterized by intense competition and rapid technological advances. If the company’s competitors succeed in obtaining patent protection, receiving FDA approval, or discovering, developing, and commercializing medicines before SCLX, it would have a material adverse impact on the company’s business, financial condition, and results of operations.

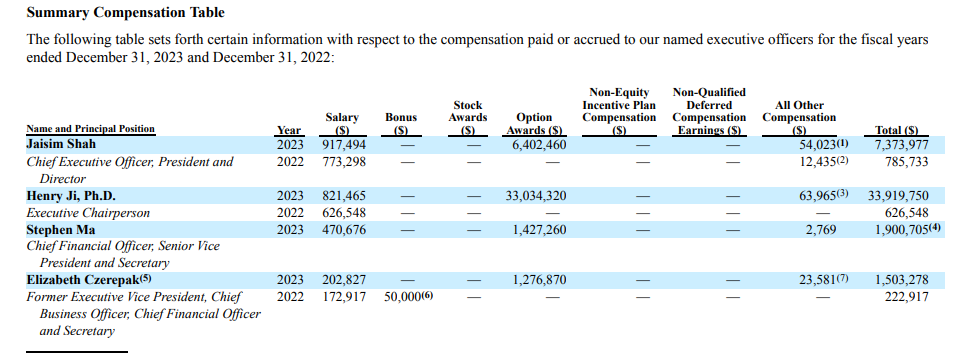

- Despite being a loss-making company, the executives are being paid significant competition.

As you can see, today’s featured penny stock offers big upside potential… but it also comes with a number of risks and red flags. As always, when dealing with penny stocks, we advise caution before entering into such high-risk ventures. Remember to think before you trade… understand the risks… and if you decide to trade, stick to your stop-losses!

Happy Trading!

Trades of the Day Research Team

READ BEFORE TRADING PENNY STOCKS: The allure of penny stocks lies in their potential to deliver massive gains in a short period of time. However, in exchange for that opportunity, most penny stocks carry tremendous risk. They can be extremely volatile and are susceptible to “pump and dump” schemes and fraud.

Unlike regular stocks, the financial condition of most penny stock companies can be extremely difficult to analyze, as the majority of such stocks are traded on over-the-counter (OTC) exchanges, which are typically less transparent and less regulated than the major exchanges. In fact, in the penny stock space, it’s often easier to spot warning signs and red flags than it is to identify a sound investment. Nevertheless, we do our best to identify short-term trade opportunities in this exciting space because we know some of our readers are looking for high-risk, high-reward ideas. We just urge you to make sure you fully understand the risks before making any of these trades.

While Nvidia makes all the headlines, this little-known company is already beginning to surpass Nvidia's stock gains this year as data center growth surges. I believe this stock could soar in the next 12-24 months, potentially leaving Nvidia in the dust. I want to give you the name, ticker and my full analysis today – because I know you certainly won't hear about this stock in the mainstream financial media. Click here to get all the details...

Source: Trades of the Day