Saving money is important.

If you spend all of your money, it’ll be impossible to build wealth.

Underspending income creates available capital.

But that capital can’t just sit in a bank account.

It must be invested, at which time it benefits from the all-powerful nature of compounding.

Compounding involves exponential growth.

Compounding involves exponential growth.

Instead of earning interest in a bank account, compounding is interest on interest.

Albert Einstein called compound interest the “eighth wonder of the world” – and rightfully so!

Now, there are plenty of different ways to invest and enjoy compounding.

But dividend growth investing might just be the best way of all.

This is a long-term investment strategy which involves buying and then holding shares in world-class enterprises that pay consistent, growing cash dividends to shareholders.

Hundreds of these businesses can be found by looking over the Dividend Champions, Contenders, and Challengers list.

This list has invaluable information on US-listed stocks that have raised dividends each year for at least the last five consecutive years.

I’ve used this strategy to great effect for more than a decade now, allowing it to guide me as I’ve gone about building my FIRE Fund.

That’s my real-life, real-money portfolio, and it generates enough five-figure passive dividend income for me to live off of.

I’ve actually been fortunate enough to live off of dividend income ever since I decided to retire in my early 30s.

How was I able to retire so early?

How was I able to retire so early?

My Early Retirement Blueprint lays it out.

While using the right strategy and investing in the right businesses can take you very far, investing at the right valuations can unlock even more success.

That’s because price only represents what you pay, but it’s value that you ultimately get.

An undervalued dividend growth stock should provide a higher yield, greater long-term total return potential, and reduced risk.

This is relative to what the same stock might otherwise provide if it were fairly valued or overvalued.

Price and yield are inversely correlated. All else equal, a lower price will result in a higher yield.

That higher yield correlates to greater long-term total return potential.

This is because total return is simply the total income earned from an investment – capital gain plus investment income – over a period of time.

Prospective investment income is boosted by the higher yield.

But capital gain is also given a possible boost via the “upside” between a lower price paid and higher estimated intrinsic value.

And that’s on top of whatever capital gain would ordinarily come about as a quality company naturally becomes worth more over time.

These dynamics should reduce risk.

These dynamics should reduce risk.

Undervaluation introduces a margin of safety.

This is a “buffer” that protects the investor against unforeseen issues that could detrimentally lessen a company’s fair value.

It’s protection against the possible downside.

Saving your money, creating capital, and using that capital to acquire high-quality dividend growth stocks at discounts can lead to immense financial success over time.

Of course, knowing what undervaluation looks like can be a challenge to the uninitiated.

Fortunately, Lesson 11: Valuation is here to help.

Put together by fellow contributor Dave Van Knapp, it provides a step-by-step valuation process that can be used to estimate the fair value of almost any dividend growth stock you’ll run across.

With all of this in mind, let’s take a look at a high-quality dividend growth stock that appears to be undervalued right now…

United Parcel Service, Inc. (UPS)

United Parcel Service, Inc. (UPS)

United Parcel Service, Inc. (UPS) is a global parcel delivery and supply chain management company.

Founded in 1907, United Parcel Service (hereafter referred to as UPS) is now a $118 billion (by market cap) package delivery monster that employs more than 500,000 people.

The company reports results across three segments: U.S. Domestic, 66% of FY 2023 revenue; International, 20%; and Supply Chain Solutions, 14%.

UPS is the world’s largest package delivery company.

The company has a footprint across 120 countries, and it uses over 500 planes and over 100,000 vehicles to deliver 20+ million packages and documents to residences and businesses every single day.

We have a simple business model here.

UPS is in the business of moving stuff from one point to another.

The long-term investment thesis is also simple, and it’s one with two key tailwinds.

First, there’s a consumption story playing out.

The world is full of consumers, and these consumers are both growing in number and increasingly consuming more stuff.

That’s because the global population is rising while simultaneously becoming wealthier (on average).

More people with more money naturally leads to more consumption, and all of that leads to more stuff needing to be moved around.

Second, there’s the e-commerce story.

The meteoric rise of e-commerce over the last decade or so has created much more demand for point-to-point shipping.

Put simply, more goods are being shipped directly to consumers (rather than to centralized stores) as a result of online purchases.

This creates more one-on-one volume, as well as more need for a scaled-up logistics player that can handle the loads.

That’s exactly where UPS – again, the world’s largest package delivery company – comes in.

In a world where more packages are needing to be moved in absolute volume terms, as well as the fact that specific point-to-point logistics are becoming increasingly used, UPS almost can’t help but to see its revenue, profit, and dividend grow over the coming years.

Dividend Growth, Growth Rate, Payout Ratio and Yield

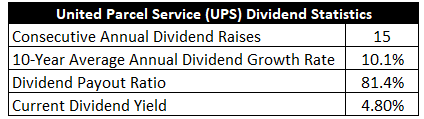

Already, UPS has increased its dividend for 15 consecutive years.

And I see a clear path toward future Dividend Aristocracy for UPS, as it’s hard to imagine UPS having any troubles with growth or dividend coverage over the next 10 years.

The 10-year dividend growth rate is 10.1%, although the dividend growth has been surprisingly lumpy – a noticeable surge during the pandemic (which fueled more e-commerce sales) followed by a material deceleration in growth over the last two years.

For instance, the most recent dividend raise was less than 1%.

Averaging things out over time, I do think UPS is going to grow its dividend at a high-single-digit rate (and I’ll show why), but it might not be extremely smooth from one year to the next.

Along with that dividend growth, the stock yields a market-smashing 4.8%.

Along with that dividend growth, the stock yields a market-smashing 4.8%.

That’s REIT-like yield on a world-class logistics business, which is highly unusual.

To put this unusualness in perspective, this yield is 190 basis points higher than its own five-year average.

Outside of short-term market crashes, this is the highest yield I’ve ever seen on the stock.

On the other hand, the payout ratio is also somewhat elevated.

Based on TTM adjusted EPS, it’s sitting at 81.4%.

Using TTM GAAP EPS, it’s nearly 100%.

What happened here is, UPS raised its dividend by 49% back in early 2022 when the world was still a bit crazy.

This speaks on the lumpiness I just mentioned.

If we could go back in time, I’m sure management would like to rectify this and hand out a more reasonable dividend raise for 2022, but it’s already “locked in” now.

Because of the high payout ratio, and because the business is still normalizing after an explosive period, I wouldn’t expect much in the way of dividend growth over the next few years.

But, again, for long-term investors, I do believe UPS can get back to its high-single-digit dividend growth ways in time.

Kicking that off with a near-5% yield, which beats what a lot of slow-growth utilities offer, seems like a fantastic setup.

Revenue and Earnings Growth

As fantastic as this may look, though, some of these dividend metrics are looking into the past.

However, investors must always be looking out into the future, as the capital of today gets put on the line and risked for the rewards of tomorrow.

That’s why I’ll now build out a forward-looking growth trajectory for the business, which will come in handy when the time comes to estimate fair value.

I’ll first show you what the business has done over the last decade in terms of its top-line and bottom-line growth.

I’ll then reveal a professional prognostication for near-term profit growth.

Blending the proven past with a future forecast in this way should give us the information we need to roughly gauge where the business may be going from here.

UPS advanced its revenue from $58.2 billion in FY 2014 to $91 billion in FY 2023.

That’s a compound annual growth rate of 5.1%.

I’m usually looking for a low-single-digit top-line growth rate from a mature business like UPS, and it delivered (pun not intended).

Meanwhile, earnings per share grew from $3.28 to $7.80 over this period, which is a CAGR of 10.1%.

Very nice.

A combination of buybacks and profitability improvement helped to drive excess bottom-line growth.

The outstanding share count has been reduced by approximately 7% over this period.

We can also see how perfectly EPS growth lines up with dividend growth over the last decade – both growth rates are exactly the same.

Although EPS growth was anything but linear, the general trend is nicely upward.

Looking forward, CFRA believes that UPS will produce an 11% CAGR in its EPS over the next three years.

That would be a slight acceleration off of the 10-year tend, but it would also represent a pretty substantial move higher relative to the last two years.

I think investors would be wise to basically just forget FY 2021 and FY 2022.

These two years, which both resulted in massive boosts to EPS, were fueled by a one-time global event that played right into the hands of UPS and its e-commerce delivery capabilities.

And now that the world is getting back to normal, UPS ends up being “collateral damage” in the sense that its volumes and EPS are winding down into regular ranges.

That large 2022 dividend raise is the pandemic hangover that UPS will have to digest over the next few years via modest dividend raises to shareholders.

Getting back to the go-forward picture, CFRA highlights automation and cost efforts as mitigating factors to higher labor costs (unions won big concessions from UPS on pay in the summer of 2023).

CFRA also notes the fact that UPS recently won a large air cargo contract from the United Stated Postal Service, which CFRA believes “…probably boosts revenues in the low-single digits for UPS.”

After a transition period, UPS will become the USPS’s primary air cargo provider.

This should move the needle.

Otherwise, CFRA seems to see a slow-going FY 2024 before UPS gets fully back to normal somewhere around FY 2025.

I concur with this.

As I noted a few times now, I think the next year or two will be unexciting.

But UPS remains a global juggernaut.

It’s simply finding its footing after processing change.

While the 11% EPS CAGR may be, in my view, on the optimistic side of things, anything close to this level would be a very nice outcome for shareholders.

And that would allow the payout ratio to compress (via a combination of higher EPS growth and lower dividend growth) over the near term, setting up UPS for EPS-like dividend growth once we get past FY 2026 or so.

That’s plenty of growth to pair with the near-5% yield.

Financial Position

Moving over to the balance sheet, UPS has a good financial position.

The long-term debt/equity ratio is 1.1, while the interest coverage ratio is over 10.

I don’t have any major qualms with UPS’s balance sheet, but these numbers are not especially impressive or comforting.

Then again, the company finished last fiscal year with nearly $19 billion in long-term debt, which isn’t overly egregious for a company with this kind of market cap.

Profitability is robust.

Return on equity has averaged 87.7% over the last five years, while net margin has averaged 8%.

ROE has been juiced by the balance sheet, but even ROIC is routinely coming in at over 20%.

I’ll also note that there’s been a steady improvement in profitability, with net margin expanding from the 5% area at the start of the last decade.

UPS is a great business with multiple tailwinds gusting its way.

And with economies of scale, a massive global network, and barriers to entry, the company does benefit from durable competitive advantages.

Of course, there are risks to consider.

Regulation, litigation, and competition are omnipresent risks in every industry.

UPS is facing a two-pronged risk in the form of customers becoming competitors; for example, Amazon.com, Inc. (AMZN), which accounts for 10%+ of UPS’s revenue, is building out its own delivery network and slowly becoming more independent in regard to logistics – cutting UPS’s revenue while simultaneously increasing competitive pressures.

UPS is exposed to economic cyclicality and macroeconomic issues, as a recession would almost certainly reduce demand for goods and shipping volumes.

The global supply chain is currently in a state of flux.

Input costs (such as fuel) are volatile, and labor costs are currently significantly elevated compared to historical norms.

UPS’s workforce is heavily unionized.

UPS has had difficulty with sourcing labor, especially drivers.

Being a global enterprise, the company is exposed to geopolitics and currency exchange rates.

There are a number of risks to consider, particularly as it relates to competition.

But with the stock down 40% from all-time highs, the valuation also needs to be considered…

Valuation

The P/E ratio, using adjusted TTM EPS, is 17.1.

In this market, that is shockingly low.

Even when using GAAP TTM EPS, the P/E ratio is below 20.

The P/CF ratio of 10.6 is low and compares favorably to its own five-year average of 11.8.

The sales multiple of 1.3 is also below its own five-year average of 1.5.

And the yield, as noted earlier, is substantially higher than its own recent historical average.

So the stock looks cheap when looking at basic valuation metrics. But how cheap might it be? What would a rational estimate of intrinsic value look like?

I valued shares using a dividend discount model analysis.

I factored in a 10% discount rate and a long-term dividend growth rate of 6%.

As I pointed out a number of times, UPS does appear to be fully capable of getting back to high-single-digit dividend growth over the coming years.

However, as I also discussed, I think the next few years will be very modest.

In short, that huge dividend increase in 2022 pulled forward a lot of future dividend growth, which is being felt and rectified right now.

Averaging things out, accounting for the next few years, assuming a decent acceleration past FY 2025, I see a 6% long-term dividend growth expectation as a reasonable one, especially seeing as how UPS is quite large/mature and facing a customer-to-competition threat.

The DDM analysis gives me a fair value of $172.78.

The reason I use a dividend discount model analysis is because a business is ultimately equal to the sum of all the future cash flow it can provide.

The DDM analysis is a tailored version of the discounted cash flow model analysis, as it simply substitutes dividends and dividend growth for cash flow and growth.

It then discounts those future dividends back to the present day, to account for the time value of money since a dollar tomorrow is not worth the same amount as a dollar today.

I find it to be a fairly accurate way to value dividend growth stocks.

I think I put together a pretty sensible valuation model, yet the stock still comes out appearing cheap.

But we’ll now compare that valuation with where two professional stock analysis firms have come out at.

This adds balance, depth, and perspective to our conclusion.

Morningstar, a leading and well-respected stock analysis firm, rates stocks on a 5-star system.

1 star would mean a stock is substantially overvalued; 5 stars would mean a stock is substantially undervalued. 3 stars would indicate roughly fair value.

Morningstar rates UPS as a 4-star stock, with a fair value estimate of $158.00.

CFRA is another professional analysis firm, and I like to compare my valuation opinion to theirs to see if I’m out of line.

They similarly rate stocks on a 1-5 star scale, with 1 star meaning a stock is a strong sell and 5 stars meaning a stock is a strong buy. 3 stars is a hold.

CFRA rates UPS as a 3-star “HOLD”, with a 12-month target price of $149.00.

I came out on the high end, but we all see attractiveness. Averaging the three numbers out gives us a final valuation of $159.93, which would indicate the stock is possibly 15% undervalued.

Bottom line: United Parcel Service, Inc. (UPS) is a world-class logistics business that is perfectly situated for the secular growth story in e-commerce and what that means for direct shipping. Although competitive pressures are rising, UPS has massive scale that’s been building up for more than a century. With a market-smashing yield, double-digit dividend growth, a sustainable payout ratio, 15 consecutive years of dividend increases, and the potential that shares are 15% undervalued, long-term dividend growth investors looking for a high yield with a growth kicker should have their eyes trained on this name.

Bottom line: United Parcel Service, Inc. (UPS) is a world-class logistics business that is perfectly situated for the secular growth story in e-commerce and what that means for direct shipping. Although competitive pressures are rising, UPS has massive scale that’s been building up for more than a century. With a market-smashing yield, double-digit dividend growth, a sustainable payout ratio, 15 consecutive years of dividend increases, and the potential that shares are 15% undervalued, long-term dividend growth investors looking for a high yield with a growth kicker should have their eyes trained on this name.

-Jason Fieber

P.S. If you’d like access to my entire six-figure dividend growth stock portfolio, as well as stock trades I make with my own money, I’ve made all of that available exclusively through Patreon.

Note from D&I: How safe is UPS’s dividend? We ran the stock through Simply Safe Dividends, and as we go to press, its Dividend Safety Score is 69. Dividend Safety Scores range from 0 to 100. A score of 50 is average, 75 or higher is excellent, and 25 or lower is weak. With this in mind, UPS’s dividend appears Safe with an unlikely risk of being cut. Learn more about Dividend Safety Scores here.

Disclosure: I’m long UPS.

Source: Dividends & Income