Value Stocks With Low Debt & Strong Growth

In this video, Chuck Carnevale, Co-Founder of FAST Graphs, a.k.a. Mr. Valuation will go over 10 value stocks with low debt and strong growth with very consistent operating histories over time, but best of all, they are in value today.

One of the problems we are facing as a value investor is an extremely high stock market, and an aberrantly long running bull market. It’s one of the longest in recorded history. Ultimately all bull markets end with a bear market. Of course, all bear markets end in a bull market.

One of the problems we are facing as a value investor is an extremely high stock market, and an aberrantly long running bull market. It’s one of the longest in recorded history. Ultimately all bull markets end with a bear market. Of course, all bear markets end in a bull market.

The really good news is, bear markets tend to be short lived, while bull markets tend to live a lot longer, but this one has pushed that even to the extreme. So what we are looking is for value and consistent growth. Today we are going to review 10 Value Stocks With Low Debt & Strong Growth

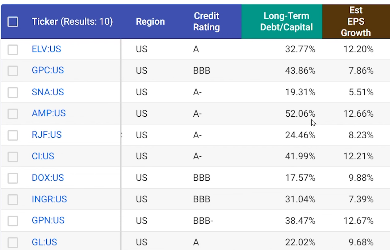

In this video Chuck will review Elevance Health (ELV), Ameriprise Financial (AMP), cigna Group (CI), Amdocs (DOX), Globe Life (GL), Genuine Parts (GPC), Global Payments (GPN), Ingredion (INGR), Raymond James Financial (RJF), Snap On (SNA).

FAST Graphs Analyze Out Loud Video

— Chuck Carnevale

Everyone wants to know when to buy, sell, or hold a stock. FAST Graphs reveals this by clearly illustrating the value of the business relative to its stock price. Get 25% off using Daily Trade Alert's special referral link and coupon code AFFILIATE25

Source: FAST Graphs